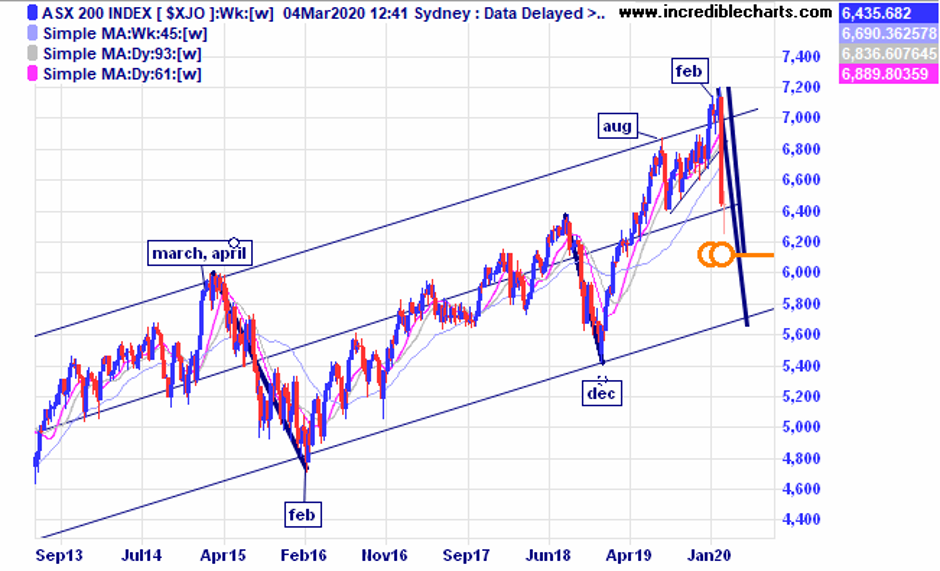

It has been a volatile week on world markets with most major indicies dropping 10 per cent or more. The local ASX 200 index fell 9.7 per cent for the week to end close to the midpoint of the current trend channel. The major decline in 2015/16 was 21 percent and fell to the lower trend line and lasted 11 months. Will it happen again this time?

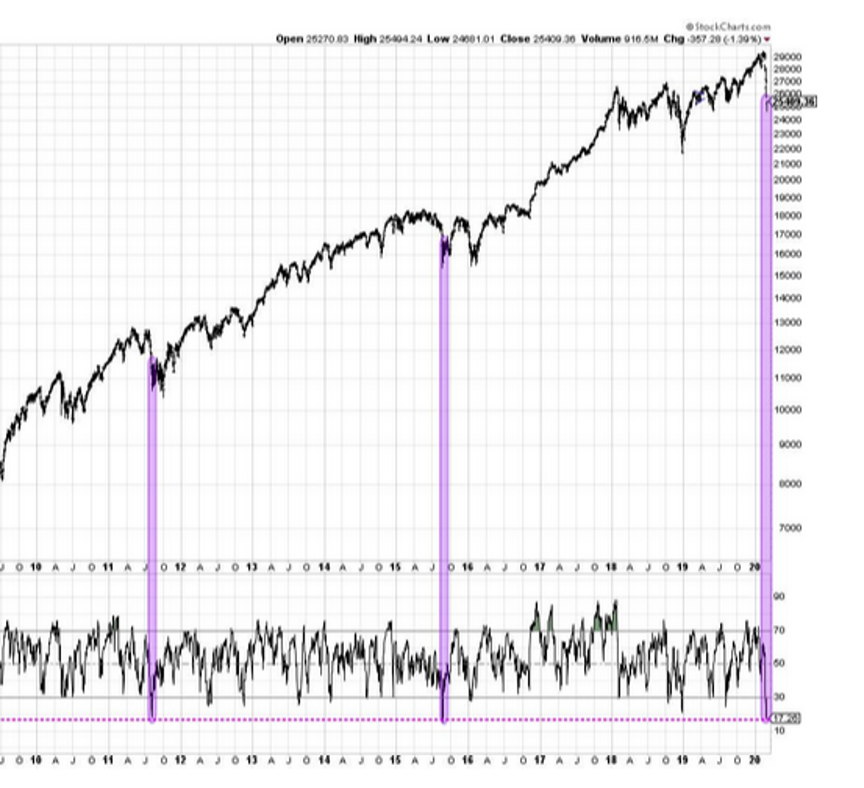

There was a big rebound in US markets on Friday night which followed through in other markets to different degrees. The chart below shows how oversold it was and previous rebounds that occurred from those levels with a secondary low coming in later. Statistics show the average rebound from a ten per cent fall in one week is about up 4 per cent a week later. After that it gets messy.

It was a hectic week for the educational portfolio which went from bearish to bullish in an instant, locking in profits and opening new positions. We exited the remaining cfd position just before lunch today and it will be tabled next week. The positions in CSL and Magellan are long term holds over the cycle with others to be bought and sold as required.

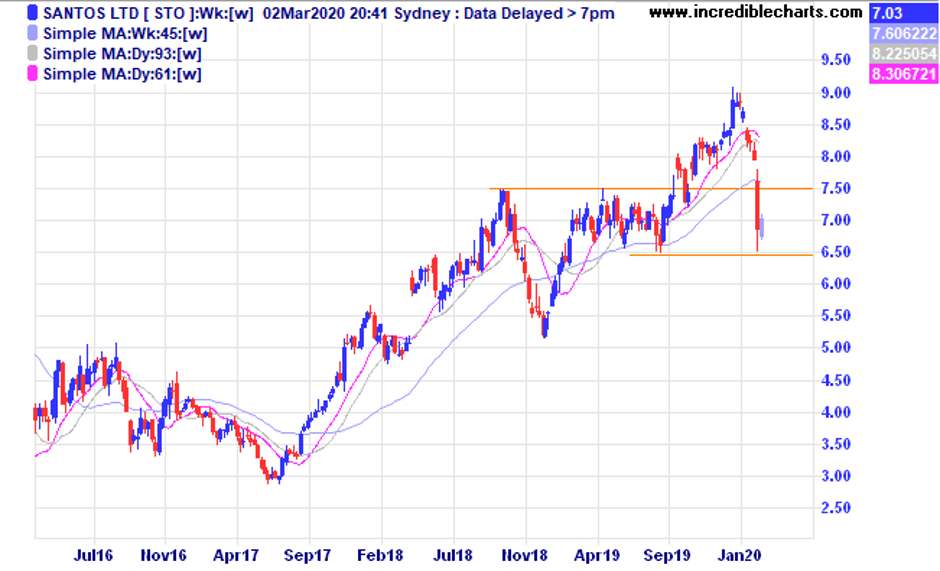

On Monday Santos and Lifestyle both rallied strongly from possible support levels and we bought a parcel of each.

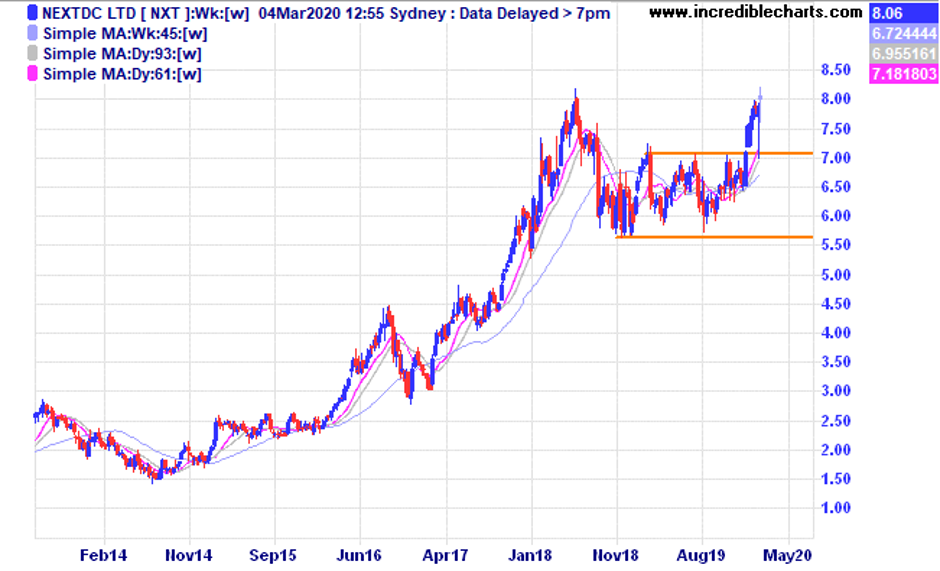

NextDC has held up well.

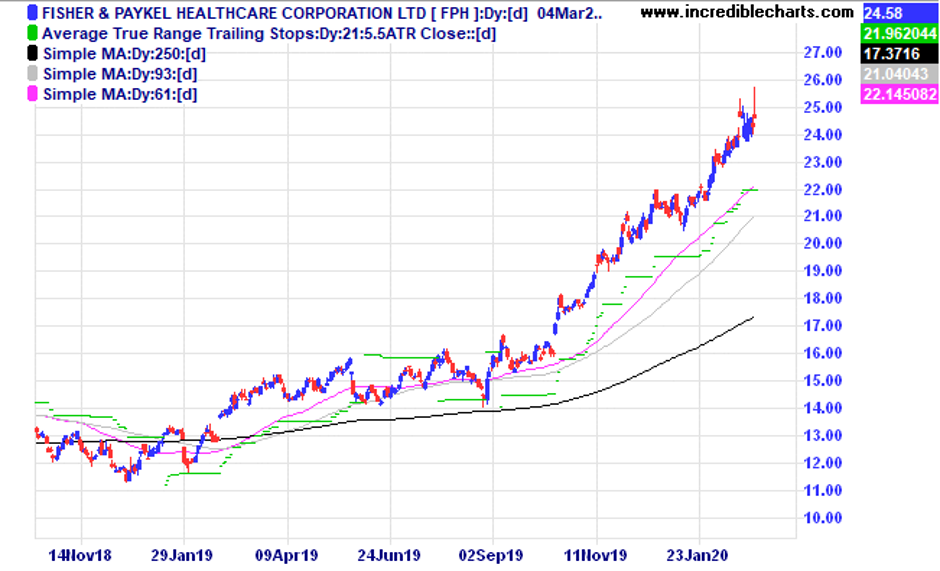

Fisher and Paykel spiked higher yesterday.

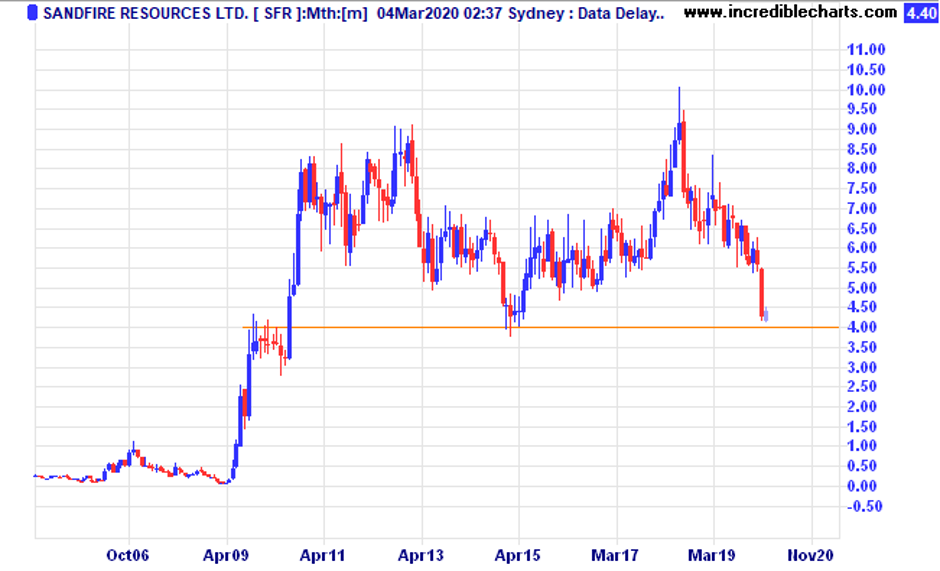

A lot of companies have dropped to possible support levels including Sandfire.

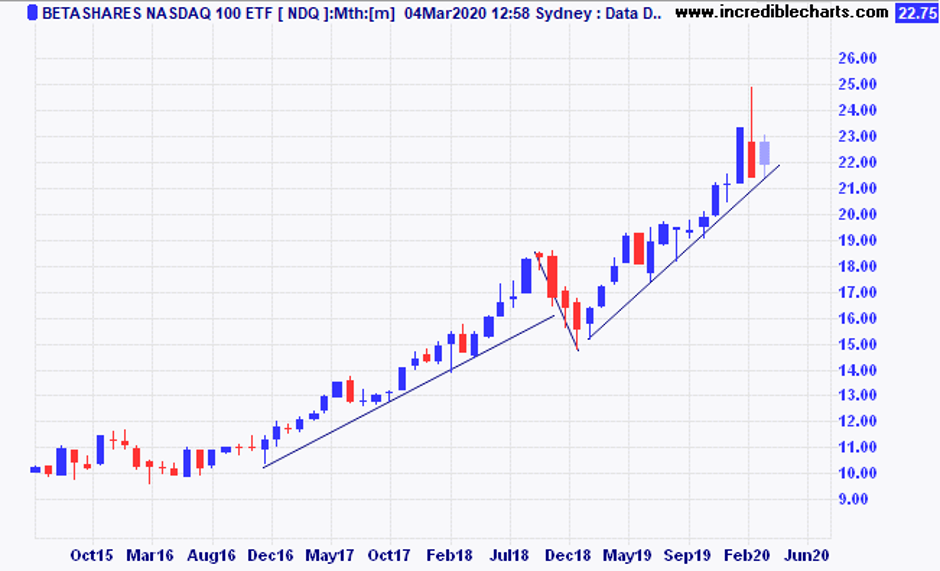

The NDQ ETF moved back to the trend line.

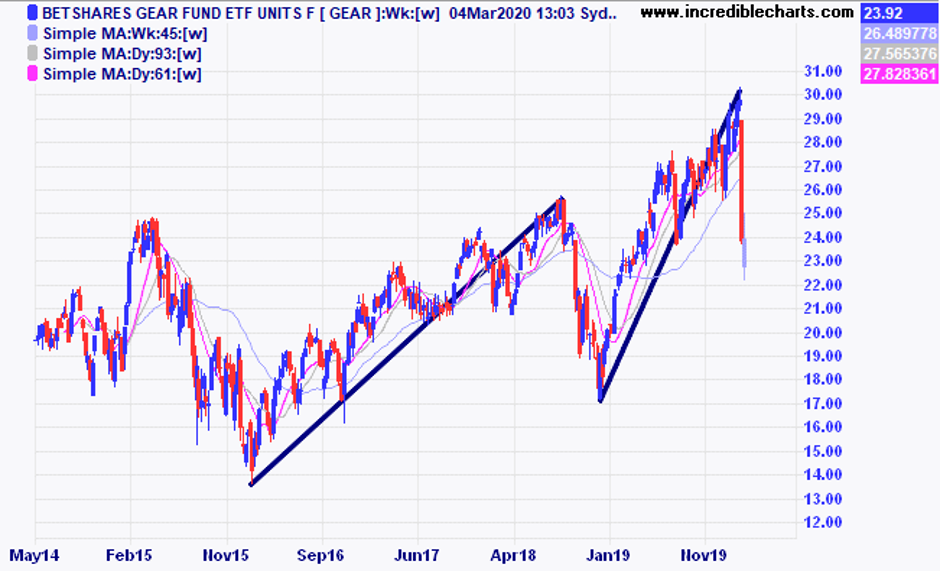

The GEAR fund showing previous bullish runs

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $324.00 | $313.00 | -$110.00 |

Bought Westgold c/fwd 3/1 at $2.33 | Bought 1,000 at $1.03 7/2/2019 | 7/2/2019 | $2.46 | $1.94 | -$520.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $68.00 | $57.38 | -$424.80 |

Bought Resolute Mining | Bought 2,000 at $1.25 | 8/1/2020 | $1.18 | Stopped 2/3 at 95c | -$490.00 |

Bought Appen

| Bought 100 at $25.00 | 16/1/2020 | $25.40 | $22.80 | -$260.00 |

Bought Capitol Health | Bought 8,000 at 25.5c | 5/2/2020 | 28.5 | 29 | +$40.00 |

Bought City Chic

| Bought 900 at $3.20 | 5/2/2020 | $3.25 | $2.88 | -$333.00 |

Sold 8 ASX 200 cfd’s

| Sold 8 at 7,125 | 17/2/2020 | 6,866 | Buy 4 26/2 at 6,750 Buy 4 2/3 at 6,366 |

+$434.00

+$1,970.00 |

Bought Evolution | Bought 600 at $4.50

| 19/2/2020 | $4.41 | $4.09 | -$192.00 |

Bought QBE

| Bought 100 at $15.00 | 19/2/2020 | $14.57 | $13.32 | -$43.00 |

Bought IPH

| Bought 200 at $10.20 | 19/2/2020 | $9.27 | $8.66 | -$186.00 |

Bought Bellevue Gold | Bought 4000 at 58c | 21/2/2020 | 61c | 55c | -$240.00 |

Bought BBOZ bear ETF | Bought 500 at $8.60 | 24/2/2020 | $8.92 | Sold 2/3 at $10.35 | +$685.00 |

Bought Gear ETF

| Bought 150 at $23.00 | 2/3/2020 | $23.00 | $23.92 | +$138.00 |

Bought 8 ASX 200 cfd’s | Bought 8 at 6,360 | 2/3/2020 | 6,360 | Sold 4 3/3 at 6,511 4 left at 6,485 |

+$574.00 +$500.00 |

Bought NDQ ETF

| Bought 150 at $22.00 | 2/3/2020 | $22.00 | $22.75 | +$112.50 |

Bought Santos

| Bought 400 at $7.00 | 2/3/2020 | $7.00 | $7.00 | Steady |

Bought Lifestyle

| Bought 300 at $8.40 | 2/3/2020 | $8.40 | $8.52 | +$36.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $56,524.60 |

|

|

| $56,524.60 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$1,690.70 |

|

|

| +$1,690.70 |

| Current total $58,215.30 |

|

|

| $58,215.30 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $40,439.50 |

|

|

| $40,439.50 |

Prices from Tuesday’s close or 6am for US | Cash available $17,775.80 |

|

|

| $17,775.80

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here