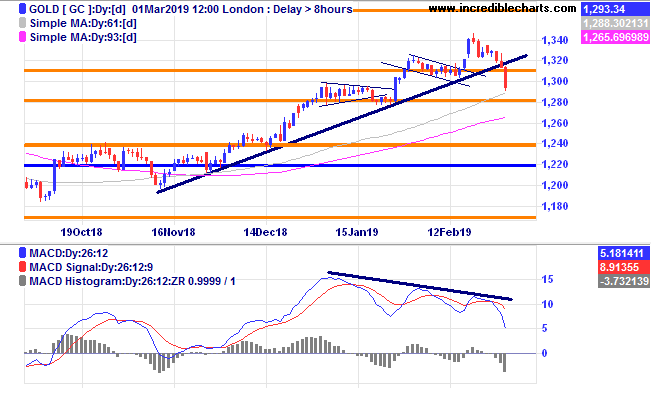

The price of gold fell below the current up trend line with a big range down after forming a classic bullish divergence pattern over the past month on the daily chart including a bearish candle last Thursday signalling a potential downwards move.

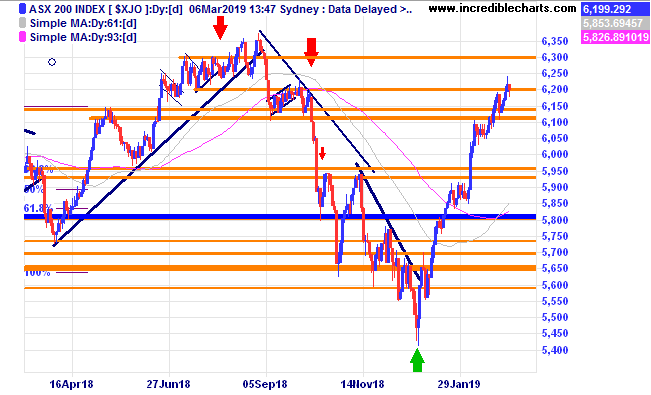

The local market has been grinding higher and could be overdue for a correction.

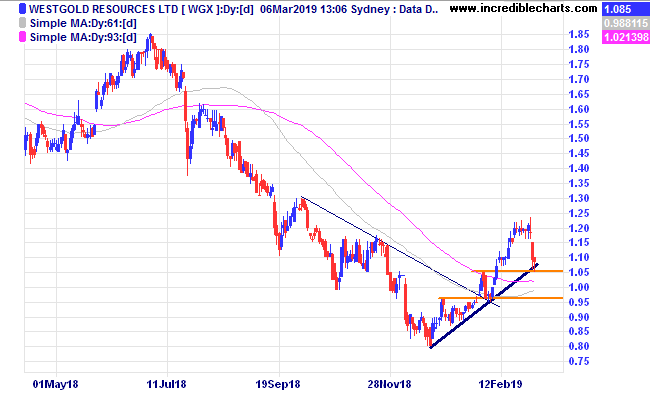

Local gold stocks suffered including Westgold which we hold for the longer term with a wide placed stop.

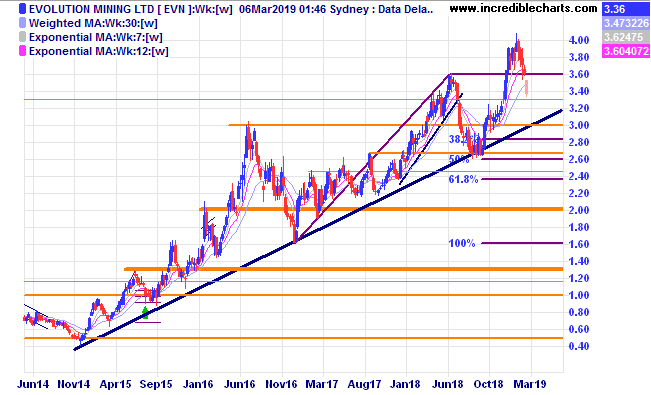

Evolution also fell and still remains some distance from the weekly trend line.

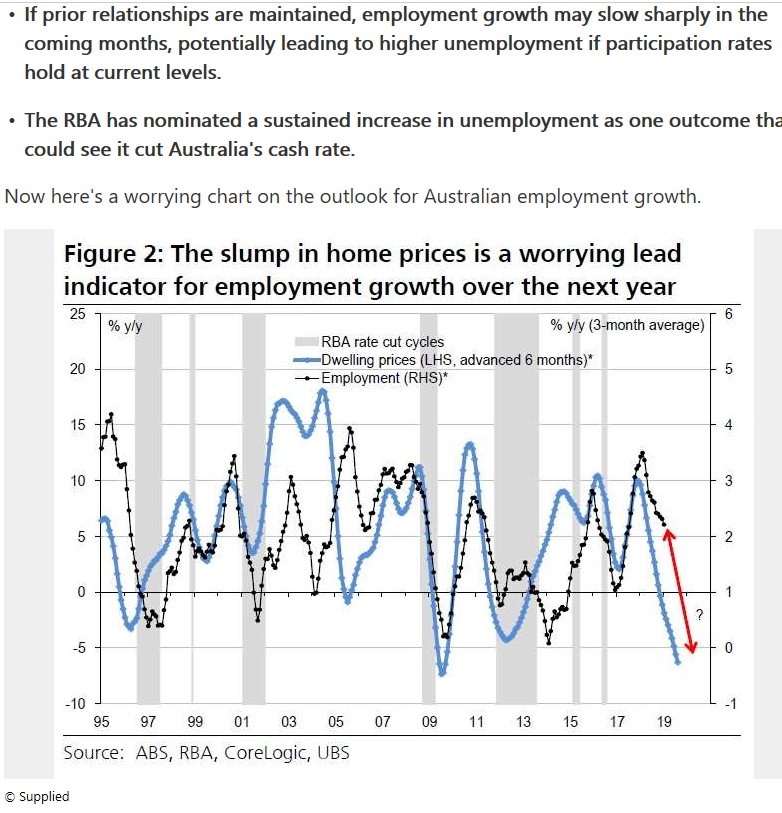

The following graph shows a relationship between falling house prices and employment numbers.

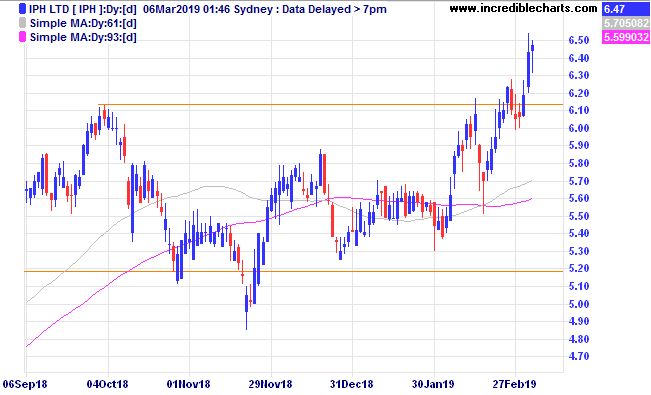

IPH has moved up from a consolidation pattern and we bought a parcel for the “Educational Portfolio”.

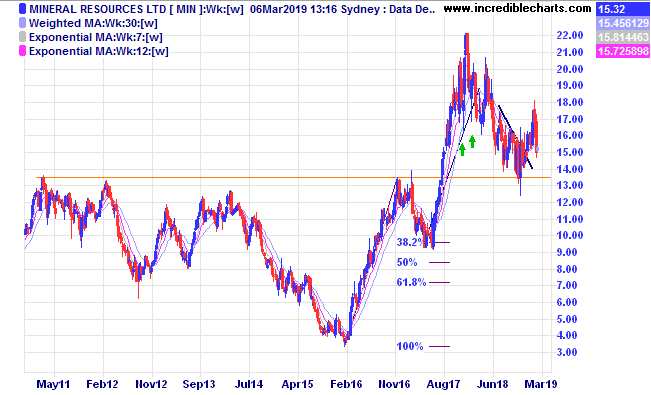

Mineral Resources has an interesting retracement pattern on the monthly chart.

Automotive Holdings has moved up from the lows.

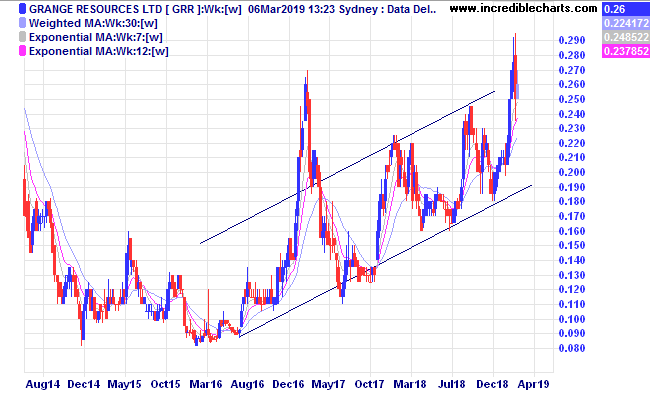

Grange Resources.

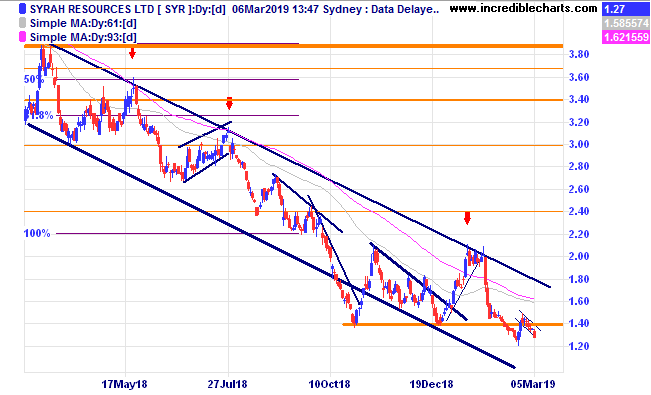

Syrah

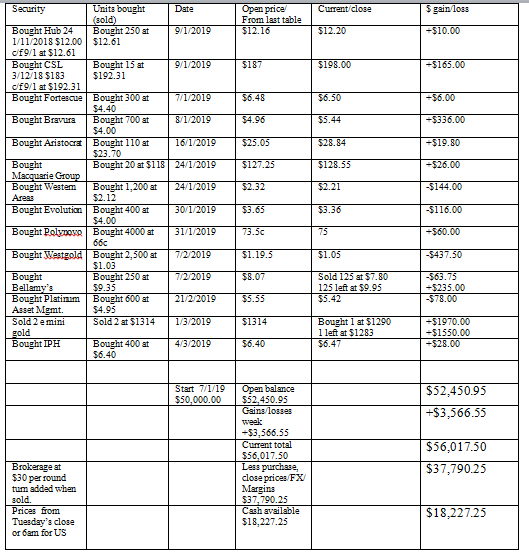

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here