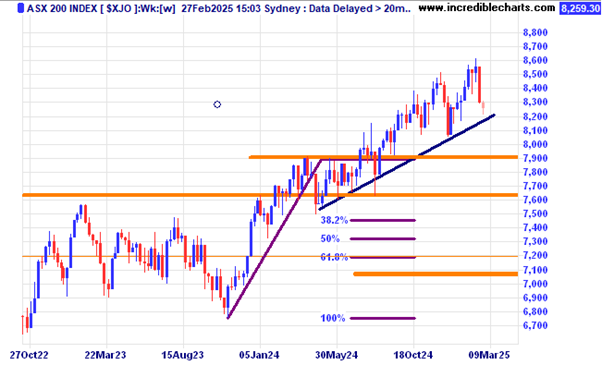

The local market looks like having a bounce off the weekly trend line for now. Longer term is becoming increasingly uncertain given what is going on in the world at present.

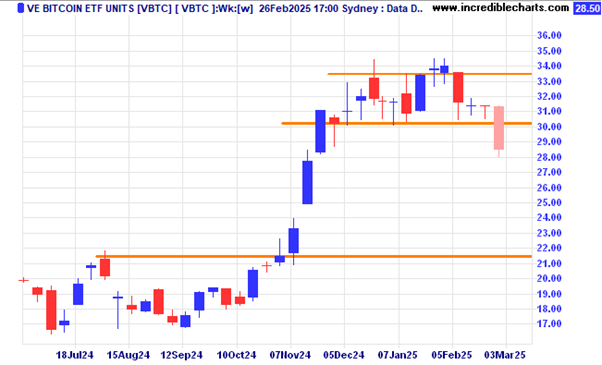

A locally listed bitcoin ETF has fallen below a support zone which could indicate lower prices are still to come. Any announcement from the Trump administration on forming a crypto strategic reserve could send price the other way. Too volatile and risky. Buffet’s rule number 1 is protect capital. The Berkshire Hathaway conglomerate is sitting on a record pile of cash at present.

The US Gold Mining Stocks ETF GDX has been trading in a large sideways pattern for some time. A break above the resistance zone might see prices go for a decent run up with the gold price not far off the highs.

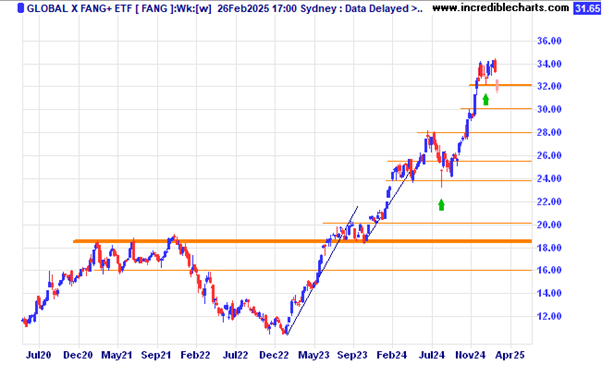

The locally listed FANG ETF of big US technology companies looks to have breached a support zone for now.

The gold explorer Strickland is sitting on a roughly 6 million ounce discovery in Serbia with a lot more drilling to come in 2025. Getting it into production could be a different story. Price has popped before will it do it again?

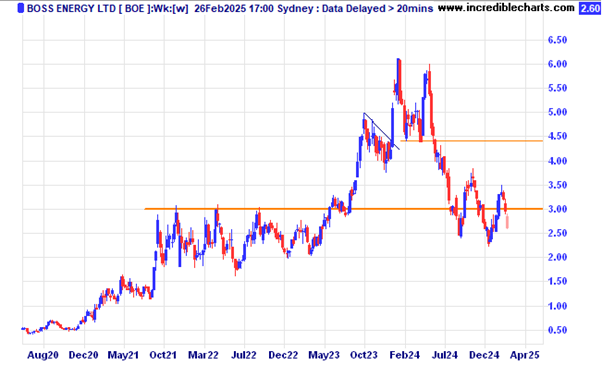

Boss Energy is moving lower in sync with the fall in uranium prices.

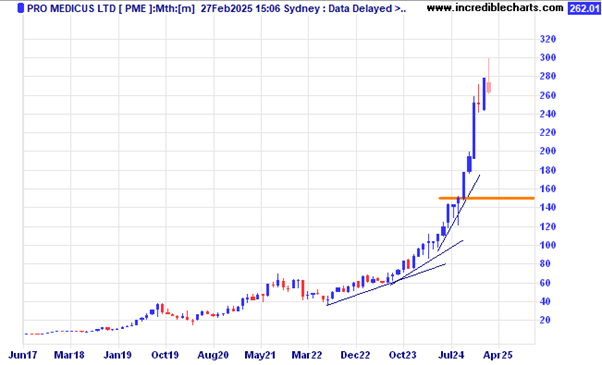

On a monthly price chart market beater Pro Medicus looks like it might take a breather for a while after recently spiking to new highs.

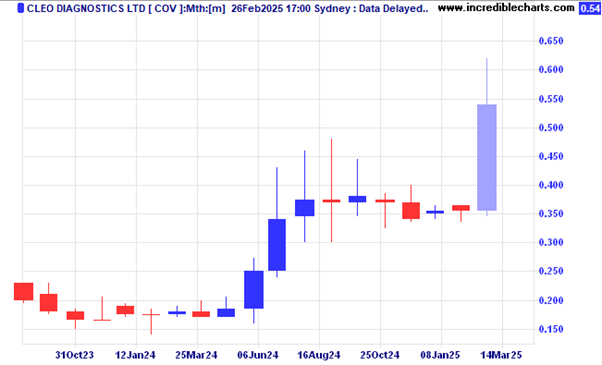

Not sure what Cleo Diagnostics does but the punters love it at the moment.

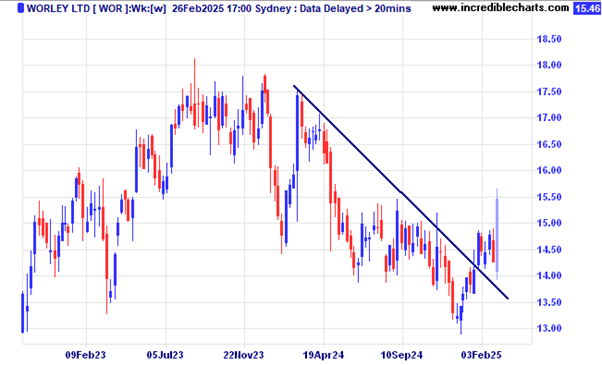

Worley jumped after their latest update.

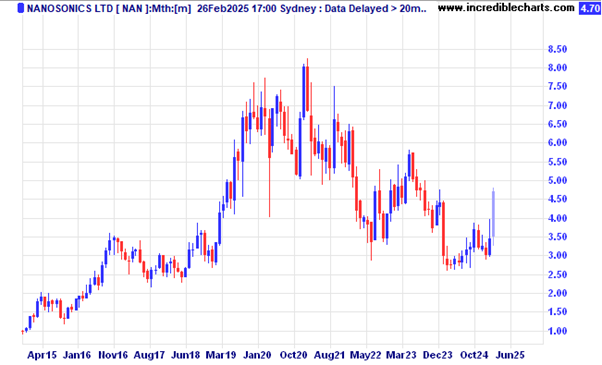

Nanosonics also rose after their latest update.

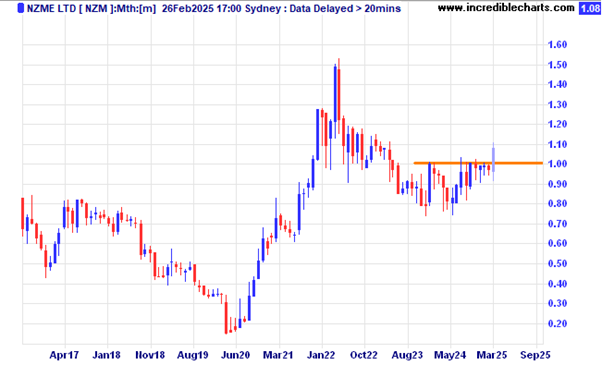

NZME has again broken through the one dollar barrier.

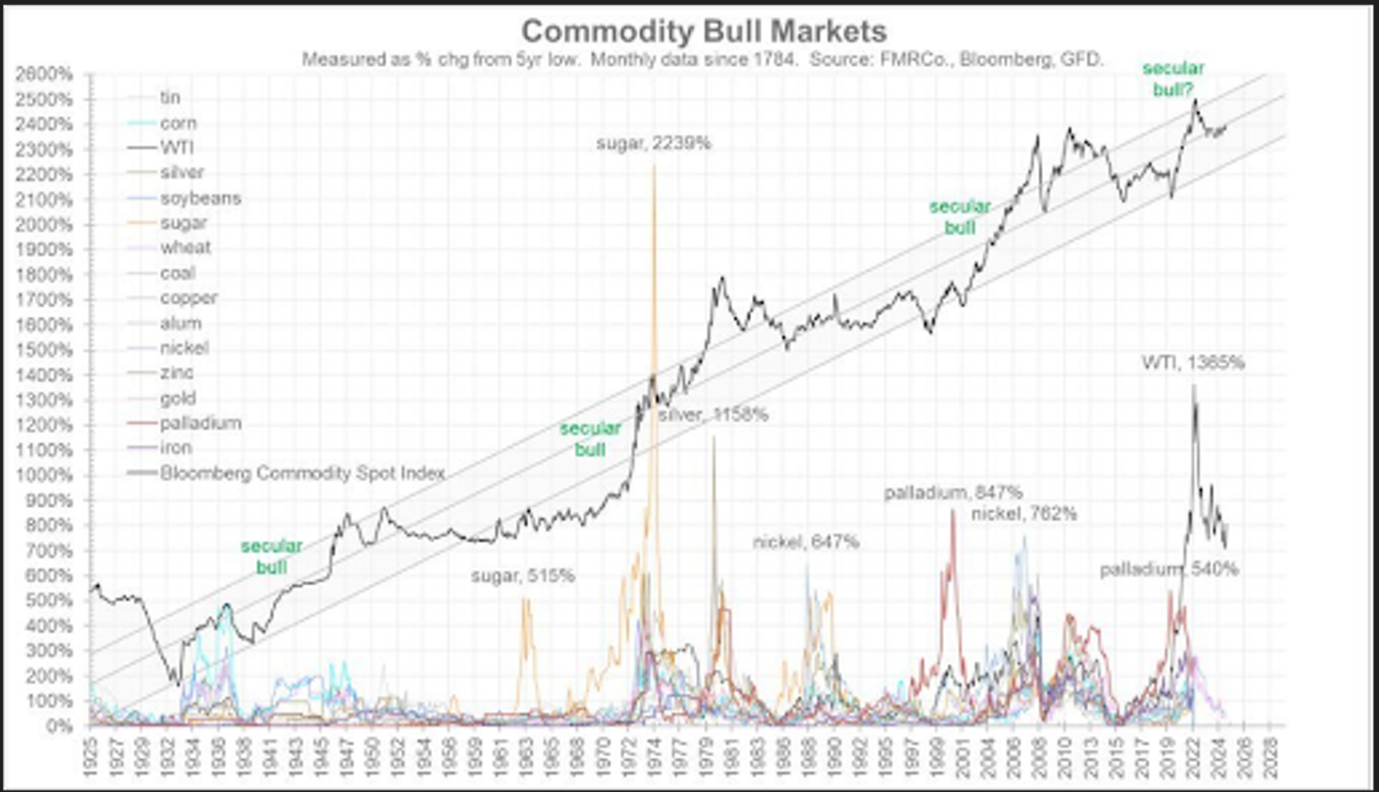

A very long term look at different commodity cycles. Is another secular bull market on the way?

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here