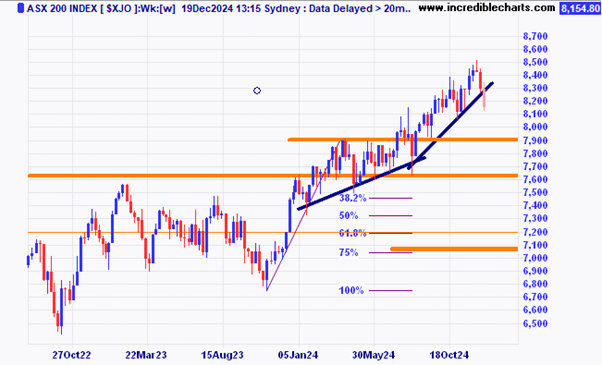

The local market is down around 1.8 per cent today after major US stocks closed down overnight after a speech from Federal Reserve chair Jerome Powell toned down the possible number of rate cuts in 2025. Will the index find support at the horizontal support zone?

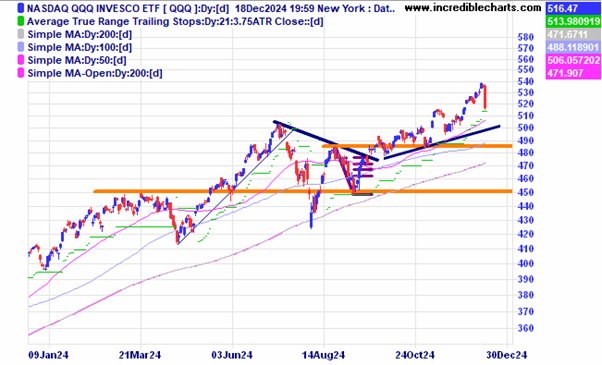

The Nasdaq based ETF QQQ fell last night as tech stocks come off their highs from the run up after the election.

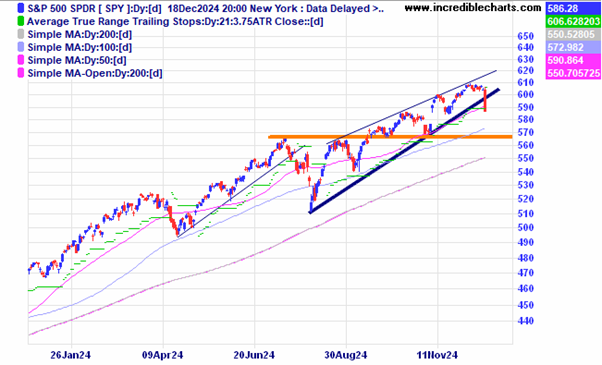

The S@P 500 based ETF SPY moved down below the current up trend line. With the US stock market up more than 20 per cent two years in a row analysts ponder if stocks will gain very much in 2025.

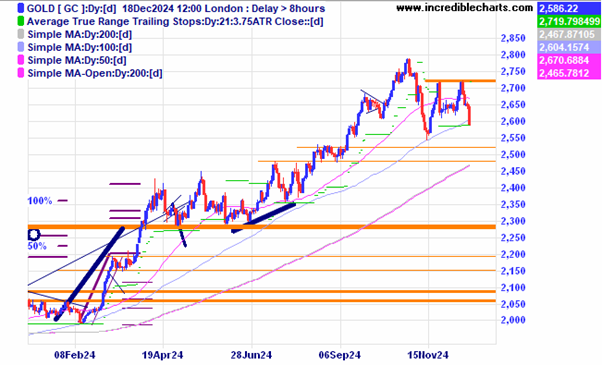

The price of gold also fell after making a lower high.

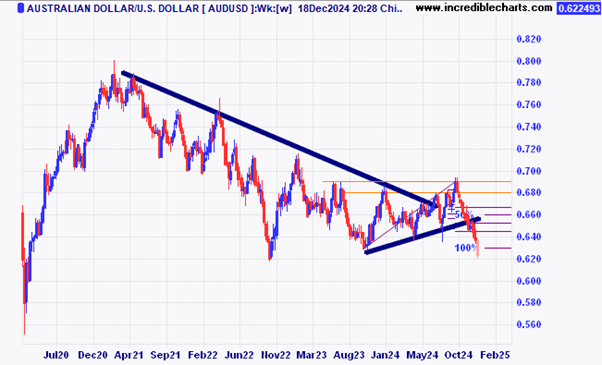

The Australian dollar continues to fall towards 60c after moving below the trend line.

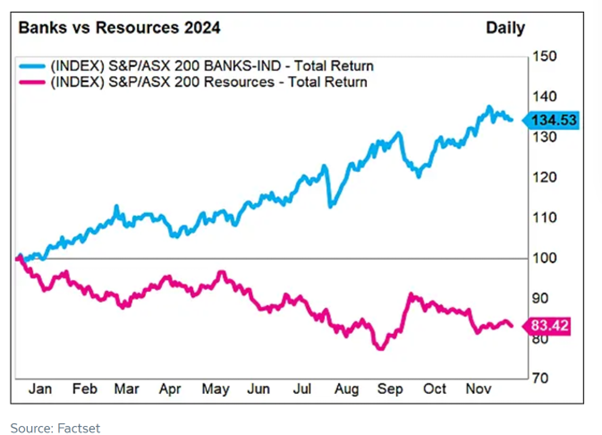

This chart shows the year to date performance of the Australian Bank index compared to the Resource sector.

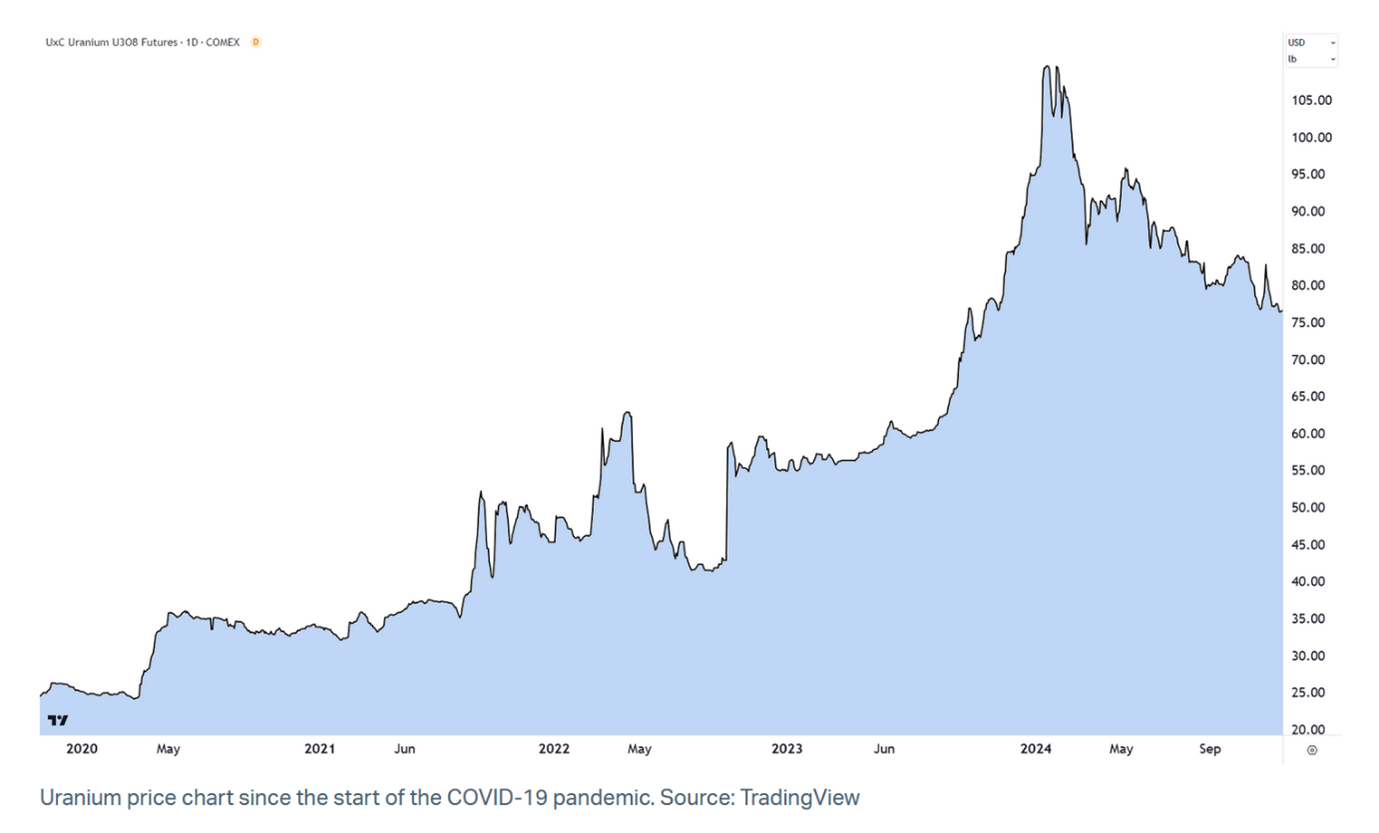

The price of uranium has been on a steady decline for most of 2024.

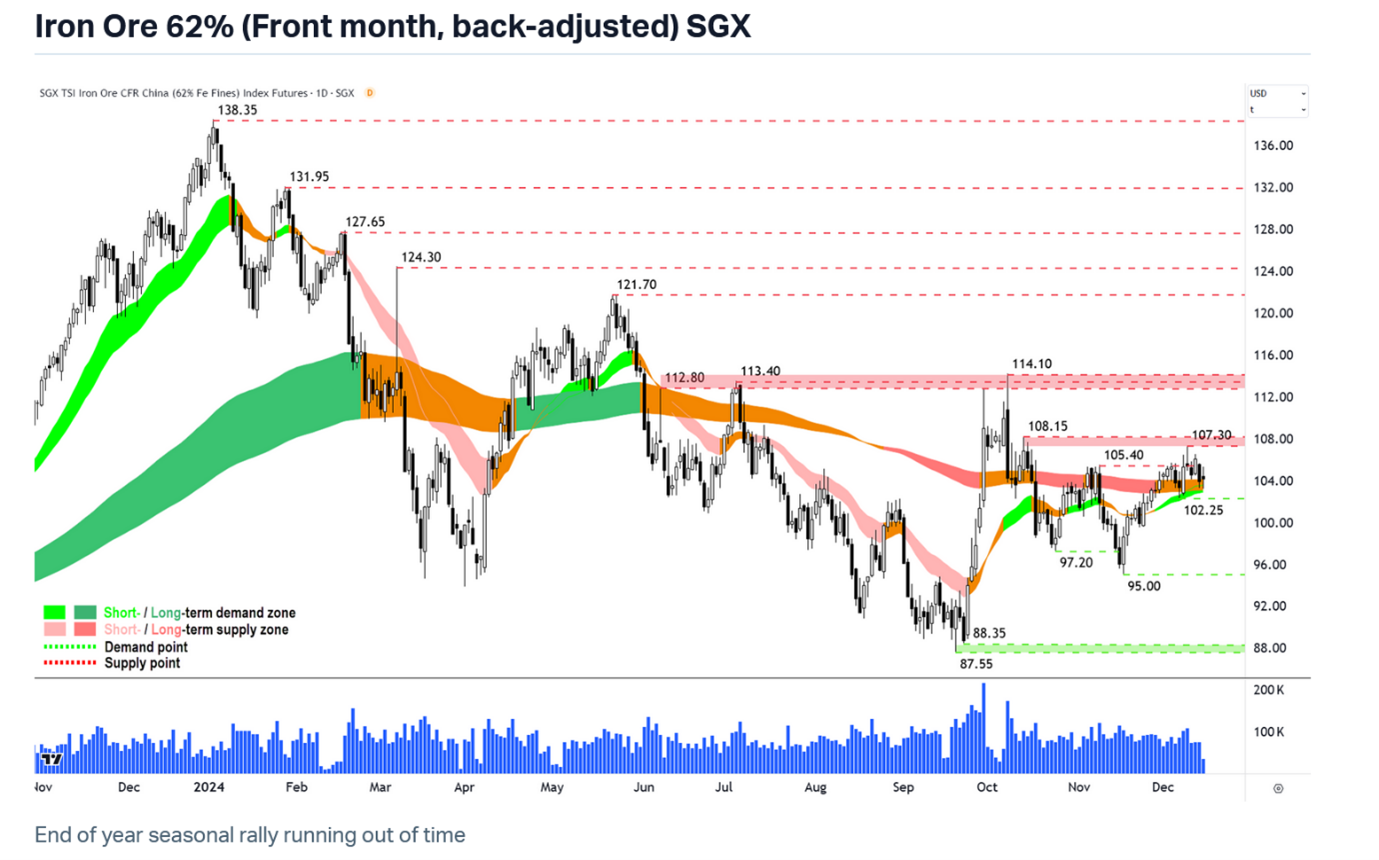

This chart of the iron ore price from Market Index shows price is stuck in a sideways pattern for now.

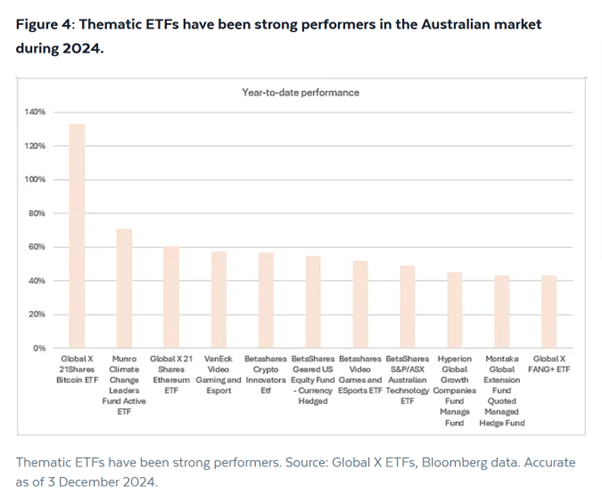

Some Australian listed ETF’s covering a range of overseas assets have performed very well during 2024 and were helped by a declining Australian dollar.

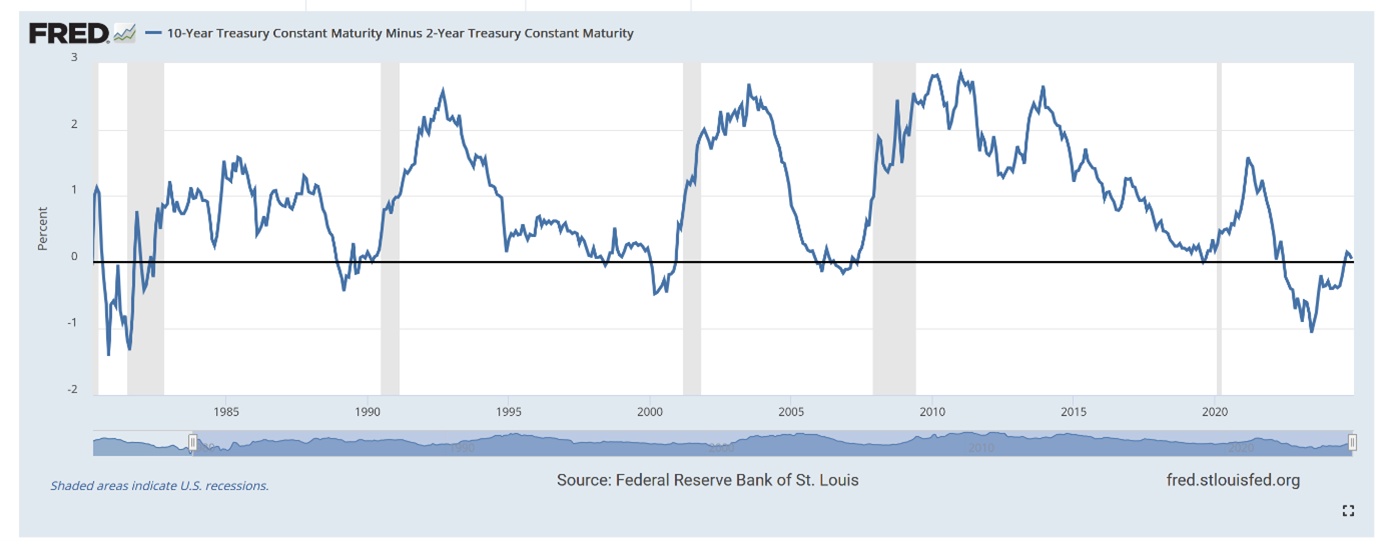

This graphic shows that during the last 40 years after the 10yr-2year US Treasury yield spread moves above zero after being negative a recession was not too far behind. What will 2025 bring for US markets? Volatility some pundits suggest.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Wishing everyone a happy and healthy holiday season and many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here