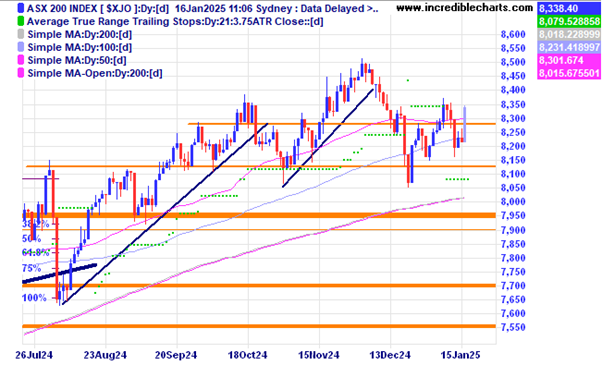

The local index is up more than 100 points today on the back of strong US markets overnight which came after the latest release of US CPI numbers and strong bank earnings.

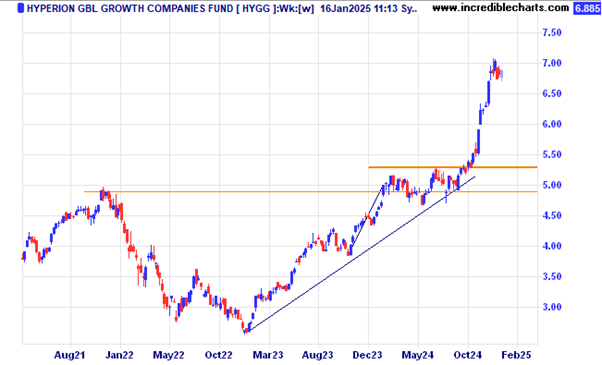

After a strong performance in the 2024 4th quarter the Hyperion Global Growth ETF looks to be taking a little breather.

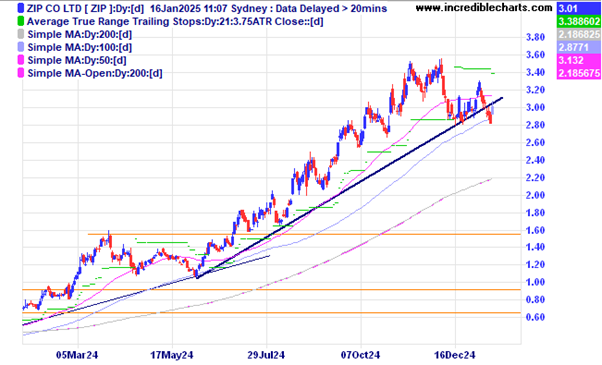

ZIP is one of the better performers on the local market today and remains just below the up-trend line. Will it regain momentum?

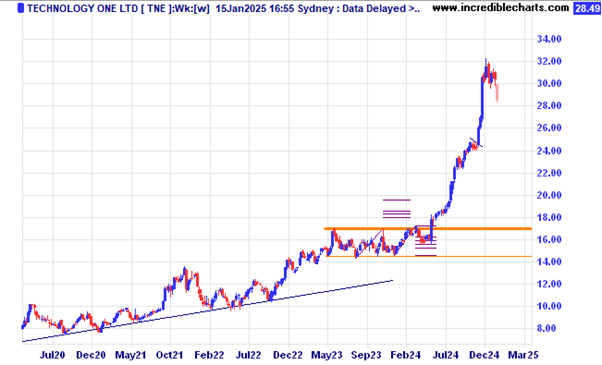

After a strong run Technology One is coming off the highs.

Nymex crude oil may have moved out of a consolidation phase giving hope for further gains.

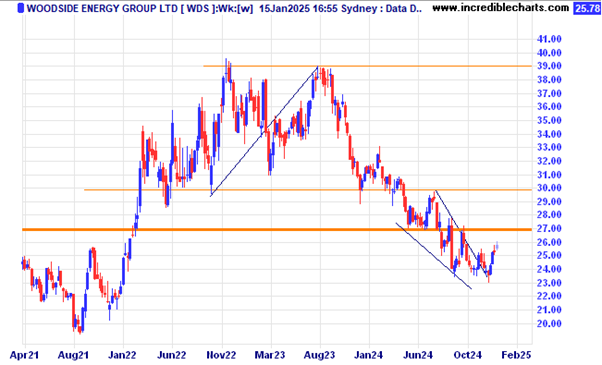

Woodside Energy is ticking up on the back of higher oil prices.

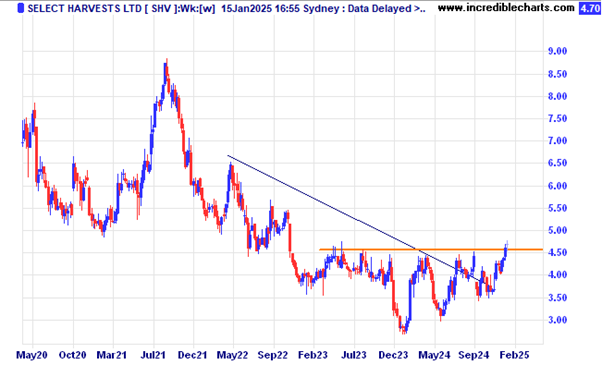

Select Harvests is close to moving above a stubborn resistance zone.

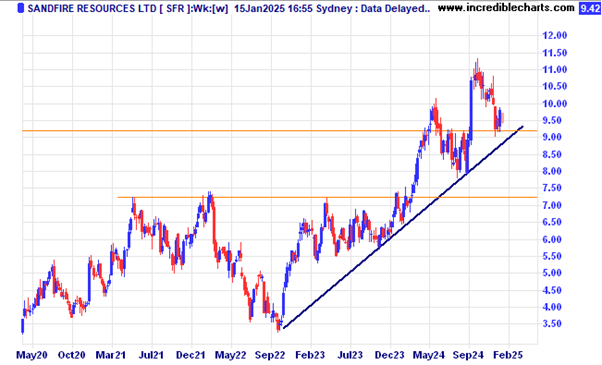

Copper miner Sandfire continues to make higher lows.

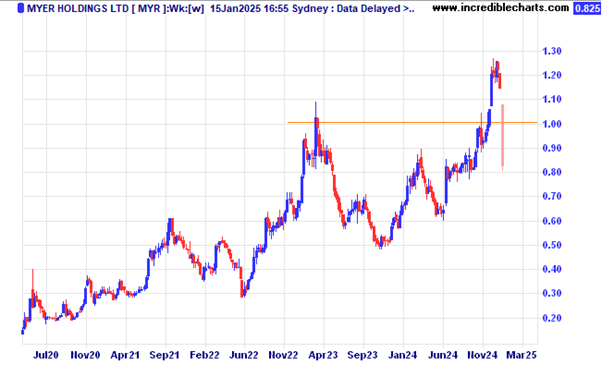

Myer shares were dumped after an earnings report did not meet investor expectations.

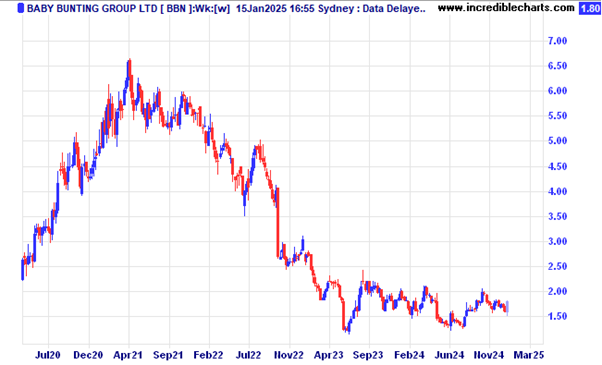

Baby Bunting shares rose after a favourable earnings report.

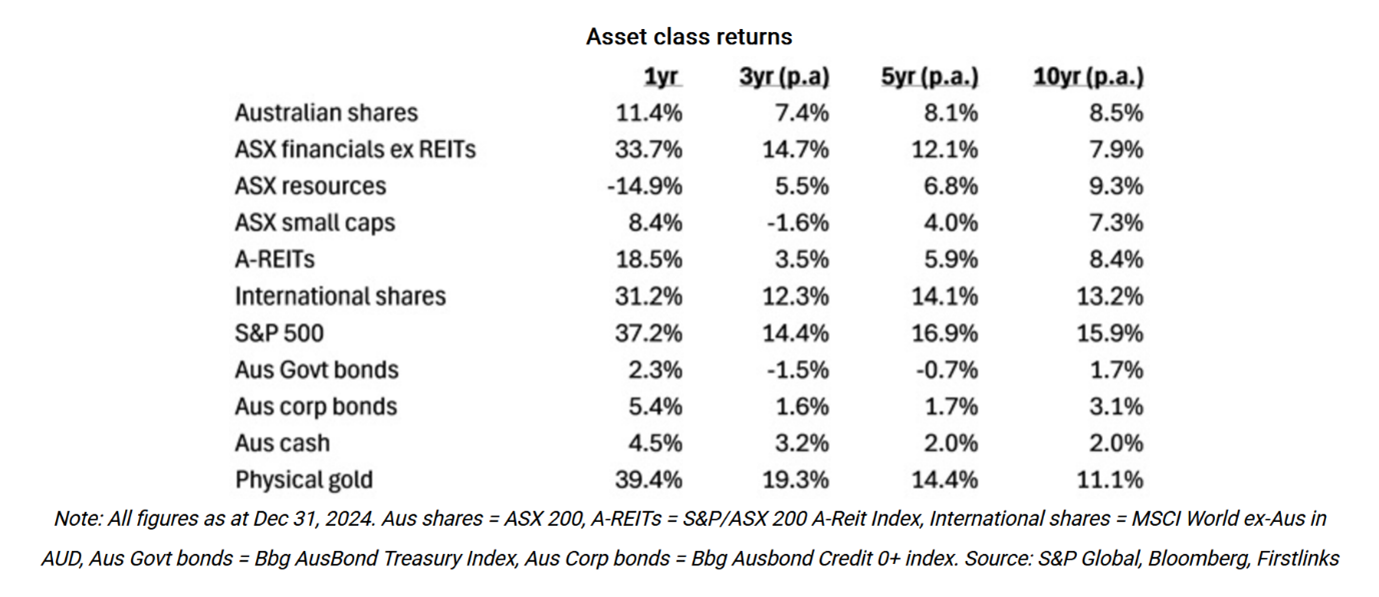

A look at different asset class returns over 2024 and periods before that. US share market returns have been strong for quite some time.

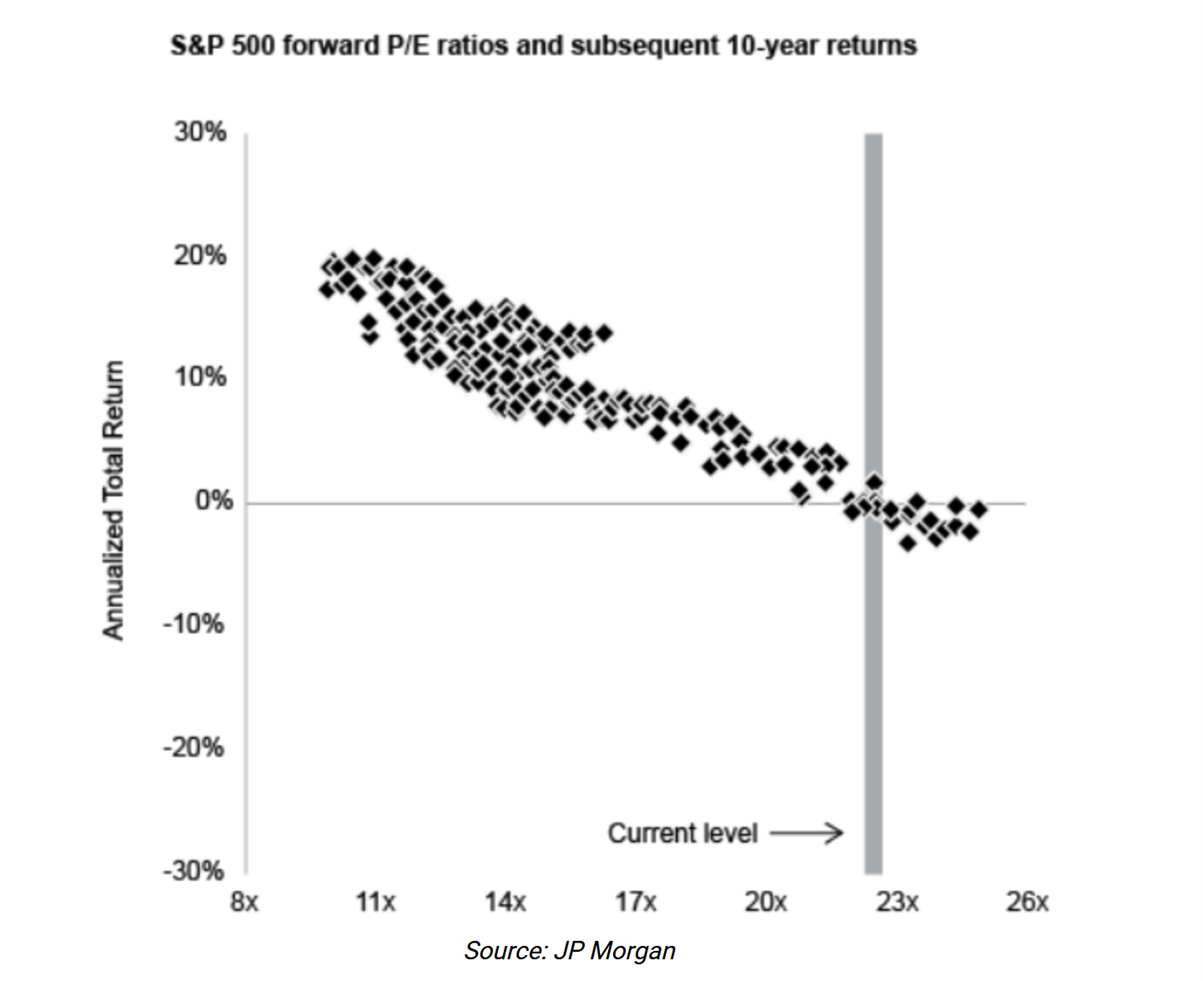

Historically higher PE ratios have led to lower returns over the next decade. Will history repeat or just rhyme a little?

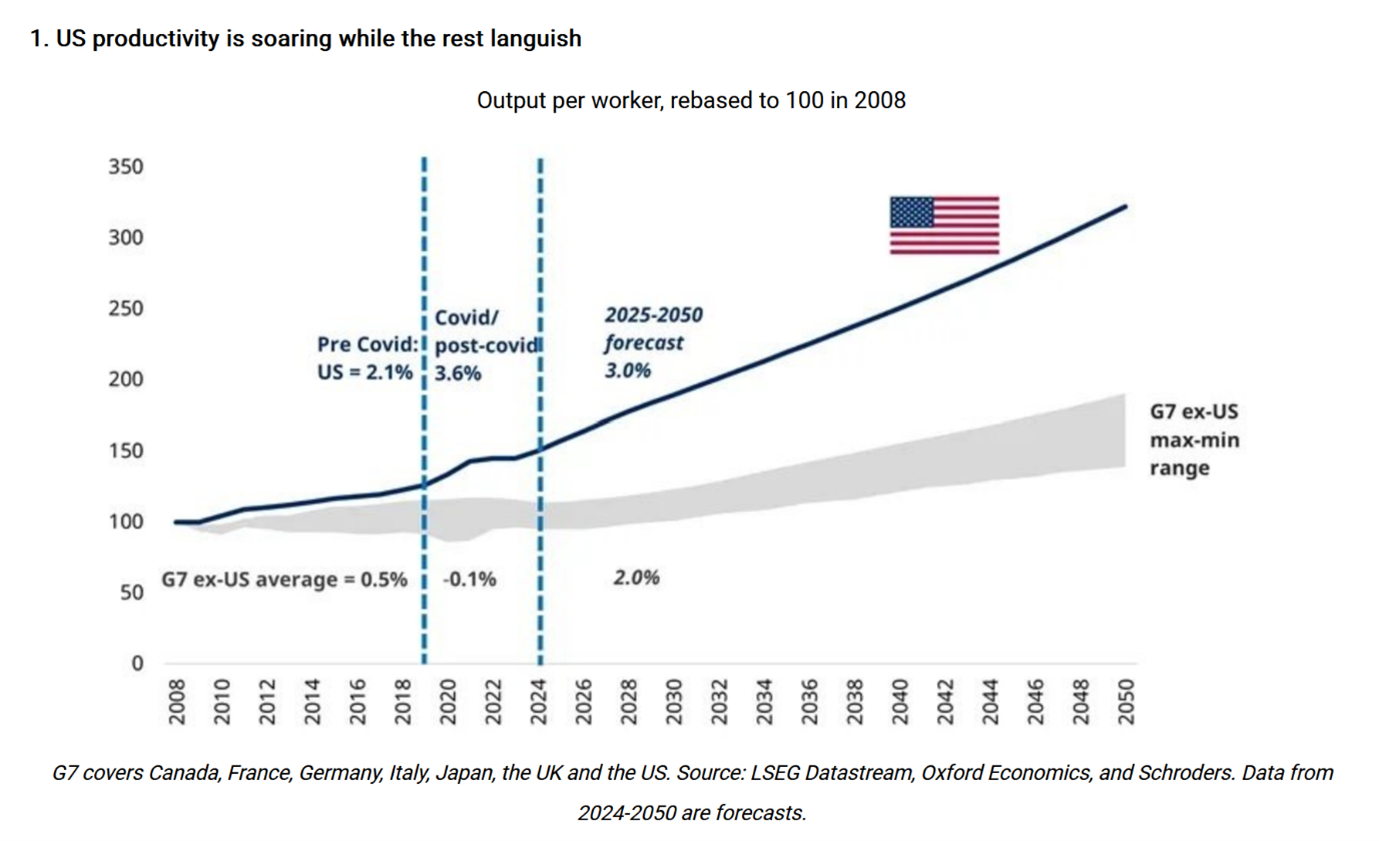

One reason behind strong US share prices is rising productivity which is forecast to continue.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Wishing everyone a happy and healthy holiday season and many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here