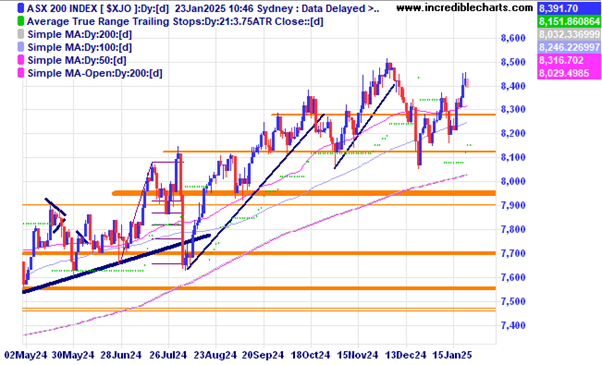

The local market is off a little bit today and not too far off the highs. Concerns over peak steel production in China has seen a drag on the large iron ore producers.

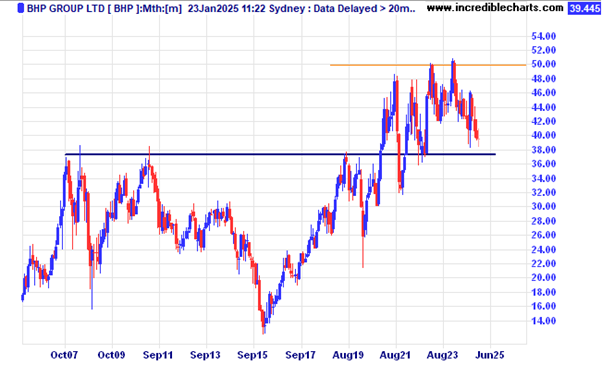

BHP is trading close to recent lows in a large sideways move.

Could the Australian dollar be about to move higher off the recent lows.

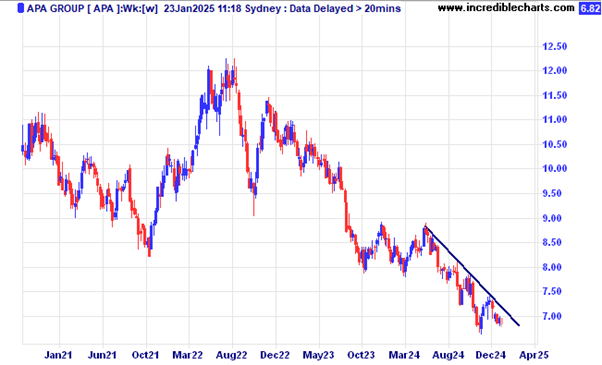

APA Group could be in the process of making an ABC type low.

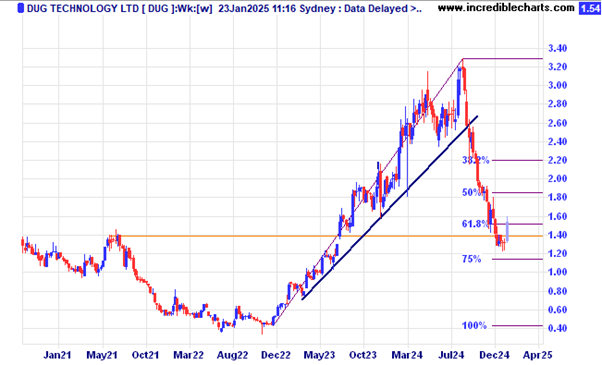

Dug Technology is moving up after a recent announcement.

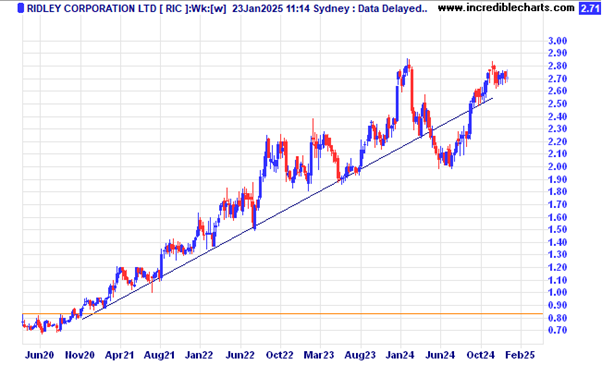

Ridley Corporation looks to have resumed the long term trend and is closing in on new highs.

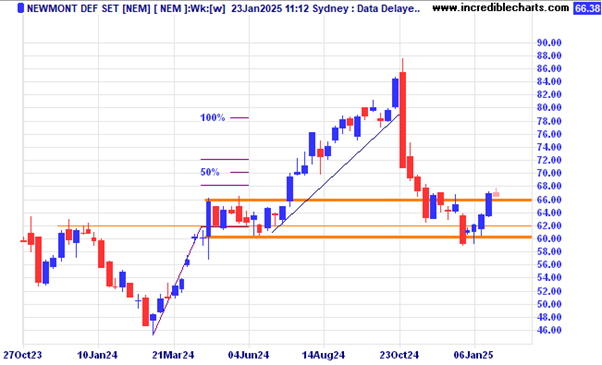

Newmont is moving off the recent lows.

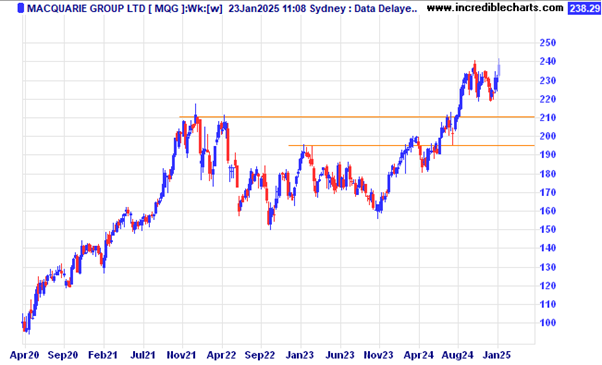

Macquarie Group could rise on the back of higher US bank earnings.

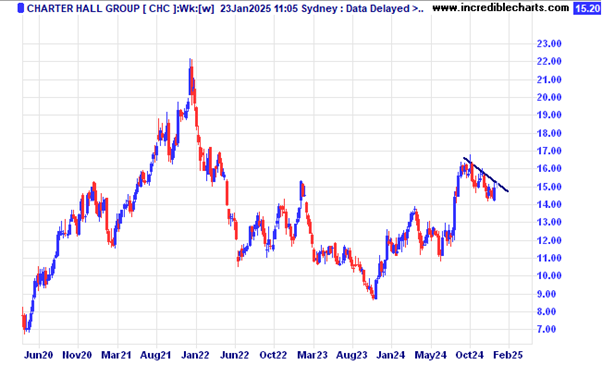

Charter Hall could be forming a bullish flag pattern.

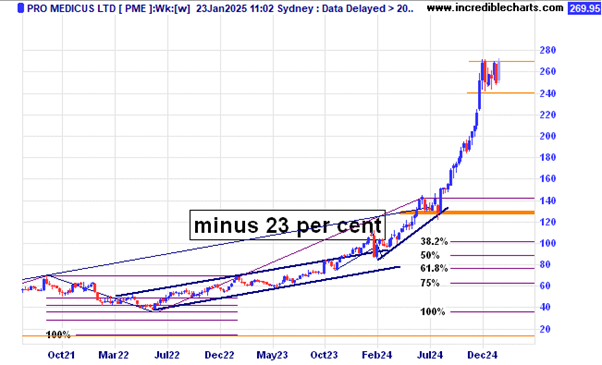

Market darling Pro Medicus is taking a breather for now.

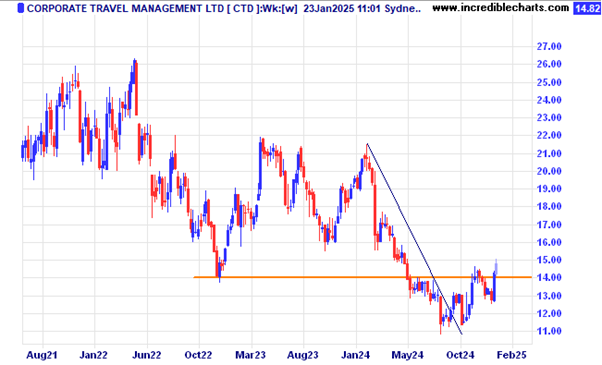

Corporate Travel looks to be moving above the resistance zone.

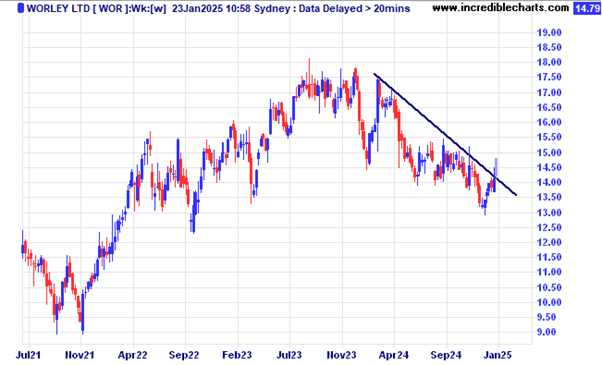

Worley could benefit from Trumps “drill baby drill” intentions.

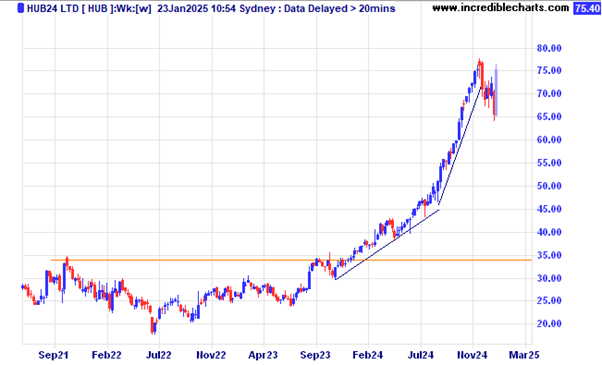

HUB 24 rose on an increase in funds under management.

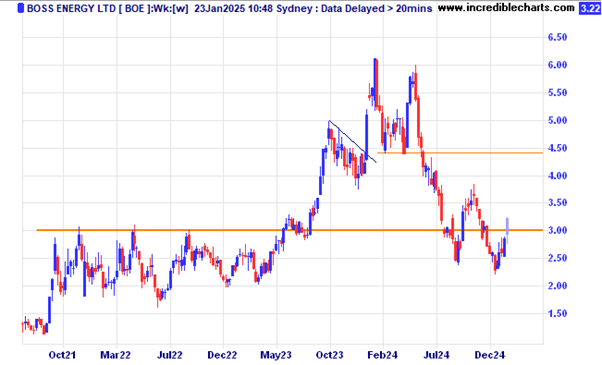

Boss Energy has moved above the zone of resistance.

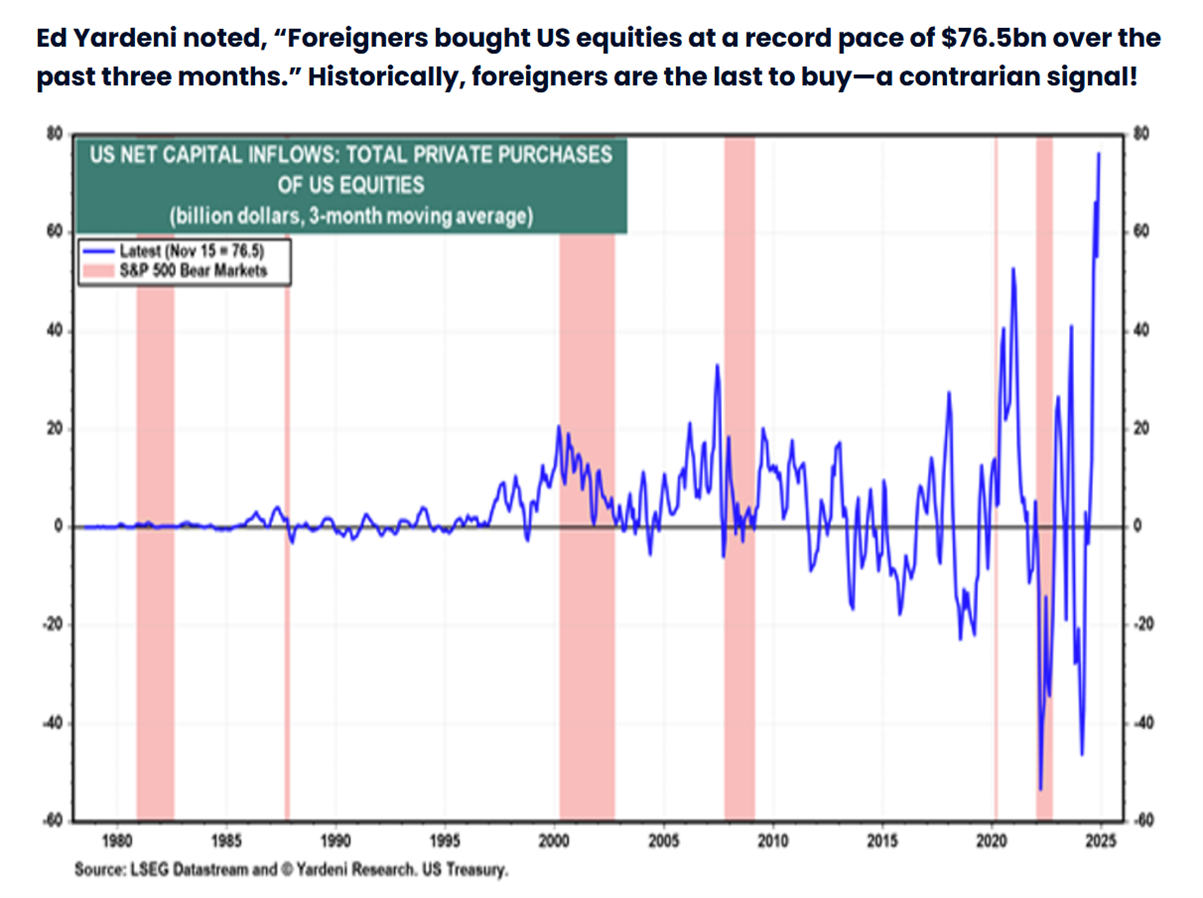

This interesting graph shows that in the past when foreigners become big buyers of US stocks a bear market in stocks can be just around the corner.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Wishing everyone a happy and healthy holiday season and many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here