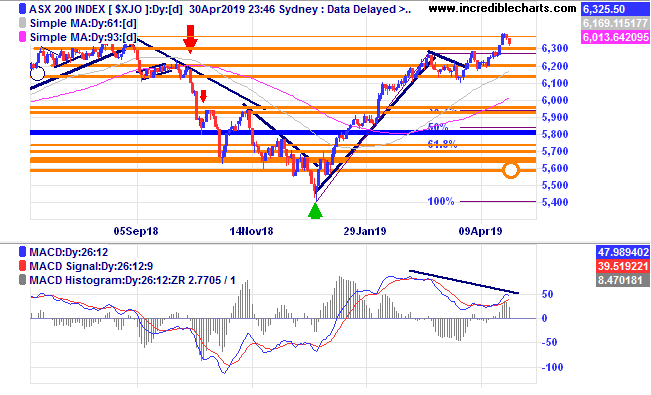

The local market posted an 11 year high late last week and the MACD indicator did not make a fresh high which suggests a period of weakness may be ahead. Perhaps a shorting opportunity is coming up for traders or a time to hedge positions for investors.

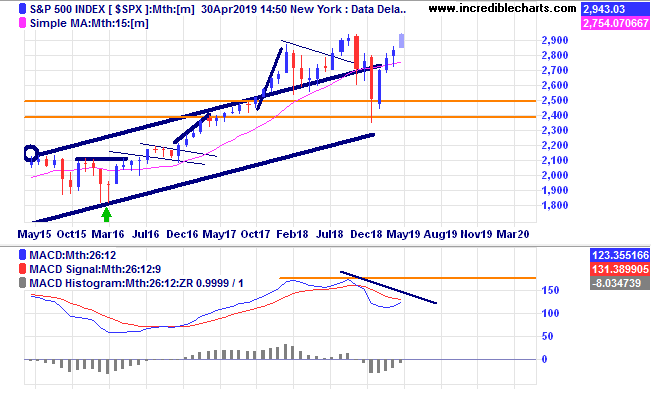

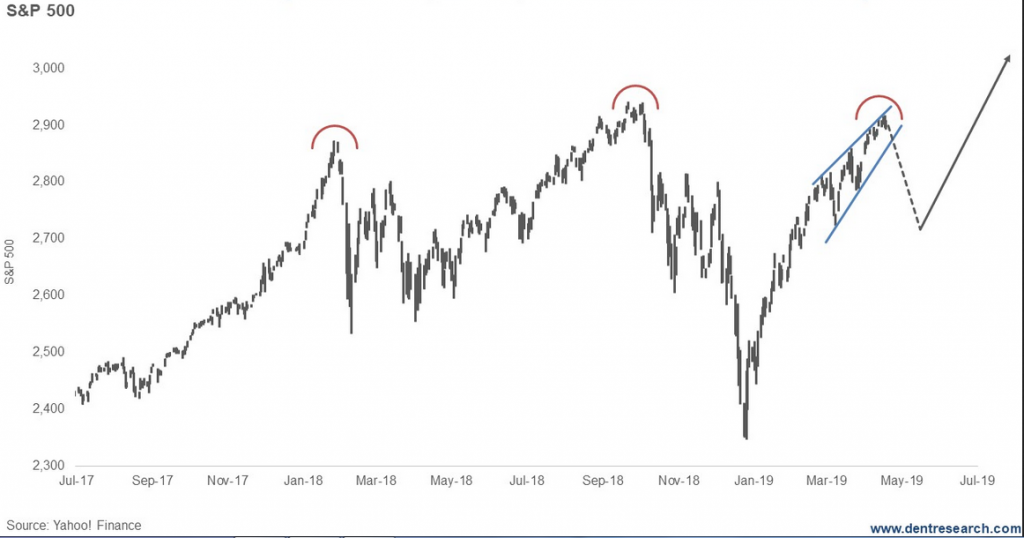

The US S@P 500 Index also made fresh highs last week and the MACD indicator on this monthly chart is showing a downtrend with a possible lower top.

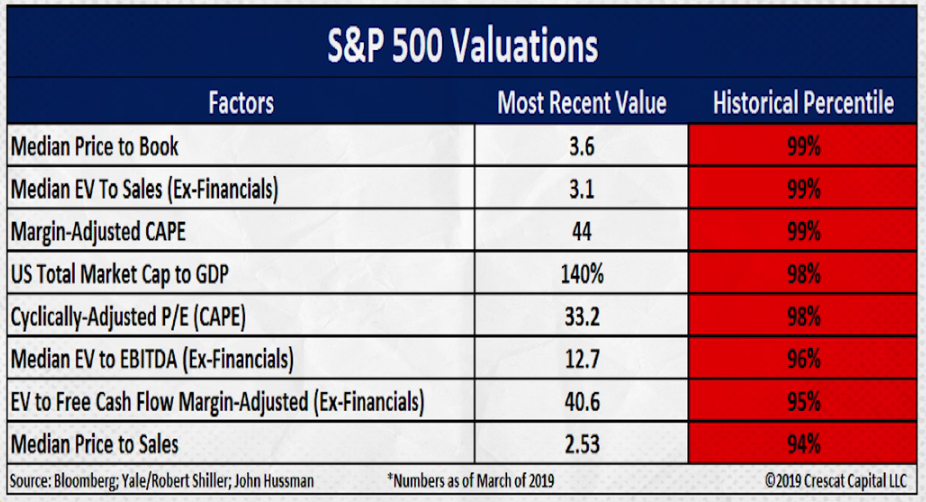

On an interesting trading site Charlie watches it showed this chart measuring how overvalued the US index is using a number of measures. Looks like we are in dangerous territory and with the “sell in May” mob getting vocal we could be in for a downturn of some kind.

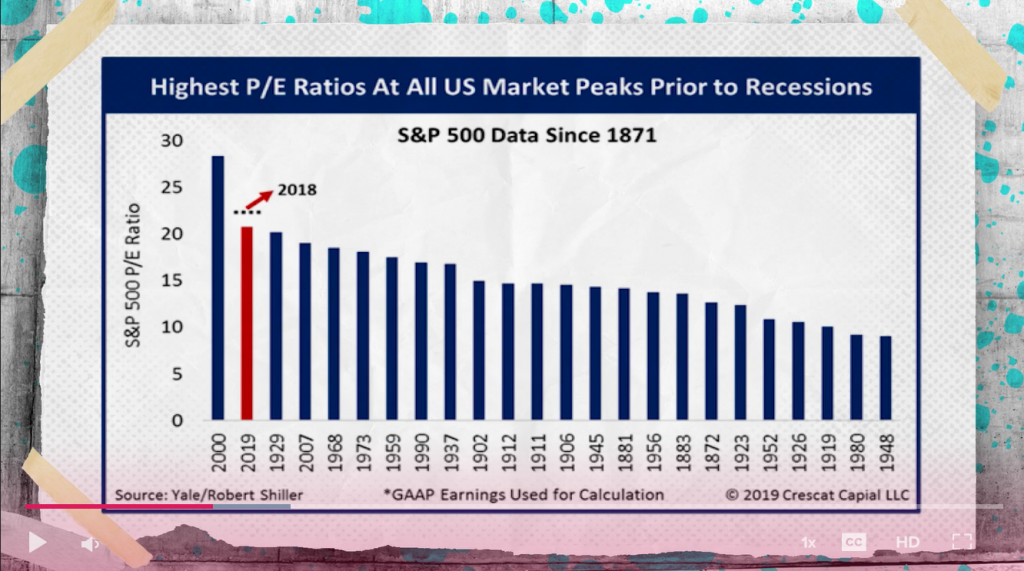

The second highest Price Earnings ratio suggests there could be more upside as well as a warning of a future decline.

Is this a tripple top with an ascending wedge pattern?

An alternate view is that after a big drop like we had late last year the drop is followed by a nice long rally. Looks like interesting times ahead with some conflicting information and only time will tell which way the market goes from here. All this is speculation of the big picture and traders need to focus on specific trade plans and risk management with stop losses in place to keep themselves out of trouble.

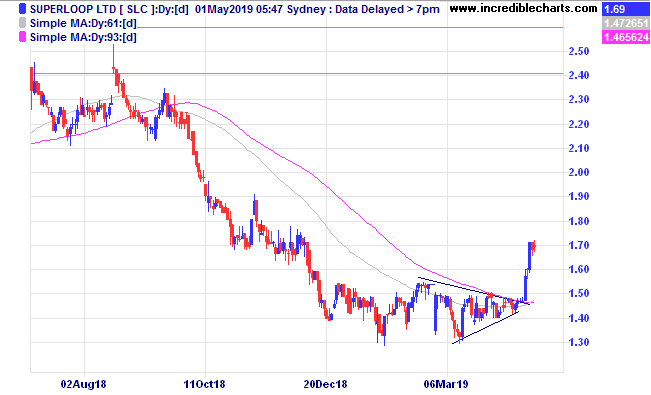

We bought into Superloop a day after the break

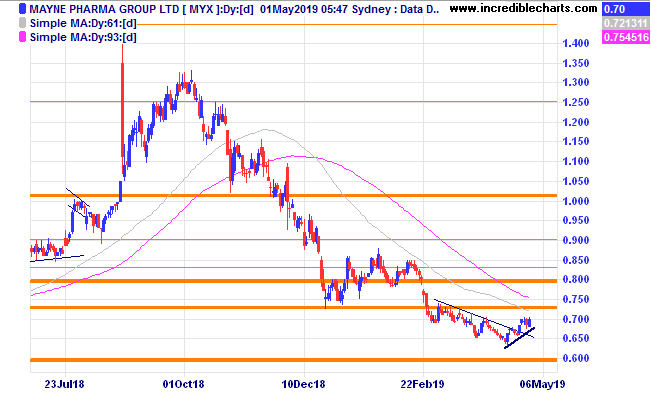

Mayne Pharma put in a higher low after breaking a small downtrend line and we bought a parcel and have our stop in place.

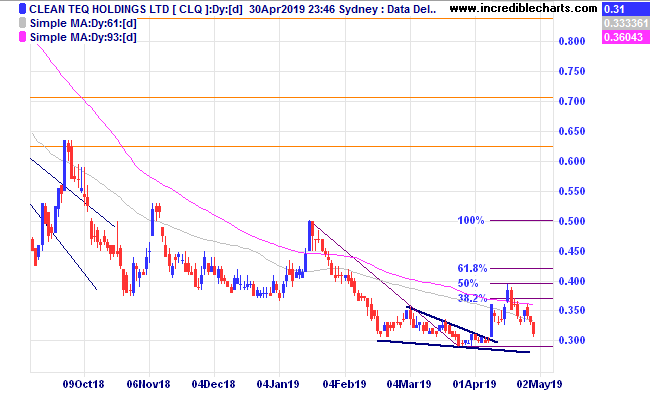

Clean Teq is moving down towards the breakout point after turning back at the 50 per cent mark of the range.

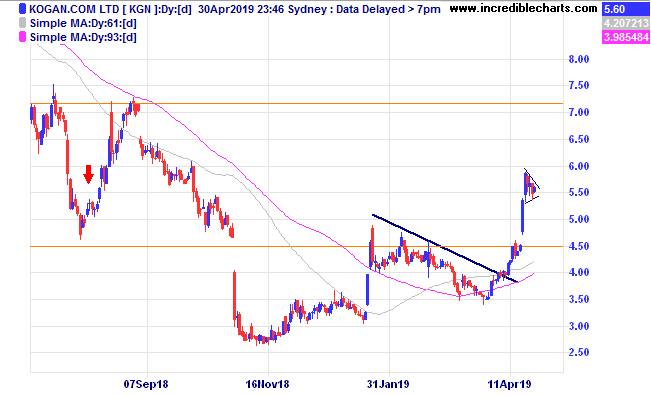

Kogan looks to be forming a bullish flag type pattern.

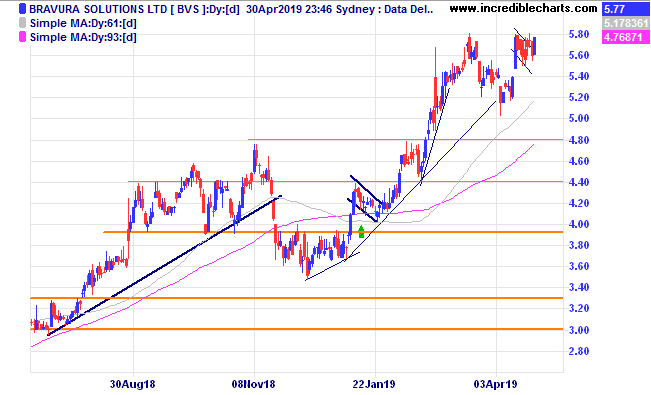

Bravura is our biggest educational portfolio holding and we could be taking some profits soon should prices decline.

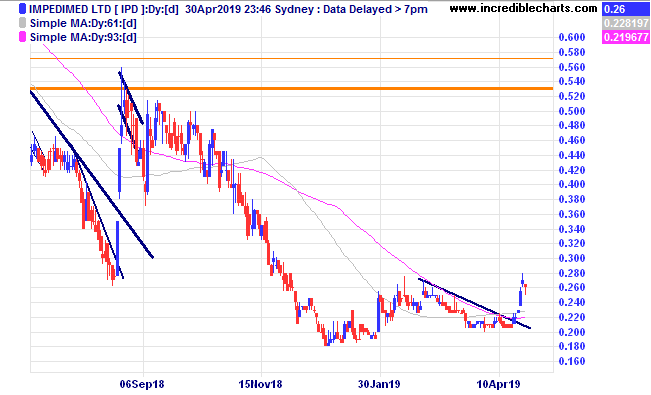

Impedimed could be on the way up if it clears the resistance zone around 28 cents with a nice looking higher low developing just below resistance.

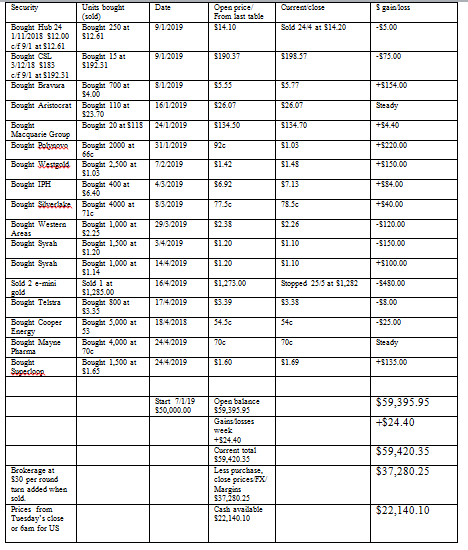

Table

Disclaimer: The commentary of trading ideas and positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here