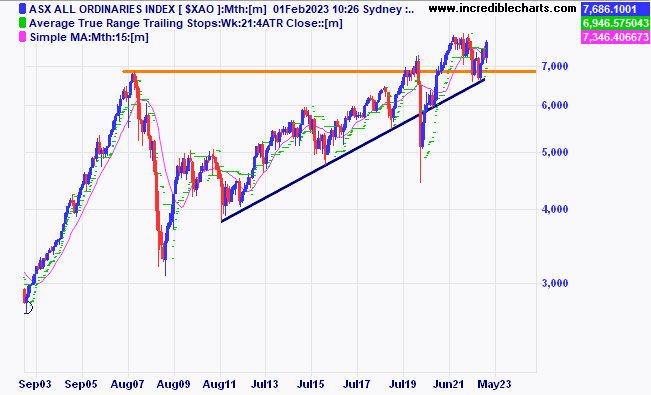

The local market as measured by the All Ordinaries Index is up 6.4 per cent in January 2023, the best start to the year since 1986. Interestingly the All Ord’s ended 1986 up a massive 46 per cent.

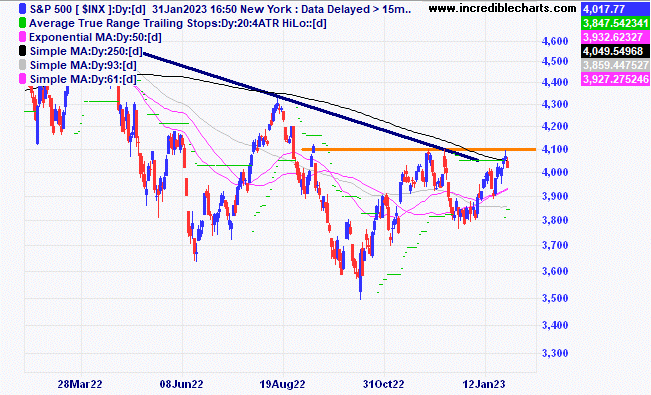

It looks like a make or break time for US markets with the Federal Reserve due to announce their latest interest rates decision later this week.

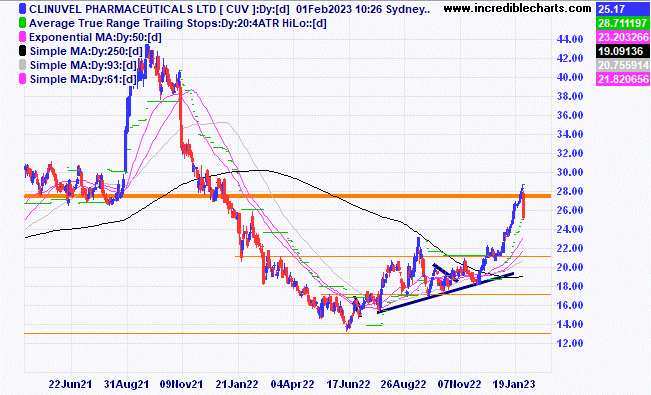

Clinuvel took a step back yesterday after releasing their latest set of numbers.

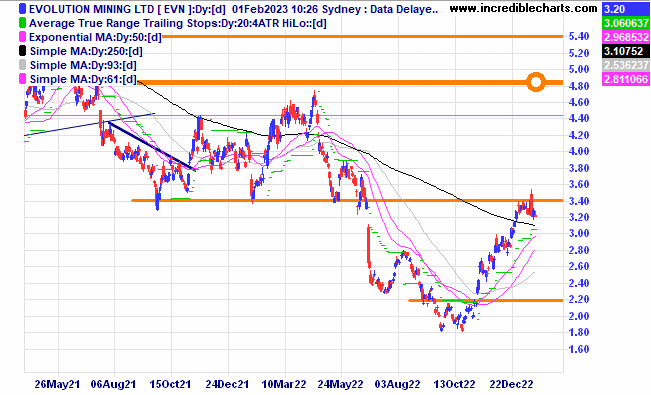

Evolution looks to have run into some resistance at these levels.

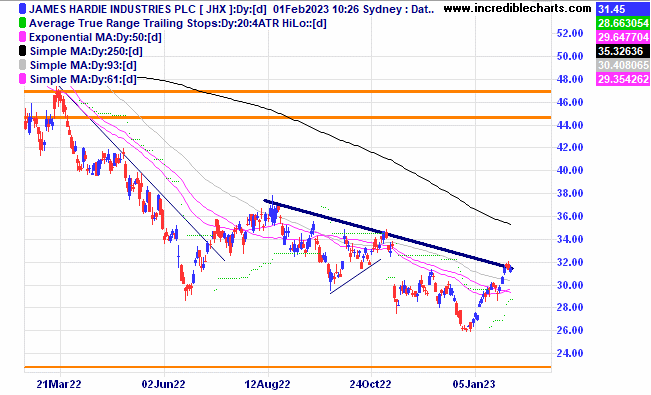

James Hardie is again testing the trendline.

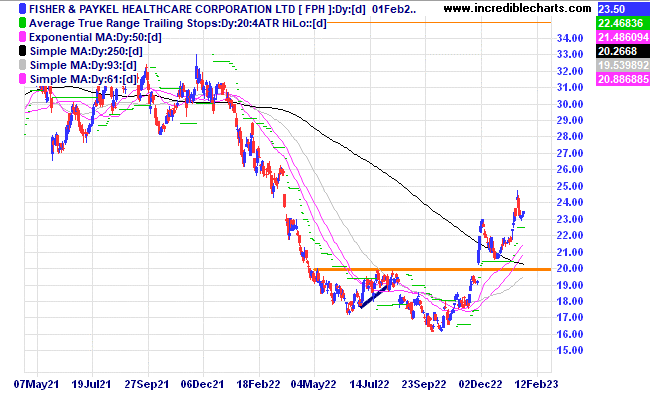

Fisher and Paykel is making some nice looking higher lows.

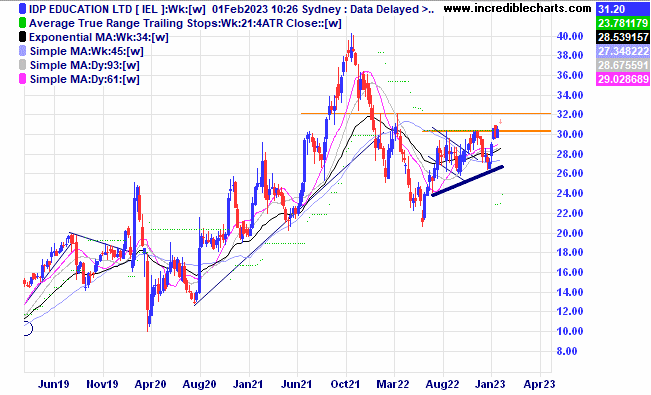

IDP Education jumped on the news Chinese students would return.

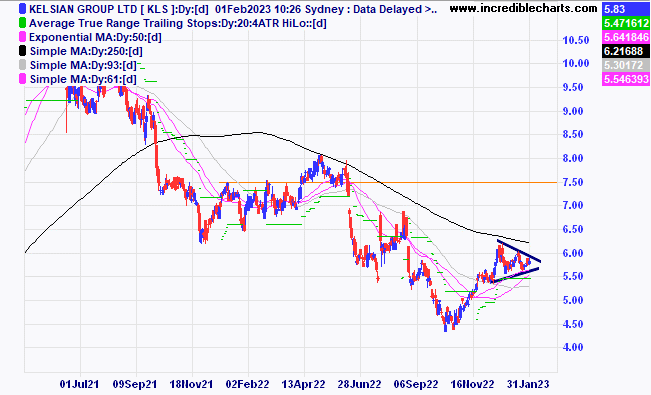

Kelsian Group is forming a nice looking consolidation pattern.

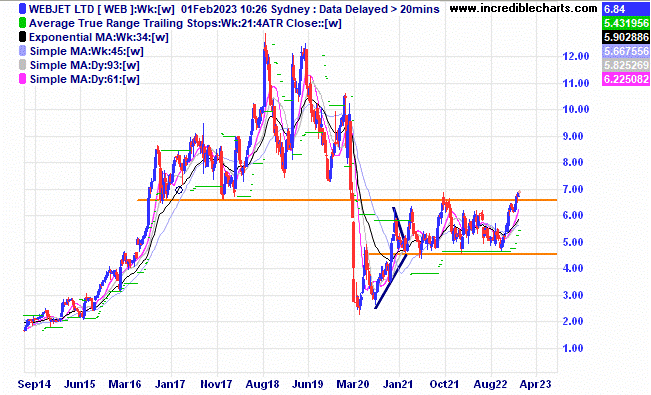

Webjet is again testing the resistance zone.

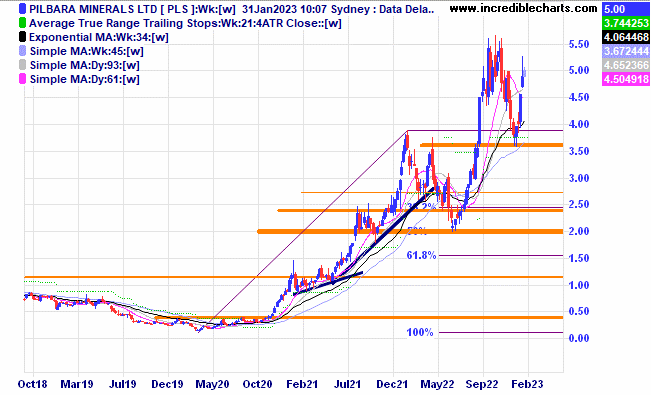

Pilbara Minerals is one of several lithium stocks that looks to have made a spike higher last week.

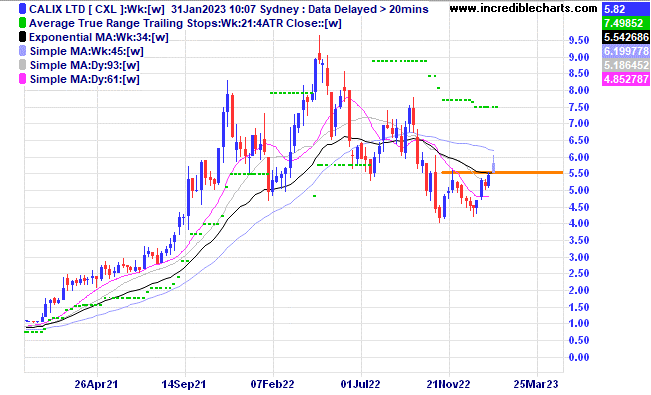

Calix looks to be moving above recent highs.

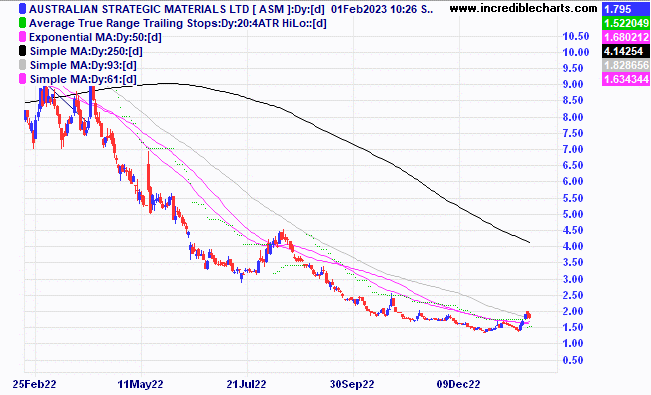

Australian Strategic Materials could be about to make a higher low.

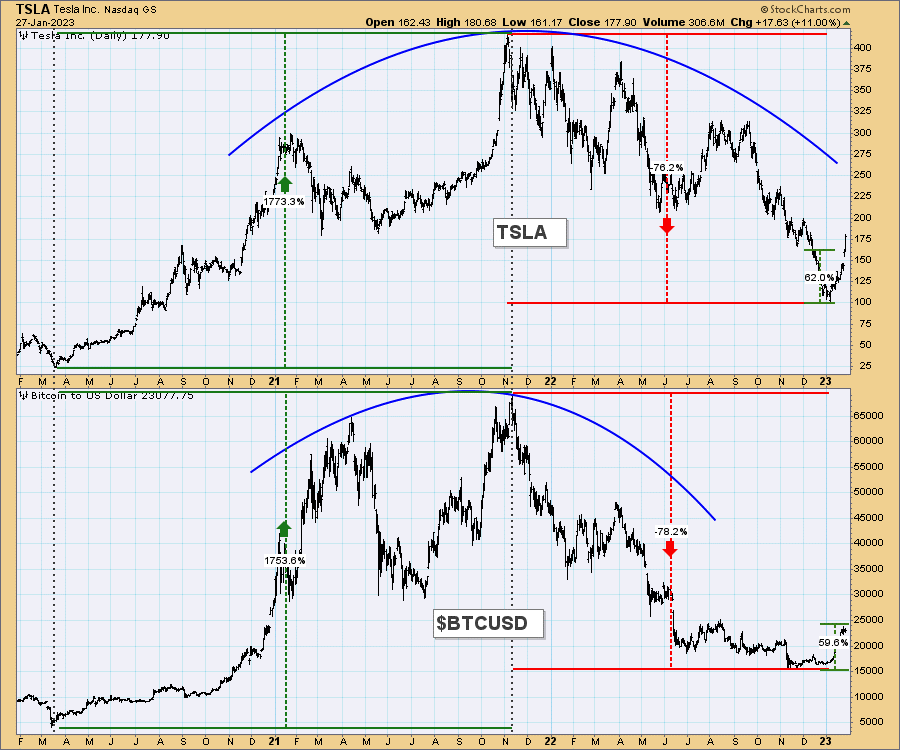

An interesting look at the Tesla and Bitcoin price graphs. Analysts at Morningstar say that Tesla is undervalued and has a fair value estimate of US$220 per share.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here