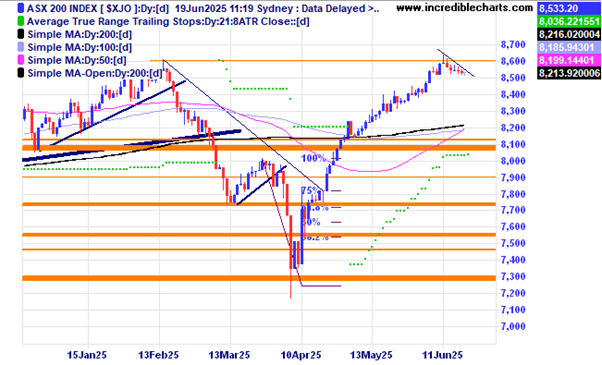

The local market is steadily drifting lower after briefly reaching a new all-time high. With tensions high in the Middle East the market could be jolted out of the comfort zone at any time.

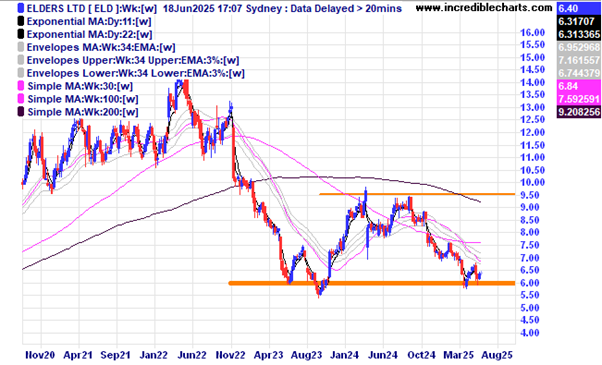

Elders looks to have found support at the recent lows. Will it hold moving forwards?

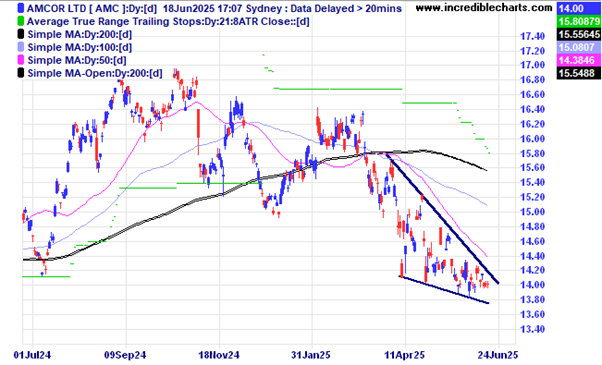

Packaging mob Amcor looks to be forming a descending wedge pattern which could see prices move up out of the pattern.

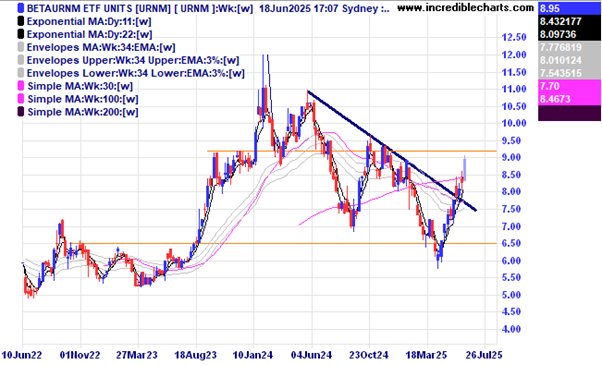

This uranium ETF has moved above the trend line and could run into a resistance zone around the $9.00 level.

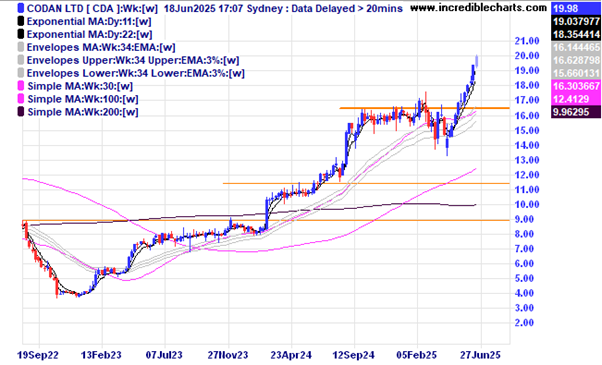

Codan keeps edging upwards.

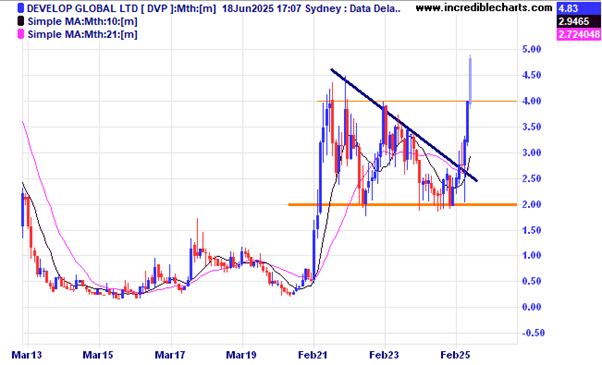

Junior copper miner Develop Global has moved above a possible resistance zone around the $4 level. An ABC type retracement could make it interesting for traders.

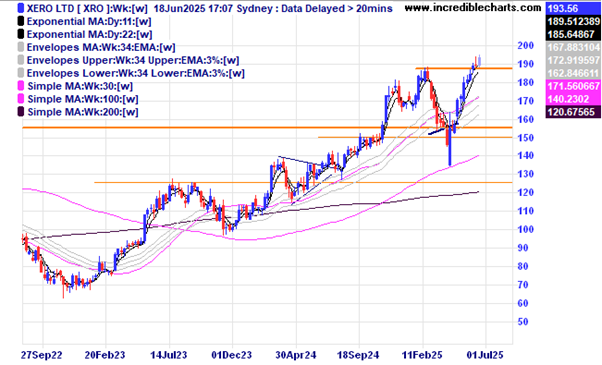

Xero has just posted a record high. Will prices consolidate before the next leg higher.

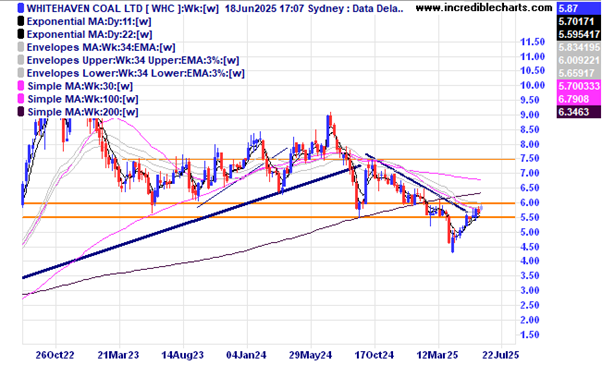

Whitehaven Coal has slowly moved back into an important resistance zone.

One way analyst Frank from Capptheis foresees the ongoing trend of the US technology sector is similar patterns continuing to lead to higher prices.

This snip from the latest edition of Firstlinks shows the yearly rise in farmland values has stalled for now and if past history is any indication it may take some time before prices rise meaningfully again.

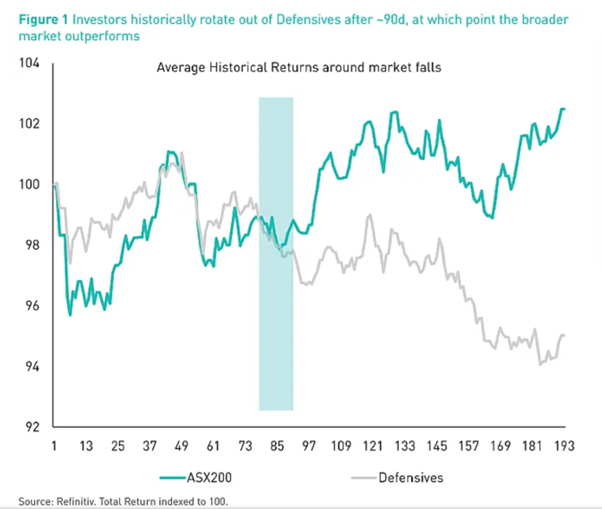

This graphic shows how investors rotate, on average, out of defensive assets and into growth assets after any perceived “panic” selling is over.

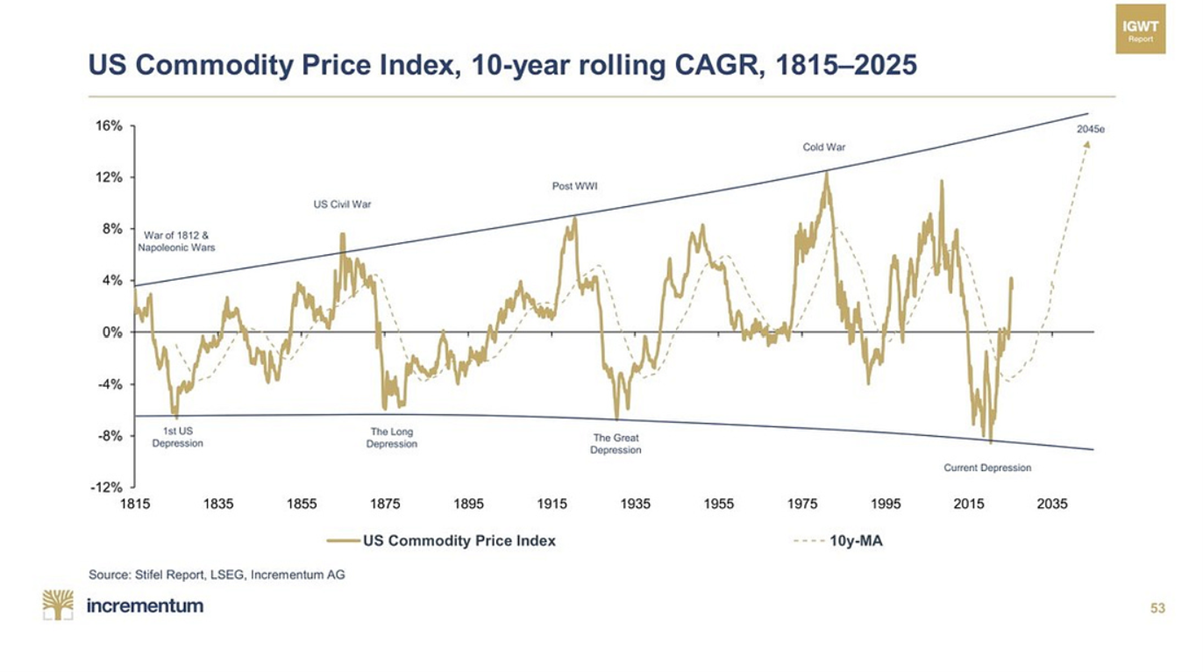

One analysts view of the commodity cycle and where it might be heading.

Disclaimer: The commentary on different charts is for general information purposes only and is not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column. Cheers Charlie.

To order photos from this page click here