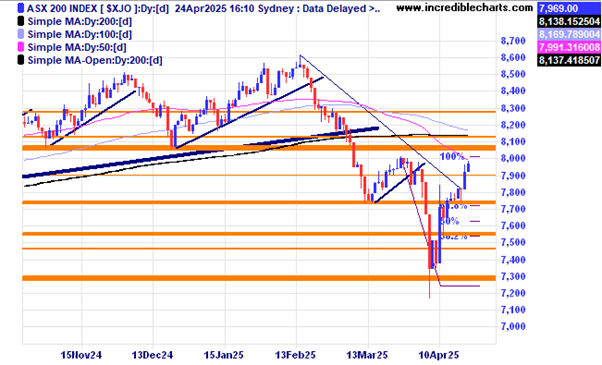

The local market is moving up on the back of good gains in US stocks after Trump toned down the language of tariffs on China and on not firing Fed chair Powell. Markets very much liked that and rose strongly. This currently “V” shaped bottom shows the volatility of the past month.

Not long after the announcement that Trump would not seek to remove Fed chair Powell the gold price started the decline and was down around 6.5 per cent at the worst so far.

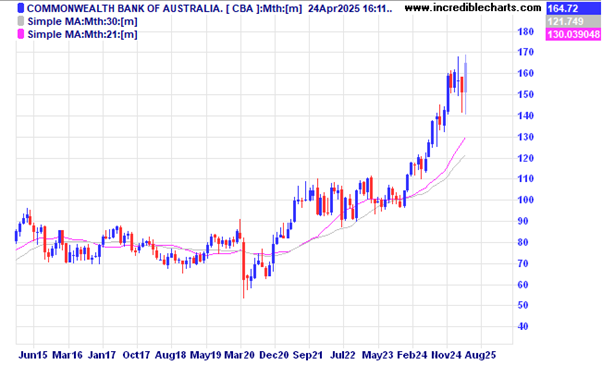

Some of the local market strength comes from The Commonwealth Bank which hit an intra-day all-time high this week.

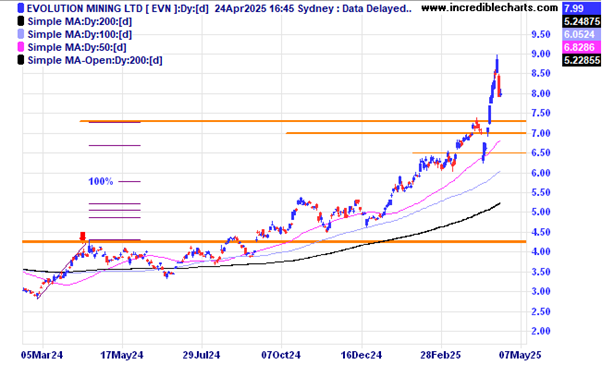

The recent ten per cent fall in the price of gold miner Evolution is put into some perspective in this chart.

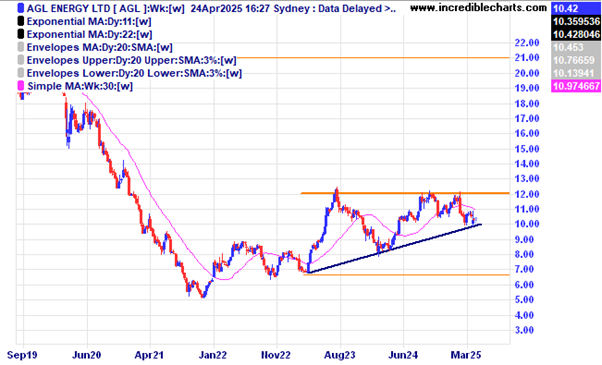

AGL could be building up for a decent move here.

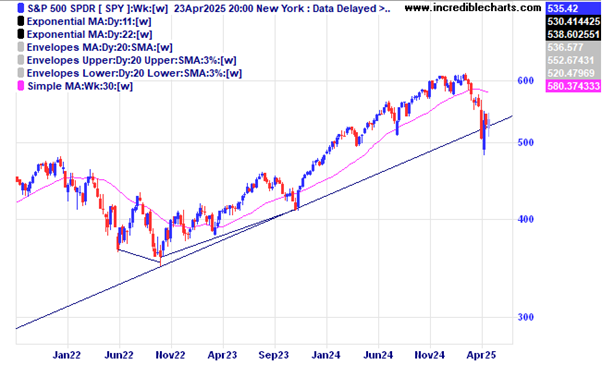

The US based S@P 500 ETF SPY has now closed above the trend line which is rising at around 17 per cent p.a. off the 2020 lows.

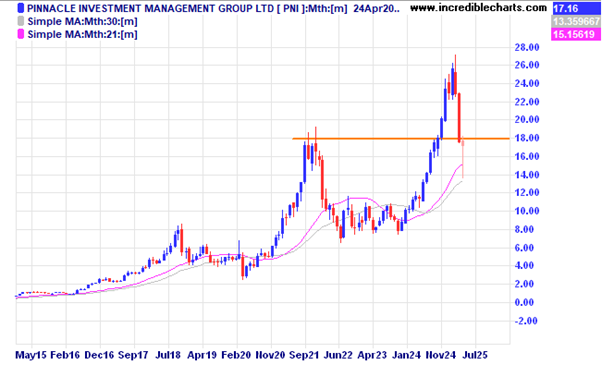

This chart of fund management outfit Pinnacle shows the sharp turnaround in prices this past week.

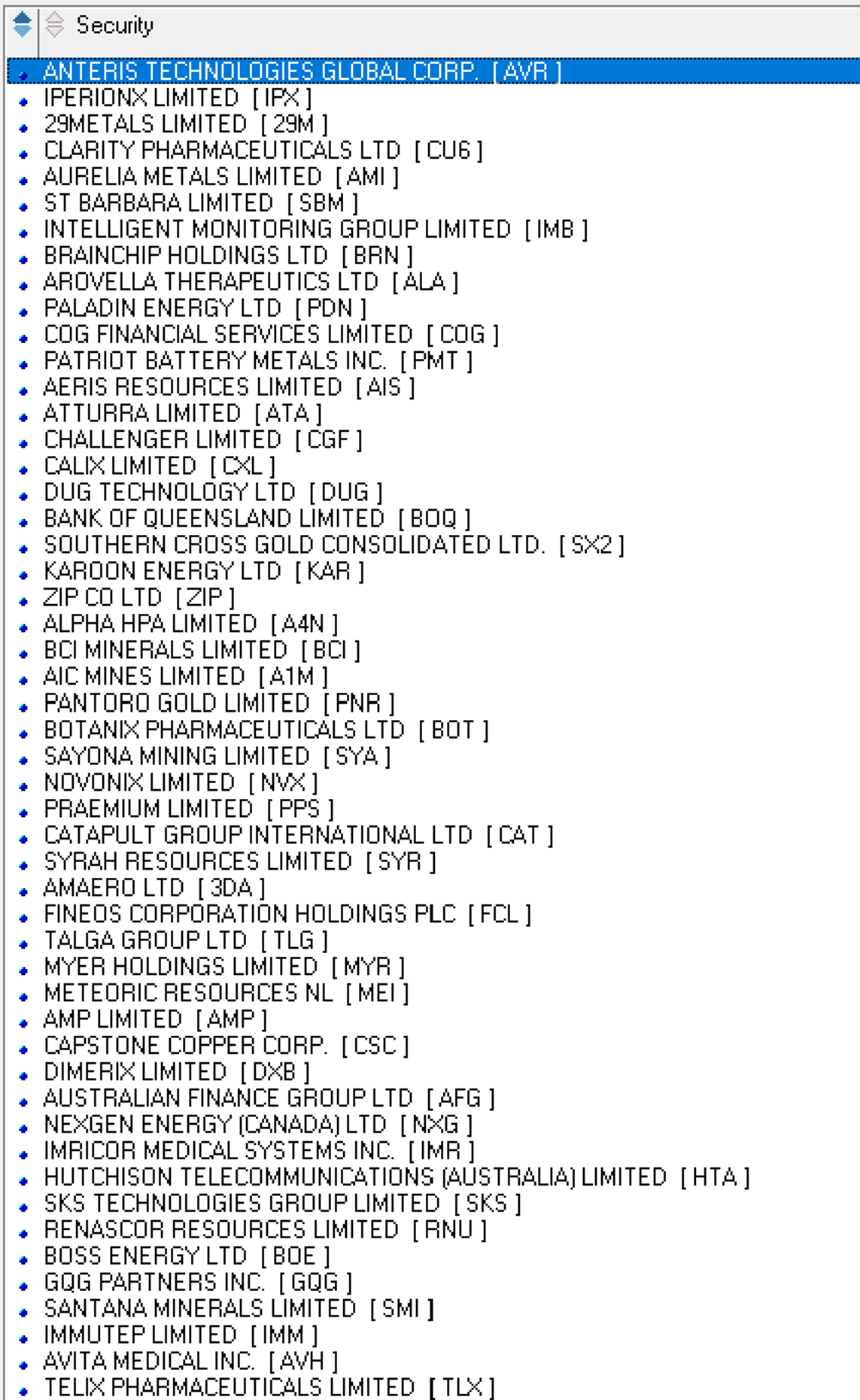

Top local performers from the All-Ordinaries index listed in percentage gains over the past five trading days.

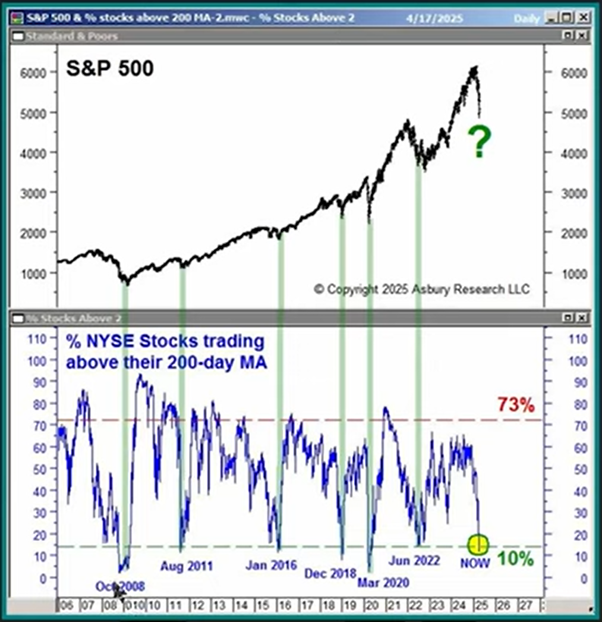

This graph comes from Asbury Research and uses the number of stocks below their 200-day moving average as an indicator that the market may have bottomed. Time will tell. With a “V” shaped recovery evident so far the uncertainty of what Mr Trump might do next could see anything happen.

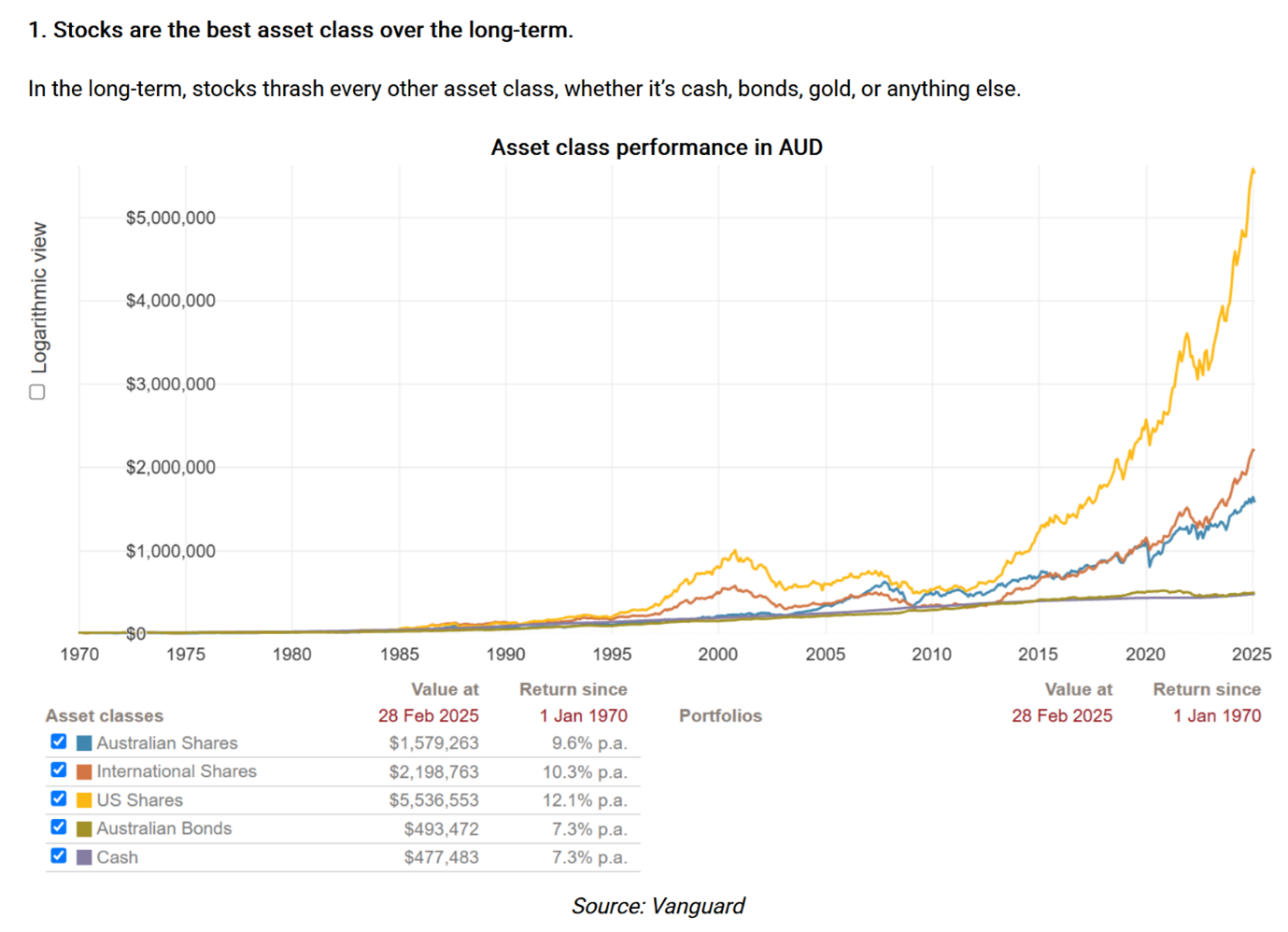

This graph shows the long-term performance of different assets with US and international shares posting the top two spots.

What previous declines in past bull markets of 16, 20 and 25 per cent look like on the current chart of gold from the recent high at US$3,500. The current 6 per cent pullback hardly measures here.

An interesting weekly chart of Bitcoin.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here