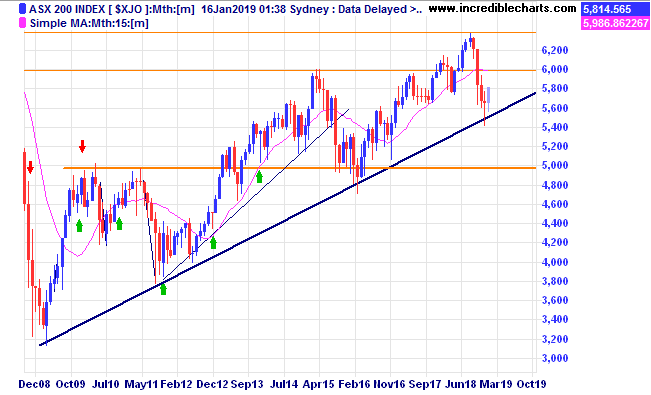

The local market has been moving steadily higher so far this year adding 2.9 per cent from the December close and over 7 per cent from the December low. Anything can happen in the markets and with lots of potential landmines to navigate it could be a very challenging year ahead.

The monthly chart of the local index shows a nice bounce from the December lows and some resistance at 6,000 points.

The daily chart of the local market shows a small consolidation at current levels.

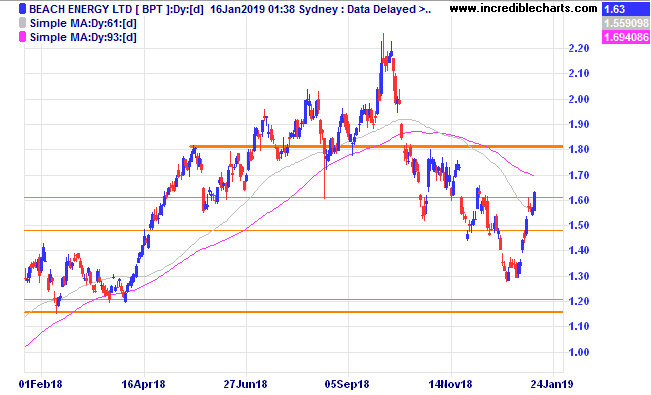

The price of oil has been moving up adding some spice to a few local oil stocks including Santos and Beach Petroleum pictured below.

Wealth platform provider Hub24 has been a beneficiary of the move away from a few of the bigger wealth managers tainted by the Hayne Royal Commission. The price is in a big sideways congestion pattern having bounced up a few times from lower levels.

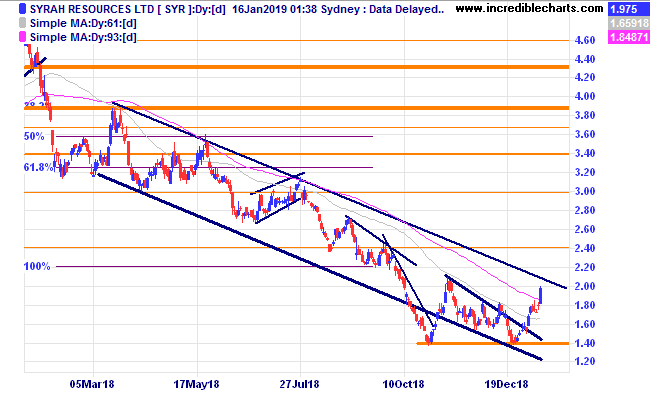

Graphite miner Syrah has been a big mover over the past ten days up 30 per cent and is still yet to break out of the downwards trend channel.

A profit downgrade from Costa Group saw the shares fall 38 per cent on the day.

Big moves like this remind us that anything can happen in the market and some would say a good reason to have a well-diversified portfolio that can with stand the odd unexpected plunge.

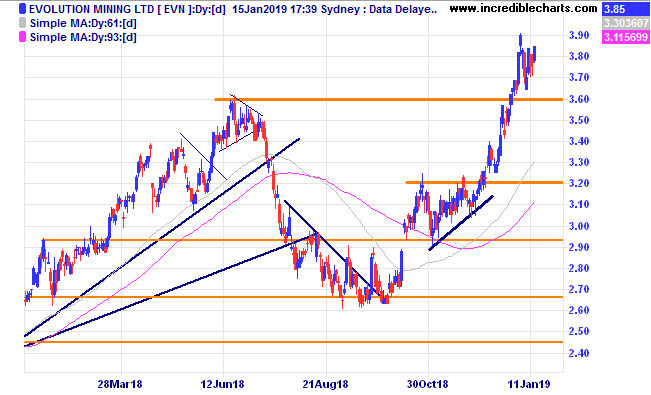

Evolution looks to be consolidating the recent break higher.

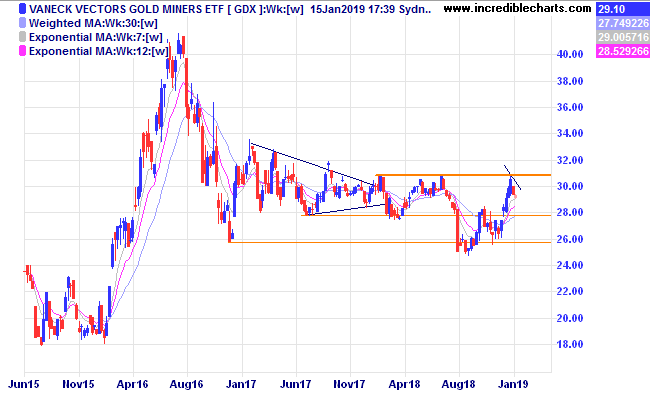

Gold miners ETF GDX has come up against previous resistance.

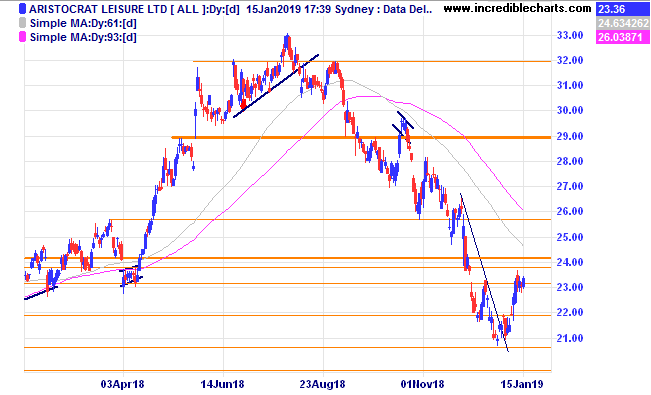

Aristocrat Leisure has moved up from recent lows.

A2 Milk looks to be moving higher out of sideways congestion.

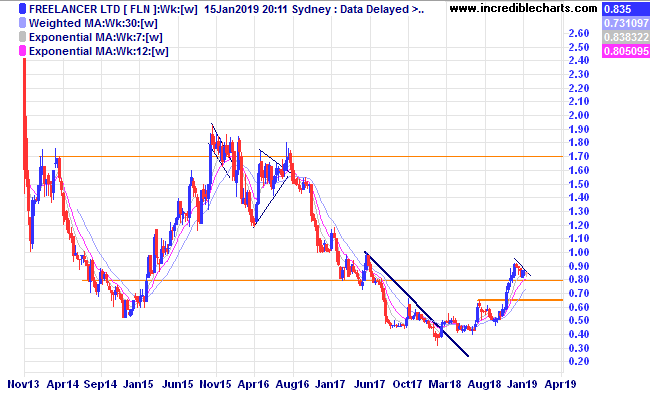

Freelancer could be pausing before another leg up.

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here