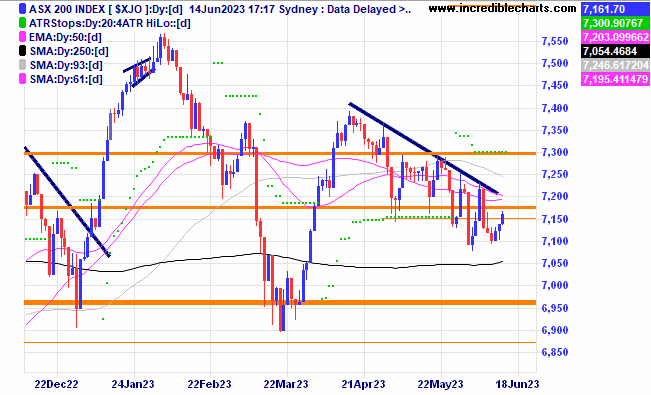

The local market has been moving higher slowly off the recent low. Can it break the series of lower tops? According to some analysts around 40 per cent of mortgage holders on low rates have yet to roll over to higher interest rates. More pain coming for parts of the local economy it seems.

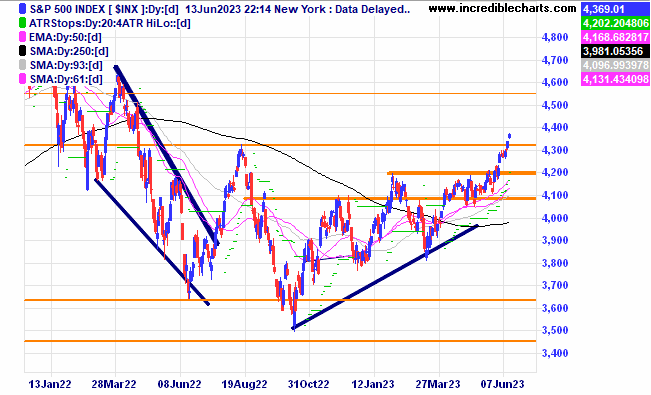

The S@P 500 index has moved slightly above a resistance zone for now.

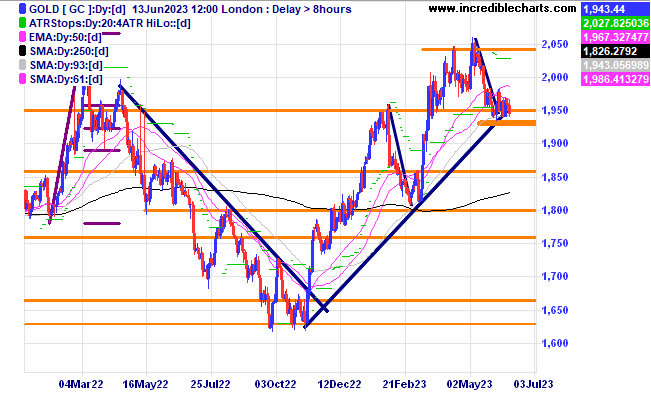

The price of gold is trading in a narrow range which is right on the edge of a support zone. Can it recover?

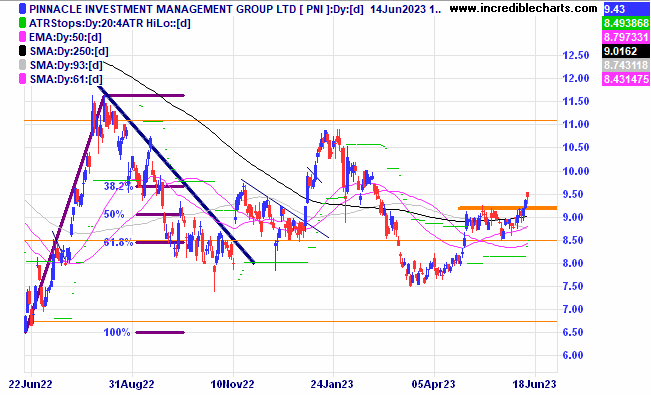

Pinnacle Investment has moved out of the recent congestion pattern.

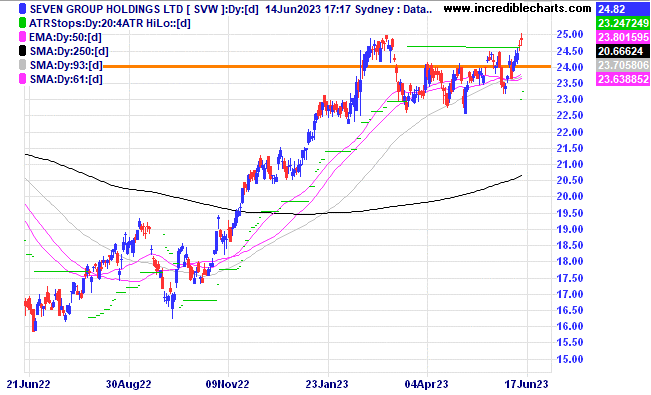

Seven Group is testing the recent high.

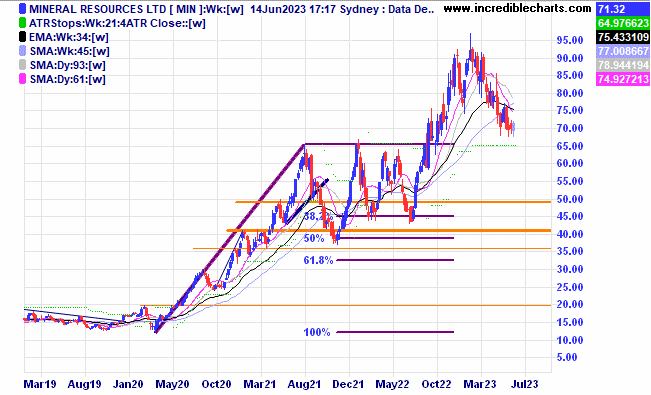

Minerals Resources is stubbornly staying above a support zone.

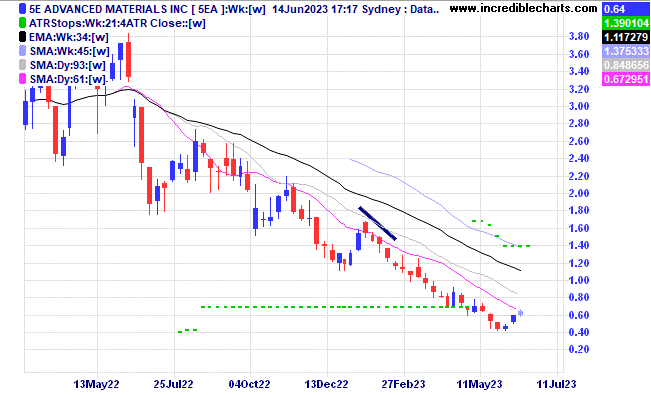

5E Advanced Materials looks to be turning higher and could possibly make a higher low on any small downturn.

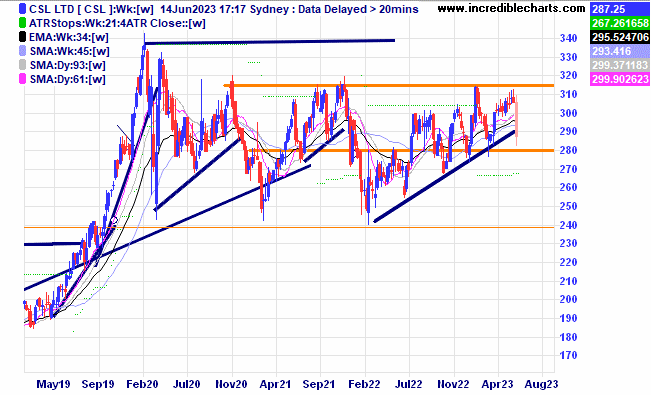

CSL disappointed with their latest update which saw their shares close down more than 6 per cent in one day and for now is below the uptrend line.

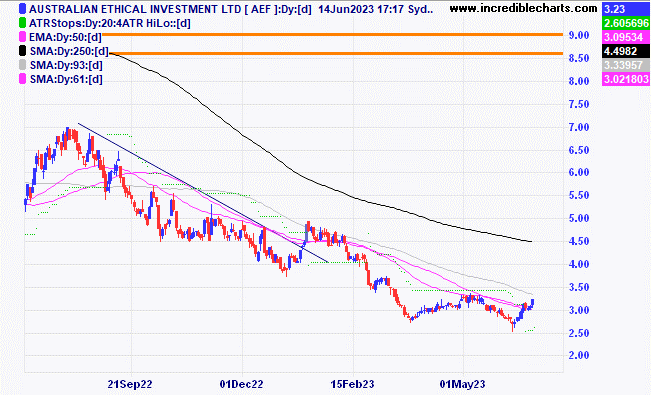

Australian Ethical Investment is showing signs of forming a bottoming pattern.

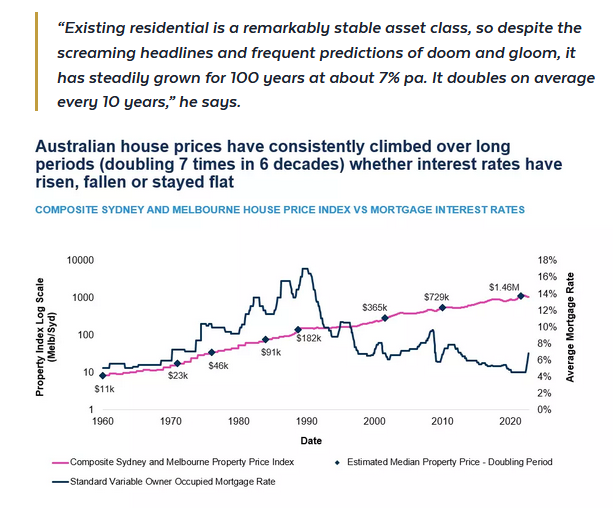

This graph shows that despite interest rate gyrations the Australian housing market keeps plodding along. One wonders when or IF this trend will eventually end.

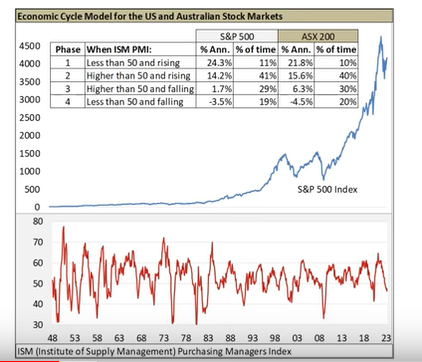

According to one economic cycle the US market could be just about to enter a very profitable stage when the ISM Purchasing Manager Index finally turns up.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here