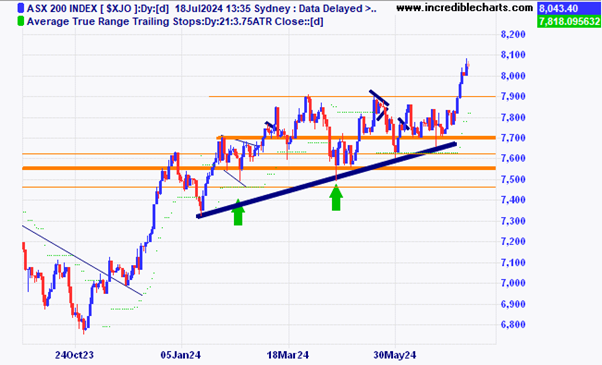

The local market looks to be marking time today. On overseas markets the Dow Jones index was up . 59 per cent, the tech heavy Nasdaq was down 2.77 per cent, the S@P 500 was down 1.39pc and Nvidia was also down.

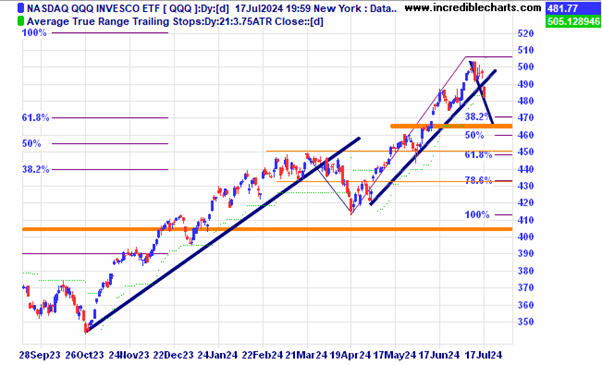

The US Tech heavy Nasdaq closed below the up-trend line perhaps signalling some further declines. If the market falls the same percentage amount as the downturn in April this year price would hit the $465 level.

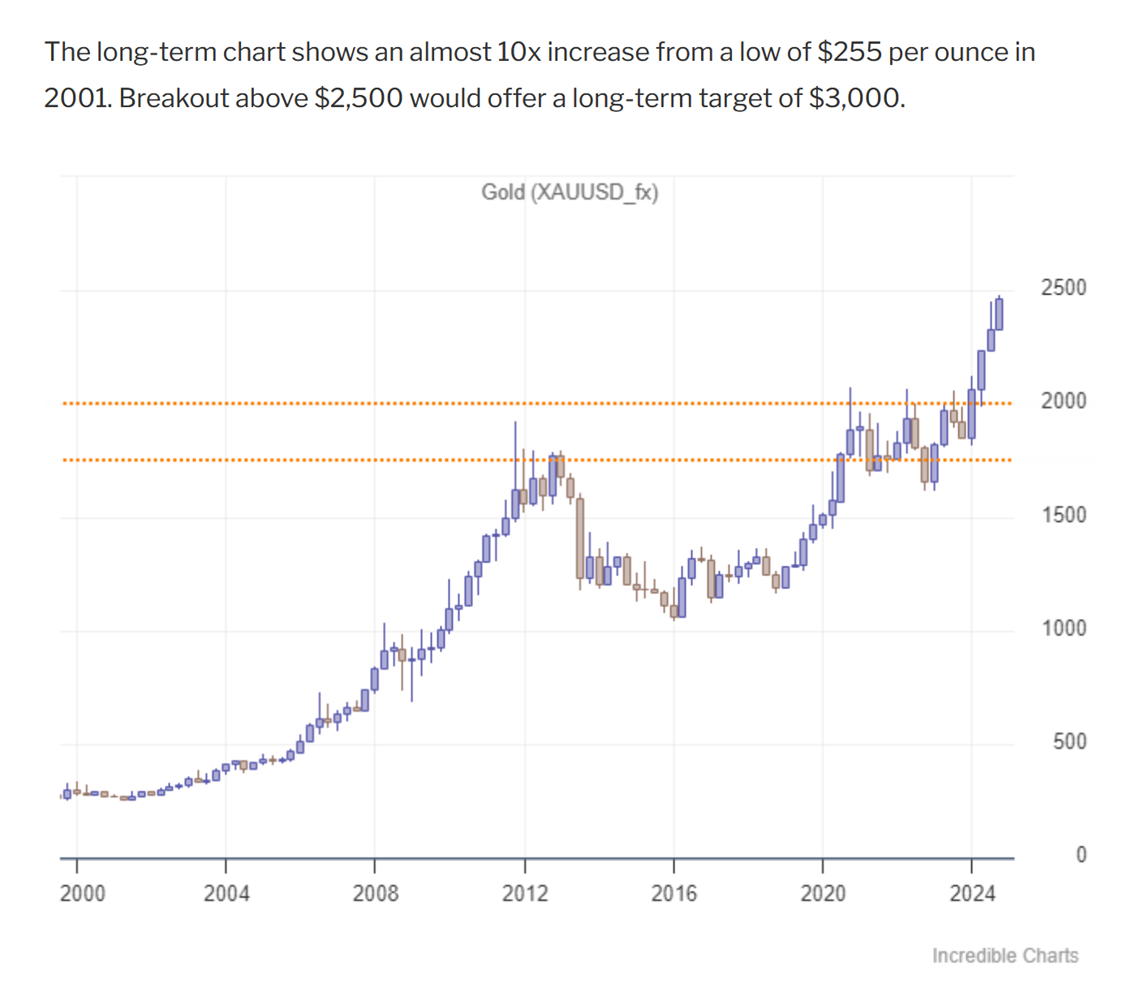

This long-term chart of gold from Colin Twiggs shows a nice little uptrend since 2001.

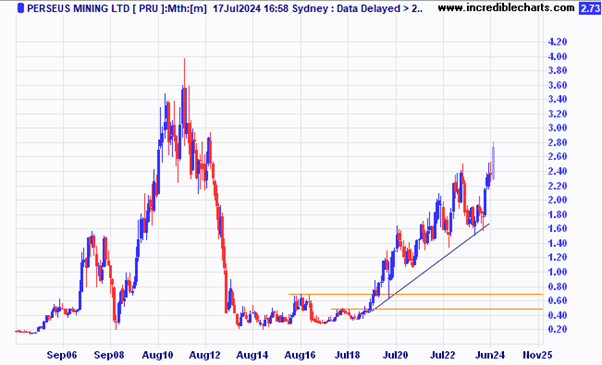

A nice 690 per cent gain for Perseus taking it from 40 cents to $2.79 in seven years.

This chart of the S@P 500 index in the US shows the last couple of booms and busts. Analysts are getting out their calculators to project where this market is headed after last nights fall.

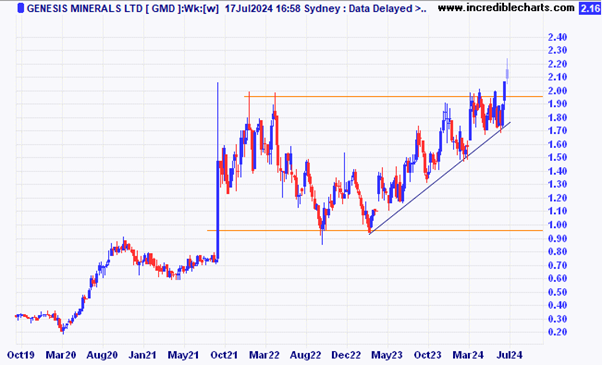

Genesis Minerals popped over the resistance zone and is holding steady today.

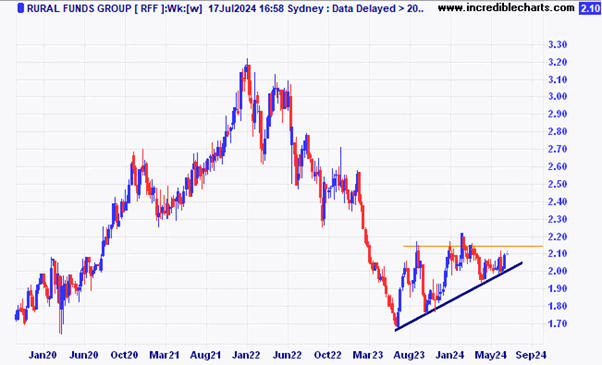

Rural Funds Group still hovering below the resistance zone.

Polynovo is back to February 2023 levels

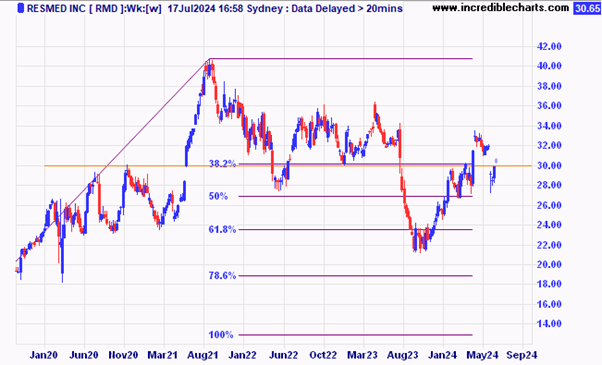

The price of Resmed is trying to close that drop in price that came after another weight-loss drug scare.

With some stories doing the rounds that China could be using aluminium as a copper replacement Alumina could be worth a look.

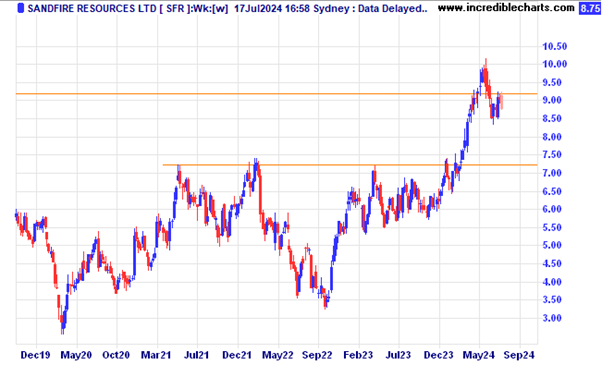

Sandfire is off the highs, is this a bullish flag or the start of an ABC type correction?

Most uranium stocks are down today.

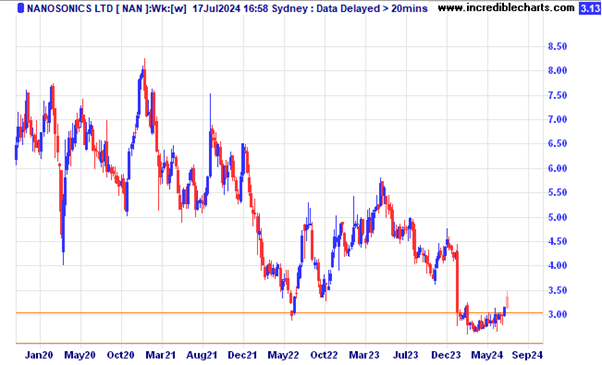

Nanosonics has popped up above the resistance zone.

After this very large fall in price from Lendlease could a turnaround finally be coming.

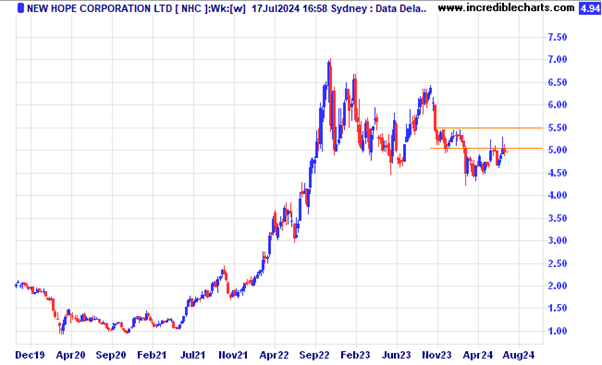

The two attempts to move above resistance for New Hope do not look promising in the short term.

Pinnacle Investment Management has finally tagged the lows of early 2022.

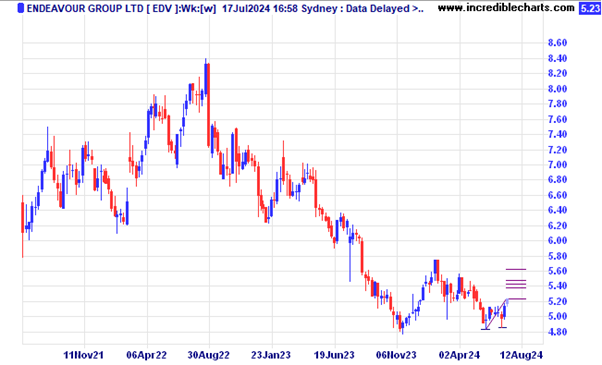

Endeavour looks it might be making a comeback off these lows.

Charter Hall has moved out of the down sloping wedge pattern.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here