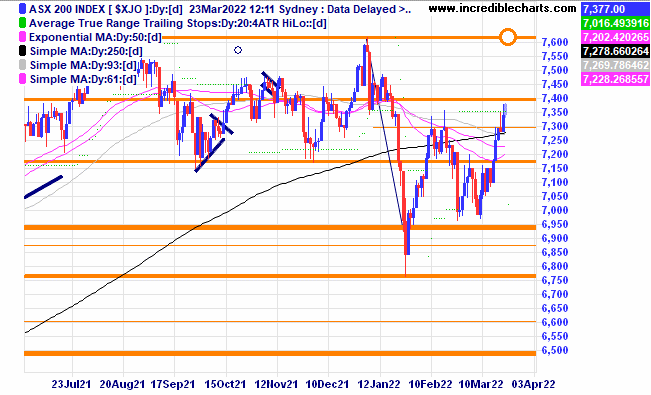

The local market declined less than the US tech market and is slowly working towards the previous tops.

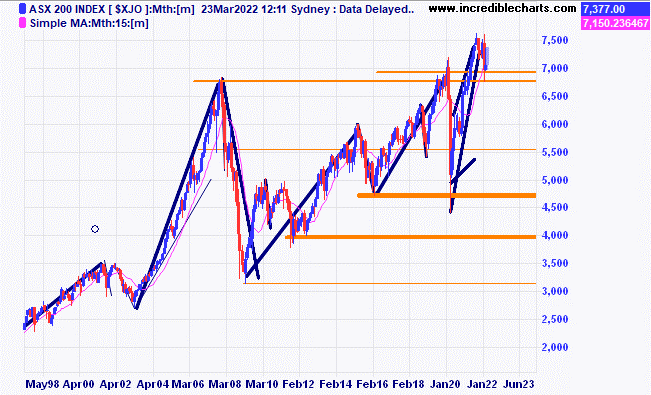

The local index on a monthly chart showing the shallow correction from a longer term perspective.

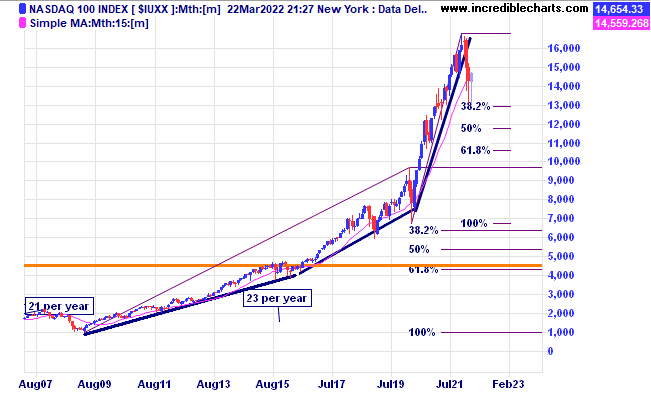

A chart of the technology-based US Nasdaq index shows the past two downturns stalling around the 38 per cent retracement mark.

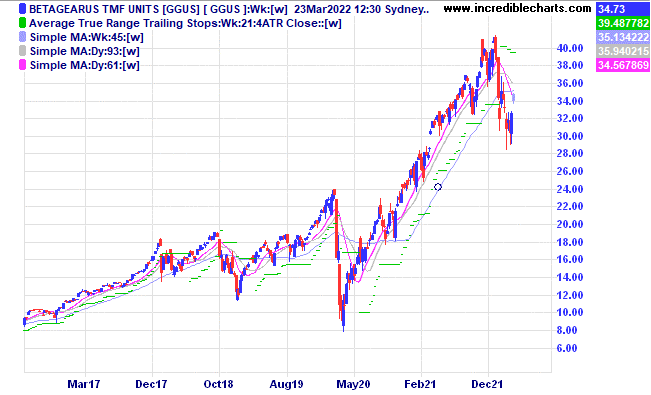

The GGUS ETF moves up faster than the underlying index and enhances both gains and losses and that gearing is one reason we bought some for the educational portfolio. March and April are generally positive months for US stocks and time will tell how accurate that seasonal trend proves to be this year.

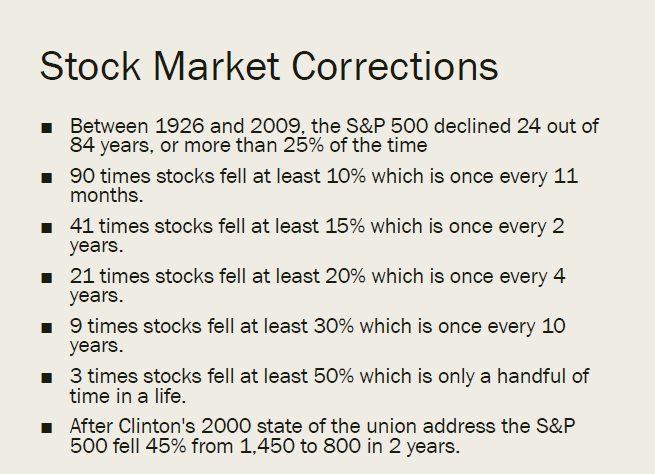

Some interesting stats on market corrections.

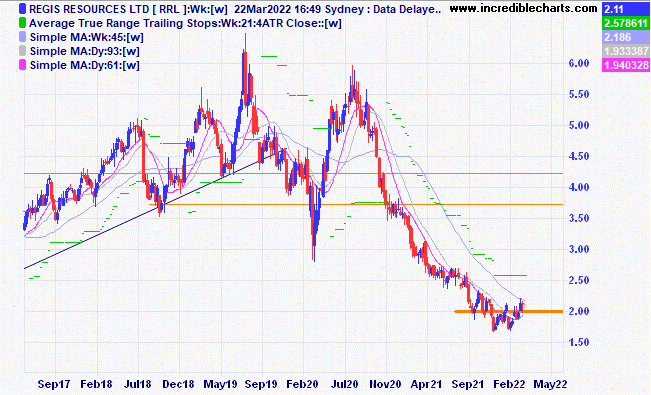

Regis Resources looks to be forming a possible base pattern.

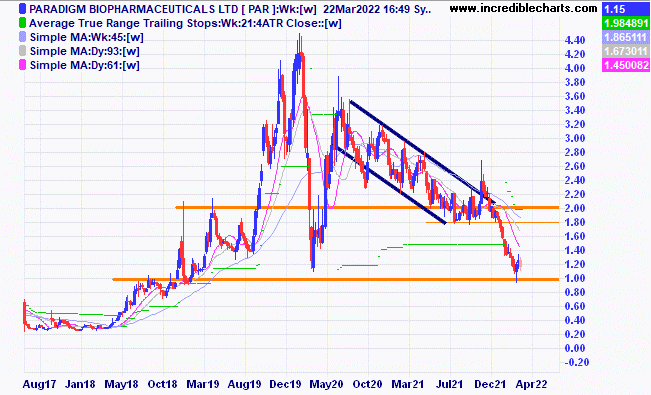

Paradigm made a spike type low near a previous support level and an ABC type pattern off the base could give traders something to think about.

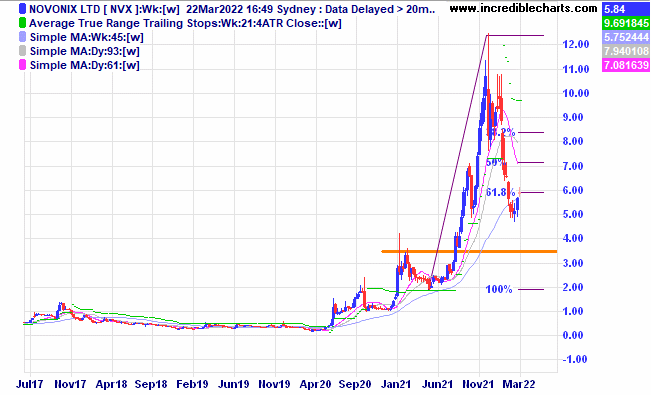

Novonix had a very big move down from the top and looks to have found some support at a previous low.

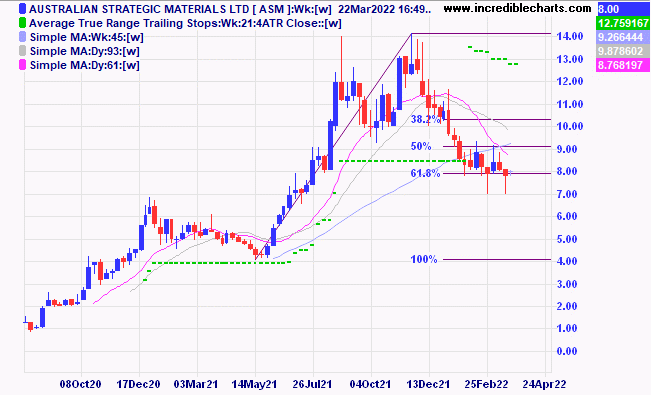

Australian Strategic Materials has formed two small spike lows around the 61.8 per cent retracement level close to a possible support zone and we bought a smaller parcel for the portfolio.

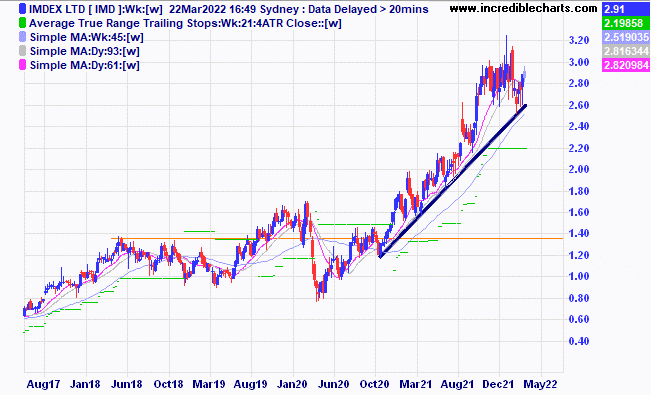

Imdex had a smaller correction and we added some to the educational portfolio today.

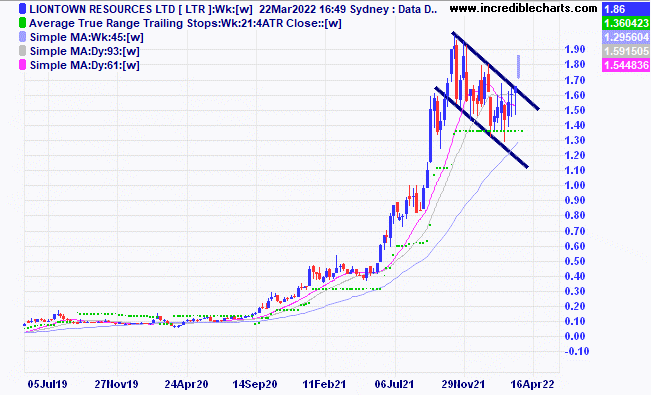

Liontown looks to be breaking out of a large bullish flag type pattern.

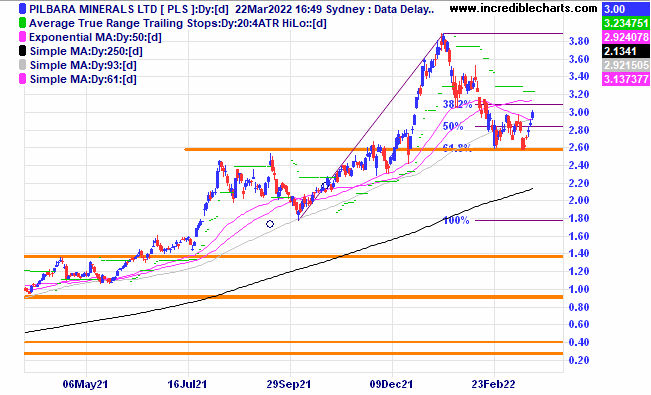

A current holding Pilbara Minerals has bounced off a previous support zone.

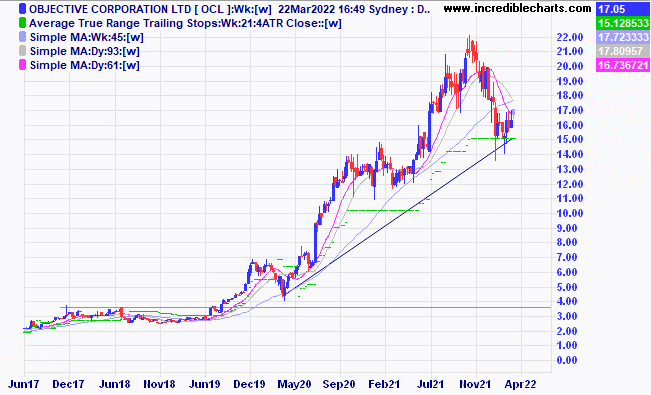

Objective Corporation has formed two nice spike lows showing a sign of investor demand at these levels and we bought a parcel for the educational portfolio today. We have added quite a few stocks to the educational portfolio today and we remain on alert for any signs of market weakness and remain open to hedging our positions.

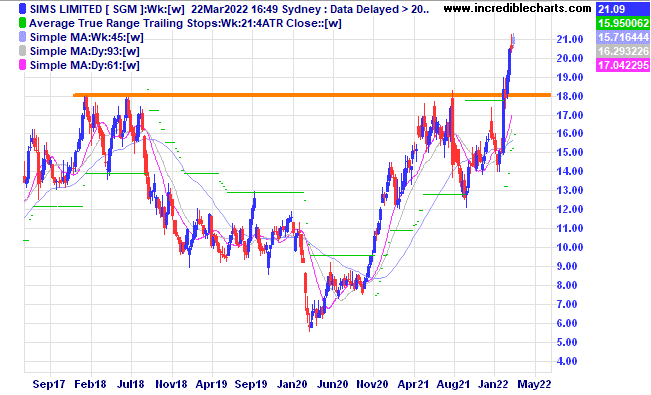

Sims has moved nicely above a previous level of resistance.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought Whitehaven Coal c/f at $2.76 | Bought 1,000 at $2.70 | 23/12/2021 | $4.02 | $4.16 | +$140.00 |

Bought Brainchip Holdings | Bought 500 at 85c | 5/1/2022 | 96c | 95c | -$5.00

|

Bought Computershare | Bought 120 at $20.50 | 5/1/2022 | $22.45 | $23.79 | +$225.60 |

Bought Macquarie Group | Bought 10 at $199.00 | 9/2/2022 | $186.00 | $197.00 | +$110.00 |

Bought Red5

| Bought 5,000 at 29.5c | 9/2/2022 | 37c | 37.5c | +$25.00 |

Bought CSL

| Bought 12 at $260.00 | 16/2/2022 | $263.00 | $265.00 | +$24.00 |

Bought Northern Star | Bought 400 at $10.00 | 22/2/2022 | $10.47 | $10.60 | +$52.00 |

Bought Monadelphous | Bought 300 at $11.00 | 23/2/22 | $11.02 | $11.02 | Steady |

Bought Goodman

| Bought 100 at $22.00 | 2/3/22 | $21.86 | $22.38 | +$52.00 |

Bought Pilbara

| Bought 800 at $2.80 | 2/3/22 | $2.57 | $3.00 | +$344.00 |

Bought Syrah

| Bought 1,000 at $1.40 | 2/3/22 | $1.30 | $1.48 | +$180.00 |

Bought St Barbara

| Bought 2,000 at $1.52 | 8/3/2022 | $1.50 | $1.53 | +$60.00 |

Bought GGUS ETF

| Bought 100 at $30.63 | 16/3/2022 | $30.63 | $33.67 | +$307.00 |

Bought Xero

| Bought 25 at $102.00 | 17/3/2022 | $102.00 | $98.82 | -$79.60 |

|

|

|

|

|

|

Start 2/1/2022 $50,000.00 | Open balance $56,261.00 |

| |

| $56,261.00 |

| Gains/losses week +$1,435.00 |

|

|

| +$1,435.00 |

| Current total $57,696.00 |

|

|

| $57,696.00 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $37,164.80 |

|

|

| $37,164.80 |

Prices from Tuesday night or 6am for US positions. | Cash available $19,967.00 |

|

|

| $19,967.00

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here