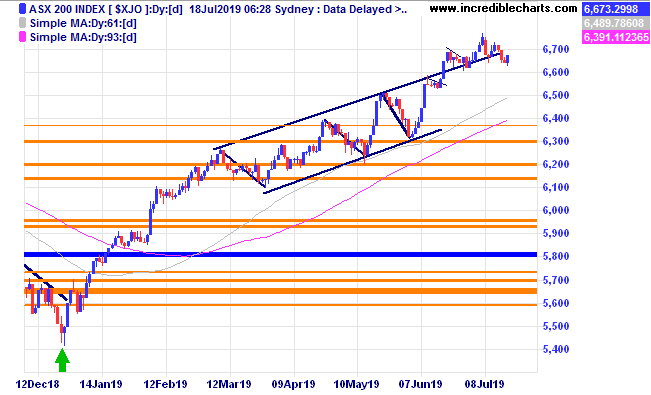

The local market has made a lower top and could drift lower towards the bottom of the trend channel as it has moved below the upper channel boundary in a sign of weakness.

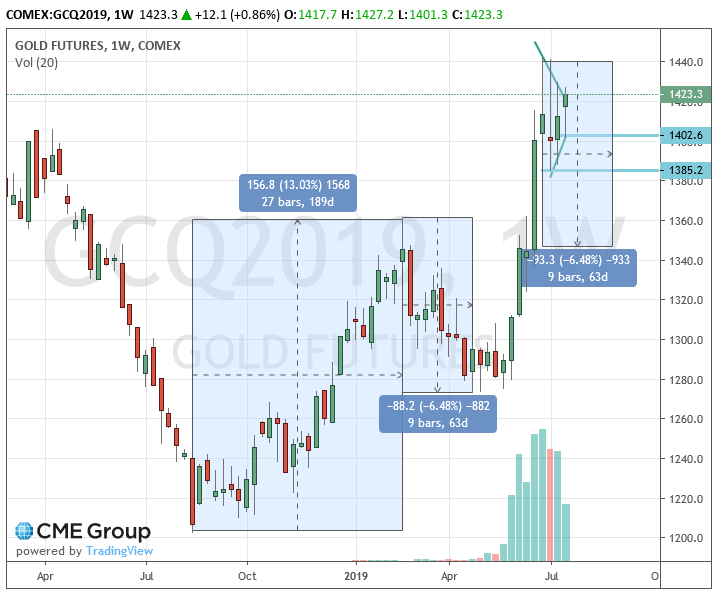

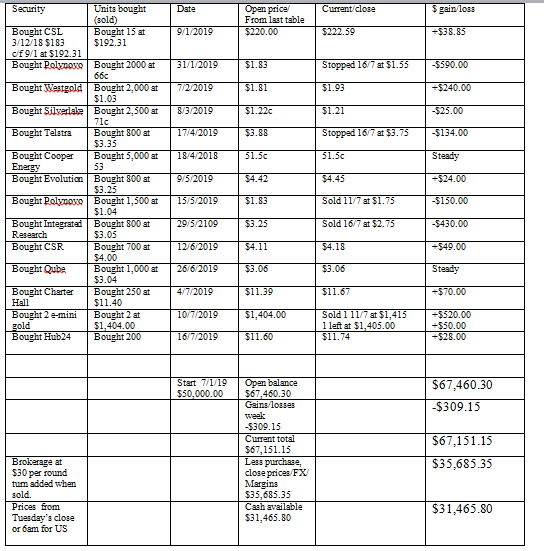

We bought 2 small gold contracts when price moved up after a reversal type candle and sold one before the weekend to lock in some profit. Most gold and index trades are short term leveraged trades and we like to keep the risks down.

The weekly gold chart below shows that gold reached the equal range target in quick time and a similar correction in price to the last move down could see gold move down to the $1,350 level. The pattern forming on the daily chart shown above is a congestion pattern which could break either way and we have our stop in place if price retreats before reaching our $1,430 target.

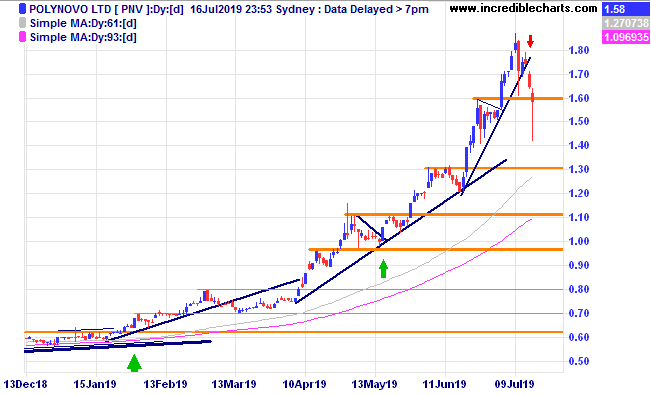

Polynovo one of the educational portfolio’s best performer’s this year has hit a series of bumps in the road with the end result being to close out both positions. The first warning sign came when the stock had a big day down and failed to recover over the next two days when another down day came and fell below the trend line on Monday when we closed out one parcel. Tuesday the price fell below the previous spike low and Monday’s closing price and below a possible support level shown in orange and this became a time for Charlie to exit. The green arrows show where we bought in.

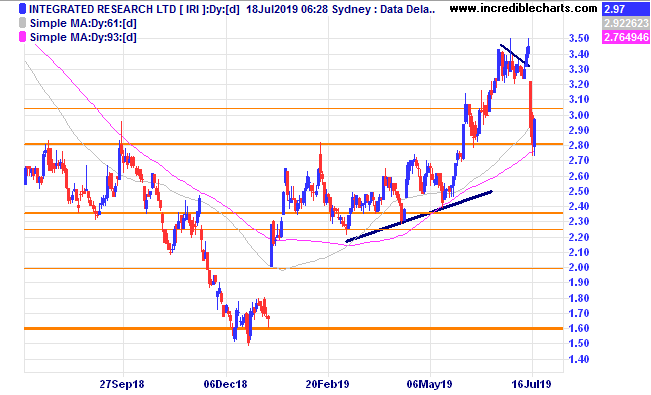

Integrated Research shares were sold down after an earnings update and we sold out.

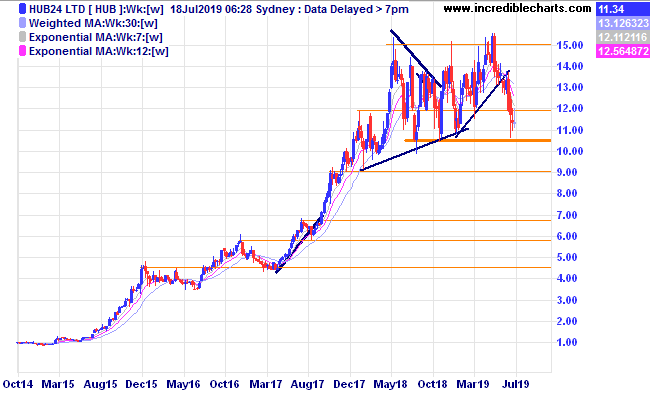

We bought a small parcel of Hub24 at the lower end of the large sideways range after the company scotched rumours that the lower cash rates on offer would severely impact earnings and some fund managers increased their holdings.

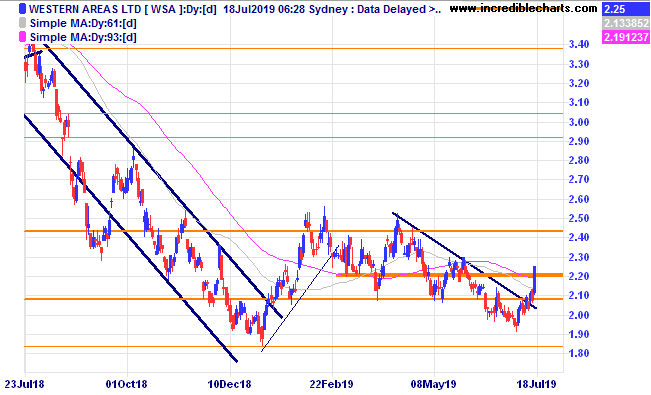

Western Areas had a nice move up on a stronger nickel price and is one to watch.

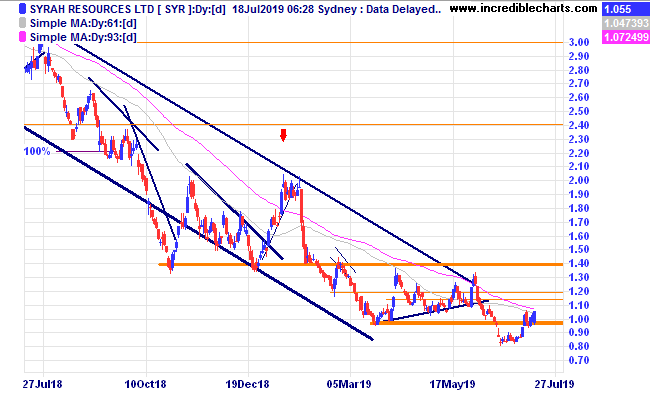

Syrah has been creeping up in price and may have finally found the low.

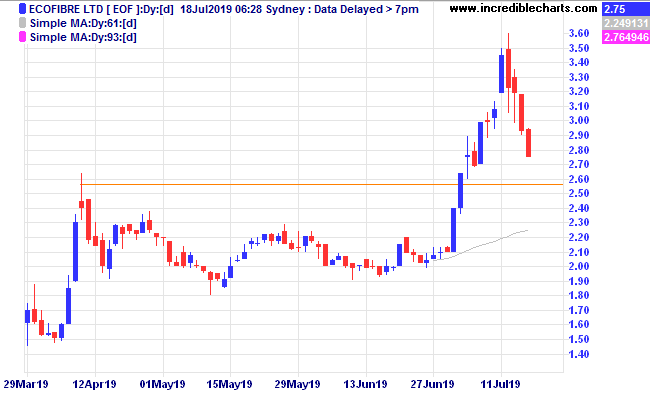

Hemp producer Ecofibre has moved down off the highs and could be a buy on a bounce from support.

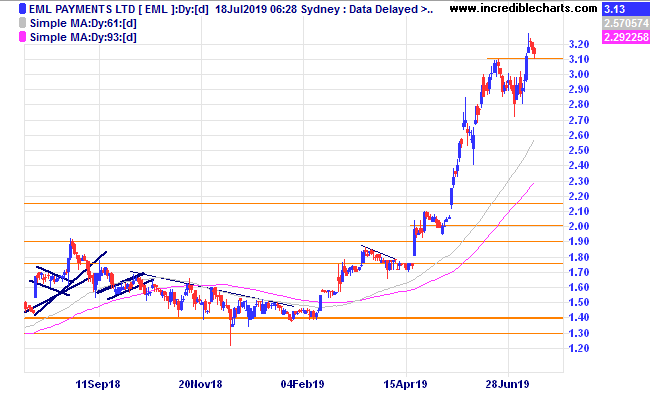

EML Payments looks to be consolidating the recent move up and could be setting up for a nice trade.

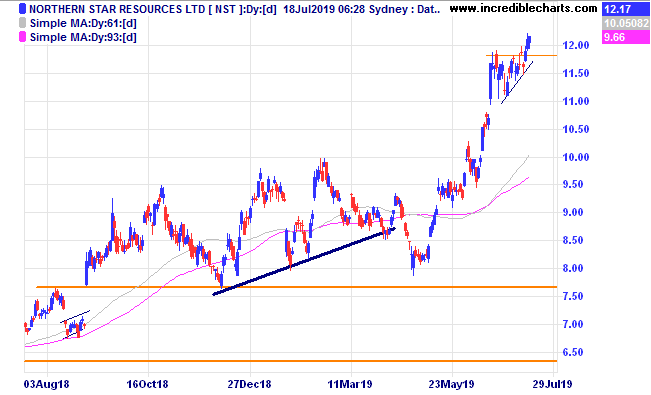

Northern Star has moved up from a consolidation pattern.

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here