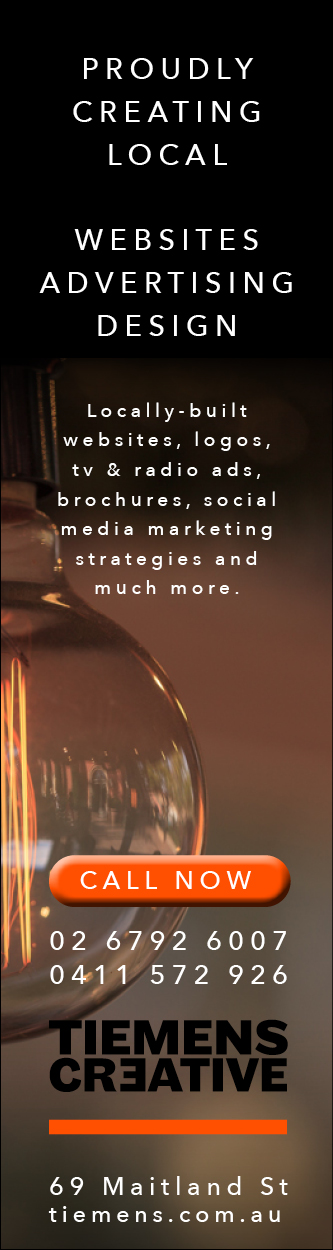

The local market has hardly moved since June 21st 2021 having been around 5.5 per cent higher and 11 per cent lower over the past 2 years. The index is today down 80 points as this is posted around 2.30pm.

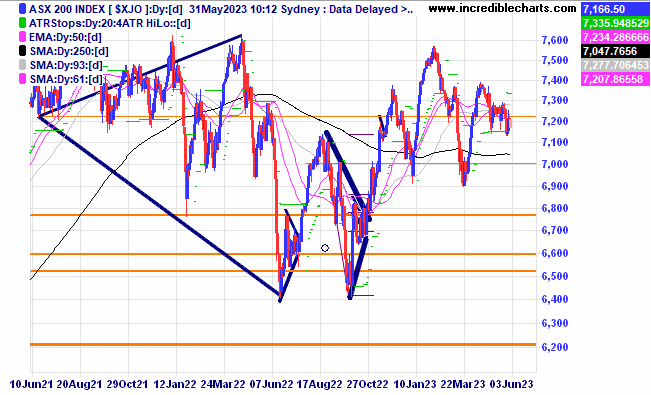

The price of gold has possibly made a false break below the recent support level and is down a similar number of days from the recent high and the last correction. It could also be a bounce off the trend line. Is this the time for a rebound? Time will tell.

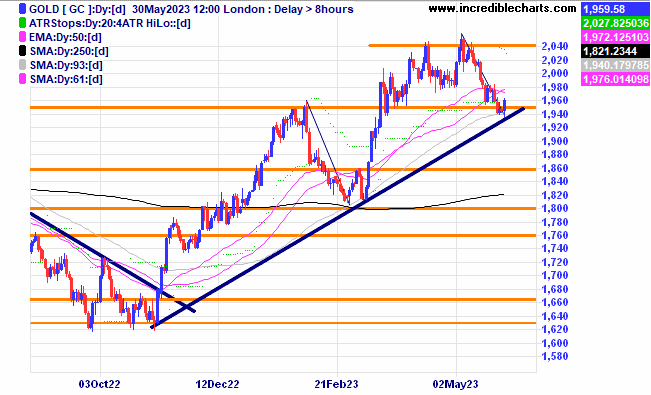

Suncorp has moved to fresh yearly highs.

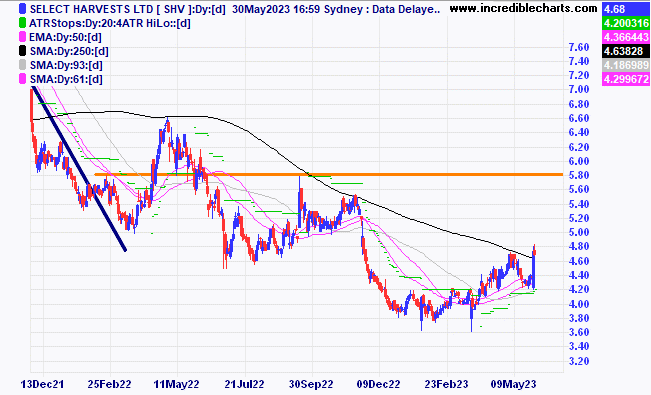

After a weaker than expected result Select Harvest is forecasting a better year ahead.

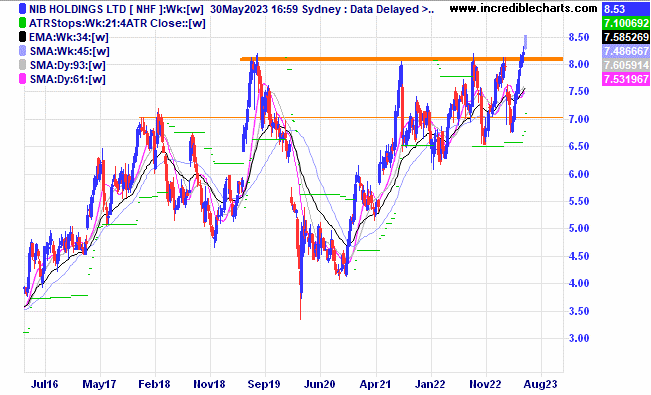

Health insurer NIB looks to have broken clear of the old tops.

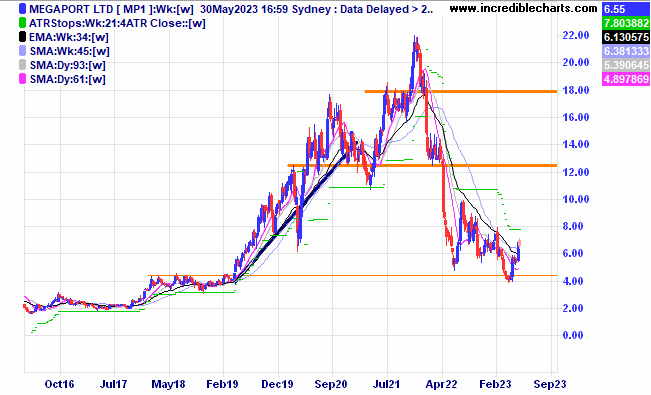

Megaport has bounced off the lows at a previous support zone amid the AI rally.

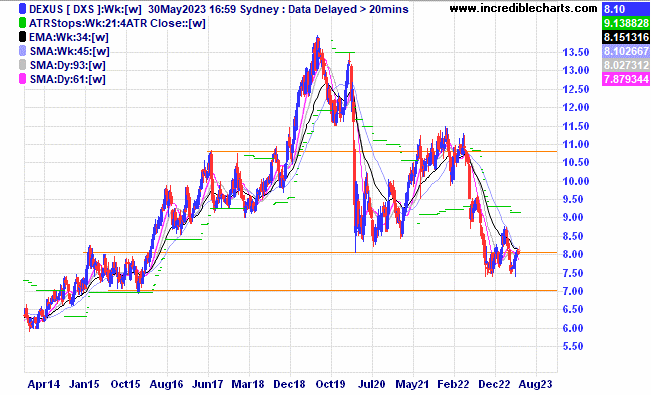

Dexus could be forming a base here.

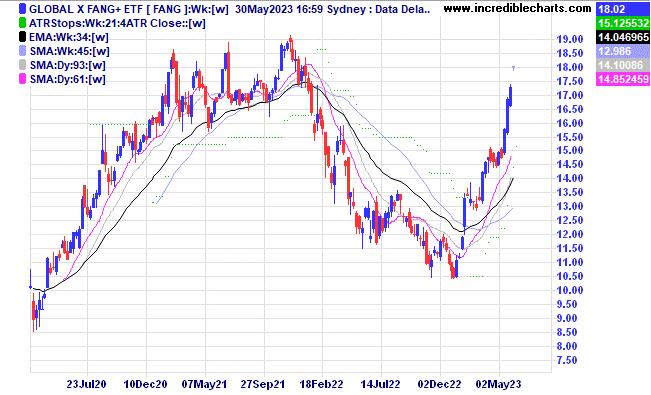

The locally listed FANG+ index is having a good run.

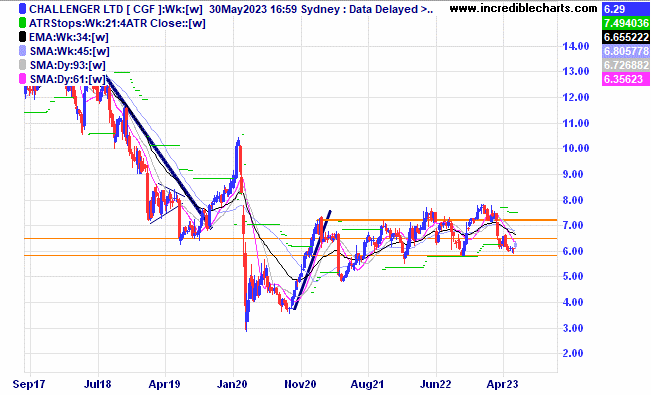

Challenger is still in a big sideways pattern and is again testing recent lows.

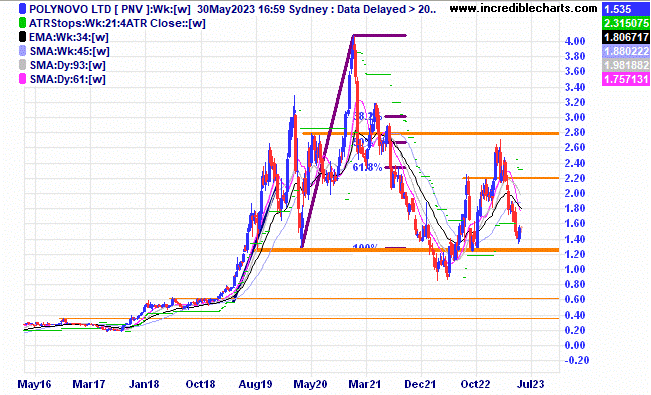

Polynovo is again close to testing a support level.

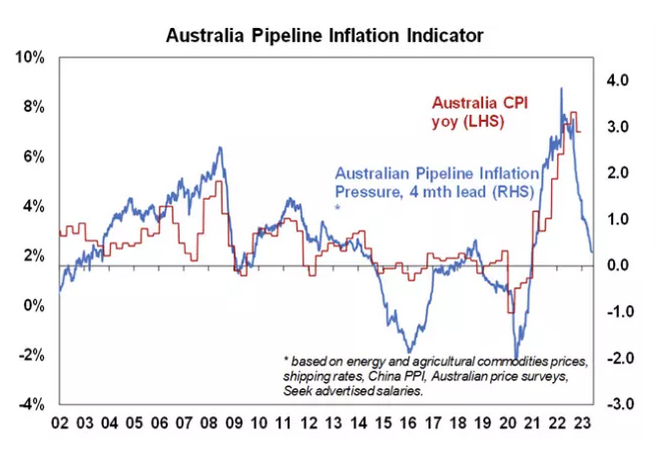

The AMP Pipeline indicator shows inflation dropping sharply in the coming months.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here