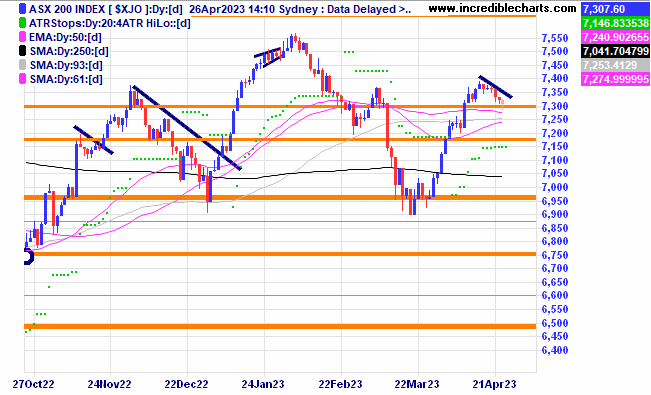

The local market continues to move lower today on the back of weaker US markets overnight. After a lacklustre April some analysts are suggesting to sell in May and stay far, far away.

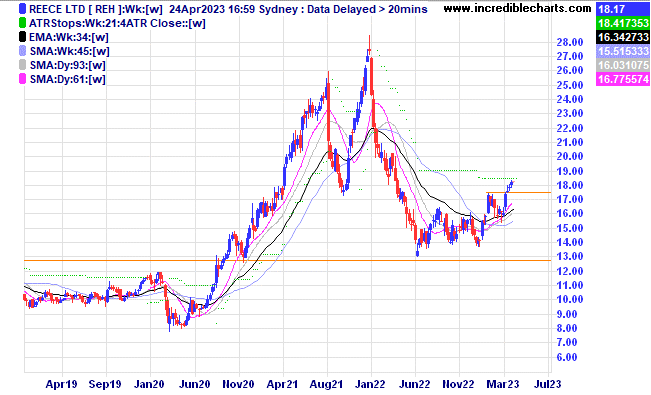

Plumbing outfit Reece has moved to a new yearly high.

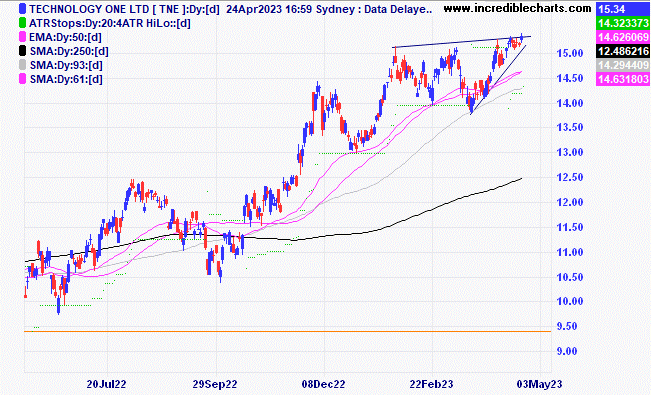

Technology One shows a possible rising wedge topping pattern.

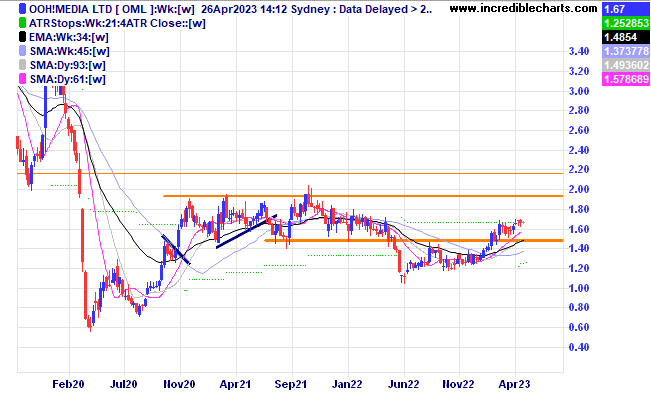

Ooh Media looks to be making very slow and steady progress.

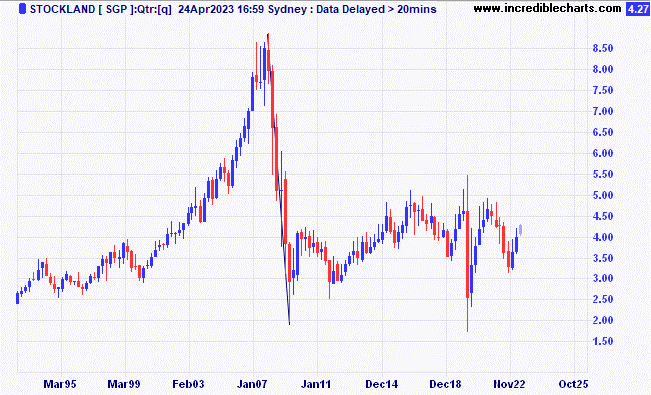

This long-term chart of Stockland Group shows only mediocre gains since the GFC low.

The US Nasdaq 100 index is up in futures after-hours trade when Apple and Microsoft reported their latest results.

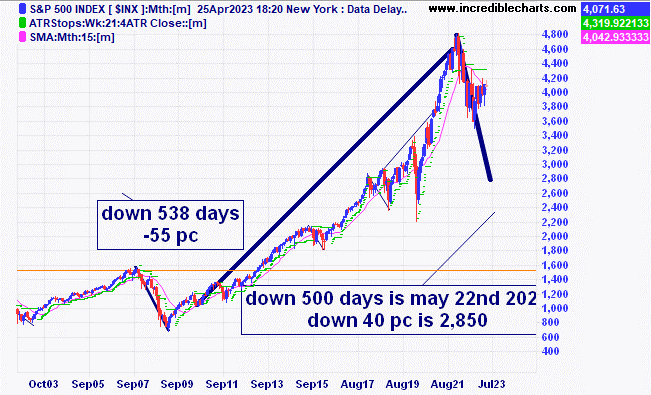

After a period of outperforming during 2010 to 2021 when US shares averaged around 13 per cent per year against the longer-term average of around 7 per cent it could be time for some under performance.

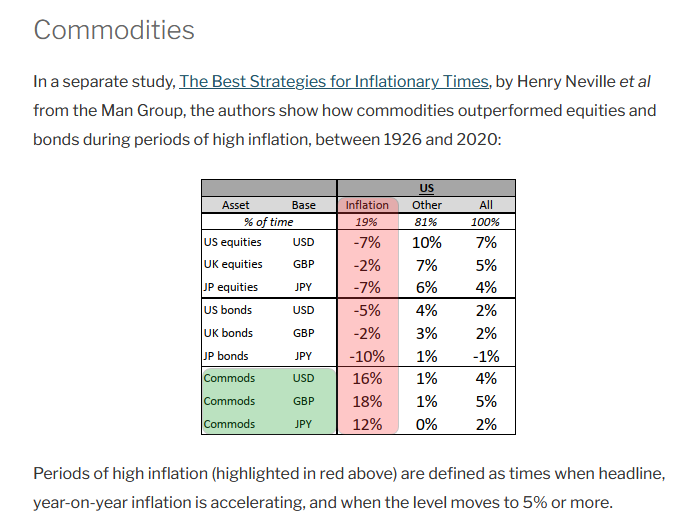

This graph shows commodities in general perform better in times of high inflation. Over the longer-term cycles US equities perform better according these statistics.

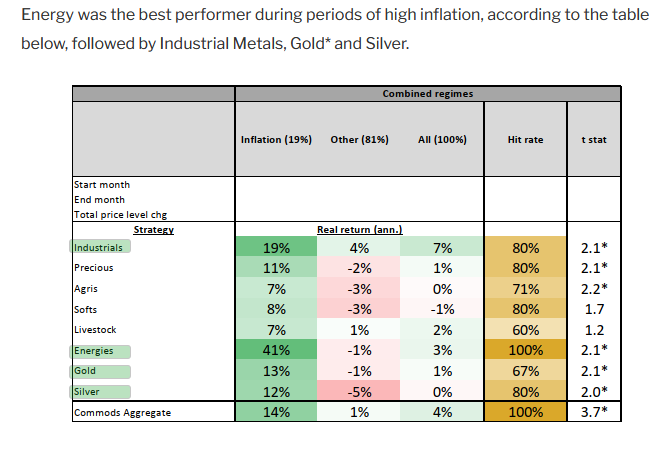

The energy sector was the best performing commodity in times of high inflation.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here