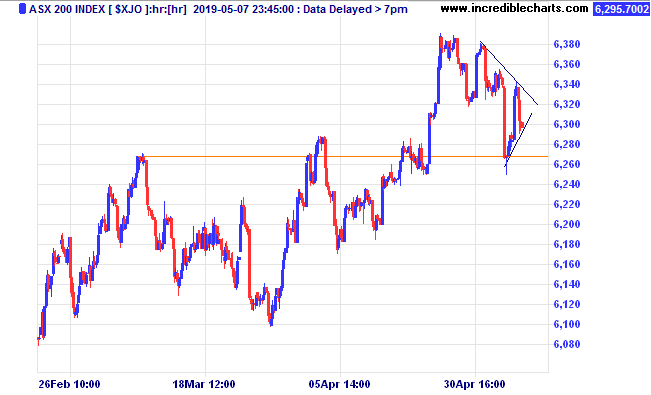

The local market closed well off the highs yesterday as US Futures markets again showed a possible big fall in their markets as increasing uncertainty surrounds trade deals with China. We took a small short position in ASX 200 cfd’s to help hedge any further falls.

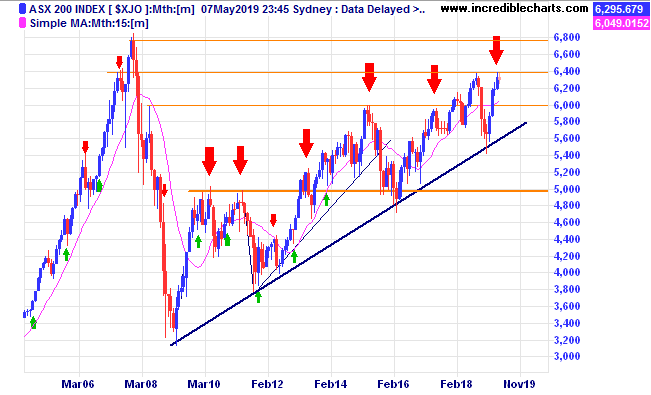

The longer term monthly chart shows more than a few highs around this time of year in the local market.

A chart of the Dow Jones Index showing last nights trade which saw recent lows broken.

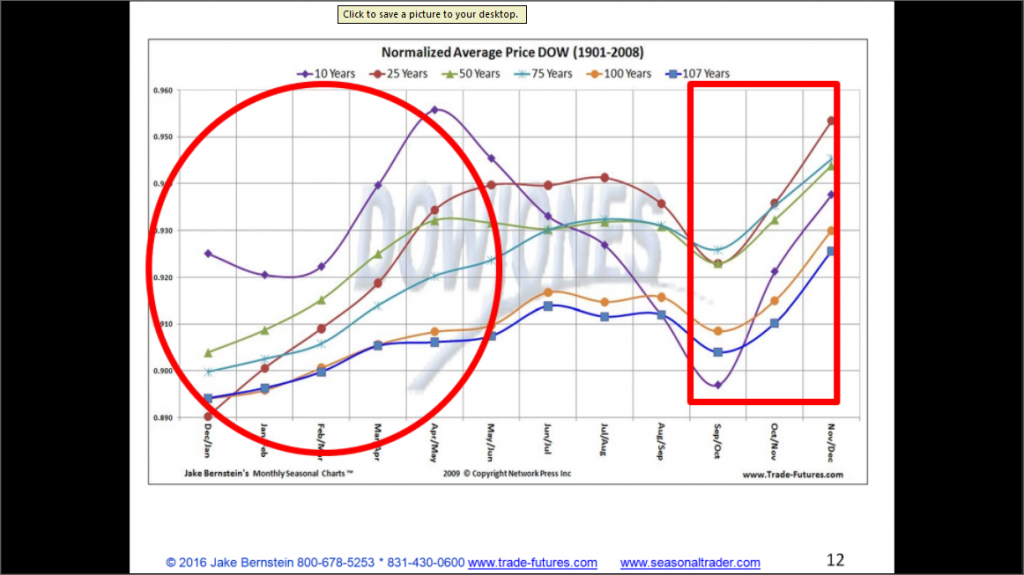

This is an interesting time of year in the US stock market as the following graph shows the middle of the year is generally a period of uncertainty with the last 10 years displaying a downwards trend on average for the Dow 30.

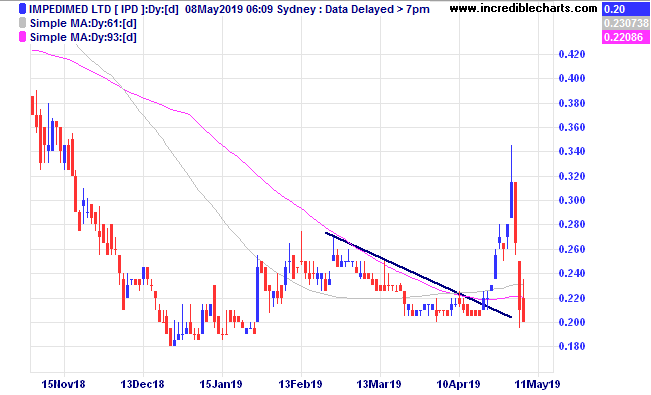

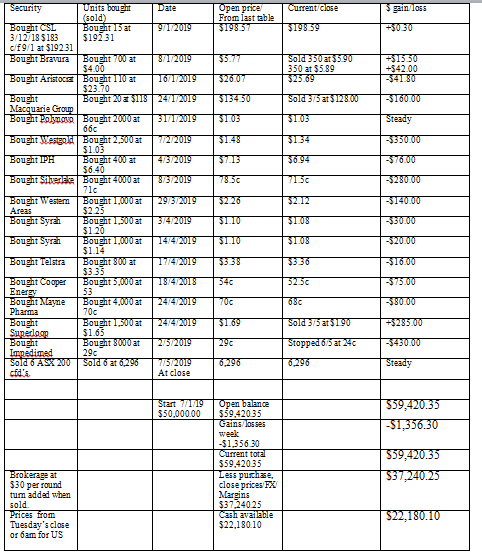

We bought into Impedimed on higher prices and were stopped out 2 days later. You can’t get them right all the time and taking individual losses quickly is one way to keep portfolio losses smaller.

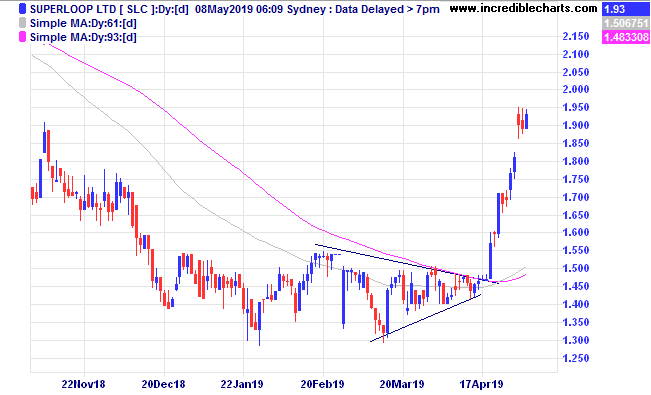

We sold out of Superloop for a quick profit as a potential buyer looks over their books. We also sold half the Bravura stake to lock in some profits.

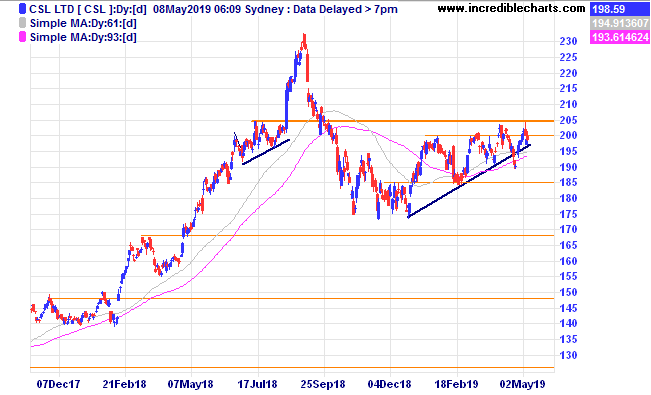

CSL has been struggling to move above resistance.

A few stocks that have had a good run and come off recent highs like Polynovo and could be vulnerable to further declines.

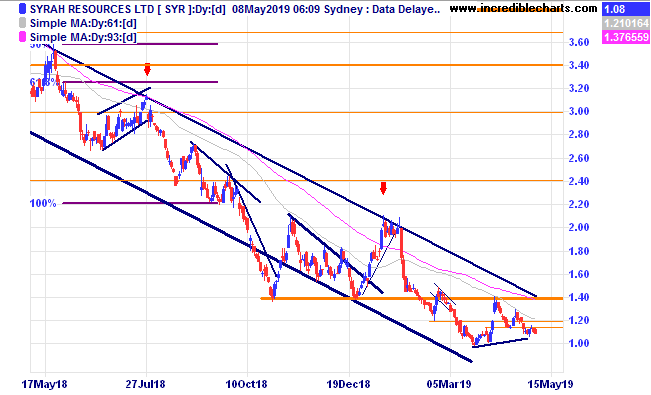

Some of our most recent buys like Syrah and Western Areas have been moving slowly down and getting closer to being stopped out.

EML Payments has moved above recent resistance and is forming a bullish flag type pattern.

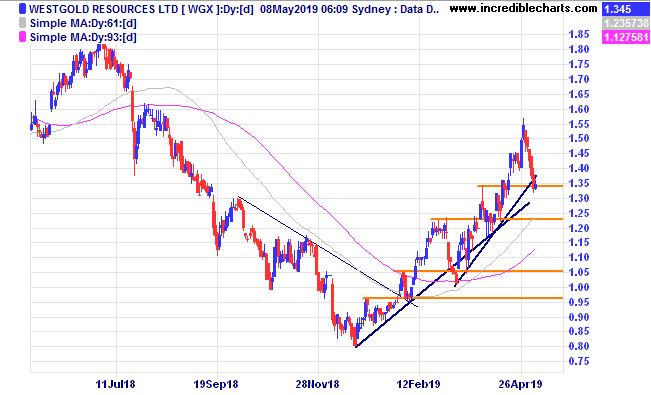

Stocks in the gold sector have also come under pressure including Westgold pictured below and Silverlake.

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here