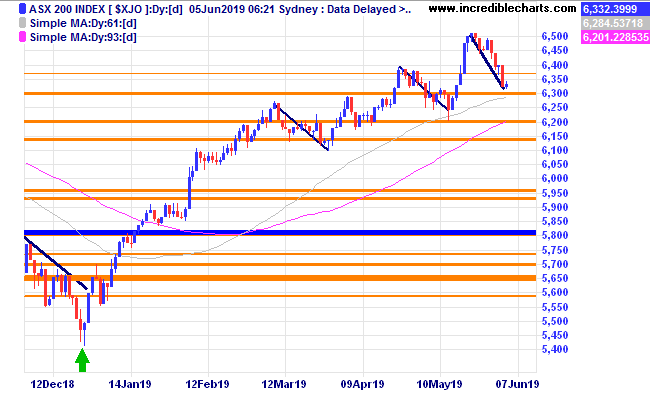

The local market has held up relatively well against a falling US market over the past week. One sign of strength has been a similar range down in points and days from the last high close to previous ranges down. Investors may seek comfort in holding nice yielding dividend stocks instead of settling for lower rates of interest for cash in the bank which could send the market higher.

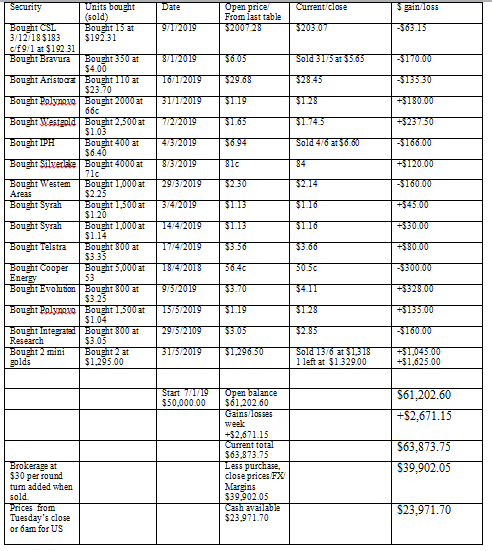

The gold futures price moved quickly above recent resistance. We bought 2 e-mini contracts and quickly sold one to lock in some profit at the next resistance level where the price eventually broke through and moved higher. Some kind of retracement from last night’s high is expected. The big question is will price move up beyond the $1335 to $1342 zone to challenge the February high?

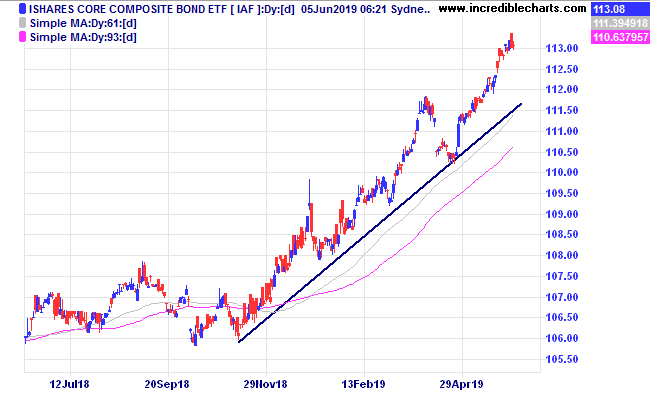

With interest rates heading lower bond funds have been moving up slowly.

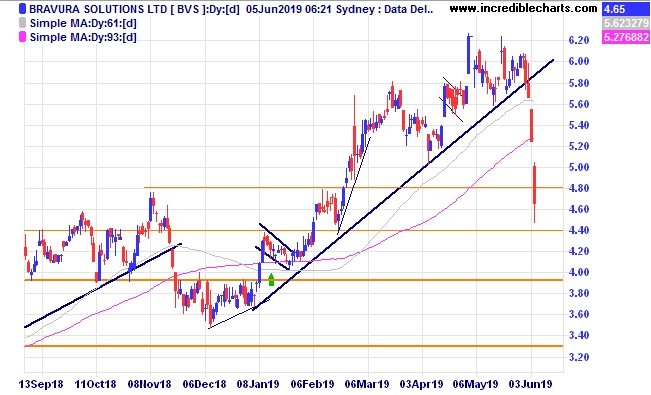

Bravura shares were sold down and we sold our remaining stake.

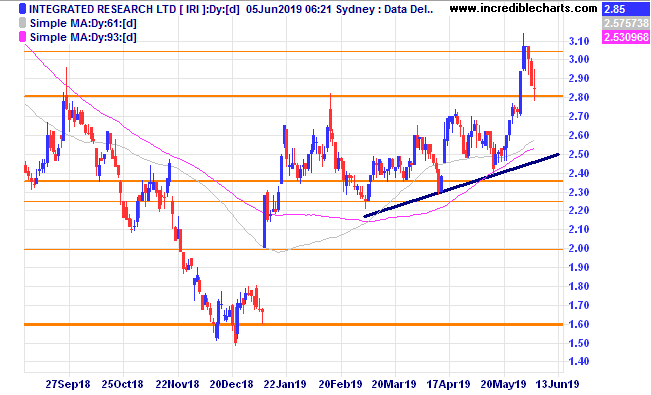

Integrated Research shares fell back close to the support zone after we bought.

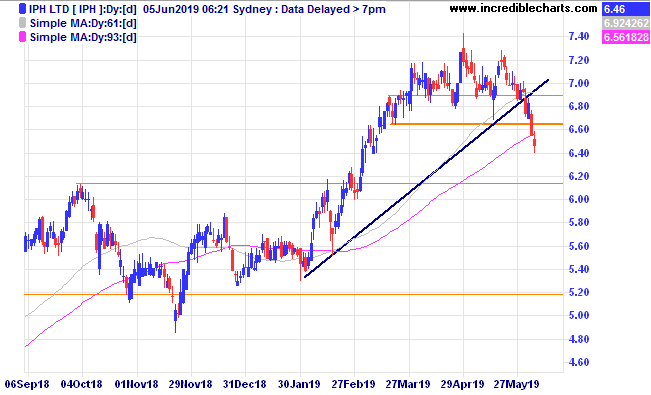

We sold out of IPH after it broke down through support.

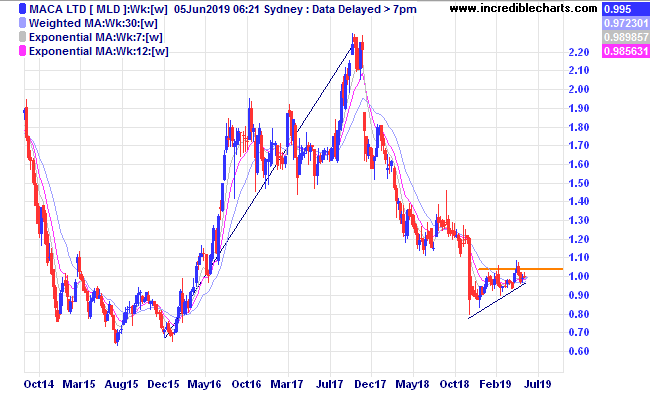

Maca is making a nice looking consolidation pattern.

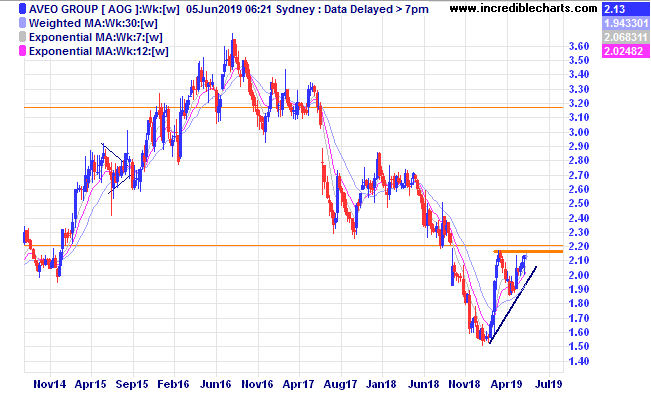

Aveo Group has moved up from the lows to consolidate at a resistance zone while making higher lows.

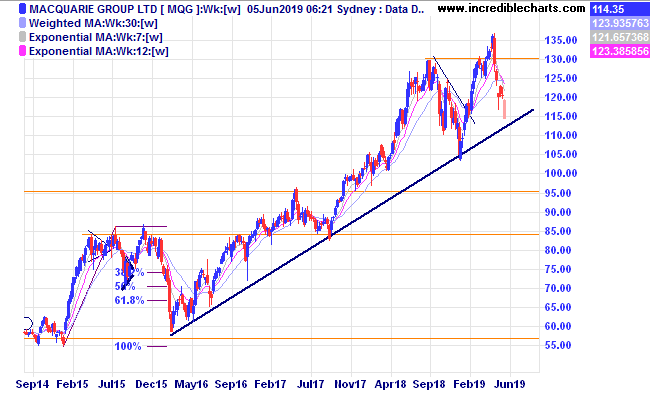

Macquarie Group is close to an uptrend line that has seen prices rebound from previously and we will buy a parcel for the educational portfolio.

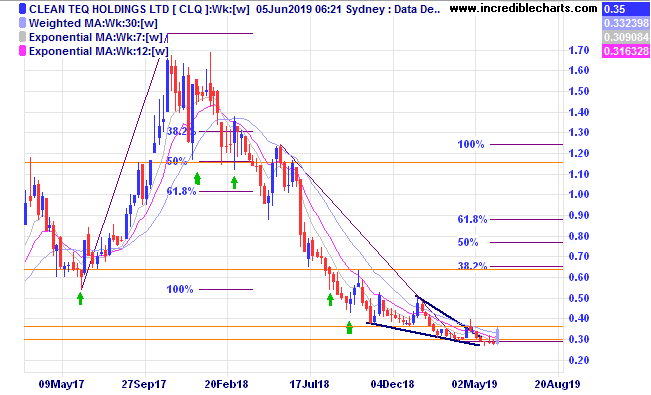

Clean Teq Holdings had a good day yesterday.

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here