Welcome to a new year everyone.

The local market has moved up tentatively from recent lows following some good gains in overseas markets and a positive outlook on US trade talks with China.

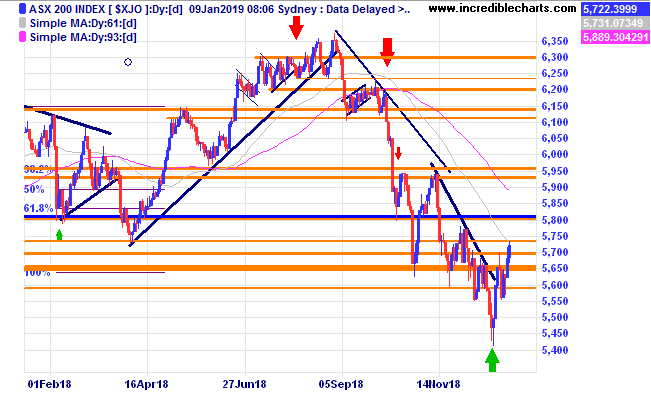

A daily chart of the ASX 200 index shows the current move up.

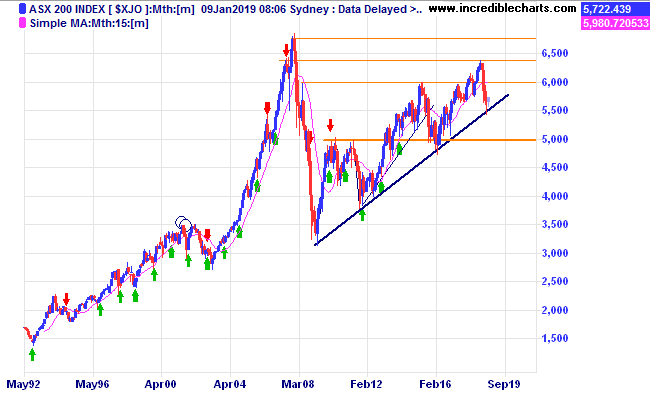

A longer term chart of the ASX 200 index shows the recent bounce from the long term up trend line.

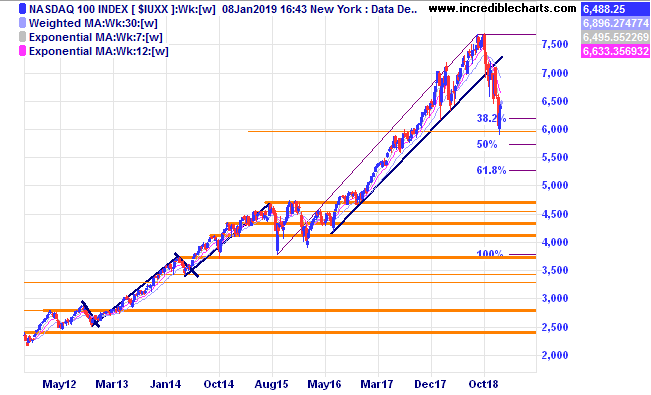

A weekly chart of the US based Nasdaq 100 index shows not quite a 50 per cent retracement of the current range up.

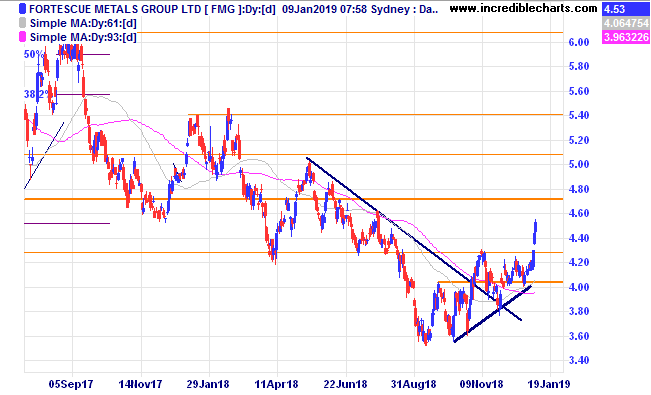

The chart of Fortescue Metals shows the recent break higher where we bought some for the educational portfolio.

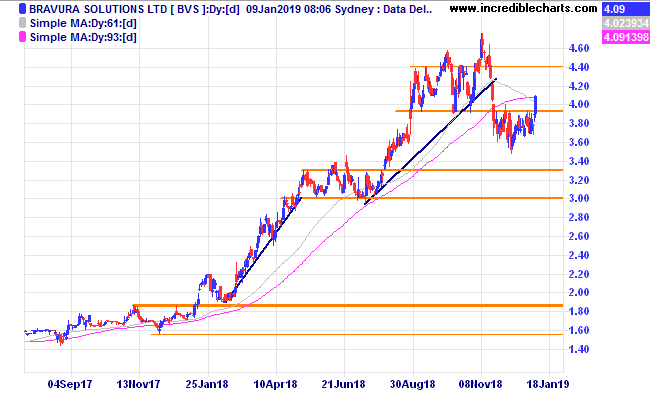

Bravura also had a move higher and we bought some yesterday.

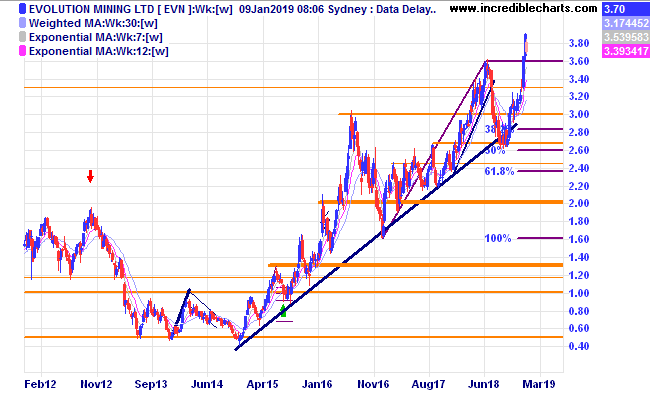

This year as we start a new educational portfolio we will carry forward CSL and HUB24 from last year at today’s prices. Some gold stocks offer interesting possibilities at lower prices including Evolution which has bounced strongly off the long term trend line.

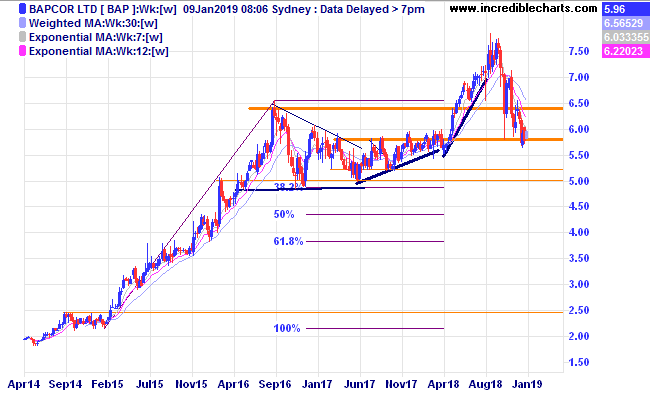

Quite a few stocks have retraced to previous support levels including Breville, Blackmores and Bapcor.

With the price of oil improving Senex and other oil companies could benefit if the trend persists.

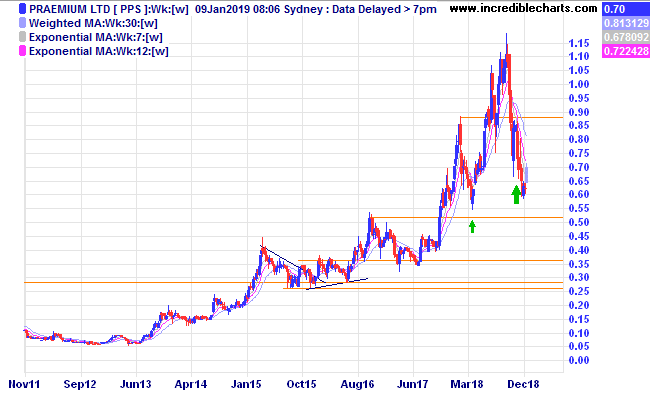

Praemium is yet another wealth management platform to benefit from people switching out of the bigger providers.

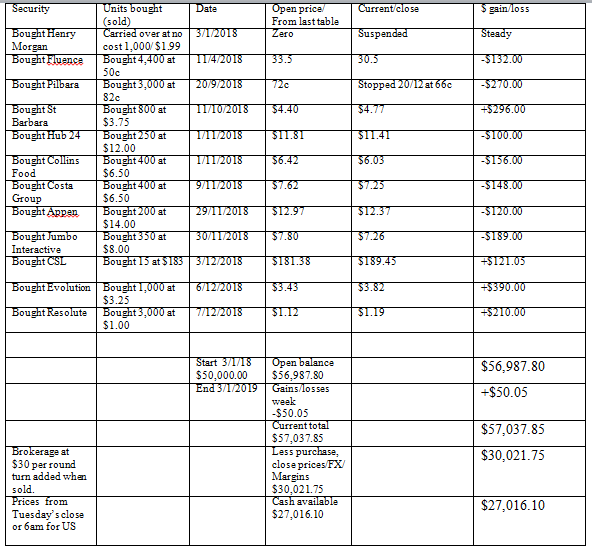

The table below shows how the educational portfolio finished the year. A new table showing our carryover stocks and new trades will start next week.

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here