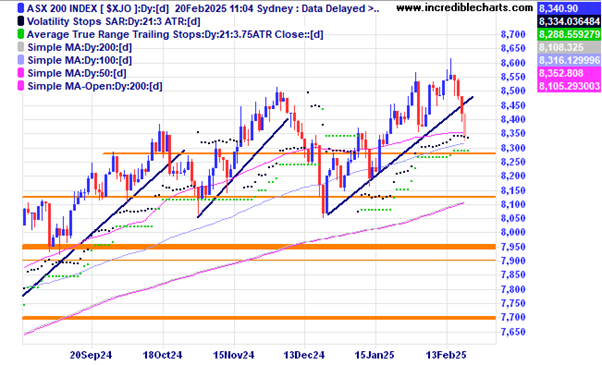

The local market has taken a bit of a tumble in the day after the Reserve Bank announced a much-awaited decision to lower interest rates by one quarter of a percentage point and then distancing itself from making another cut anytime soon.

This is one analysts targets for the US based S@P 500 ETF. First hurdle is the current resistance zone with multiple new intra-day highs with no decent follow through.

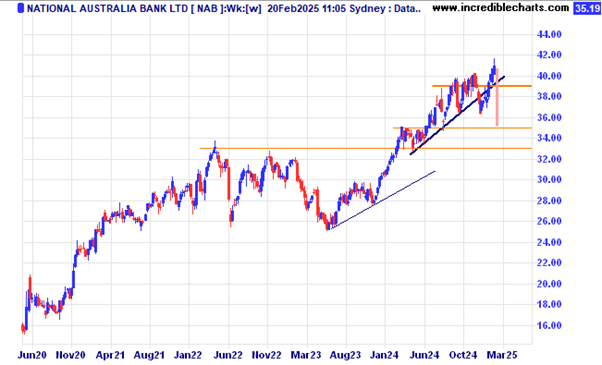

National Bank had a big tumble after their latest update.

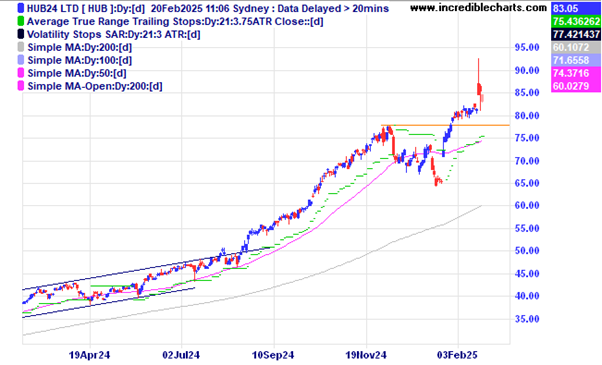

Wealth platform mob Hub24 jumped after their latest update and has since come back closer to the break out level.

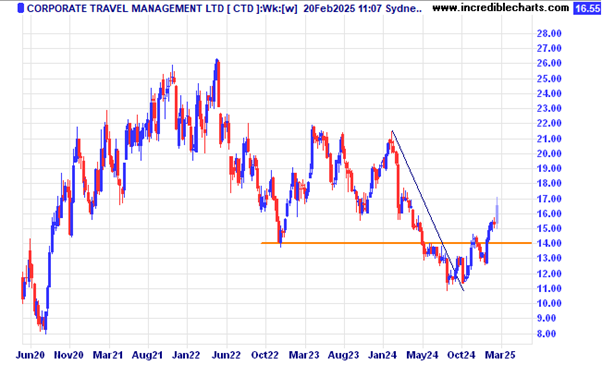

Corporate Travel keeps gaining ground.

A2 Milk’s latest update was well received.

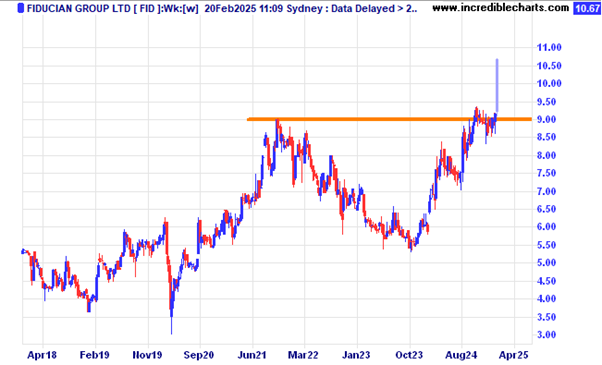

Fiducian Group had a stellar jump on their latest earnings updates.

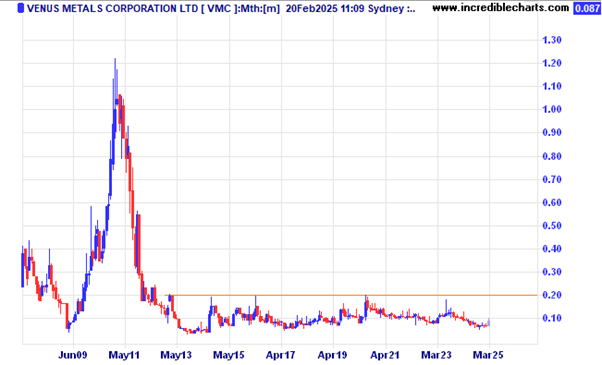

Gold explorer Venus Metals has been doing the hard yards for some time now. Probably needs a decent find to push price beyond the resistance zone.

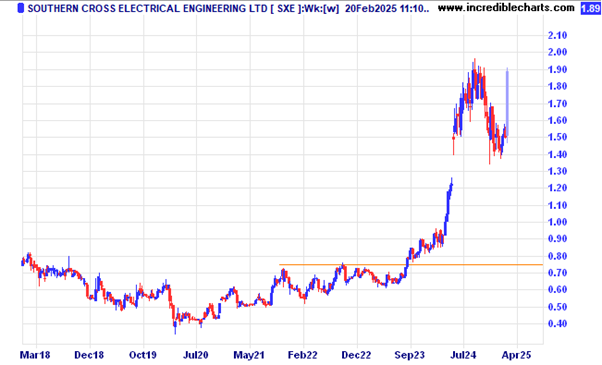

Data centre electrical contractor Southern Cross jumped higher after their latest update.

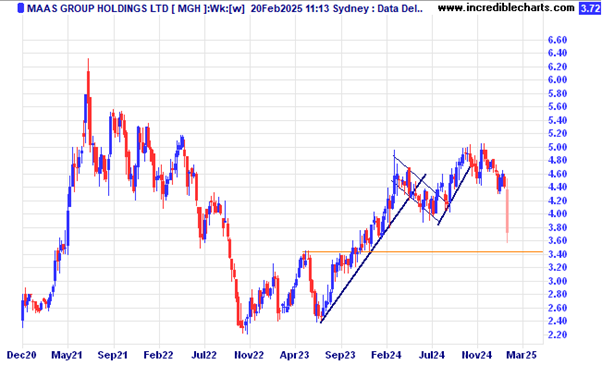

MASS Group fell after their latest update.

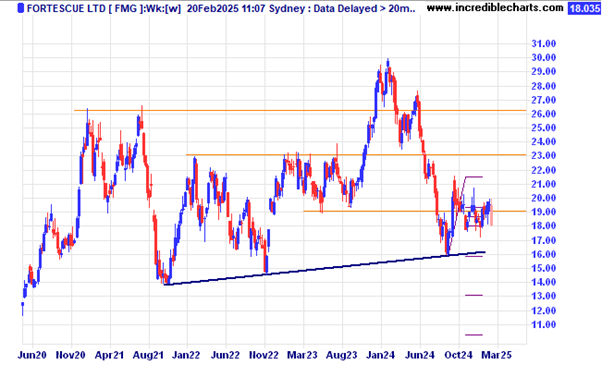

Fortescue has been trading in a small range for some time now.

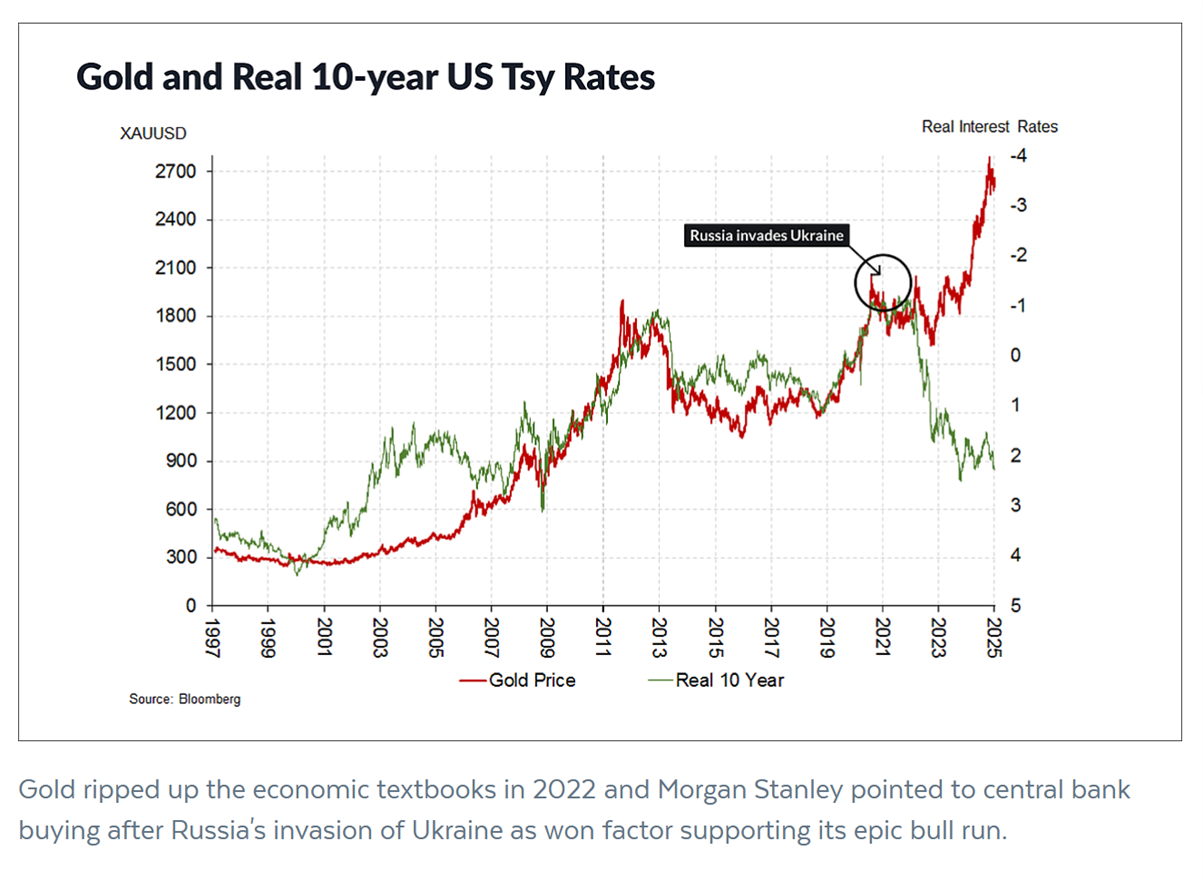

Gold makes the headlines.

On the other hand the 2022 disconnect in rates from the price of gold when Russia invaded the Ukraine is likely to “mean revert” at some point in time. Just when that might happen is the elephant in the room. Interesting to note that gold fell around 1.5 per cent the same day Trump announced the possibility of doing a peace deal with Putin.

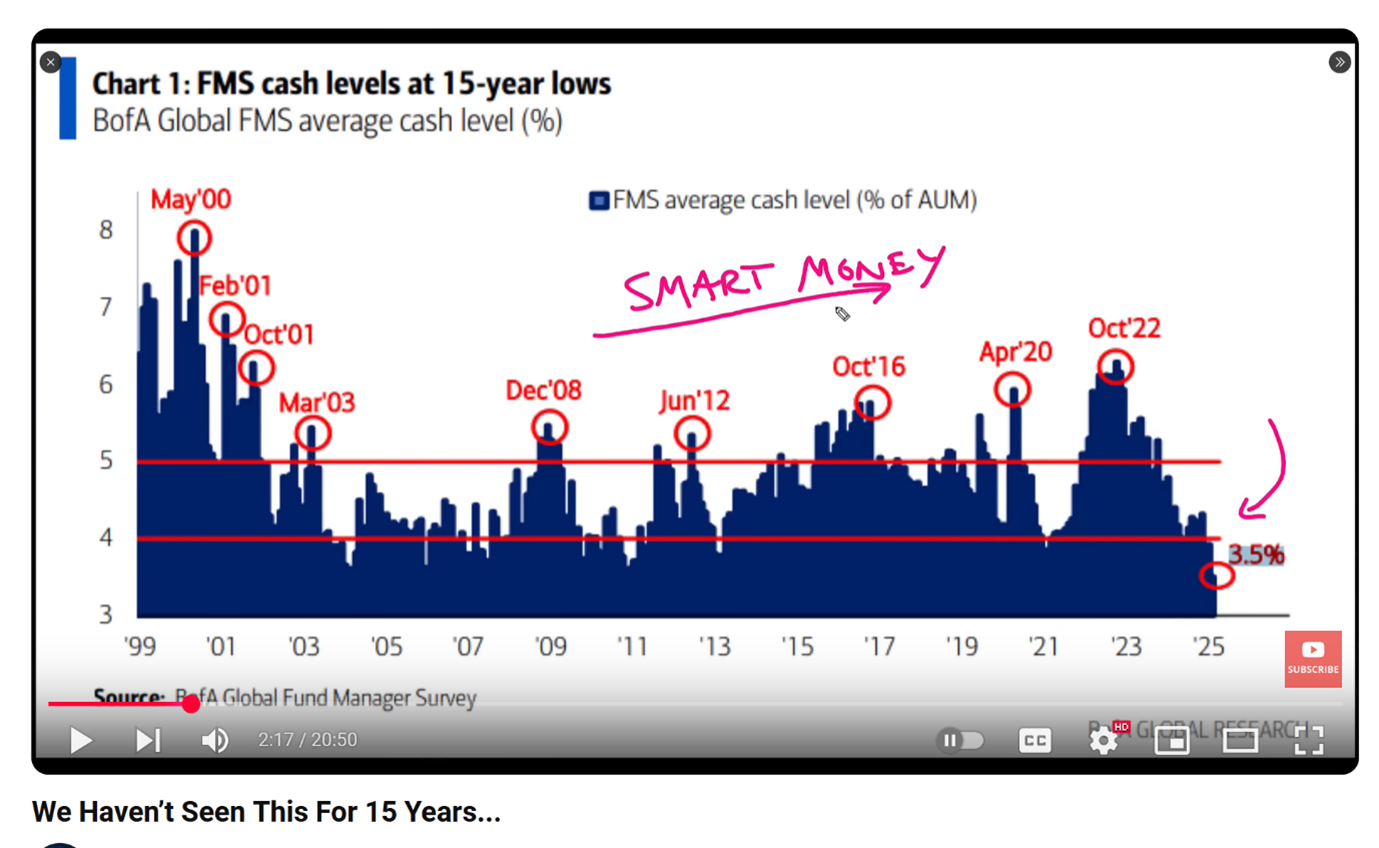

The latest Bank of America survey reckons the “smart” money is reducing their holdings of US stocks.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here