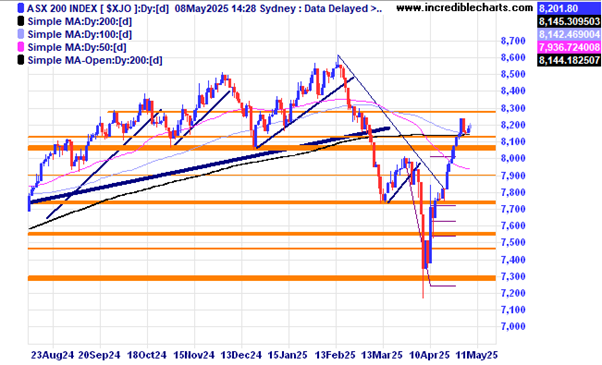

The local market looks to have moved above a major resistance zone and is marking time the last couple of days.

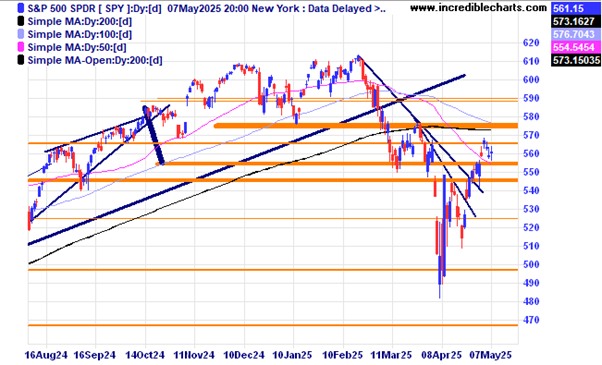

The US listed SPY ETF of the top 500 stocks is taking a breather after a quick 16 per cent move up from the lows. Some analysts reckon any economic damage from the imposition of tariffs will take some time to filter through to the bottom line.

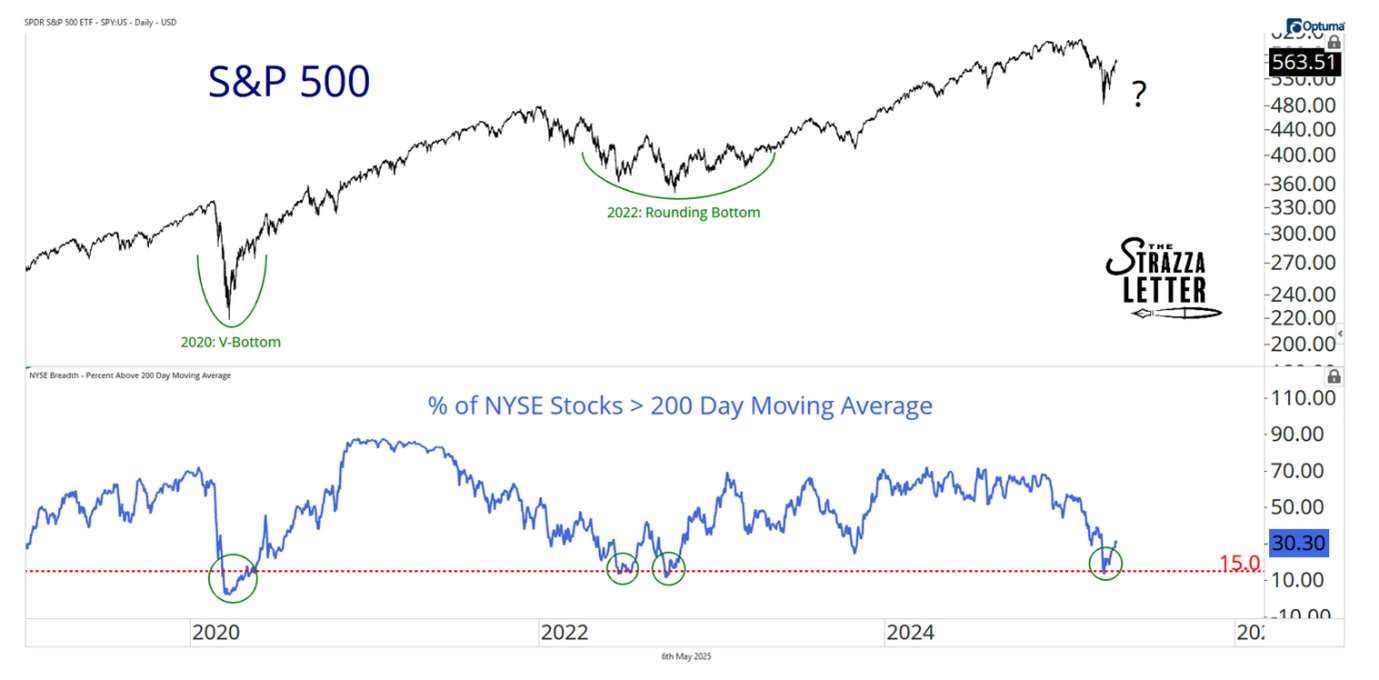

How The Strazza Letter saw the recent lows as a possible turning point.

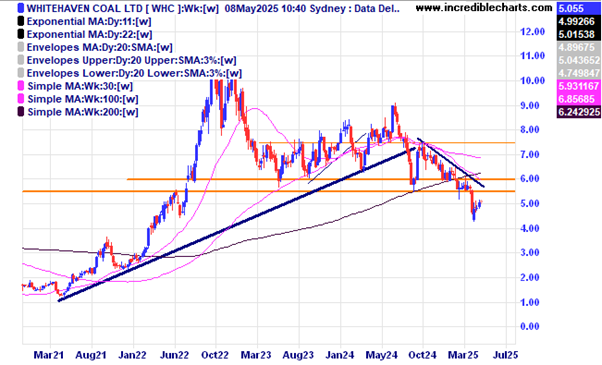

Could coal stocks make a bit of a comeback on increasing steel demand from India?

Whitehaven Coal is slowly moving up from the lows with some overhead resistance ahead.

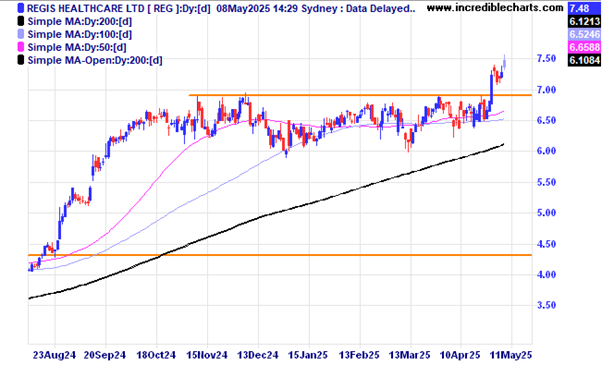

Regis Healthcare is continuing the run up after breaking out of the sideways consolidation.

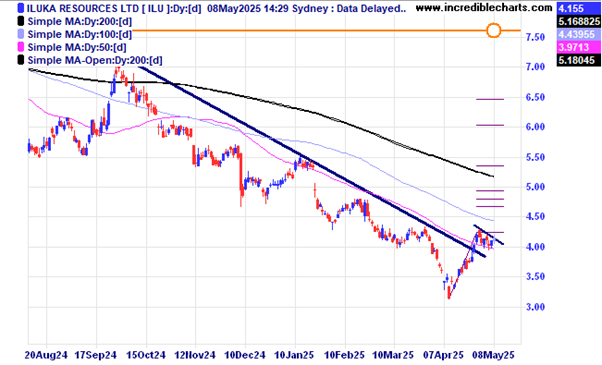

Mineral sands and emerging rare earth producer Iluka looks to be forming a bullish flag type pattern above the previous down trend line.

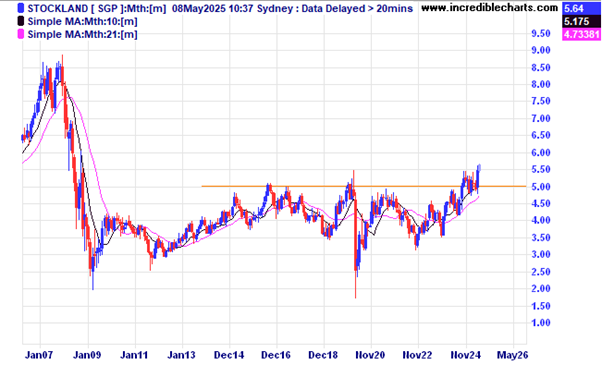

Property mob Stockland could be a winner from lower interest rates along with other property and consumer stocks.

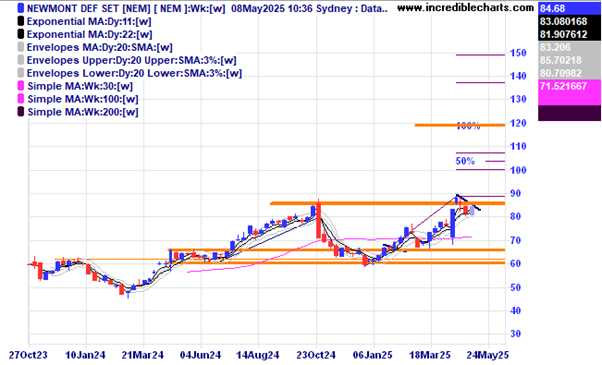

Big gold miner Newmont looks to be making a bullish cup and handle type pattern. Some analysts say the gold miners have been lagging the increase in the gold price and are due for a push higher, time will tell.

Superloop has made it back to previous 2018 levels.

Is the price of oil setting up for a possible double bottom pattern at these levels?

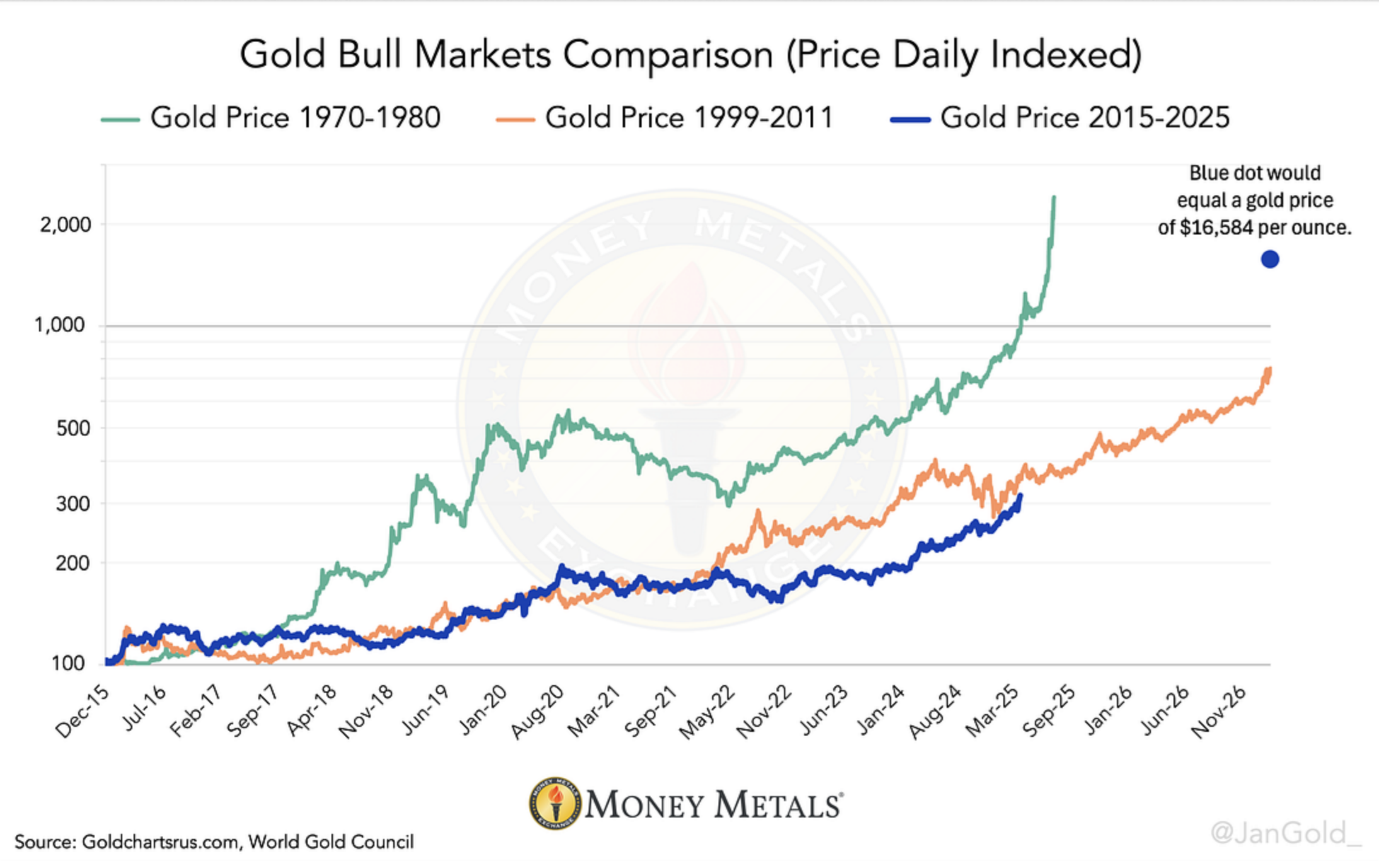

Another look at the possible trajectory for the gold price when compared to the two other big bullish run ups in price. Both runs up had sizeable corrections along the way.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here