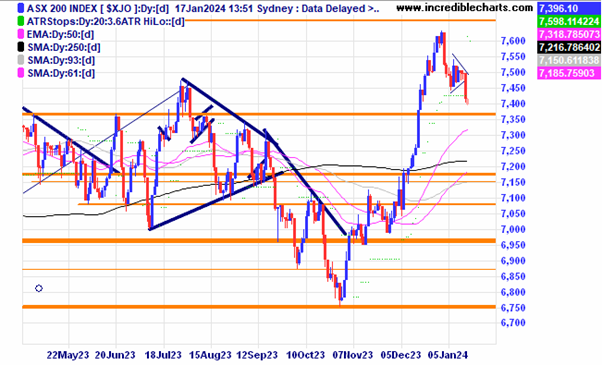

The local market fell one per cent and out of the recent consolidation pattern yesterday and is marking time today.

This shows a divergent MACD to the market index which could signal some market weakness.

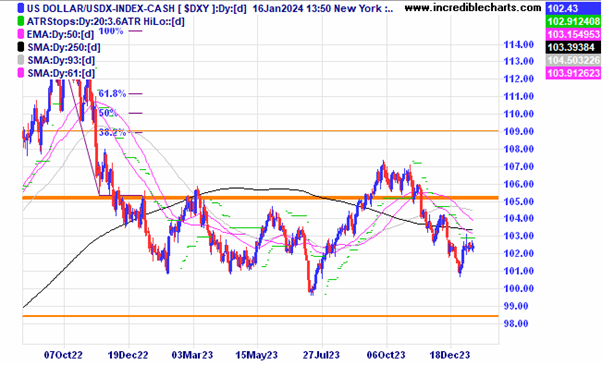

Given the amount of global uncertainty the US Dollar Index has remained steady so far.

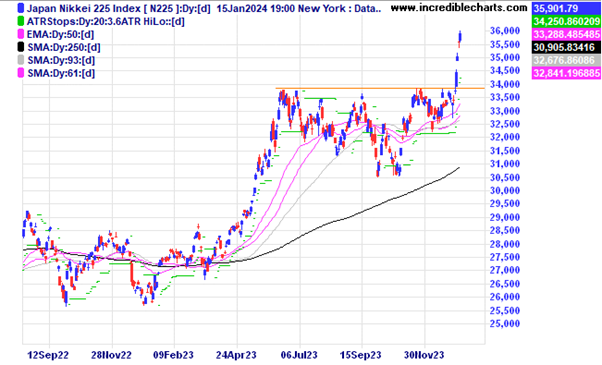

The Japanese stock market has been on the move recently.

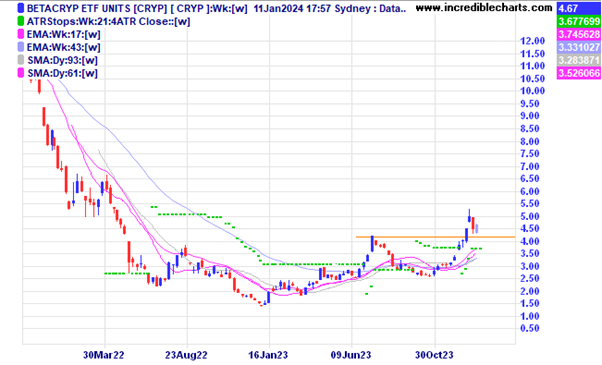

The local Cryp ETF is down from recent highs.

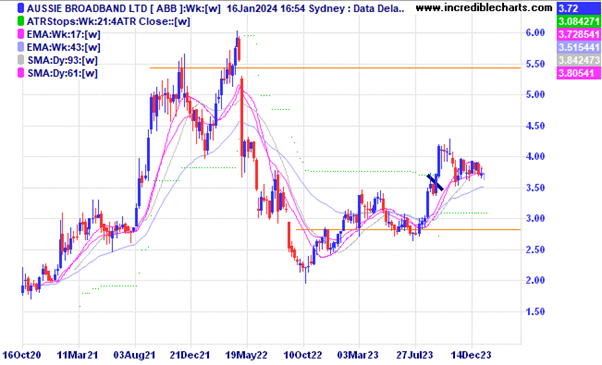

Aussie Broadband has been going sideways for a while.

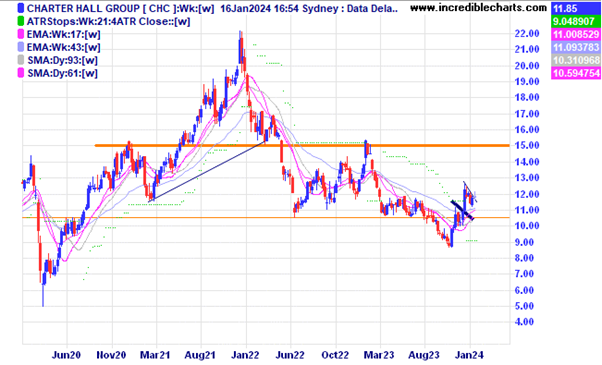

Charter Hall Group looks to be forming a bullish flag pattern.

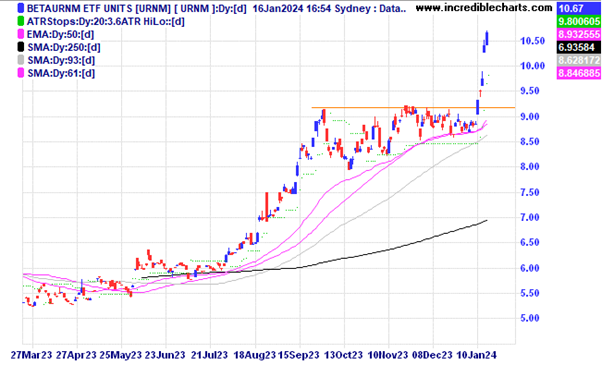

One of the locally listed Uranium ETF’s.

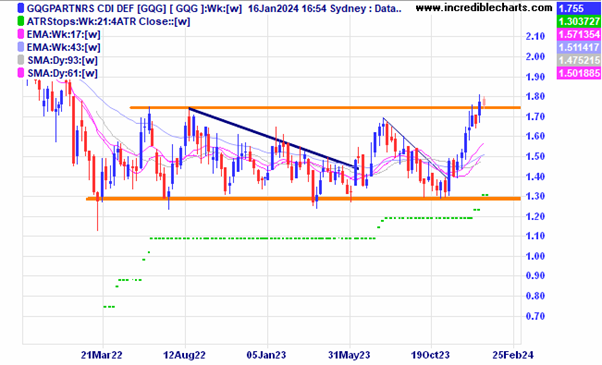

Can GQG push higher or will weaker markets take a toll?

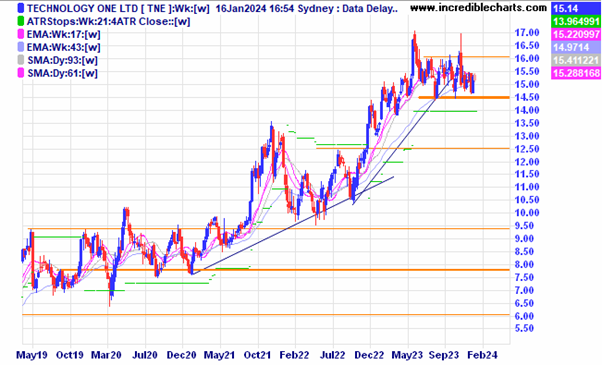

Technology One going sideways for now.

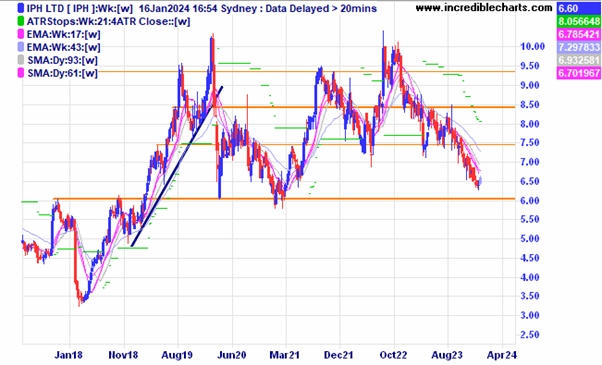

IPH getting close to previous support levels.

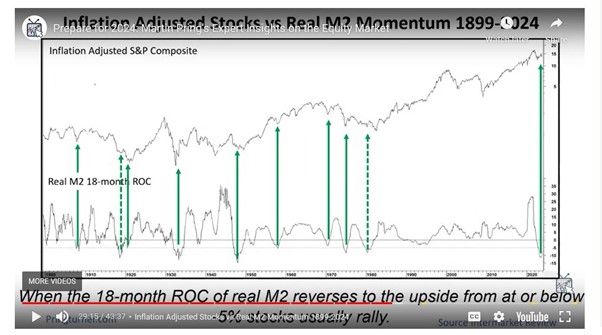

This graph shows when the change in US money supply ticks up from low levels stocks tend to get bullish.

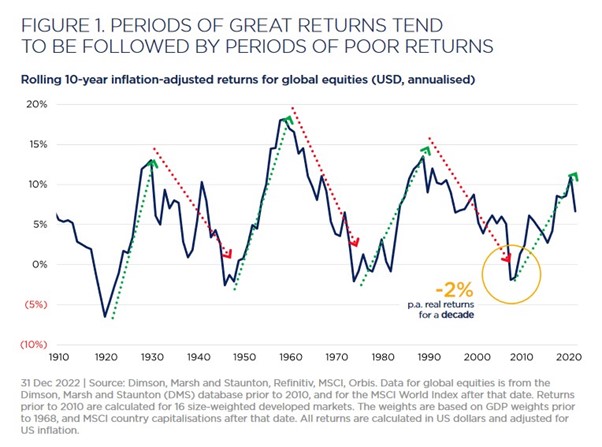

This next graph shows that after having a good run markets tend to reverse.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here