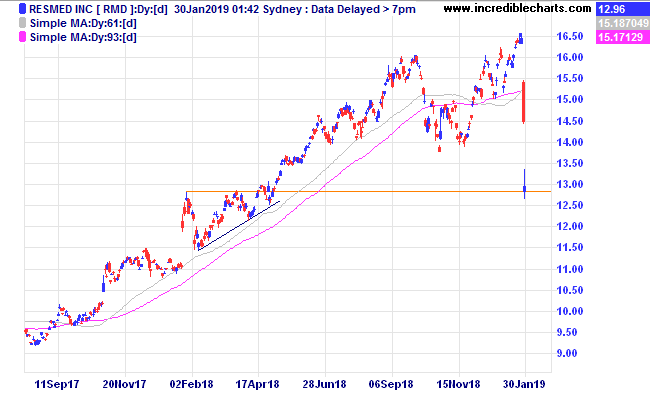

Things can change quickly in the markets and a weaker than expected result followed by a change in investor sentiment can really move the share price in a short time period. “Priced for perfection” stocks that report less than expected earnings and a subdued outlook can fall dramatically.

The price of Resmed has fallen 20 per cent on the back of weaker results and a change in short term investor sentiment. In a ten stock concentrated portfolio a 20 per cent fall in one stock has a negative 2 per cent impact.

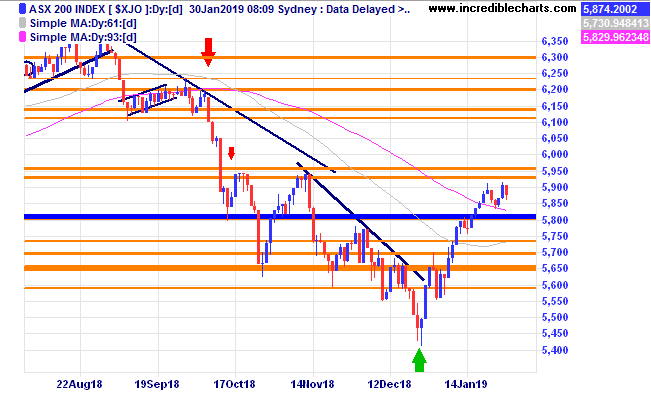

The local market is in a sideways congestion pattern at the moment.

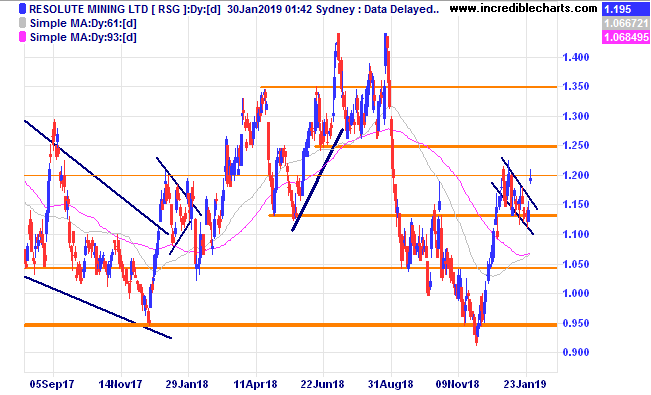

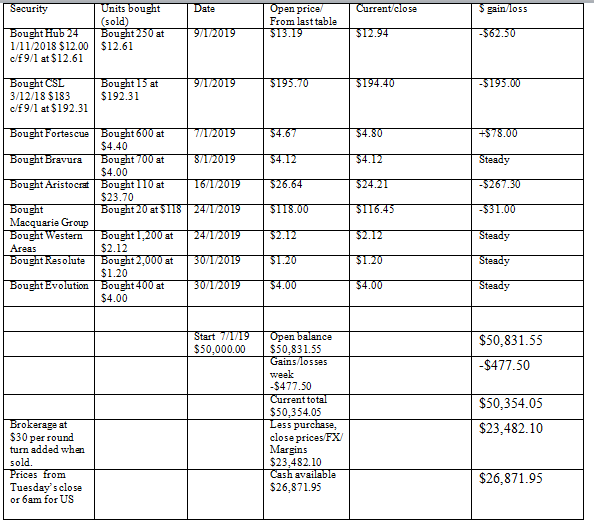

The price of gold and Australian gold stocks bounced yesterday and we picked up a small parcel of Resolute when price burst up from a bullish flag type pattern which is one of Charlie’s favourites to trade from.

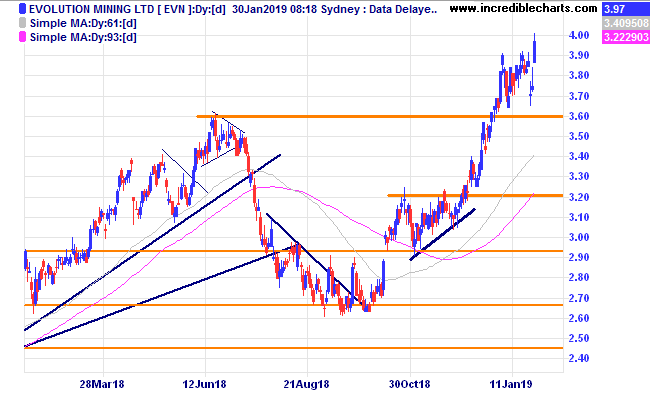

The price of Evolution looks to have bounced from support in the chart below and we bought a small parcel. Northern Star on the other hand reported increasing mining costs and was marked down 15 per cent last week.

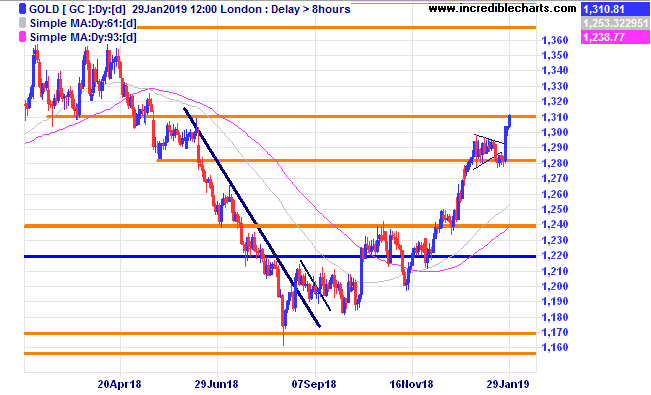

The price of gold on a daily chart shows the previous resistance levels ahead of any sustained rally. A 50 per cent retracement of the previous move down is around the $1,500 level.

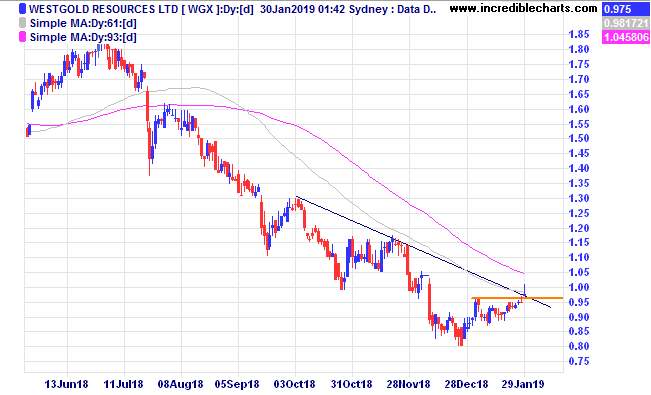

Westgold looks to be moving up from the lows.

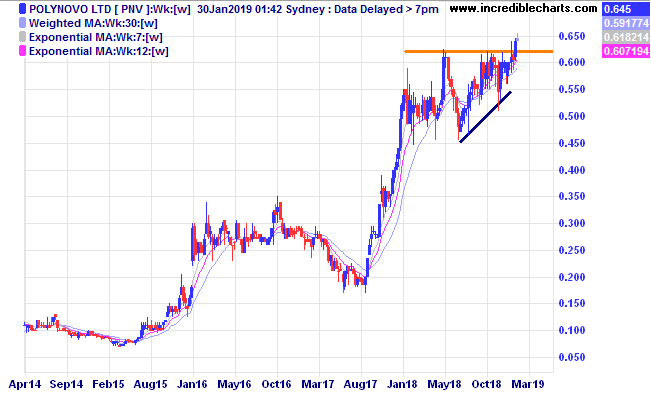

Polynovo looks to be finally moving out of the year- long congestion pattern.

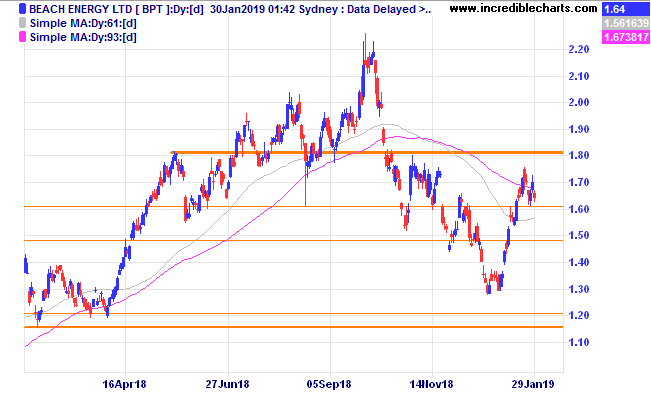

Beach Petroleum looks to be in some sideways congestion.

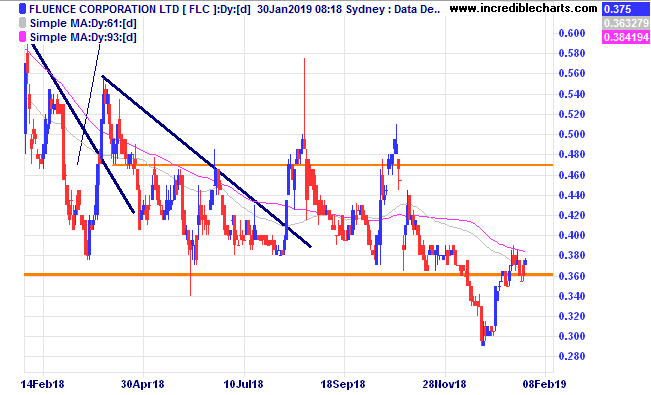

Fluence is a stock we have traded before and looks to be creeping up from the lows offering interesting possibilities.

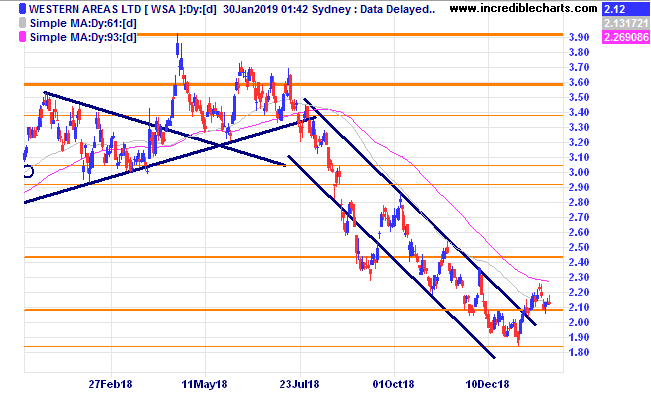

Western Areas shown below and Macquarie Bank are the other two stocks we added to the “educational” portfolio last week.

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here