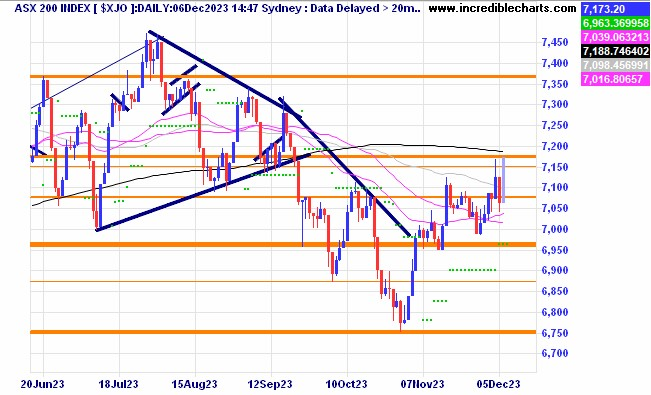

The local market is slowly moving higher on the daily chart with higher lows and higher highs for now.

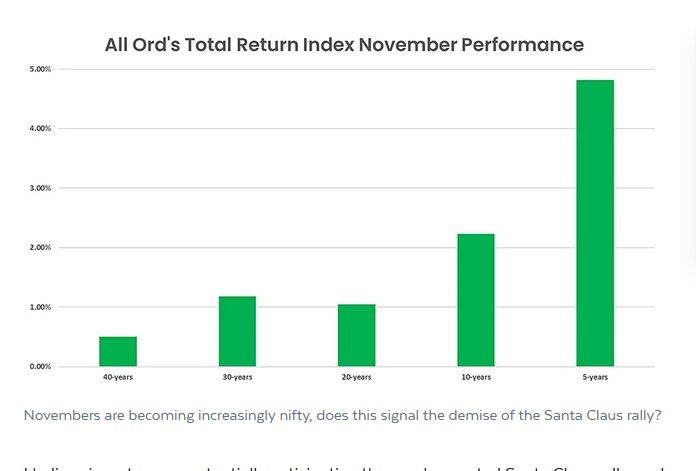

November is putting in very strong performances in recent years.

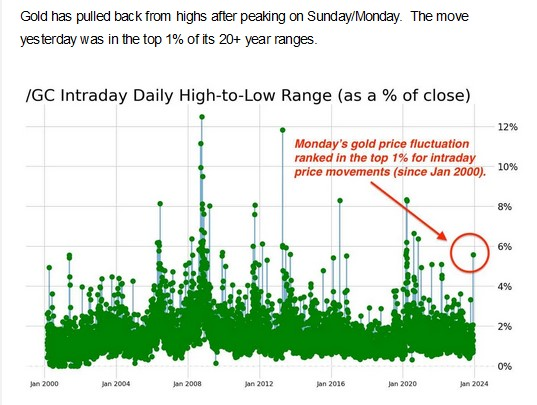

The price of gold spiked higher as some short sellers were squeezed out and price quickly came back to a possible area of support.

Where the recent spike in gold sits over the past 20 years.

Sandfire looks to be building for a break out move.

Calix looks to be quietly building under resistance.

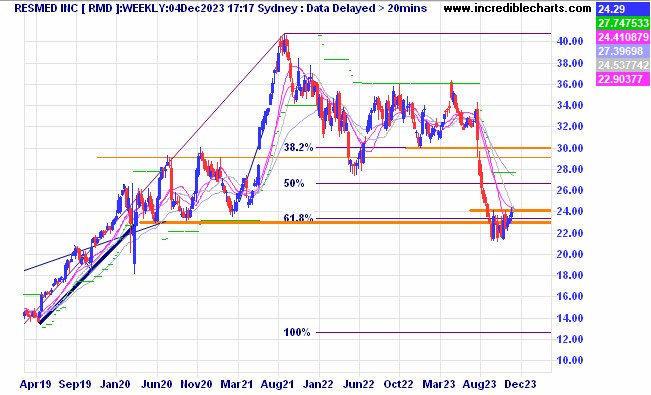

Resmed has nudged out of the base pattern for now.

Neuren is looking strong.

MA Financial in a consolidation pattern.

Karoon is only just hanging onto the trend line.

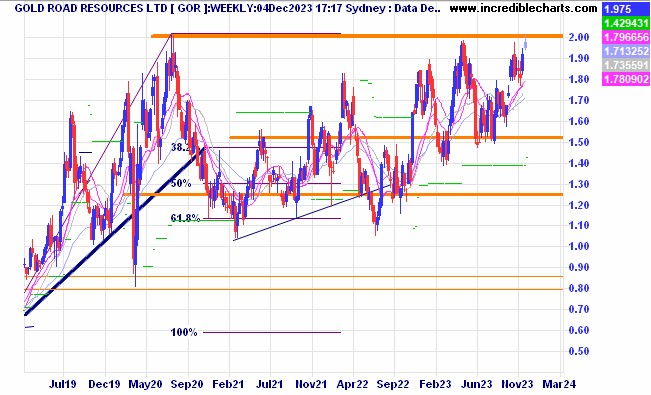

Gold Road retreating from resistance around the $2 level again.

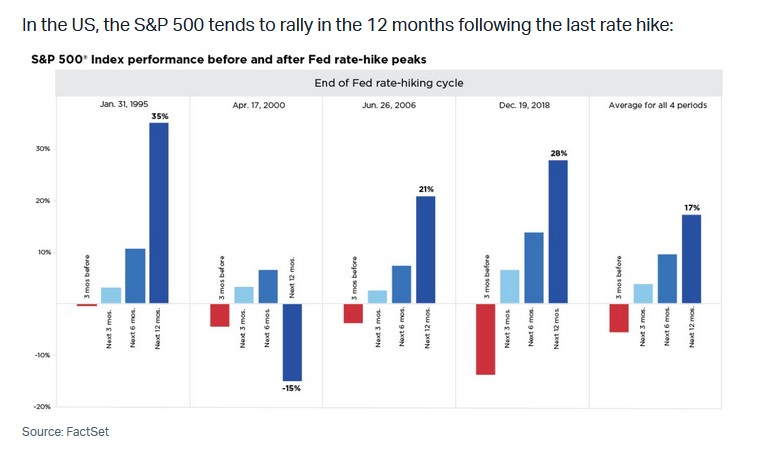

US stocks usually do well after the last rate hike, are we done with the hikes? Maybe, maybe not. One thing interesting to note is that shares were up over the next six months even though there was one significant loss after one year.

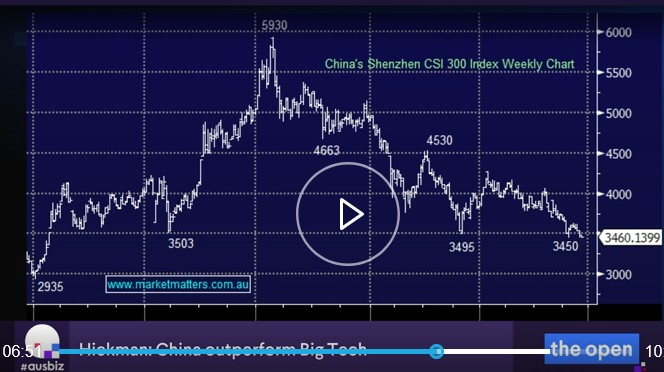

The Chinese market could finally find some support around these levels.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here