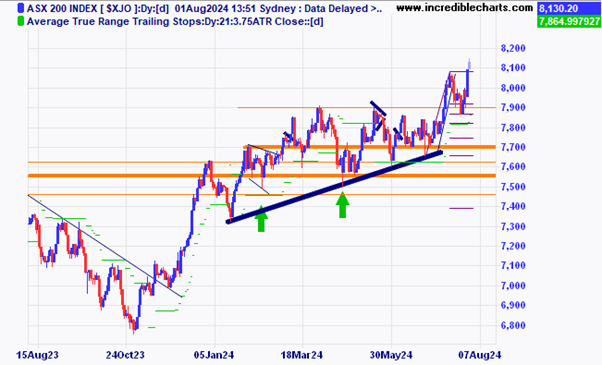

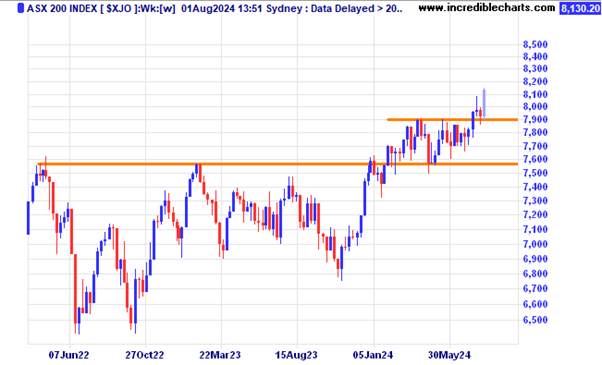

The local market exploded upwards yesterday after the latest inflation figures were released and traders breathed a sigh of relief that those figures came out within expectations and in turn pushed aside the recent speculation of any rate rise.

The local market is up around 2.6 per cent so far this week and has made a new all-time high as shown on his weekly logarithmic chart.

A lot of retail and consumer stocks rose nicely yesterday after the inflation numbers were out. Below is the JB Hi-Fi chart.

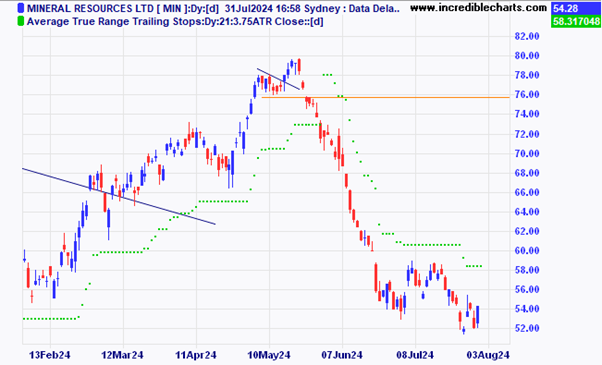

Iron ore, mining processing and lithium stock Mineral Resources looks to be bouncing off the lows.

Data#3 posted some nice gains yesterday

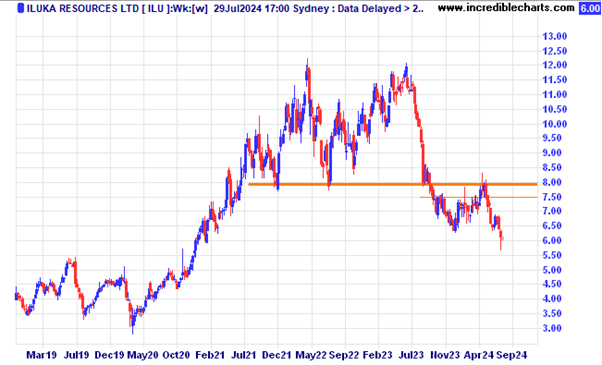

Mineral sands mob Iluka looks to have made a spike low. Time will tell.

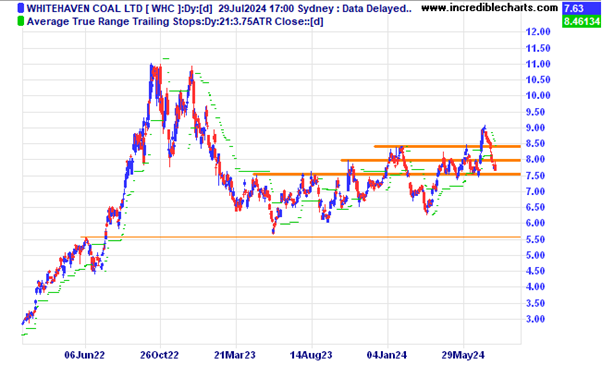

Whitehaven Coal has retreated from the recent highs.

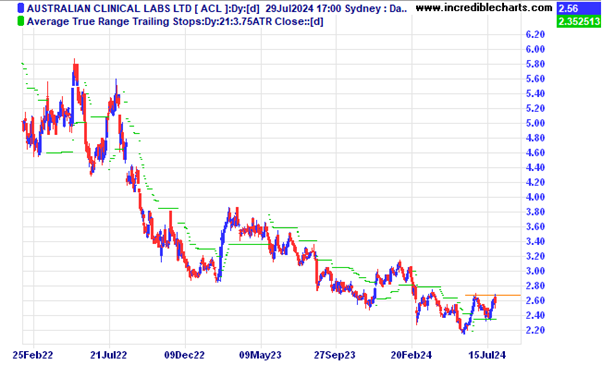

Australian Clinical Labs looks to be making a bottoming pattern.

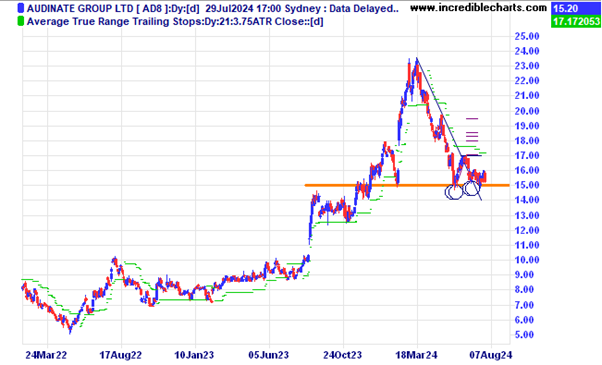

Audinate looks to be just holding on to these support levels.

Coal miner Yancoal is making nice higher lows for now.

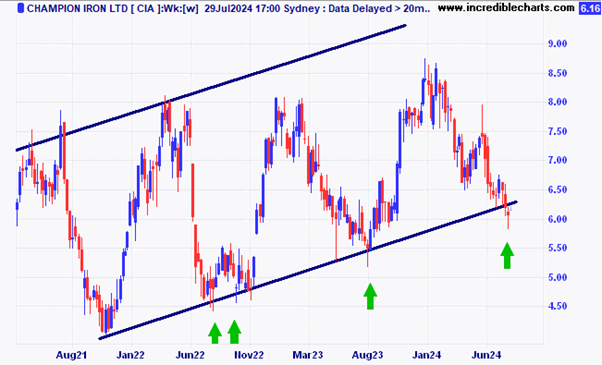

Champion Iron looks to be bouncing again off the lower trend line for now.

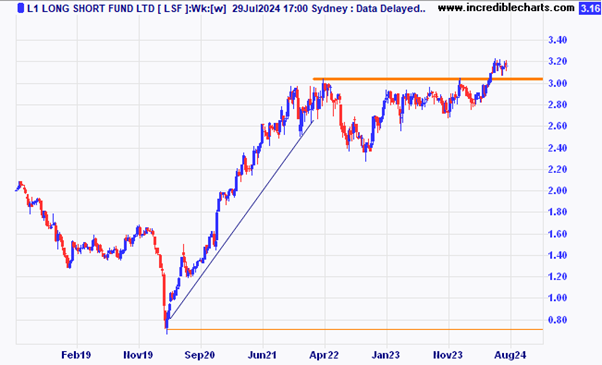

L1 Long Short Fund is holding steady above the recent sideways consolidation.

The A2 Milk Company looks to be building up for a move above this line of resistance.

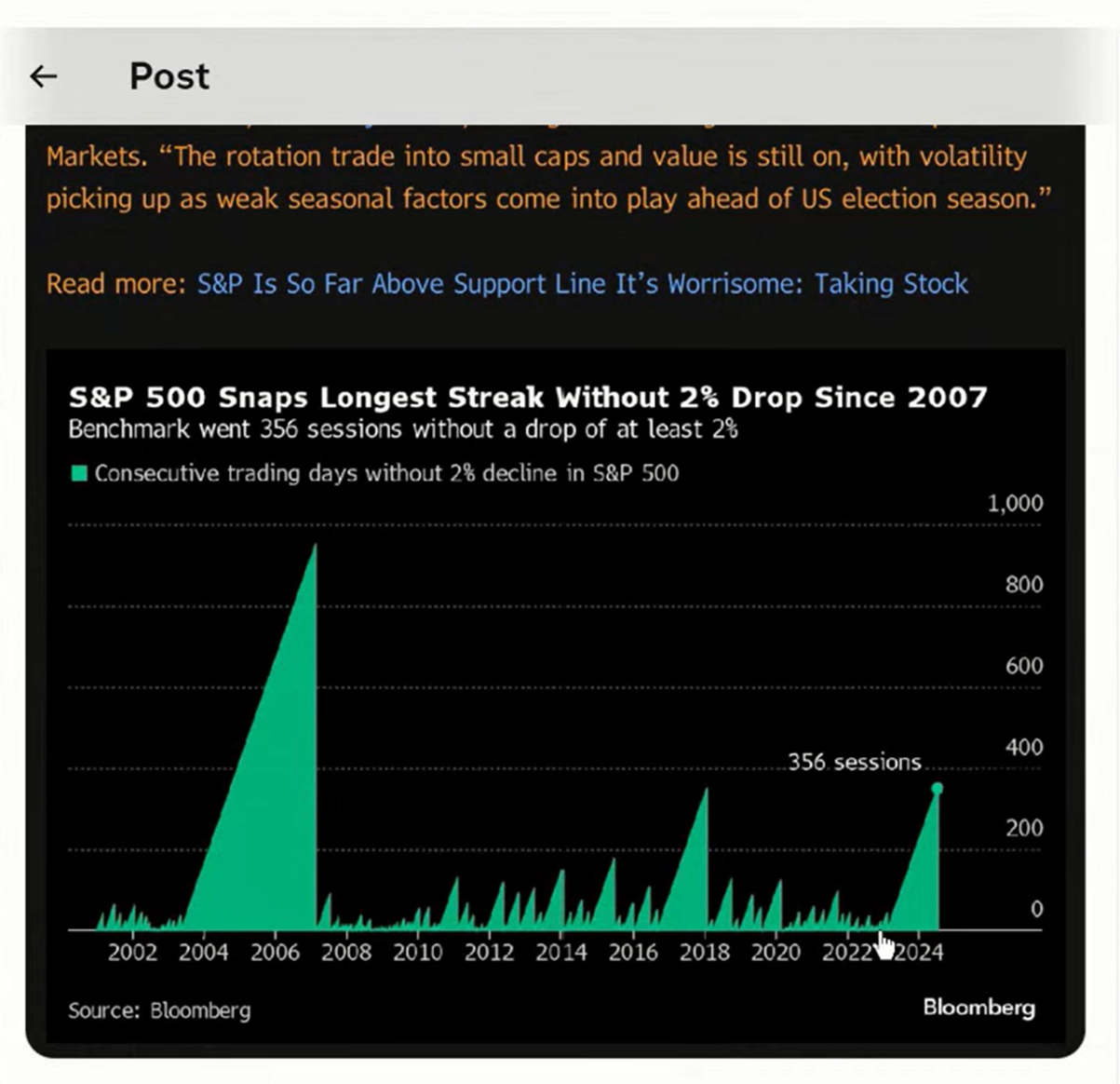

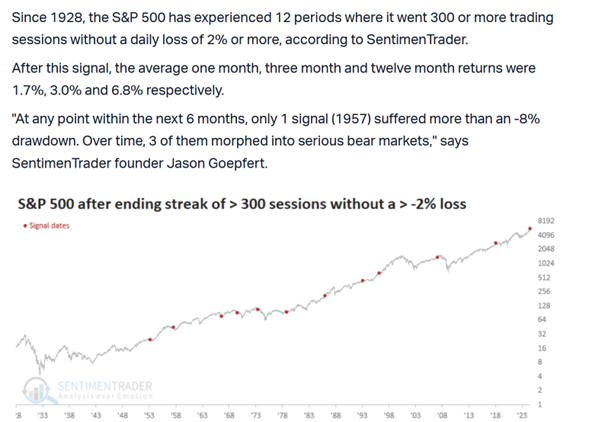

The US S@P 500 index recently broke a 300 odd days streak of not dropping by 2 per cent. Over time 3 of these signals have morphed into a decent bear market.

Some statistics on previous signals after making a 2 per cent losing day after a string positive days.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

To order photos from this page click here