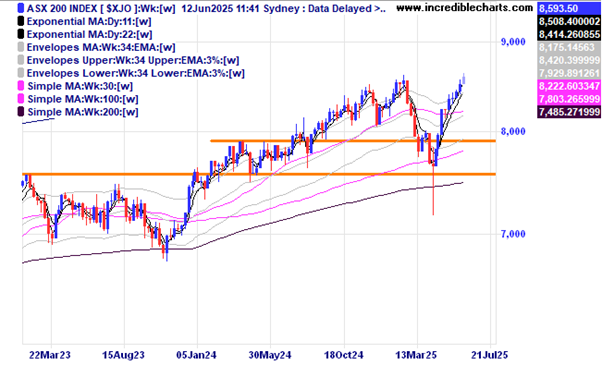

The local market briefly made a fresh all-time high this week. One possible reason the Australian Index is stronger than the US index could be that a lot of US investors are parking more of their assets in offshore markets says a story in the Financial Review today. There are 48 Australian stocks in the MSCI EX-US index with the Commonwealth Bank the 10th biggest company in this benchmark and in a way creates even more demand for the stock.

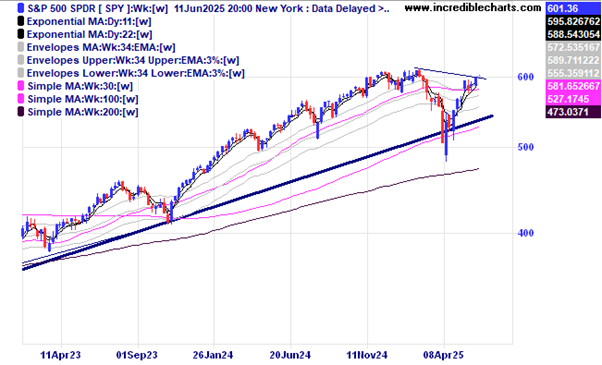

The much hyped US stock market is yet to regain the previous highwater mark. The upcoming bond auctions in the US could perform poorly and put some pressure on prices.

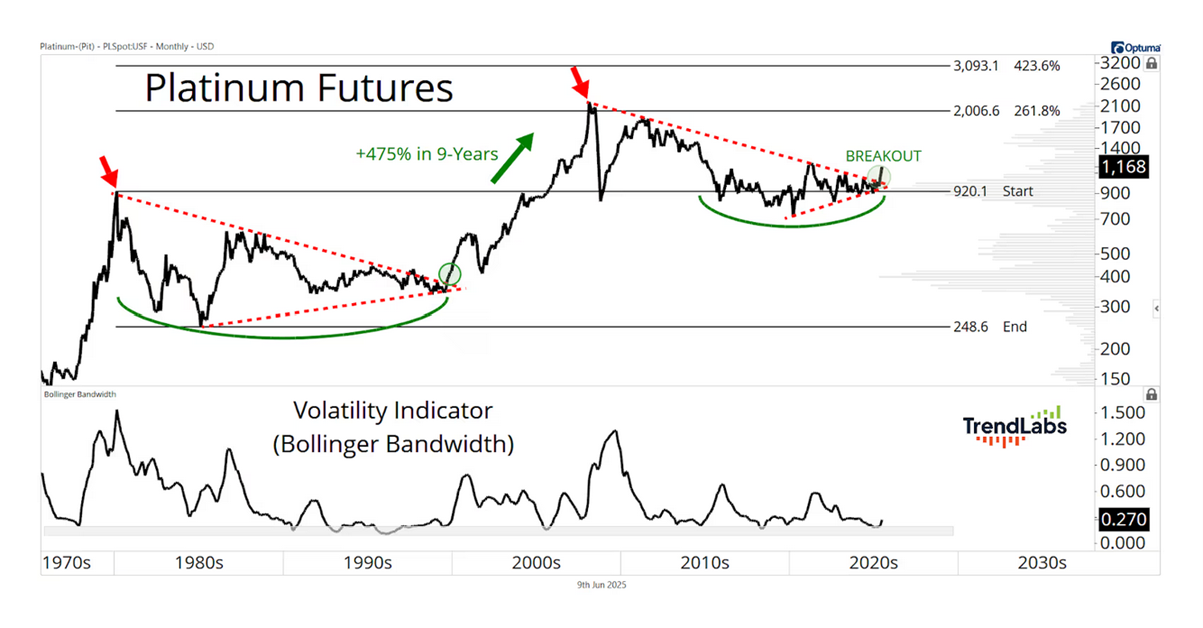

The price of Platinum has moved out of a consolidation pattern and could be heading towards the previous highs.

Local platinum stock Zimplats has moved above the down trend line. An ABC type correction could provide a decent entry point for those looking to enter the sector.

The monthly chart of Zimplats shows a rebound off a previous support and resistance level.

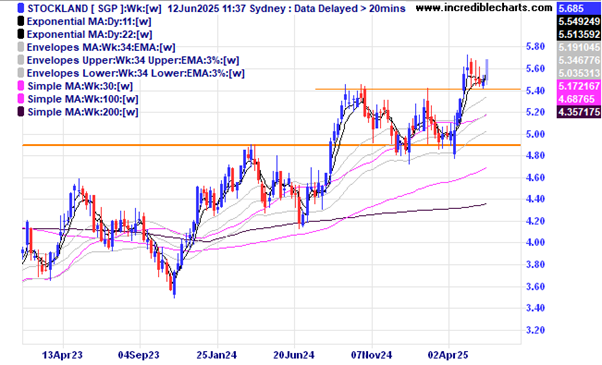

Stockland looks to be having a bounce up from the break out level.

Electro Optic Systems looks to be stalling at current levels after a steep rise moving above the trend line.

CSL could be close to breaking out of the down trend channel on the daily chart.

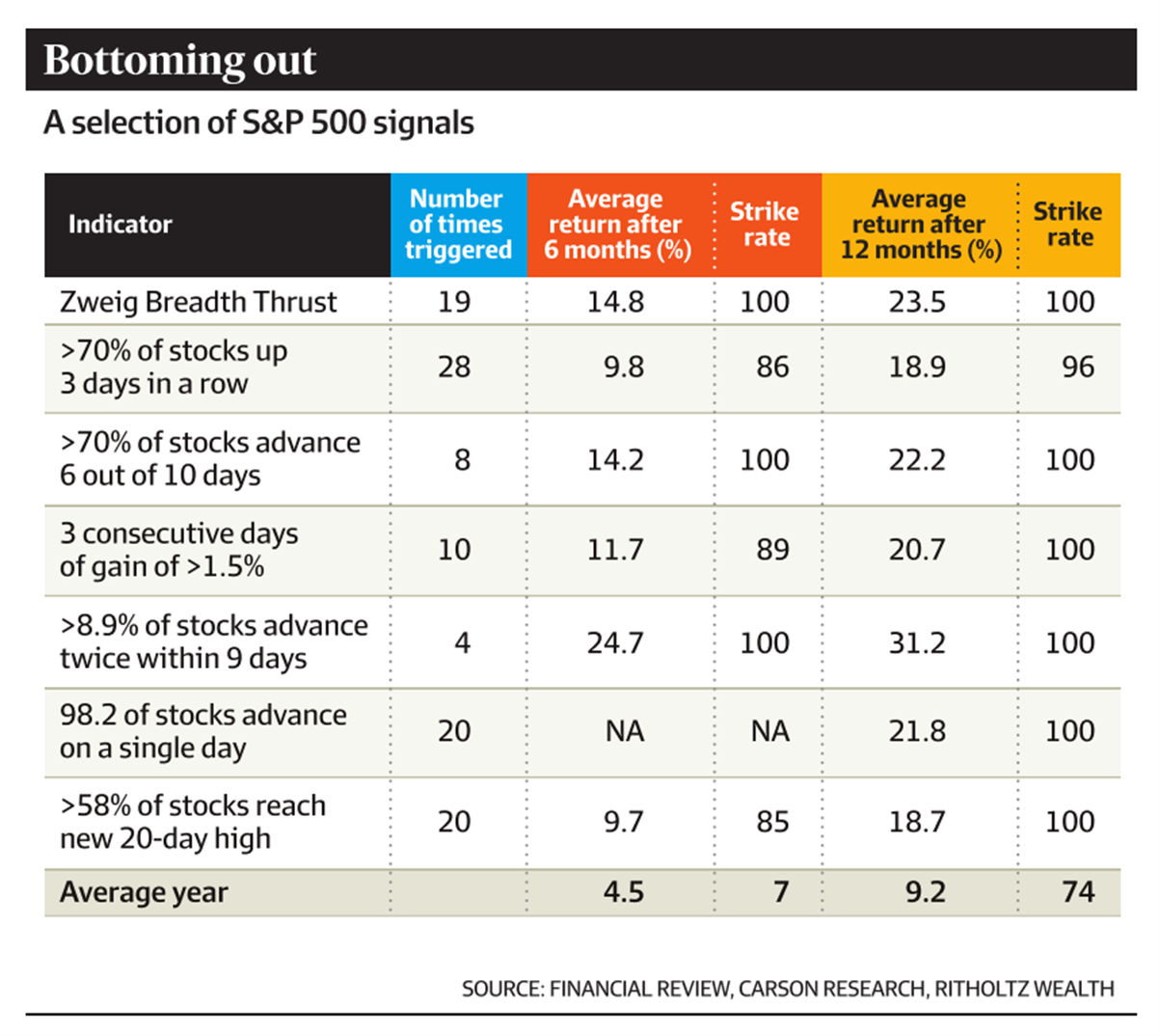

This shows a group of positive signals for the S@P 500 index made since 1980 and the subsequent average returns over different time periods.

There is an old traders saying that fast moves can come from false breaks. We will soon see if the false break in the gold/silver ratio holds to that notion.

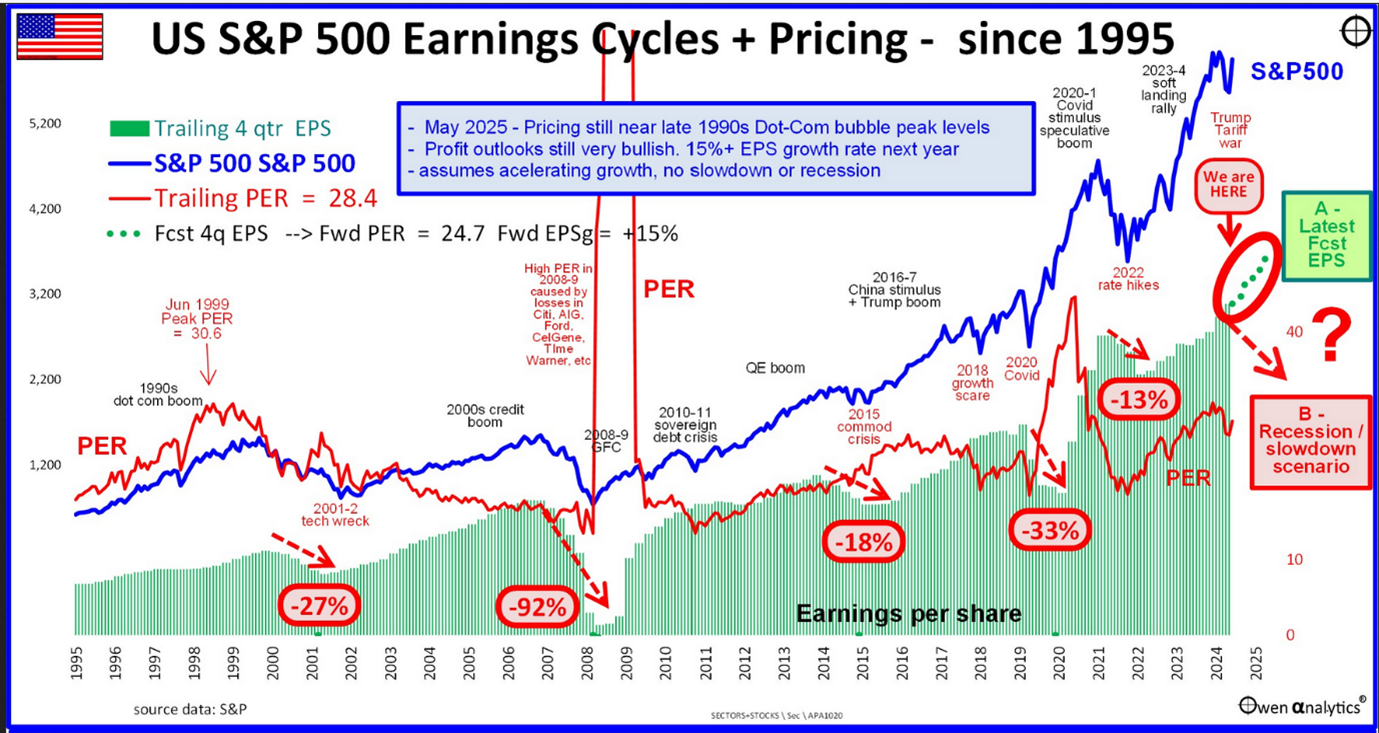

This graphic from Ashley Owen at Owen Analytics from the latest Firstlinks edition shows the cycle of US earnings. Are we topping out is the big question?

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here