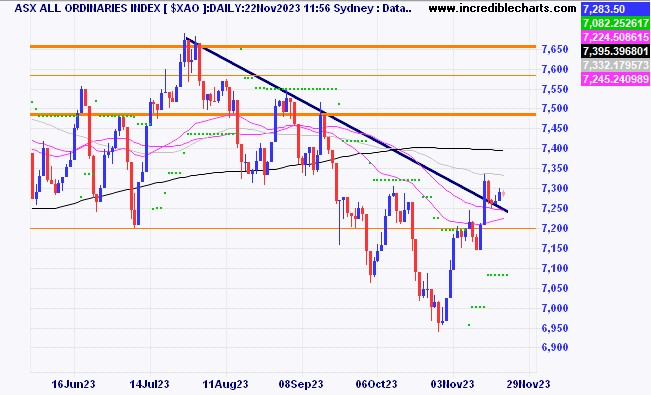

The local market is just remaining above the trend line in a weak looking pattern for now.

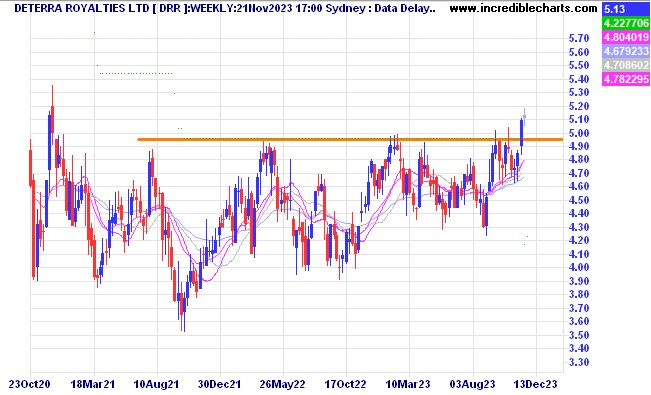

Deterra Royalties made fresh 2-year highs.

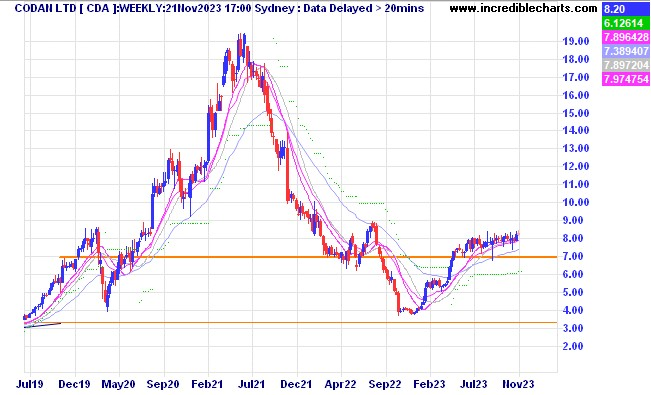

Codan is in a tight range and could explode out of it at any time.

Fortescue is closing in on a previous line of resistance. Can it break through this time around?

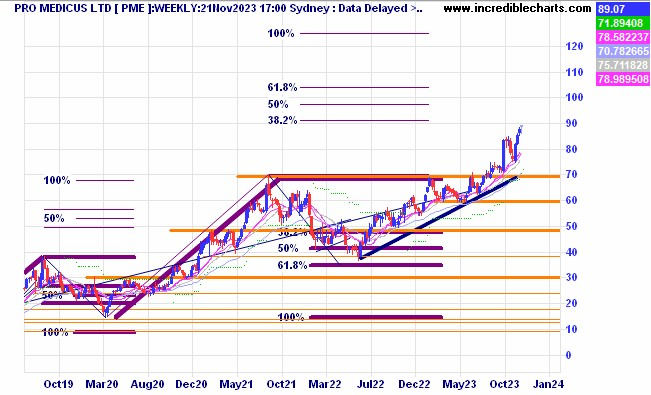

If Pro Medicus sticks to past form $100 a share is not too far away.

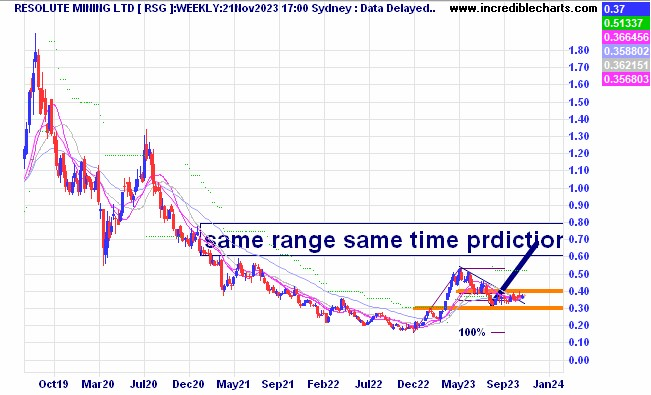

Resolute is still stuck in sideways mode.

Adairs is yet to break out of the wedge pattern.

Boss Energy looks to be making a nice ABC retracement pattern.

MA Financia is still in a consolidation pattern.

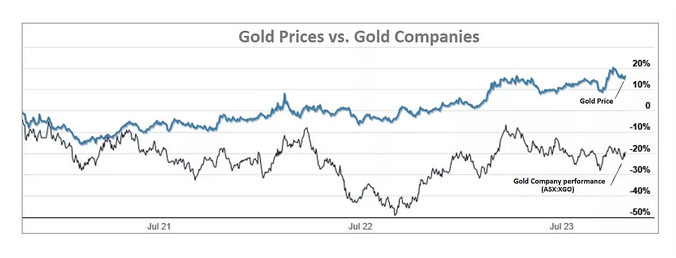

This chart shows the current disconnect between the slowly increasing price of gold versus a basket of gold mining shares contained in the locally listed XGO fund.

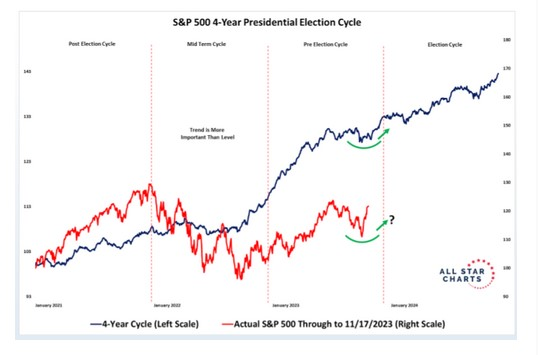

The seasonal tendency for next year looks good with years where a sitting president runs again mostly ending positive to the tune of around twelve per cent on average.

Sitting president Obama’s re-election year in 2012, up 13.4 per cent.

The Trump re-election year in 2020 includes the big recovery from the Covid induced lows and closed up 16.2 per cent.

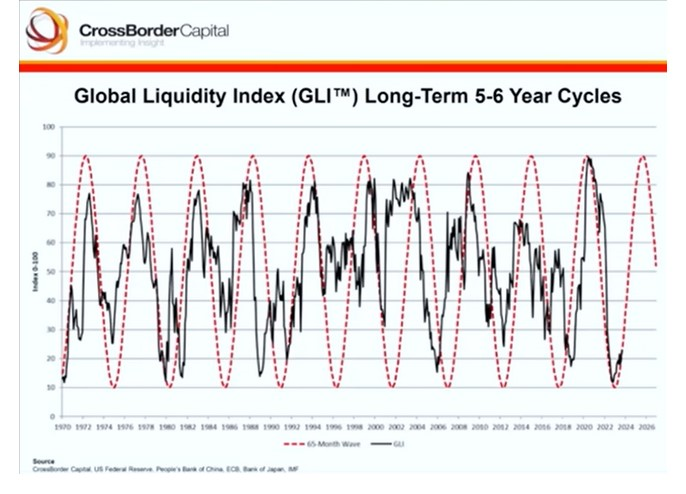

This from CrossBorder Capital shows the “Liquidity” cycle that measures the capacity of capital that generally pumps up risk-on asset prices. Their outlook is for the cycle to expand into late 2025 and suggests lower high street inflation but more monetary inflation.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here