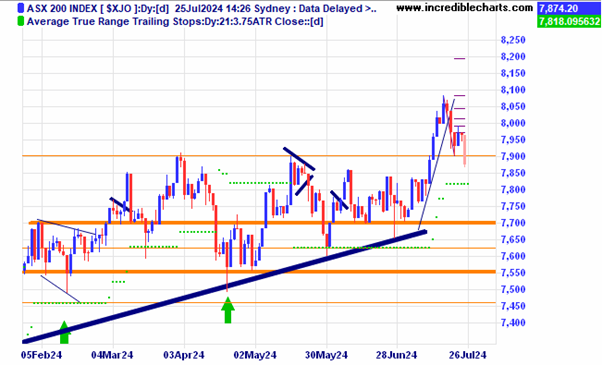

The local market is taking a tumble today, falling down just over one per cent on the back of lower US share markets with the tech heavy Nasdaq falling 3.65 per cent and the broader-based S@P 500 index falling 2.31 per cent. What looked like a nice ABC pullback and bounce off the support zone yesterday at the close now looks like the second leg down in what could be a much larger corrective move lower. With some luck the thick up trend line will again offer support to the bullish camp.

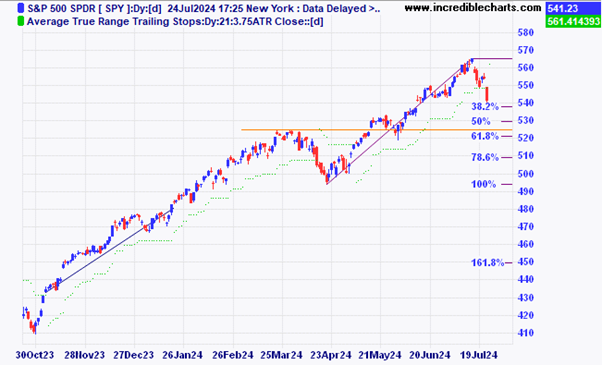

The US S@P 500 index dropped 2.3 per cent overnight. The SPY ETF that represents that index gapped lower and the first sign of support is at the 520 to 530 level. Will it just bounce or hold firm? Only time will tell.

The Tesla price chart below shows how volatile the price moves for this stock can be.

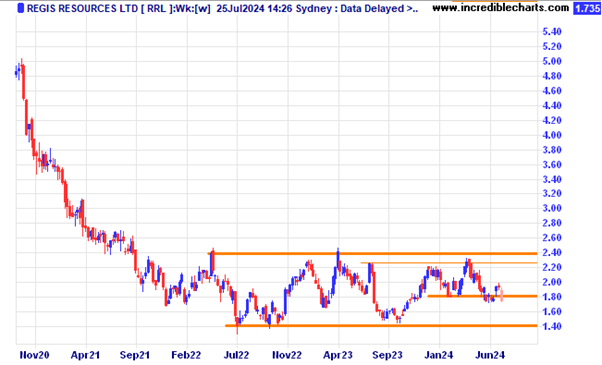

The chart of gold miner Regis Resources was looking like it might make a move higher until the latest results update today saw the price down nine per cent at one point.

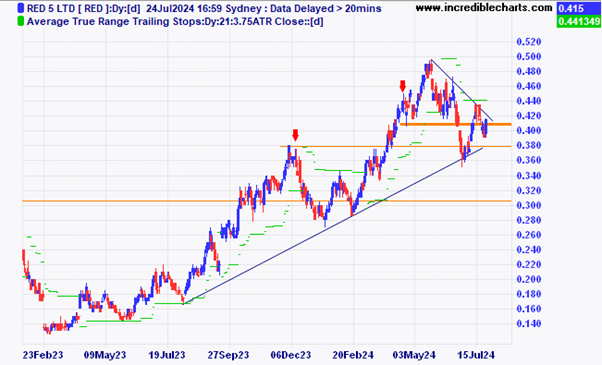

Junior gold miner Red 5 has had a nice run up and recently bounced off the trend line.

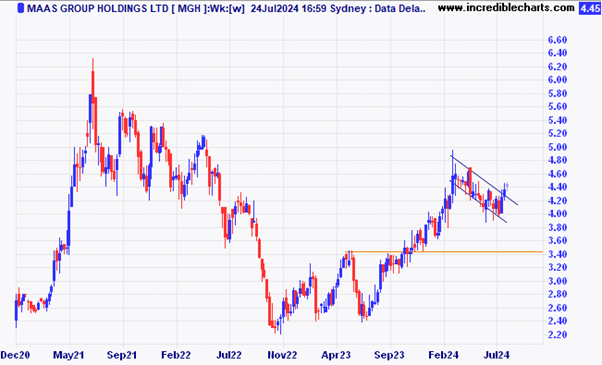

Dubbo based Maas Group recently moved up and out of a slow downwards channel.

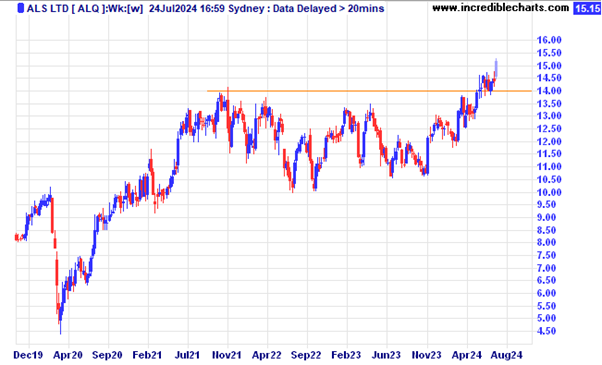

ALS looks to have bounced off the support resistance zone for now.

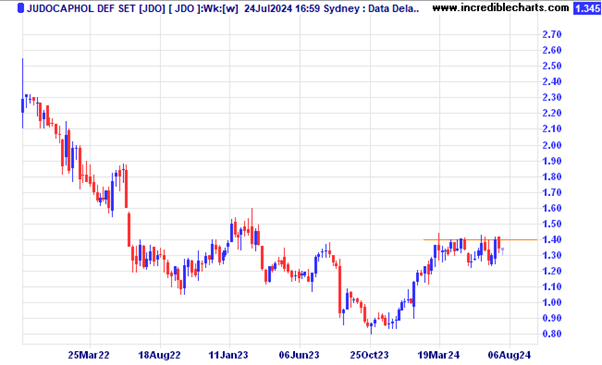

Judo Bank is yet to break above this resistance zone.

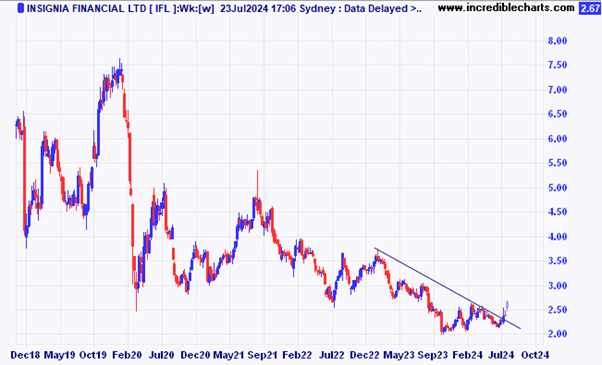

Insignia looks to have moved above the trend line and the resistance level around the $2.50 mark.

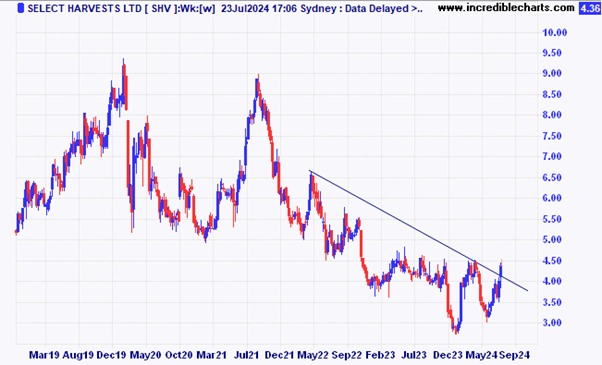

Select Harvests looks like it wants to head higher once it overcomes the resistance zone around the $4.50 .

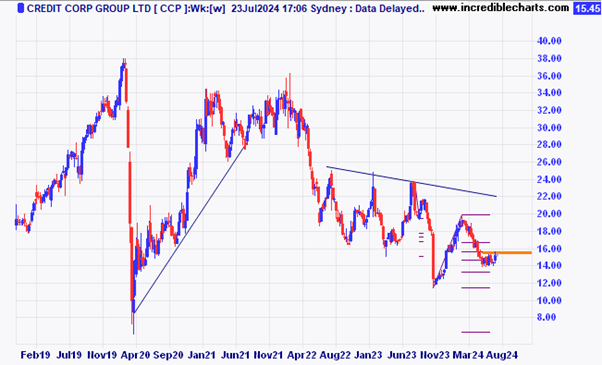

Credit Corp Group is currently trading in a very tight price range. With this type of pattern, when the move comes it can be very quick, but not a certainty.

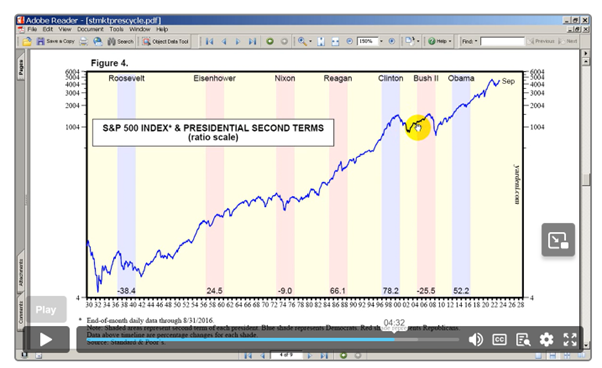

This long-term chart from Alan Hull’s website shows what happened during different US President’s time in office. One interesting thing to note is that leading up to the election stocks were generally going up.

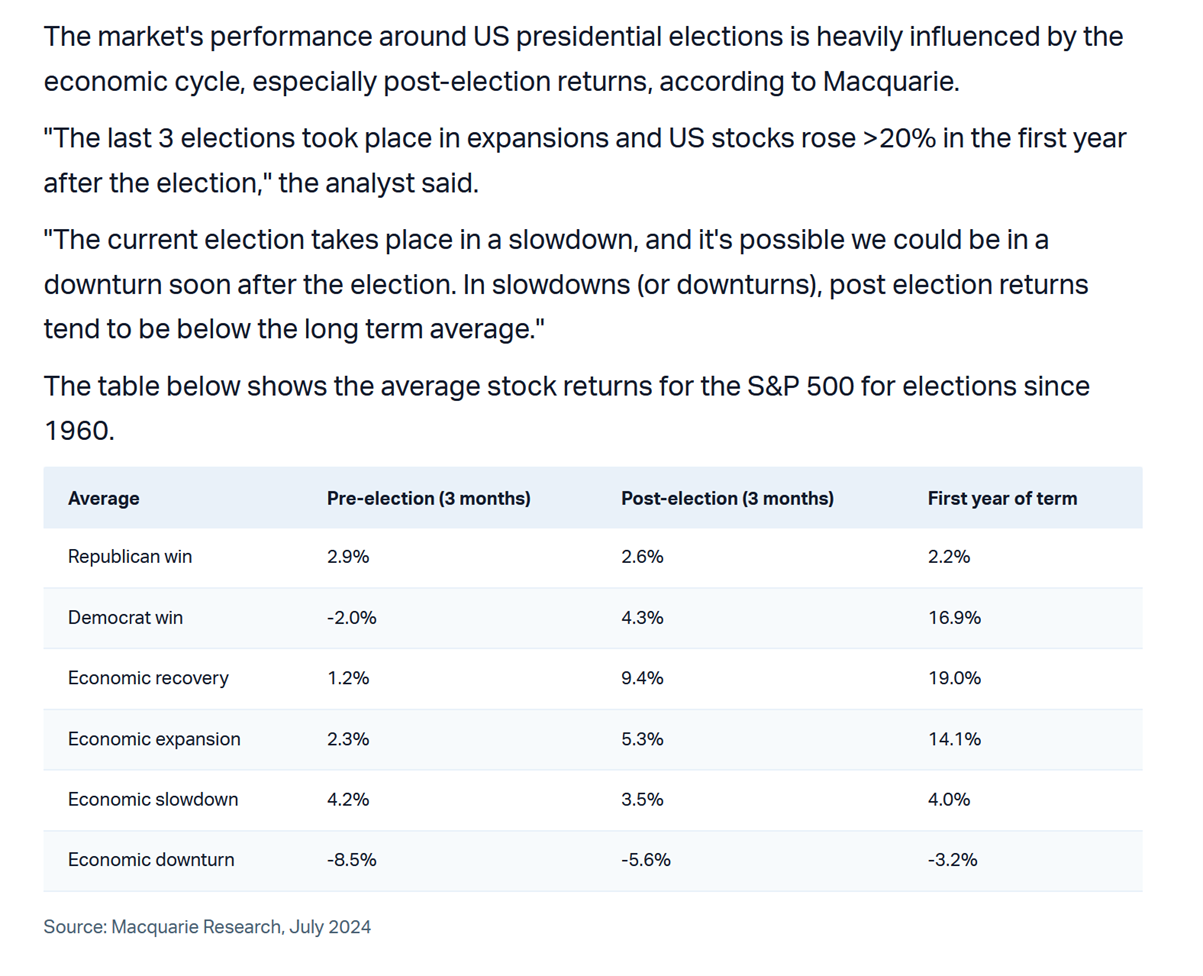

This information comes from the analysts at Macquarie and published in Market Index. It is full of information about how US markets perform over the election cycle. Analysts at Macquarie also reckon Australian investors should hold stocks with a large earning base in the US including Block, James Hardie and Pro Medicus.

This chart comes from Market Index and shows the Chinese Mainland Real Estate Index. It looks like the big falls might be over, or are they?

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here