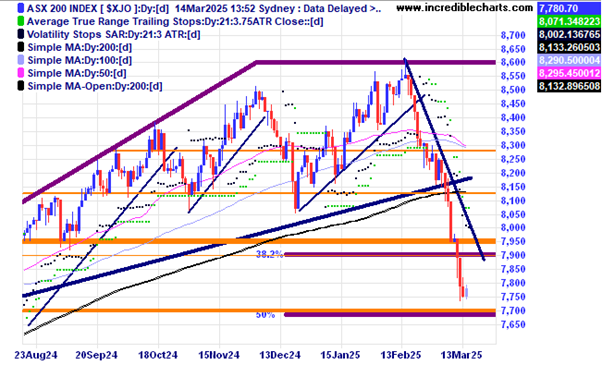

The local market continues the downwards trend and is treading water today. Most world markets remain on edge over ongoing trade war uncertainty. Sometimes when markets break a trend line it can retrace back towards that trend line before continuing the trend further.

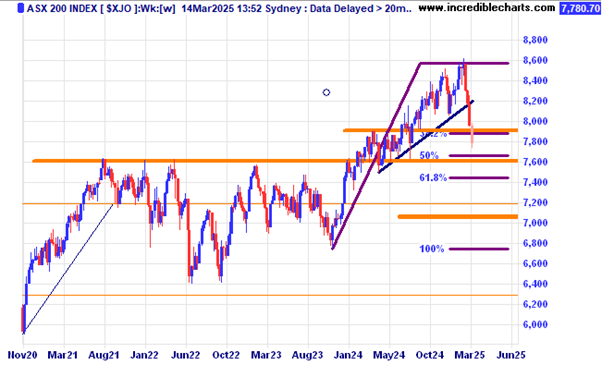

On the weekly time frame the local index is close to giving back 50 per cent of the range up from the 2023 lows and not far from a series of previous peaks.

This MAGS ETF listed in the US shows the fall of the magnificent seven as a group.

The Newcastle coal price continues to drop.

Whitehaven Coal is very close to moving below a significant support and resistance zone.

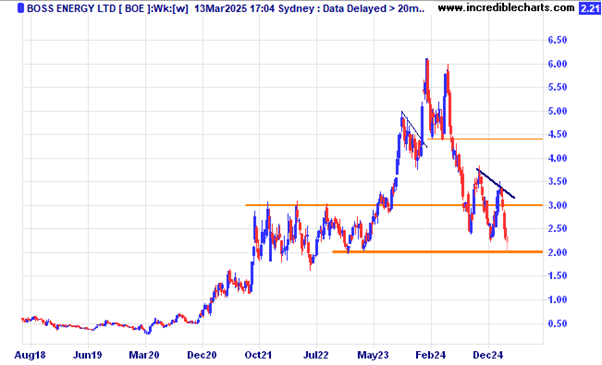

Can Boss Energy hold the support level around current prices.

Pinnacle Investment has fallen quite quickly after moving below the support zone.

With a lot of stocks falling Australian Agricultural Company has gone against the trend and made a fresh yearly high.

Strickland Metals is on the verge of breaking through the falling wedge pattern.

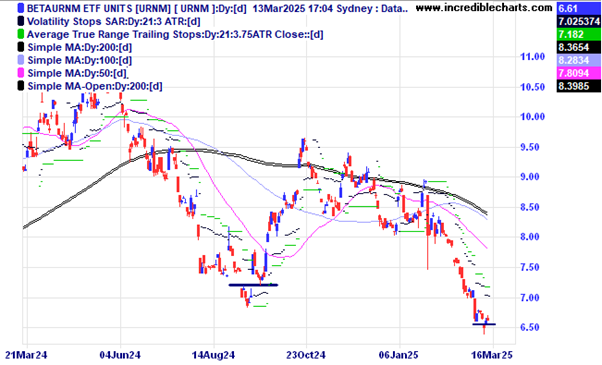

This uranium ETF recently made a fresh low. Can it rebound from here?

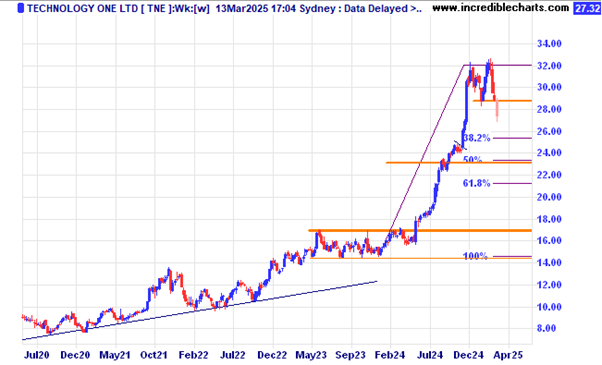

Technology One has moved below a recent support level along with a lot of other stocks which had a good run last year.

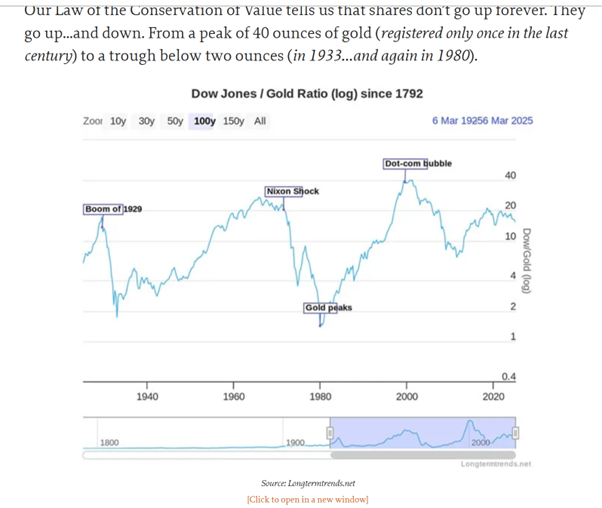

They say things can happen in cycles and the gold price has been creeping up as the stock market falls. Can this Dow Jones/Gold ratio once again reach the lower levels.

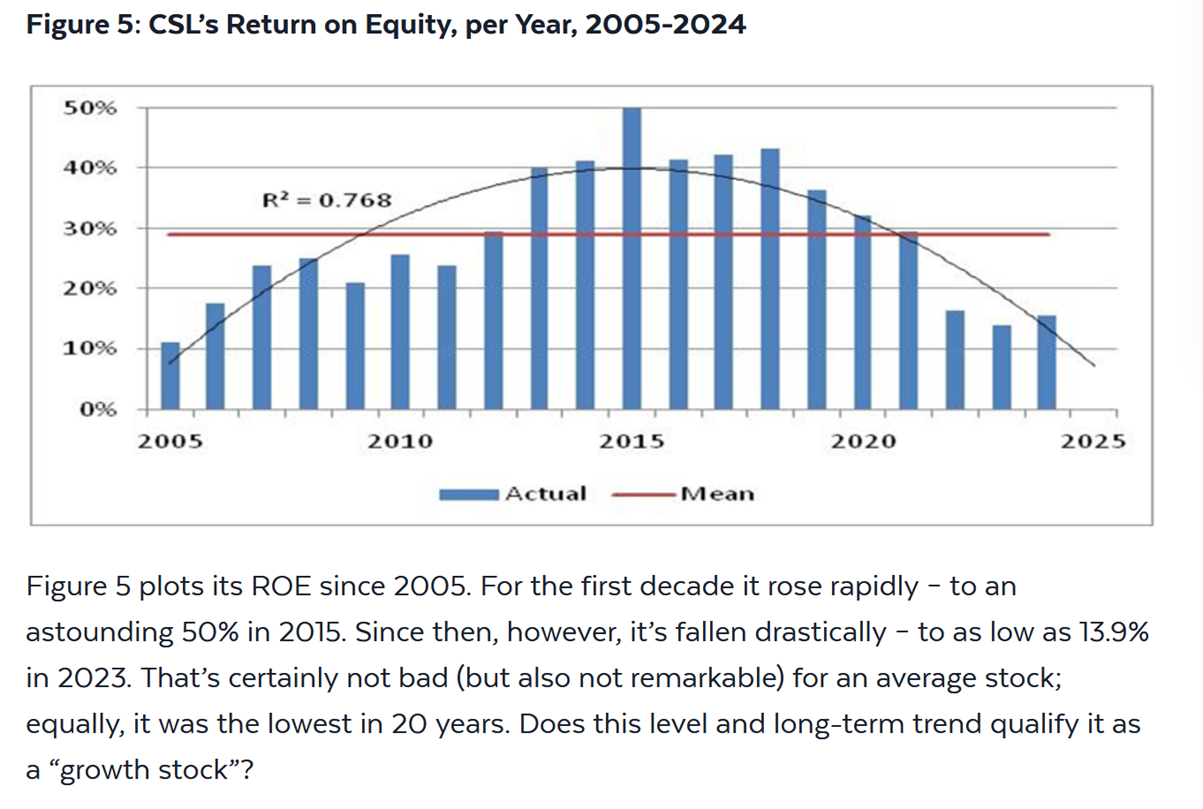

A very informative graph of how CSL’s return on equity has been coming off the boil over recent years.

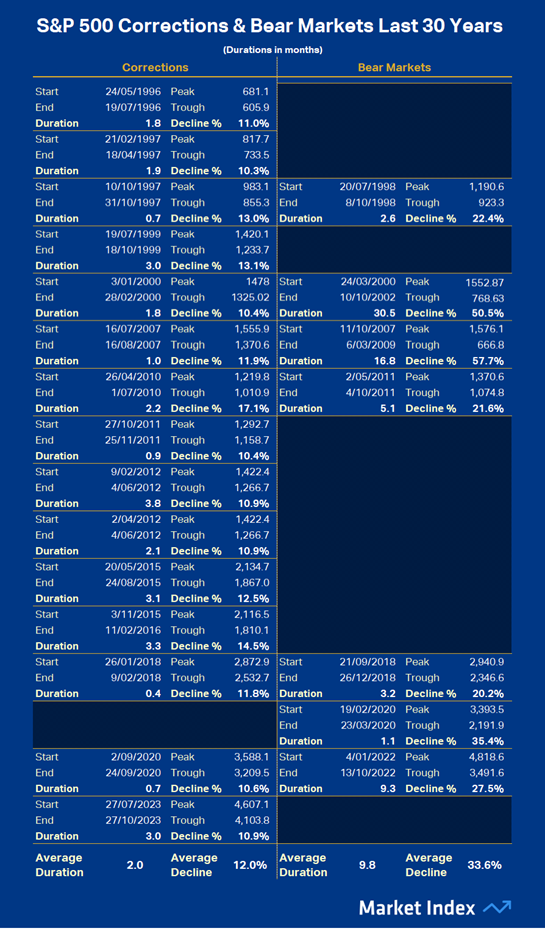

The following table and information on historic US share market corrections can give some perspective to what is happening in markets now and also how bearish things can become. This information comes from the Market Index website which has a free daily report well worth the read.

No “stimulus” rebound suggests US Treasury Secretary and former hedge fund guy Scott Bessent.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here