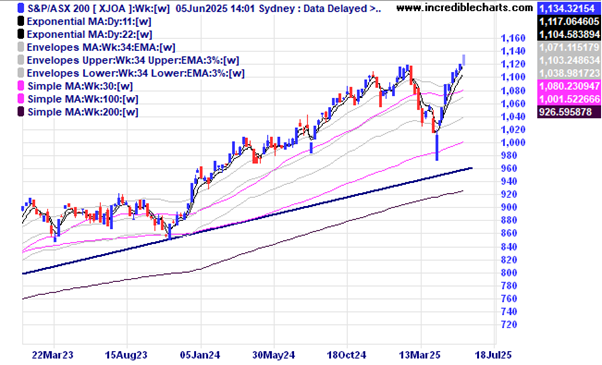

The local market’s total return index which includes re-investing the dividend payments hit an all-time high this week and is up around 124 per cent from the Covid lows. Over time the re-investment or compounding of dividends can make a big improvement to the gains made over time.

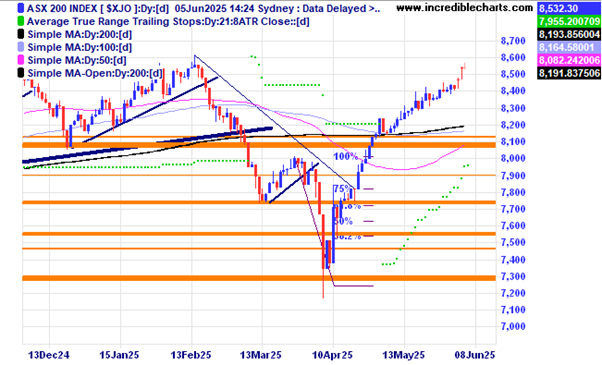

The local index is slowly creeping towards the highs with some analysts suggesting a pull back of some kind would be healthy for the market after the steep rise. With President Trump making announcements on all manner of things it’s a wonder the markets are not more jittery. The rollover of a lot of US debt this year may still put pressure on stocks, and on the other hand rate cuts could be a positive for the share market.

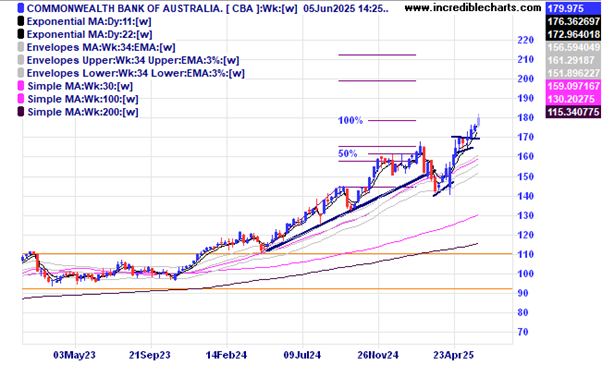

One of the big drivers of the local stock index rise is the Commonwealth Bank which just reached a $300 billion market capitalisation. Gains from Wesfarmers, Goodman, Telstra and Technology One also contributed.

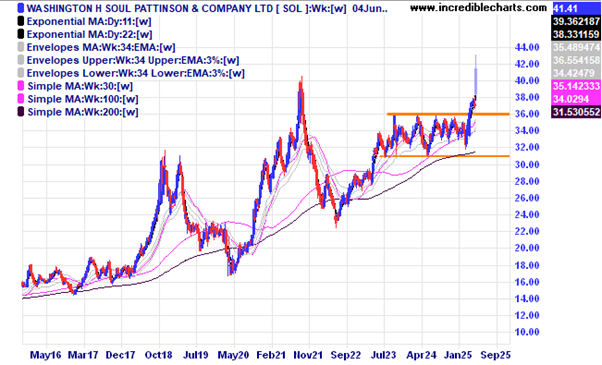

The announcement of the long-held cross holding of shares between Soul Patts and Brickworks ending boosted the price of their shares and will eventually create an investment powerhouse. Some analysts think the chance to unlock Brickworks under-utilised property assets is the catalyst.

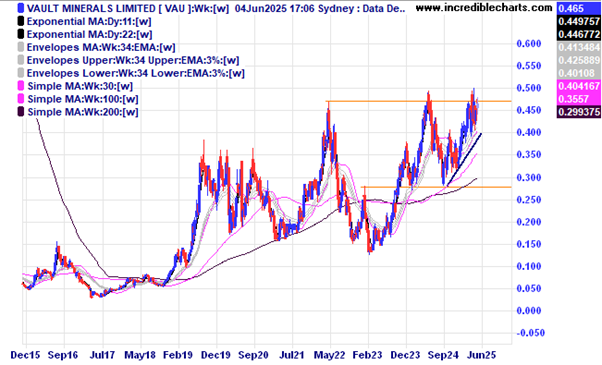

Gold miner Vault looks like it could be close to another leg up if price can move above the resistance zone.

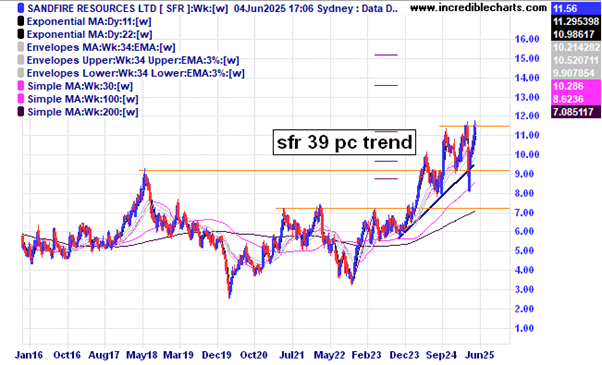

Copper miner Sandfire has again stalled at overhead resistance. Will it finally break through.

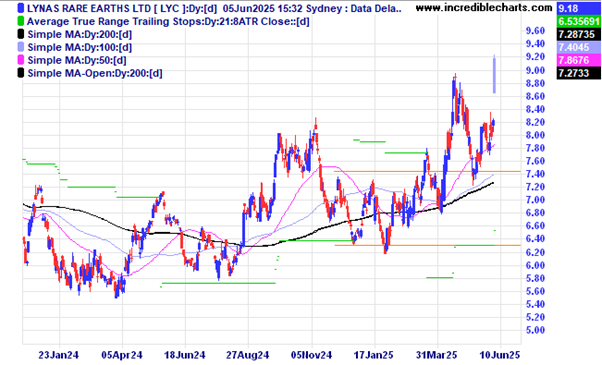

Lynas was up strongly today as investors gravitate towards rare earth stocks and lithium stocks also caught a bid with some chatter around Chinese pressure on the market.

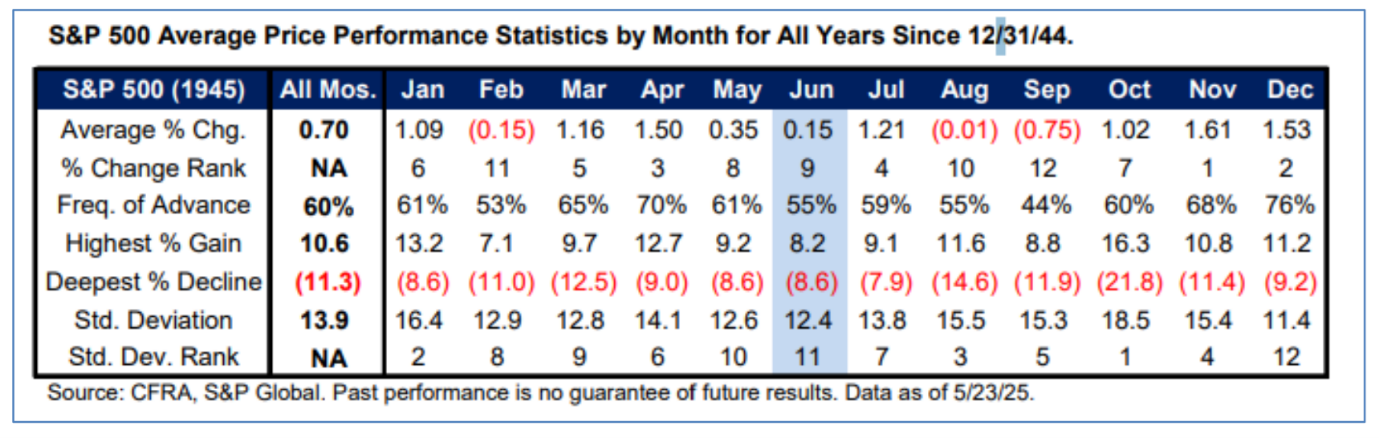

This little table shows the US S@P 500 average monthly performances from 1945 with June a relatively poor performer over the years closing higher only 55 per cent of the time.

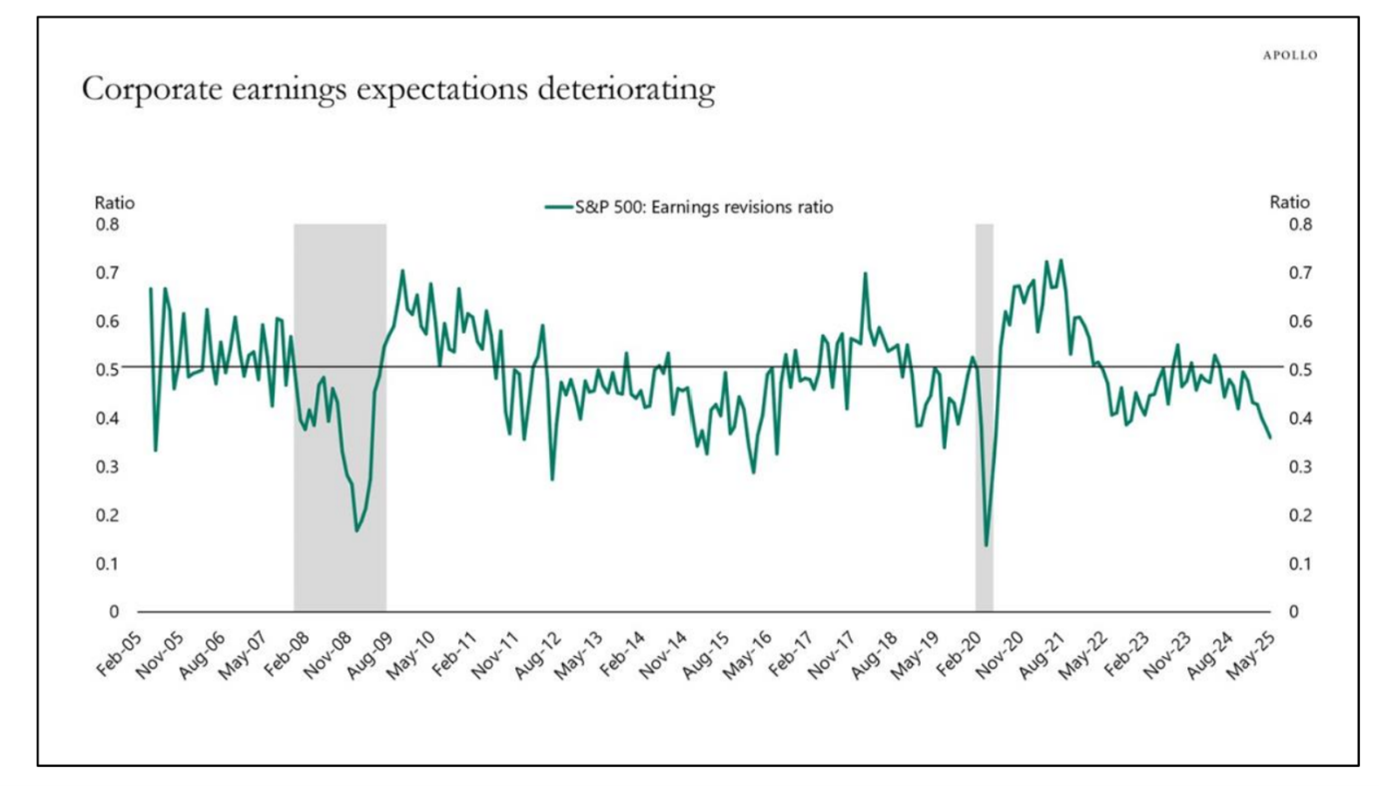

This graph from Apollo Asset Management shows US corporate earnings expectations are on the decline with the main stock index likely to follow at some point.

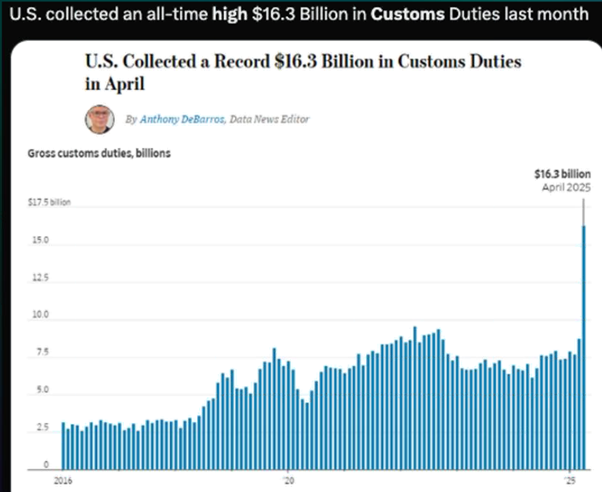

Although the US collected a record $16.3 billion in customs duty recently it is just a drop in the ocean compared to the estimated one trillion dollars in interest repayments yearly.

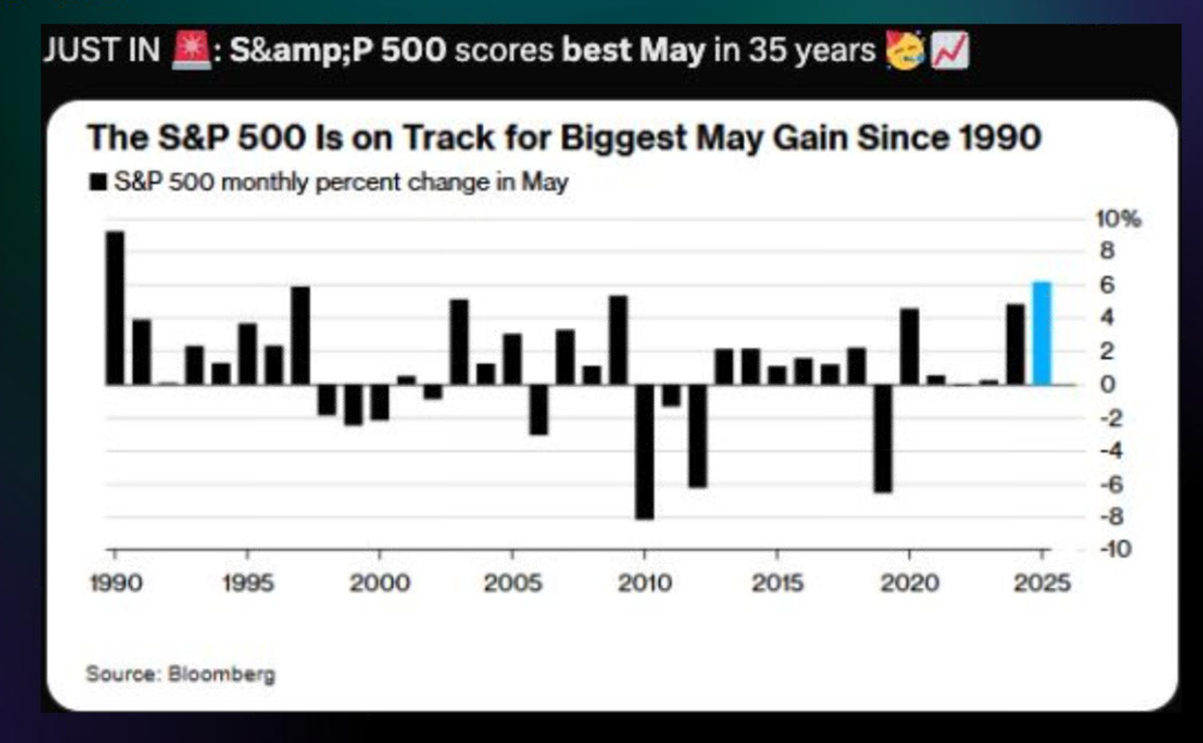

The US S@P 500 index had the biggest May gains for over 30 years and is on track to deliver a strong year.

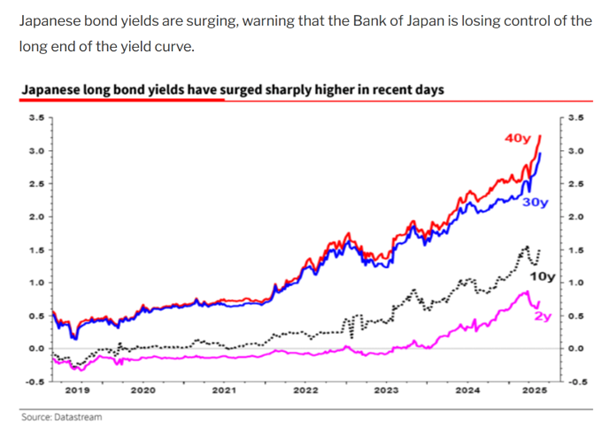

The rolling over of US Treasuries is becoming that little bit harder as Japanese yields rise.

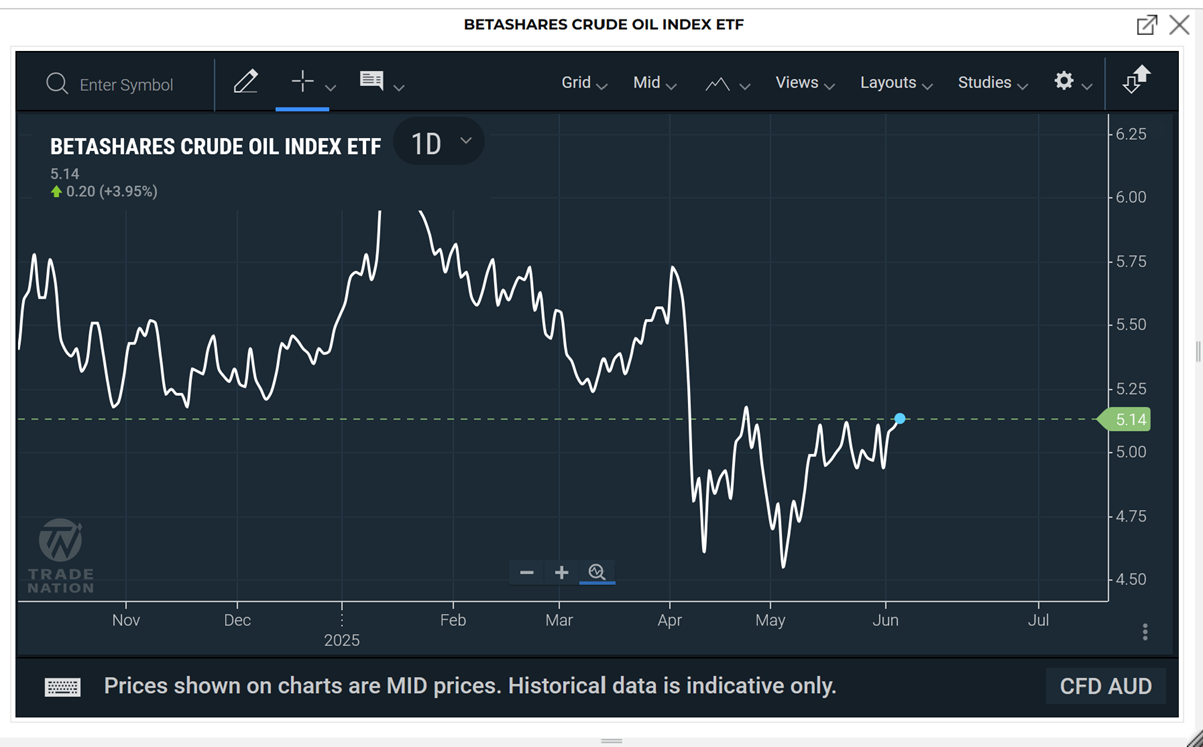

This charts shows the Betashares crude oil index ETF could be building up for a move higher despite talks of Saudi Arabia increasing output to put further pressure on US shale producers.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here