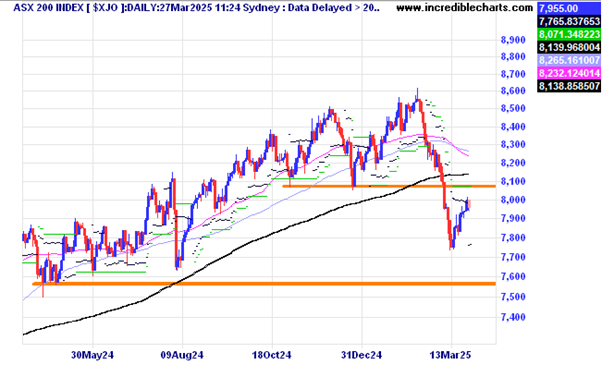

The local index did not quite reach the resistance zone at the December 2024 lows and briefly touched the 8,000 level before moving lower today.

On a monthly chart the local index could find support around the 7,600 zone or perhaps fall another 10 per cent from current levels before reaching the lower trend line of the channel.

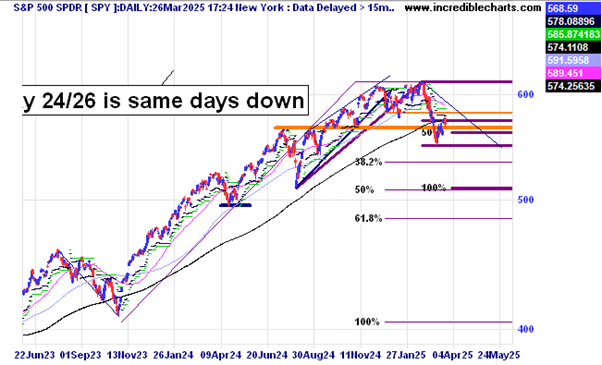

The US SPY ETF of the S@P 500 index ran into a resistance zone last night and looks set to fall further amidst all the global uncertainty and Trump tariffs. If that index were to fall the same number of days as the downward leg into the October 2023 lows it would give a date in late May. The SPY ETF had already reached the same percentage amount down at its lowest point in far less time. Not a great sign for possible things to come.

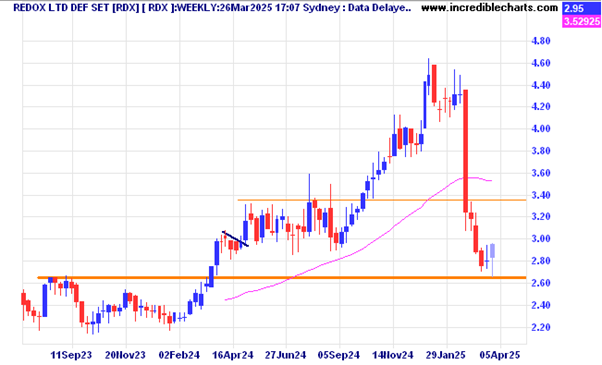

Redox looks to be finding some support at current levels.

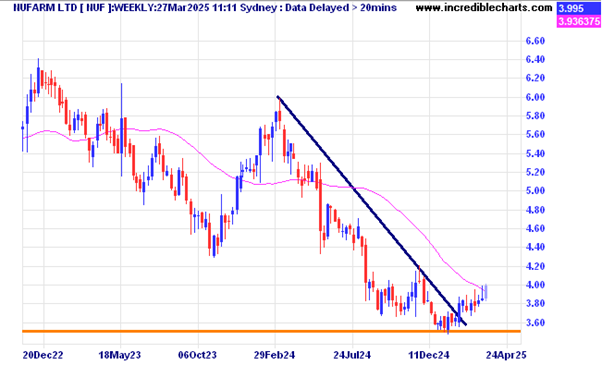

Nufarm is finding some buyers at current levels.

Cogstate has made a nice higher low.

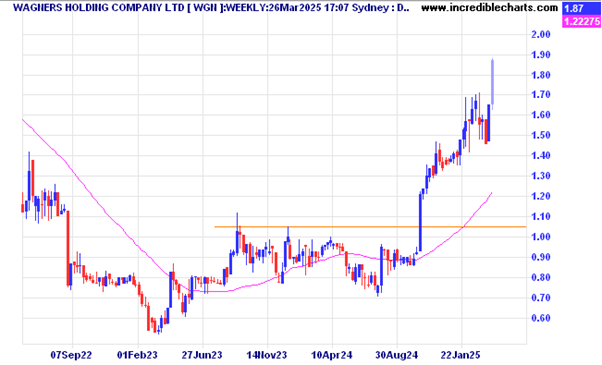

Queensland building mob Wagners price was boosted by the state government’s Olympic venue announcement.

Monadelphous looks to be consolidating the recent break higher.

Telix is holding the up-trend for now.

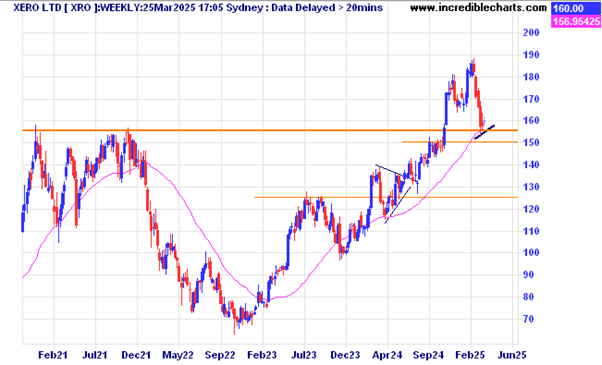

Xero looks to be holding onto the support zone for now.

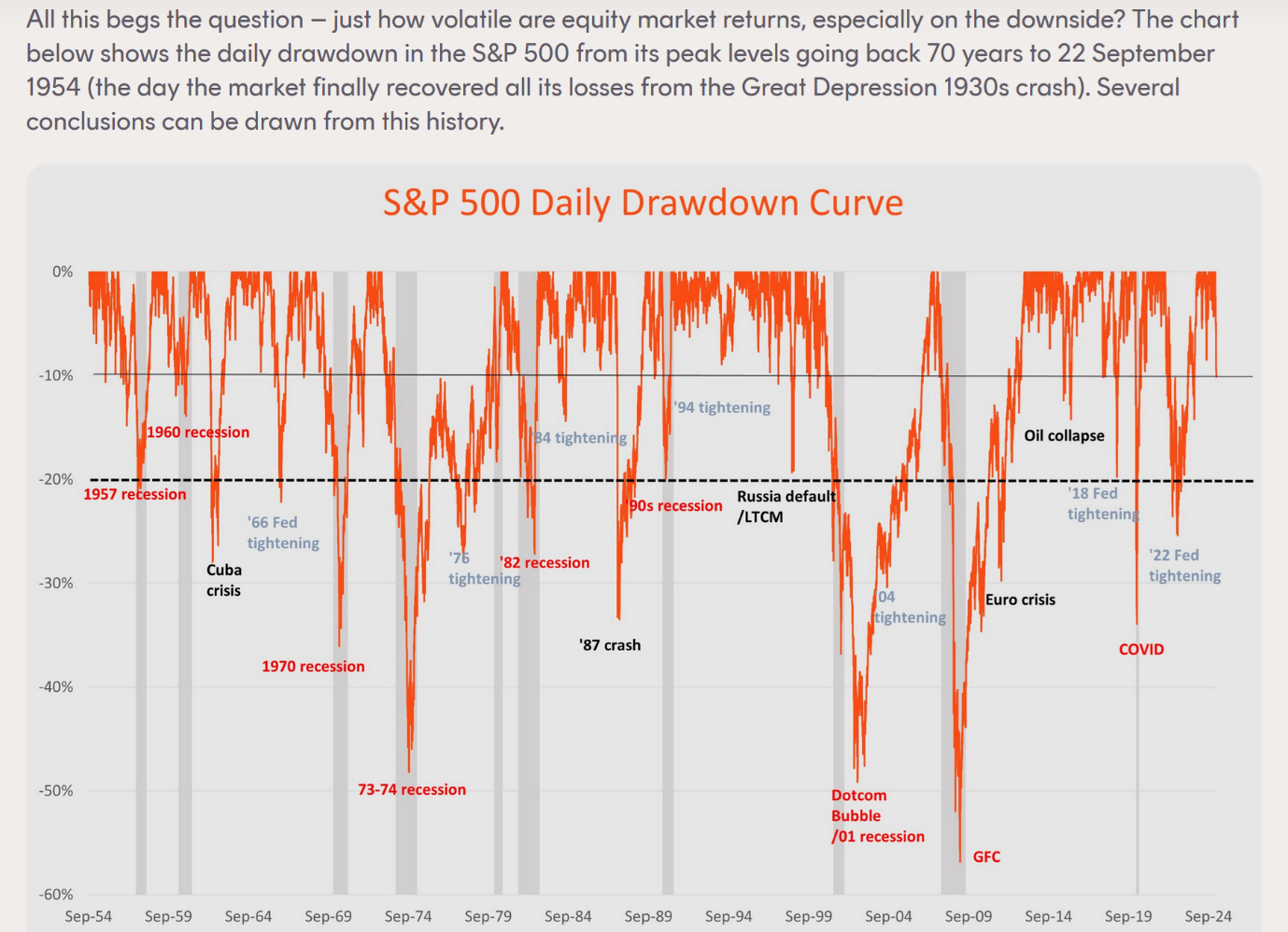

This is an interesting look at the number and severity of drawdowns in the US based S@P500 index since the mid 1950’s. A ten per cent drop is quite a normal market event.

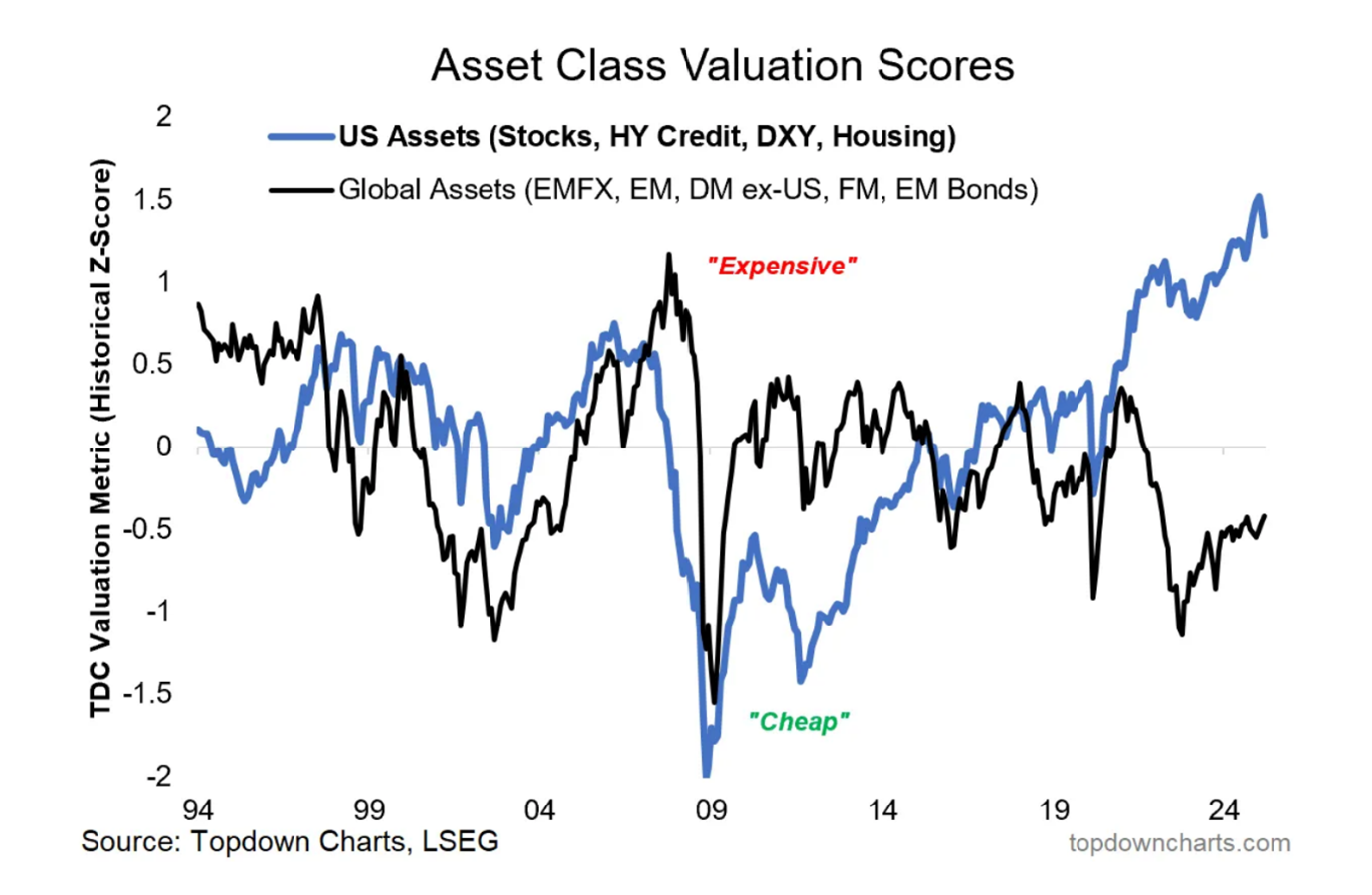

The big difference in the valuation of US based assets versus the rest of the world asset classes will close at some point.

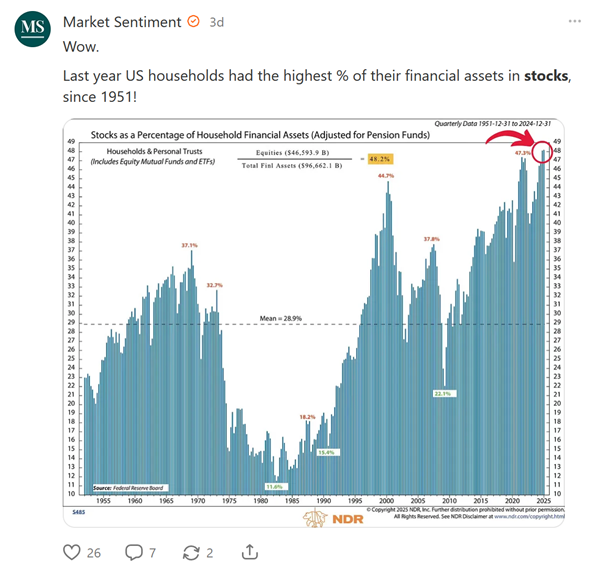

Households in the US will be feeling the pain of the current drop in share prices after having had a very high proportion of assets invested in the market in 2024.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here