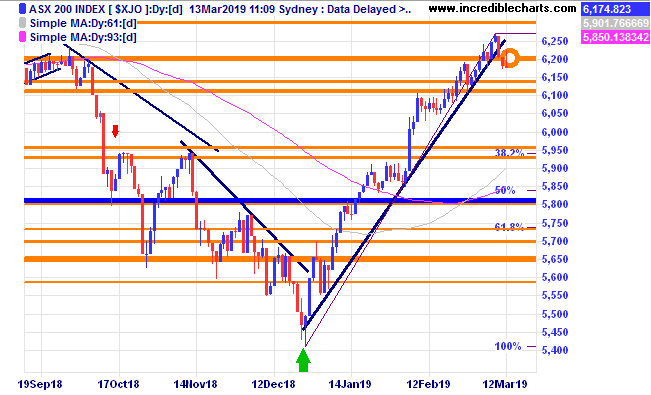

The local market continues to drift lower after a very strong run moving up from 5410 to 6270 a range of 860 points in 50 trading days which comes out at an annualised rate of 100 per cent per annum which is just not sustainable. The break of the uptrend line is shown along with some Fibonacci retracement levels.

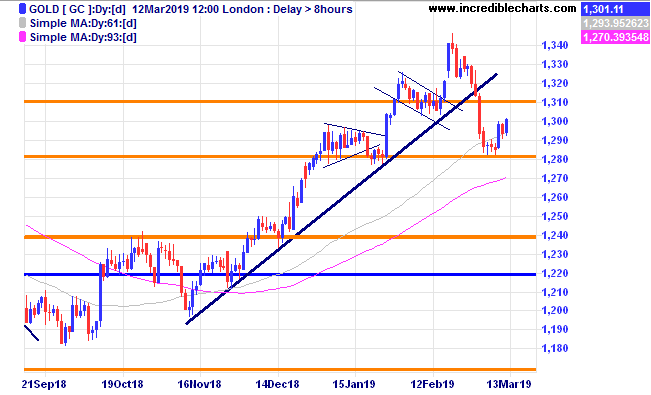

The price of gold bounced off a previous support zone moving higher and we were stopped out of the short position. How far will this rally go and can it break through the stubborn $1370 level of resistance?

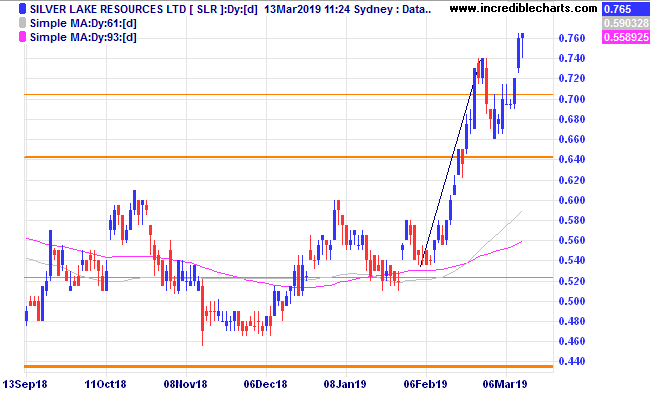

Junior gold miner Silver Lake was added to one of the indices and we bought a parcel. The company is looking to merge with Doray.

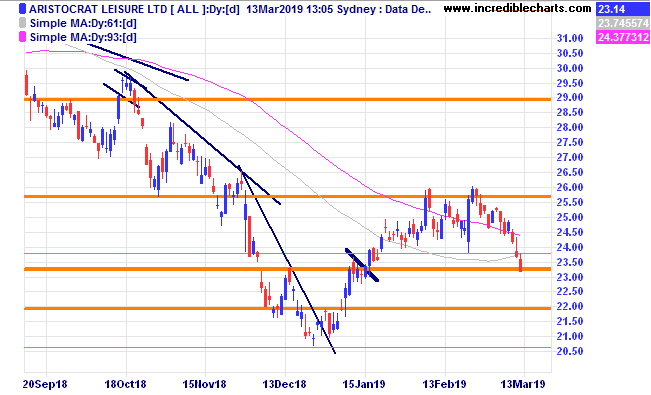

Aristocrat Leisure is looking a bit shaky.

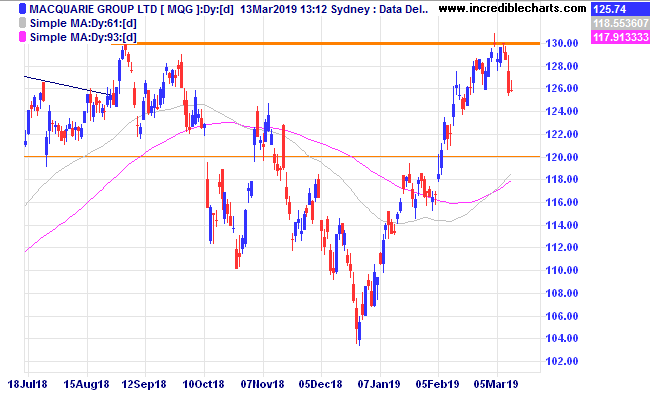

Quite a few stocks seem to be running into resistance close to previous highs including Macquarie Group.

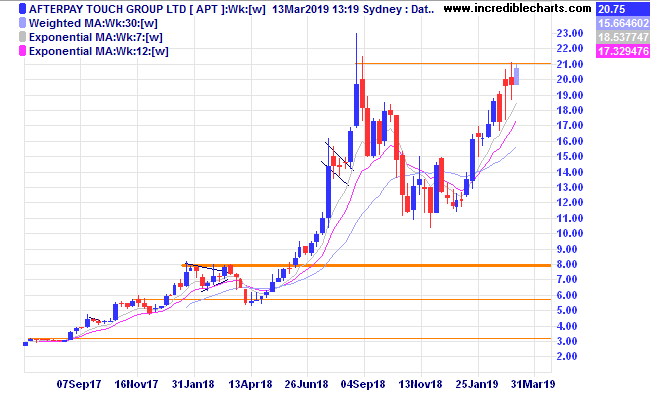

Afterpay

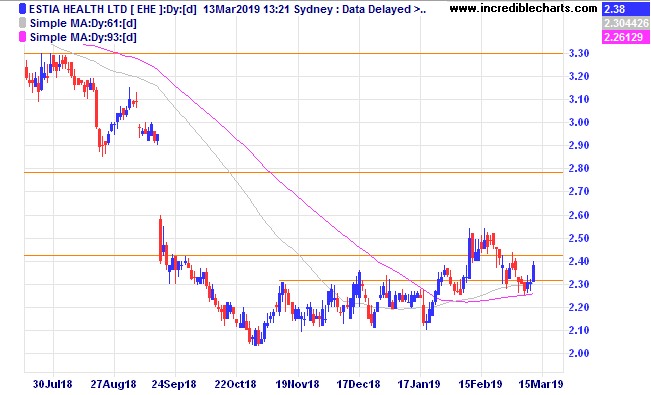

A few aged care stocks have been moving up from the lows including Estia.

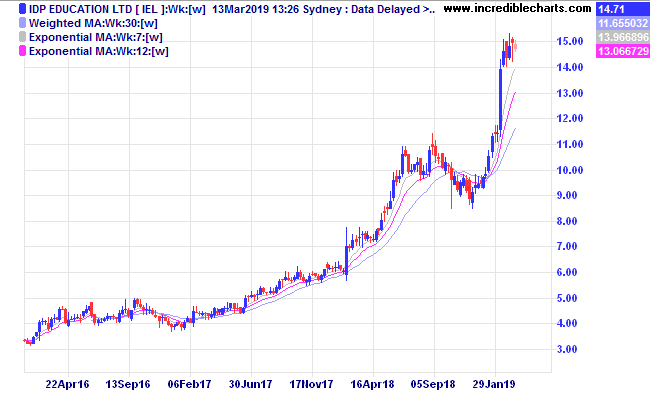

IDP Education is consolidating after a strong run up

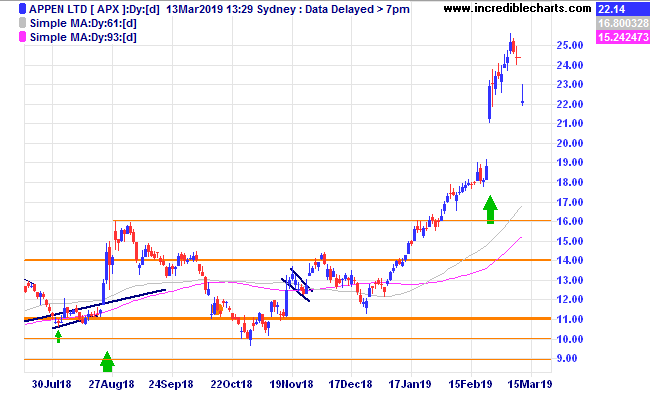

Software mob Appen fell yesterday after announcing a takeover of a rival which is yet to generate profits. This could put a strain on current valuations yet could enhance future growth prospects.

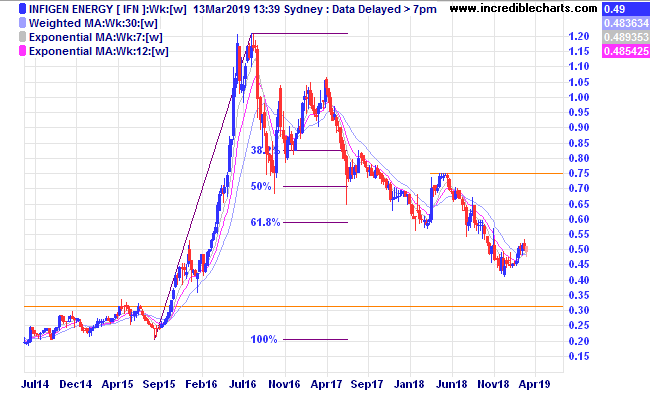

Infigen Energy could benefit from a change in government.

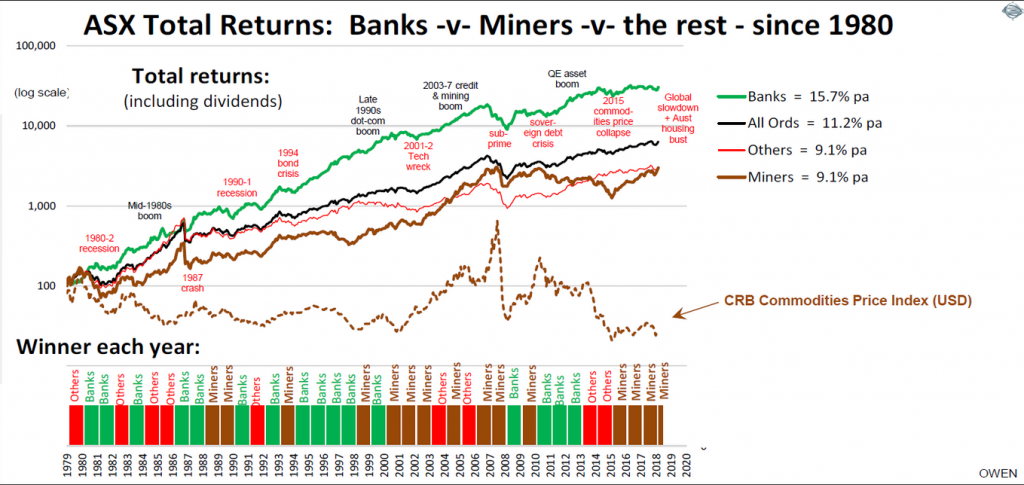

This is an interesting graph from the most recent Cufflinks newsletter showing a comparison of returns from the banking sector, the All Ords index and the mining sector since 1980. High bank dividends compound well over time.

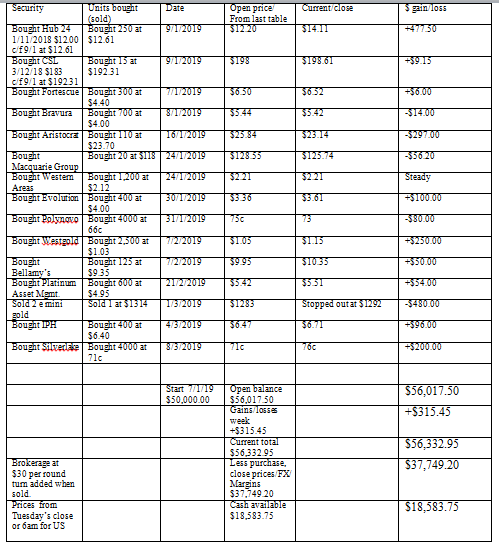

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here