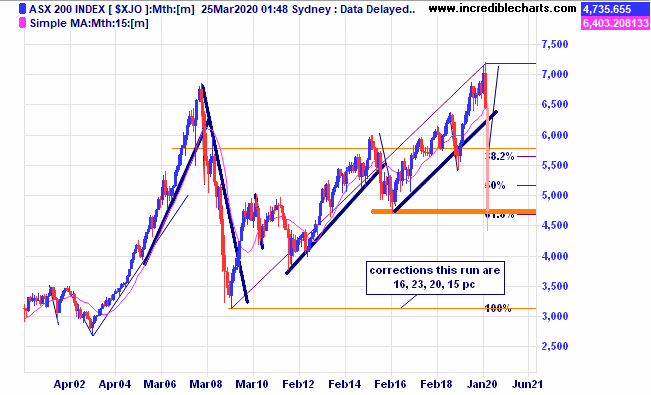

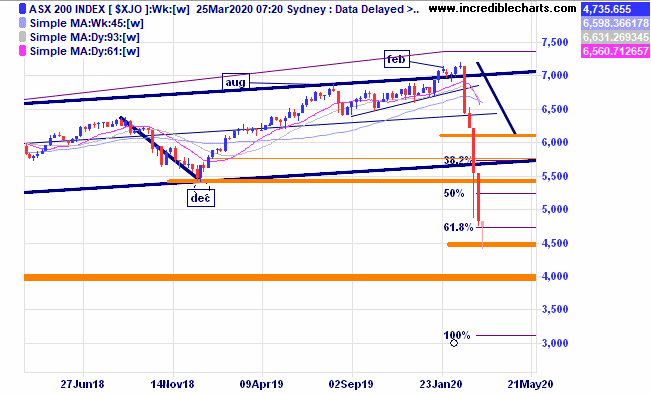

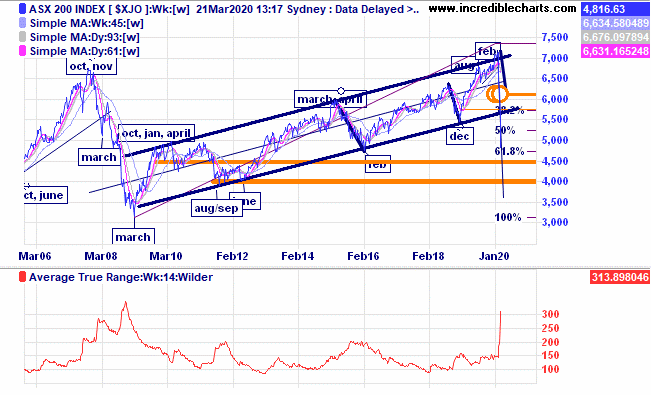

A wave of buying confidence swept across markets late yesterday as the US Federal Reserve said it would buy an extraordinary amount of bonds to inject money into the US economy. All this comes on top of a proposed $2 trillion rescue package of measures yet to be passed in the US. As the saying goes “don’t fight the Fed.” Stock markets, currencies and commodities were all reacting late yesterday local trading time and we switched from being bearish to a bullish bounce in an instant. A longer-term picture of the local market showing a dip just below a possible support level at a previous major low and at the 61.8 major retracement level of the run up from the 2009 lows. A nice confluence of events for a trader.

This is a wild trader’s market and we will need to see more evidence of a slow-down in Covid19 spreading throughout the world and a reduction of volatility before investors could jump back in. This is likely to be a “relief type rally” which could see prices rally to around 50 per cent of the range down and close to the 5,400 point lows of the late 2018 decline. Time will tell.

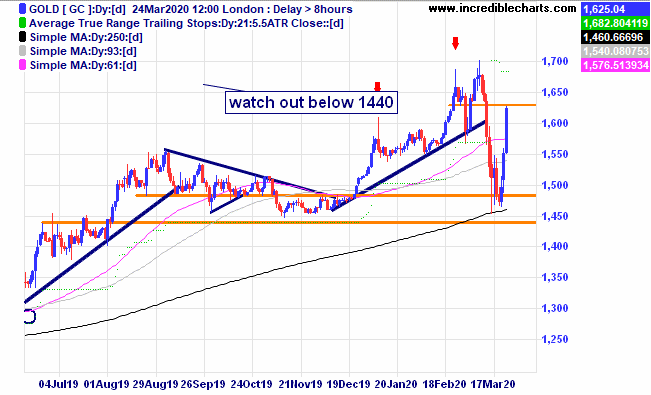

The gold price rallied from a possible support zone and the US announcements sent local gold stocks soaring yesterday. The price needs to clear and consolidate above the previous $1,700 spikes in price for the next leg up. Gold prices could oscillate in this wide range for some time before breaking out. With such a large amount of Quantitative Easing throughout the world a shift away from currencies into monetary type commodities may well take place at a faster pace. Time will tell as anything can happen in the markets as this is basically an educated guess.

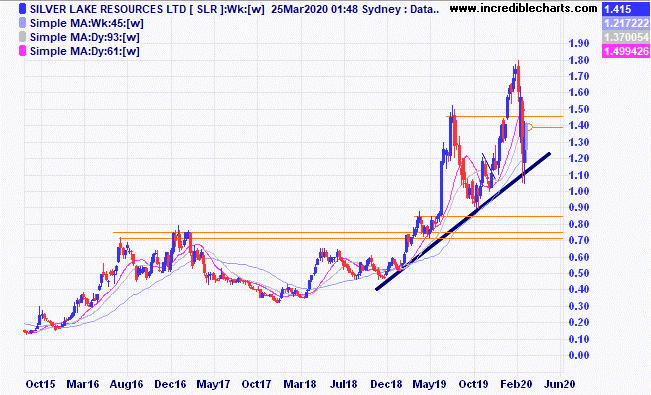

We picked up a parcel of Evolution and Silver Lake shown below as prices again bounced up from strong trend lines.

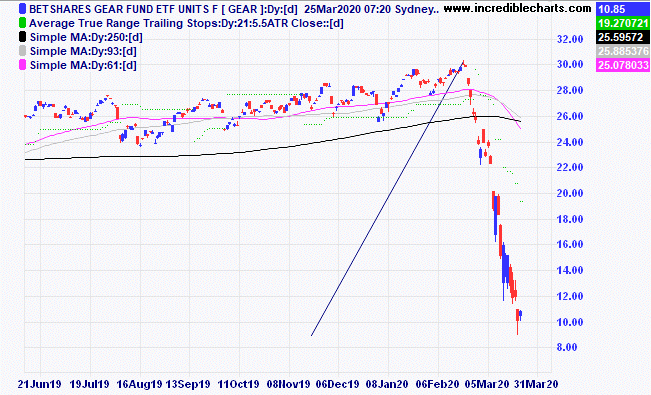

We bought a hefty amount of the Gear ETF as this fund moves more than the underlying index which is what we want. A 69 per cent move to the downside gives around a 230 per cent move up to the previous top. The ASX 200 index moved down around 39 per cent. We sold 200 GEAR just after the open this morning to lock in some profit and reduce downside risk. You never know the market could fall again tomorrow.

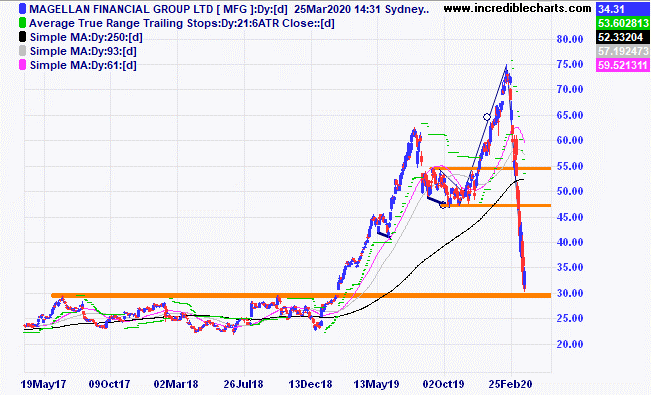

Meanwhile our longer-term positions in CSL and Magellan continue to be under water and at some point we will add to them and buy other companies we like. As Charlie said to someone last week a company can announce anything at any time and totally destroy your position. An index goes on even though the constituents change.

Magellan has bounced off a likely support zone. For how long is the question?

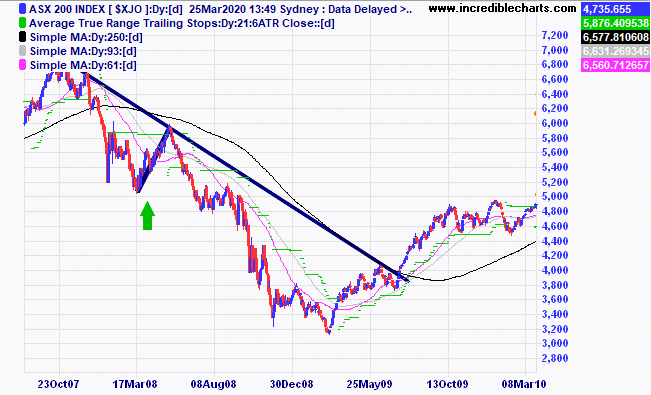

This chart shows the 2008 high to 2009 low and the reactionary moves up during the overall downtrend. The larger 18 per cent up move with the green arrow was in hindsight a temporary move dwarfed by the next downtrend.

A longer-term chart showing spikes in volatility in comparison to different lows. In each instance the market began to trend after the spike in volatility subsided. For the 09 low the spike came more than 3 months before the low, in 2011 the spike came in 3 months after the low at the first slightly higher low, for the February 2016 low the spike came in 4 months earlier, and in 2018 the spike in volatility coincided with the low in the market. The spike in volatility is just one “angle” to look at as to when all the drama is finally over and the markets can start trending again.

After the big jump in US markets overnight quite a few well- respected analysts all say it is too early to jump in boots and all. Patience is the key. Something Charlie lacks at times as we have been in and out of positions quickly and they have not all been winning trades. We may have done better by sitting on the sidelines. We will continue to look for trading opportunities with longer term investment signals yet to turn green.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $296.90 | $285.35 | -$115.50 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $42.02 | $34.31 | -$308.40 |

Bought Capitol Health | Bought 8,000 at 25.5c | 5/2/2020 | 22.5 | Sold 19/3 20c | -$230.00 |

Bought Lifestyle

| Bought 300 at $8.40 | 2/3/2020 | $6.90 | Sold 19/3 at $6.20 | -$240.00 |

Bought BBOZ ETF

| Bought 400 at $16.00 | 19/3/2020 | $16.00 | Sold 200 23/3 at $20.00 Sold 200 24/3 at $18.00 |

+$770.00

+$370.00 |

Bought BBOZ ETF

| Bought 400 at $18.50 | 23/3/2020 | $18.50 | Sold 400 24/3 at $17.20 | -$550.00 |

Bought GEAR ETF

| Bought 1000 at $10.85 | 24/3/2020 | $10.85 | $10.85 | Steady |

Bought VTS ETF

| Bought 10 at $195.87 | 24/3/2020 | $195.87 | $195.87 | Steady |

Bought Evolution

| Bought 800 at $3.98 | 24/3/2020 | $3.98 | $3.98 | Steady |

Bought Silverlake

| Bought 2,00 at $1.41 | 24/3/2020 | $1.41 | $1.41 | Steady |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $55,695.90 |

|

|

| $55,695.90 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week -$303.90 |

|

|

| -$303.90 |

| Current total $55,392.00 |

|

|

| $55,392.00 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $23,851.20 |

|

|

| $23,851.20 |

Prices from Tuesday’s close or 6am for US | Cash available $31,540.80 |

|

|

| $31,540.80

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here