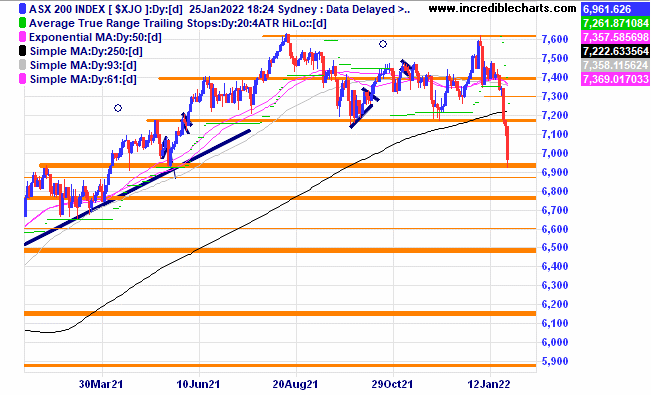

The local market made short work of falling to the lows of April and May 2021 reaching our second profit target quickly where we exited the remainder of the short ASX 200 cfd position.

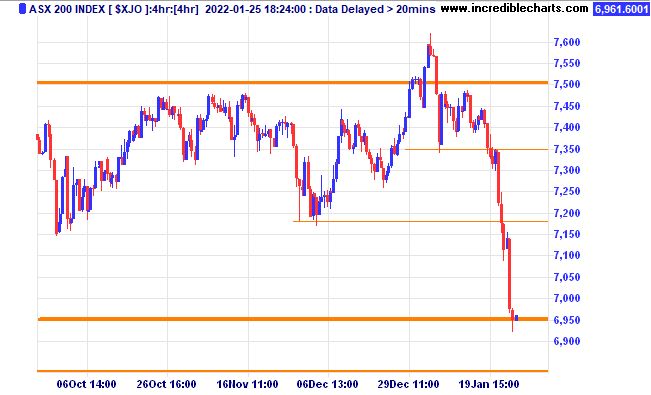

The recent moves on the four-hour chart show how the market tagged our profit targets.

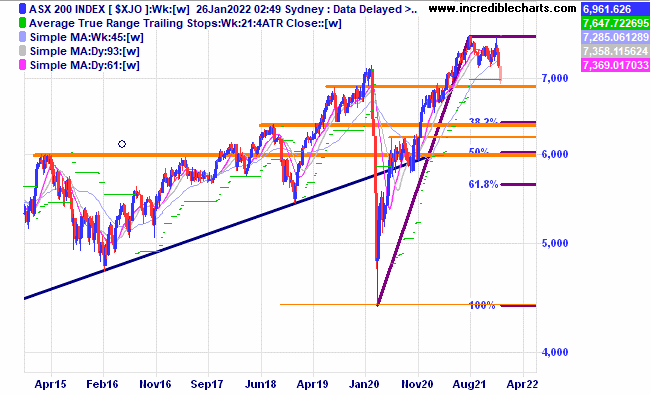

A longer-term chart of the local index shows several possible retracement zones including the 50 per cent retracement of the run up from the Covid low coming in close to the 6,000 point mark and near the high in April 2015.

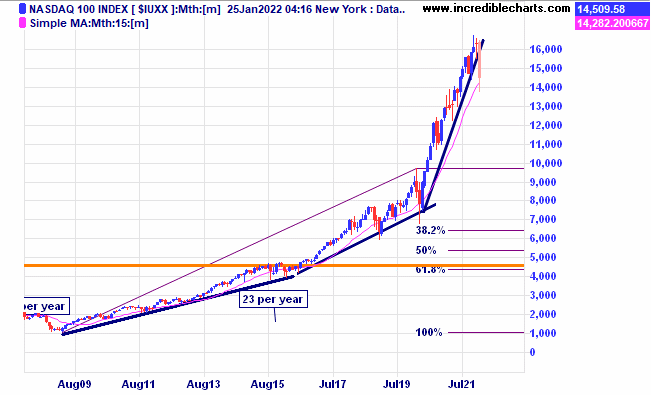

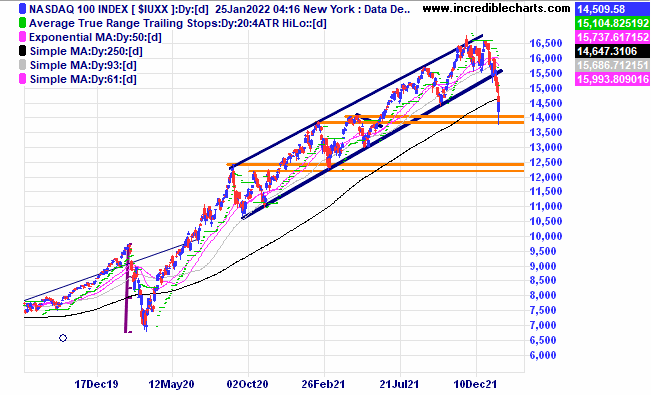

This monthly chart of the US based Nasdaq shows a very fast rising market after the Covid low. Rising at the rate of over 50 per cent annually would be considered unsustainable. The question is where will the market find support? The 50 per cent retracement of this run up would give a target around the 12,000 area.

The Nasdaq on the daily chart shows possible short-term support levels. The strong bounce off potential support around 14,000 points gives the bulls some hope that this fall could be minor.

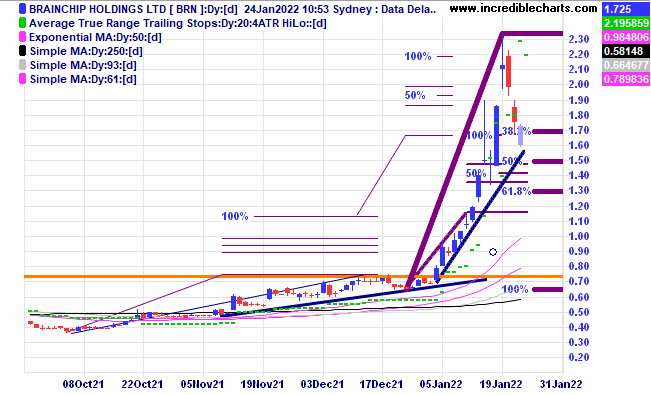

Brainchip Holdings reached the 300 per cent target where we sold another portion. We also sold another portion as prices fell. When the ATR stop reverses, we may well add some more to the now much reduced holding or we could be stopped out. Time will tell.

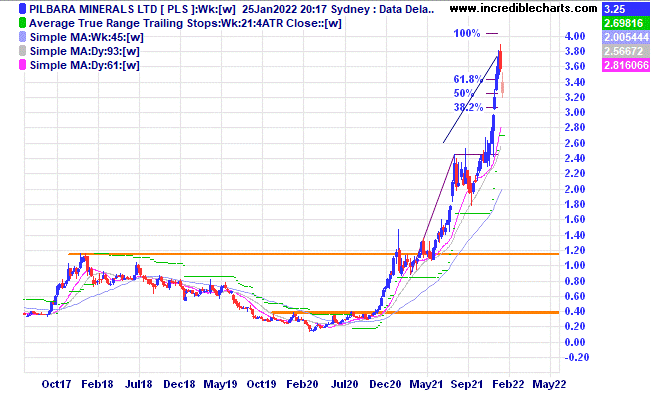

Pilbara Minerals has been moving fast over the past year and some kind of retracement could be seen as healthy for the longer term trend.

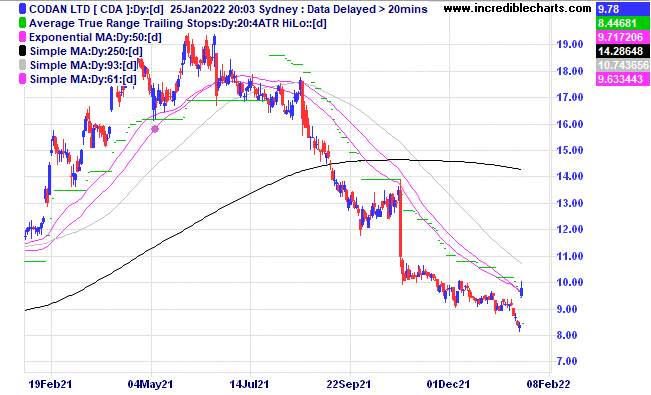

With all the red ink in Tuesday’s sell-off Codan was one of the few gainers.

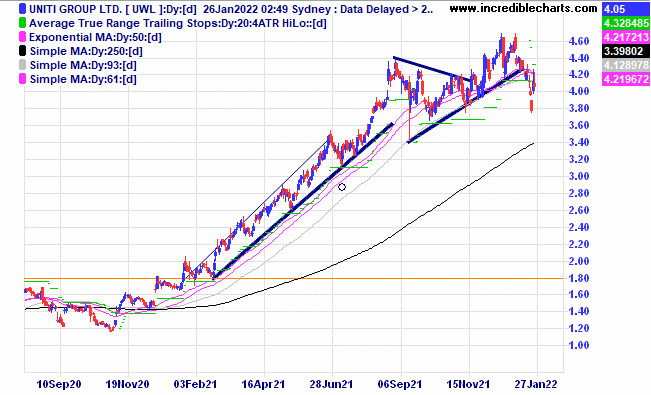

Uniti Group jumped in price when the company revealed several parties showing some takeover interest.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought NDQ ETF c/f 4/1 at $36.58 | Bought 70 at $26.50 | 1/10/2020 | $34.50 | Sold 20/1 at $33.40 | -$107.00 |

Bought Resolute Mining c/f 4/4 at 37.5c | Bought 6,000 at 58c | 7/7/2021 | 34.5 | Sold 3000 24/1 at 33.5c Sold 3000 at 31.5c | -$75.00

-$120.00 |

Bought Stavely Minerals c/f4/1 at 53c | Bought 5,000 at 48c | 27/10/2021 | 50c | 51 | +$50.00 |

Bought Oz Minerals c/f 4/1 at $28.80 | Bought 100 at $27.50 | 15/12/2021 | $28.39 | Sold 25/1 at $26.50 | -$219.00 |

Bought Whitehaven Coal c/f at $2.76 | Bought 1,000 at $2.70 | 23/12/2021 | $2.87 | $2.63 | -$240.00 |

Bought Brainchip Holdings | Bought 2,000 at 85c | 5/1/2022 | $1.86 | Sold 500 at $2.20 Sold 500 at $1.80 1,000 left at $1.43 | +$140.00 -$60.00 -$430.00 |

Bought Computershare | Bought 120 at $20.50 | 5/1/2022 | $20.77 | $19.20 | -$188.40 |

Bought Macquarie Group | Bought 12 at $214.00 | 5/1/2022 | $206.86 | Stopped 20/1 at $198.00 | -$136.32 |

Bought Mt Gibson

| Bought 6,000 at 45c | 5/1/2022 | 45.5c | Sold 3,000 at 44c Sold 3,000 at 40c | -$75.00 -$195.00 |

Bought Ansell

| Bought 80 at $34.00 | 12/1/2022 | $33.47 | $32.15 | -$105.60 |

Bought Credit Corp

| Bought 80 at $35.17 | 19/1/2022 | $35.17 | $32.45 | -$217.60 |

Sold ASX 200 cfd’s

| Sold 12 at 7,320 | 20/1/2022 | 7,320 | Bought 6 21/1 at 7180 Bought 6 25/1 at 6960 | +$810.00 +$2,130.00 |

Bought BBUS bear ETF | Bought 400 at $9.13 | 20/1/2022 | $9.13 | $10.06 | +$372.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $52,092.72 |

| |

| $52,092.72 |

| Gains/losses week +$1,333.08 |

|

|

| +$1,333.08 |

| Current total $53,425.80 |

|

|

| $53,425.80 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $18,697.60 |

|

|

| $18,697.60 |

Prices from Wednesday night or 6am for US positions. | Cash available $35,304.80 |

|

|

| $35,304.80

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here