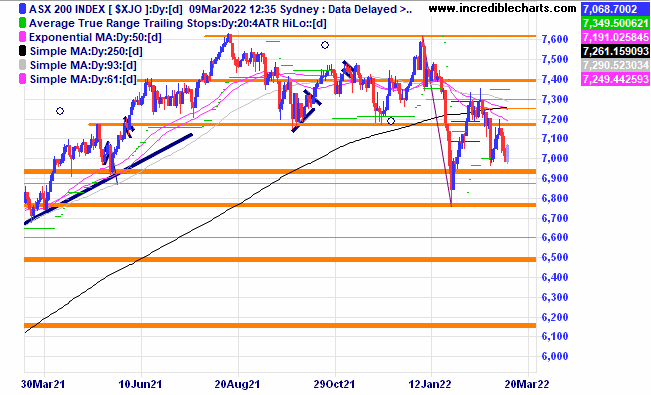

The local market remains choppy and long-term investing advocates see short-term market weakness as a longer-term buying opportunity. At this point in time the local share market is holding up much better than most others.

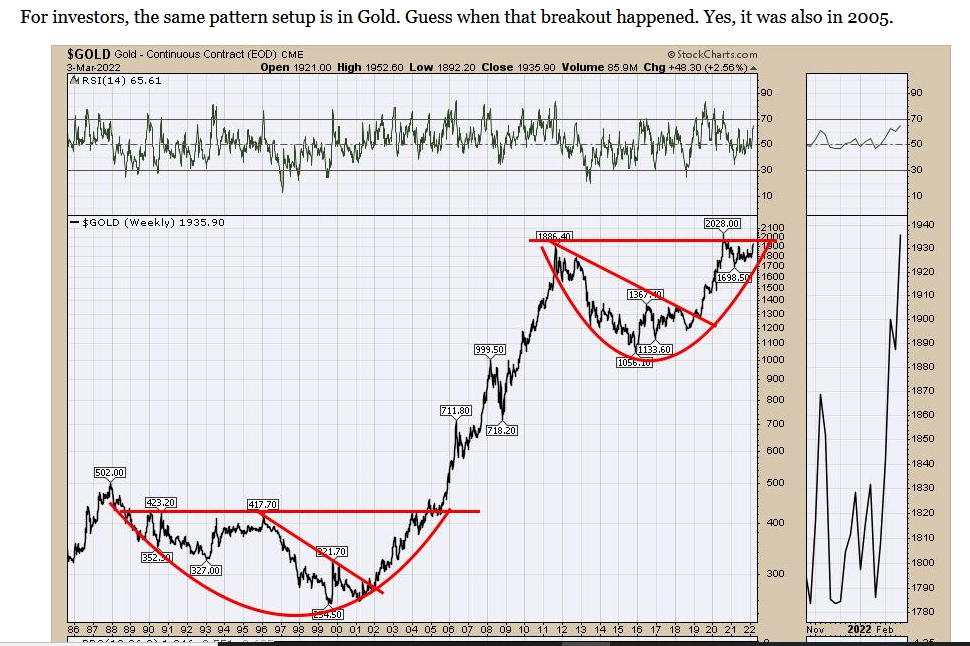

We were fortunate to be able to trade the recent big night up in the gold price and sold after price retreated dramatically after a big spike upwards.

We were fortunate to be able to trade the recent big night up in the gold price and sold after price retreated dramatically after a big spike upwards.

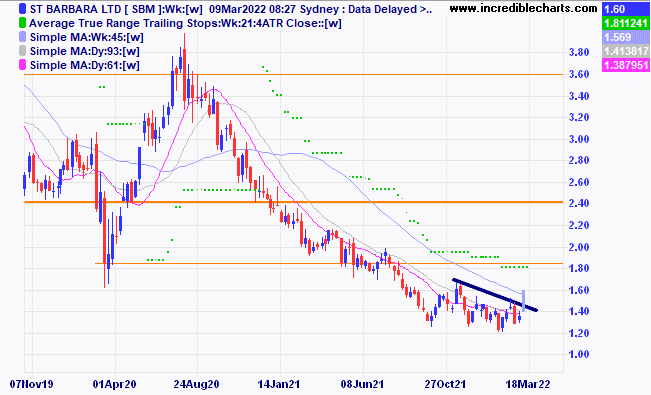

We bought St Barbara on a fresh move up and after speculative takeover talk started.

A longer-term chart on the continuous futures price of gold shows how the current pattern is similar to a pattern formed from 1990 to 2005. A fresh break up here could see the pattern completed and the price of gold move a lot higher.

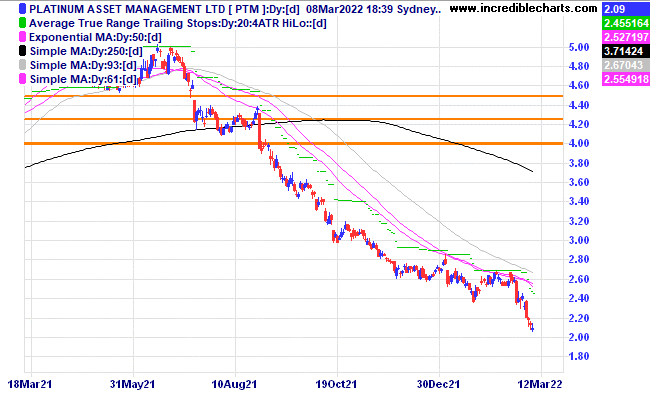

We were stopped out of Platinum and the most recent Brainchip purchase after price broke down through the stop loss point.

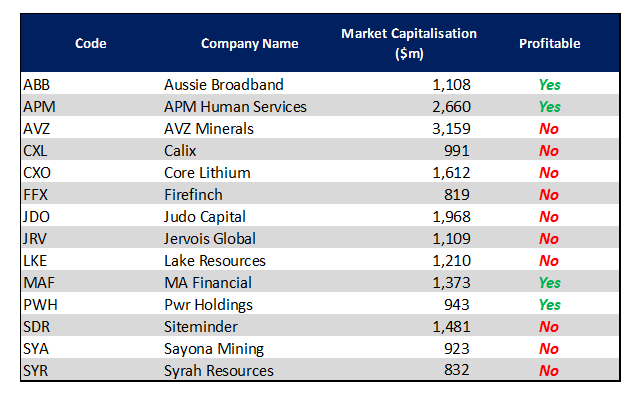

A recent list of companies being promoted into the ASX 300 index.

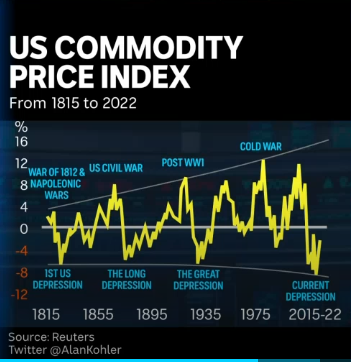

A recent chart on the Alan Kohler finance segment on ABC TV shows a long-term chart of a commodity index near the current lows of the cycle and highs formed during or just after wars.

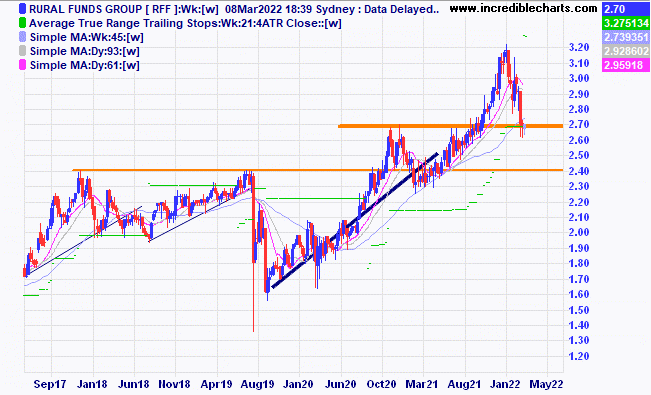

Rural Funds Group looks to have found some support at current levels.

In last weekend’s Firstlinks edition a Morningstar article named ten companies they think are undervalued after reporting season and included Magellan Financial Group, AGL, A2Milk, Wisetech Global, Pinnacle Investment Management, Aurizon Holdings, Westpac, TPG Telecom, Brambles and AUB Group.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought Whitehaven Coal c/f at $2.76 | Bought 1,000 at $2.70 | 23/12/2021 | $3.38 | $4.07 | +$690.00 |

Bought Brainchip Holdings | Bought 500 at 85c | 5/1/2022 | $1.27 | $1.03 | -$120.00

|

Bought Computershare | Bought 120 at $20.50 | 5/1/2022 | $21.50 | $20.57 | -$111.60 |

Bought Credit Corp

| Bought 80 at $35.17 | 19/1/2022 | $31.28 | Sold at $30.50 | -$92.40 |

Bought Macquarie Group | Bought 10 at $199.00 | 9/2/2022 | $183.00 | $175.00 | -$80.00 |

Bought Red5

| Bought 5,000 at 29.5c | 9/2/2022 | 31c | 35c | +$200.00 |

Bought CSL

| Bought 12 at $260.00 | 16/2/2022 | $261.00 | $256.00 | -$60.00 |

Bought Platinum Asset Management | Bought 1,000 at $2.55 | 16/2/2022 | $2.42 | Sold $2.10 | -$350.00 |

Bought Northern Star | Bought 400 at $10.00 | 22/2/2022 | $10.02 | $10.87 | +$340.00 |

Bought Monadelphous | Bought 300 at $11.00 | 23/2/22 | $11.60 | $10.96 | +$192.00 |

Bought Brainchip

| Bought 1,000 at $1.22 | 2/3/22 | $1.22 | Sold at $1.10 | -$150.00 |

Bought Goodman

| Bought 100 at $22.00 | 2/3/22 | $22.00 | $21.34 | -$66.00 |

Bought Pilbara

| Bought 800 at $2.80 | 2/3/22 | $2.80 | $2.68 | -$96.00 |

Bought Syrah

| Bought 1,000 at $1.40 | 2/3/22 | $1.40 | $1.30 | -$100.00 |

Bought St Barbara

| Bought 2,000 at $1.52 | 8/3/2022 | $1.52 | $1.60 | +$160.00 |

Bought e-mini gold

| Bought 1at 2,010 | 8/3/2022 | 2,010 | Sold 9/3/2022 at 2054 | +$2,230.00 |

|

|

|

|

|

|

Start 2/1/2022 $50,000.00 | Open balance $53,618.40 |

| |

| $53,618.40 |

| Gains/losses week +$2,586.00 |

|

|

| +$2,586.00 |

| Current total $56,204.40 |

|

|

| $56,204.40 |

Brokerage at $30 per round turn added when sold. | Buy/ close prices and Margin $30,621.40 |

|

|

| $30,621.40 |

Prices from Tuesday night or 6am for US positions. | Cash available $25,580 |

|

|

| $25,580.00

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here