The local market continues to rise with the current leg up reaching fresh yearly highs and within striking distance of the all-time high set back in 2007.

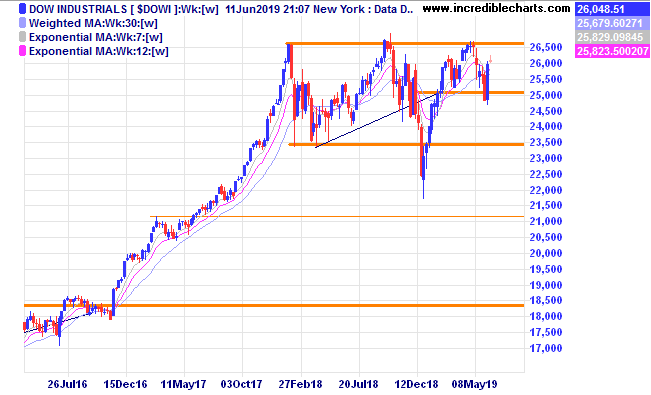

The Dow Jones Index in the US is off the highs and is trading in a large sieways range and may have formed a triple top type pattern.

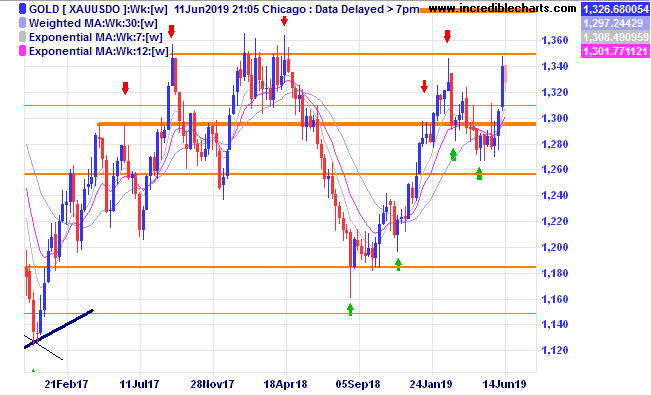

The price of gold has once again met resistance at the $1,350 zone and we sold out of our remaining position and will be watching to see if any tradeable pattern develops from here, perhaps a higher low before finally breaking through.

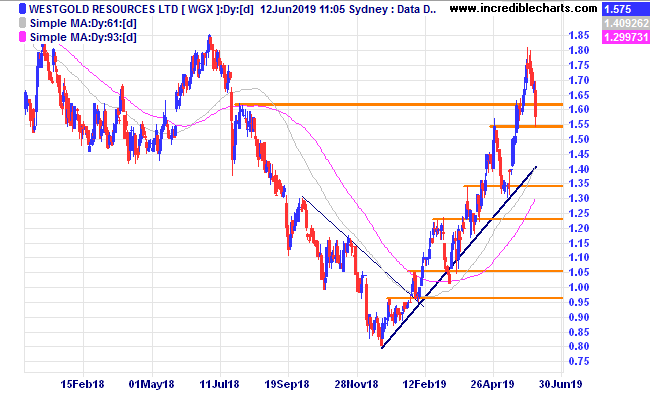

Westgold has fallen from a resistance zone and being the educational portfolio’s largest position reduced the holding and took some nice profit off the table. A bounce off support here could show another leg higher.

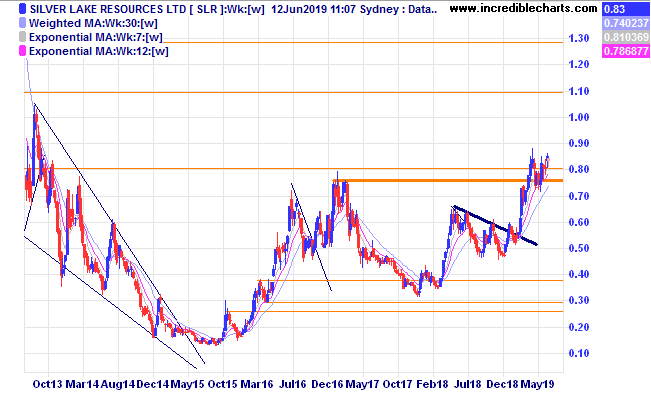

The Silver Lake chart shows an interesting pattern forming with a possible leg higher.

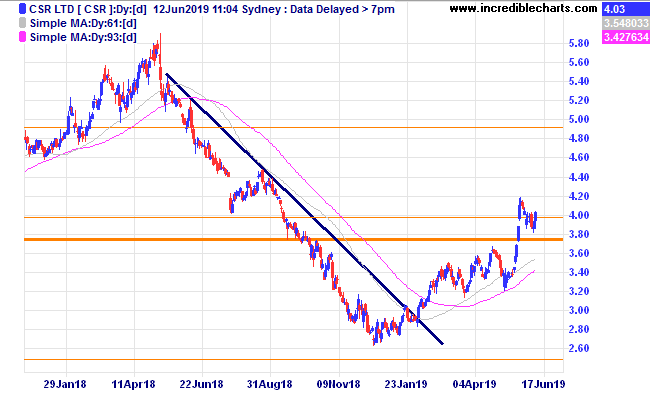

Building products mob CSR has formed a nice ABC type continuation pattern and we will add some to the portfolio today.

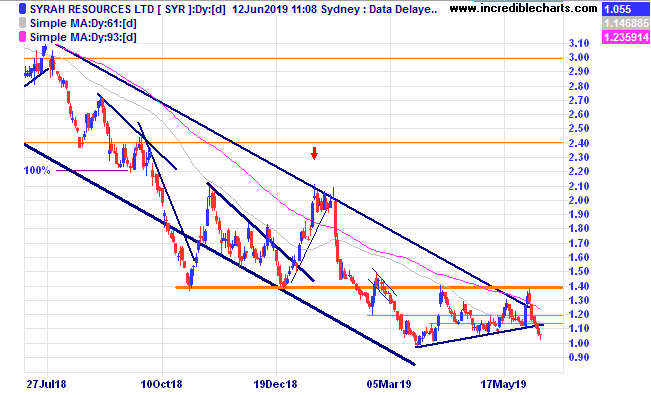

Syrah broke the short term trend line after failing to break up through resistance and we sold out of our smaller holding.

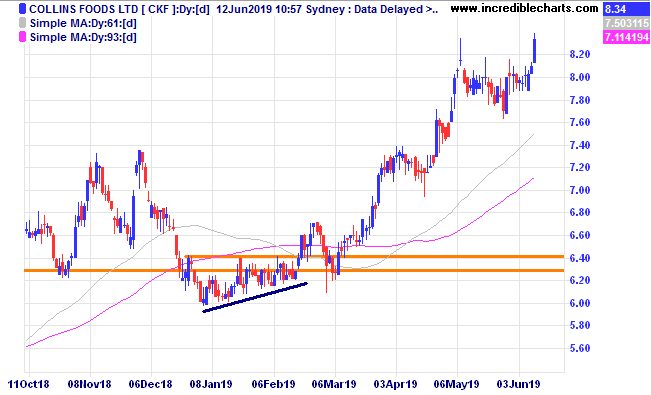

Collins Foods is looking to break higher.

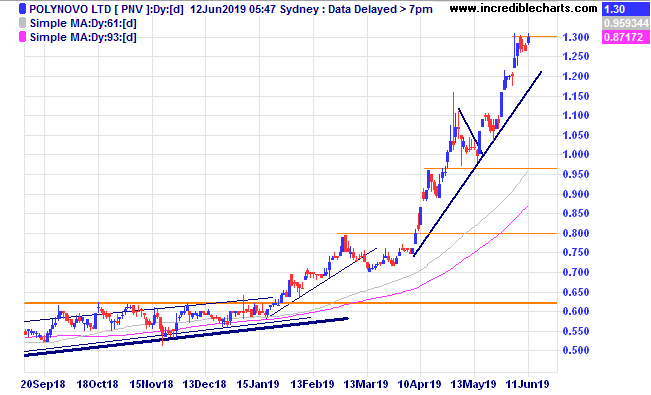

Polynovo could be forming yet another small consolidation pattern which could break either way. A move below the fast rising trend line would be a sell signal for some traders.

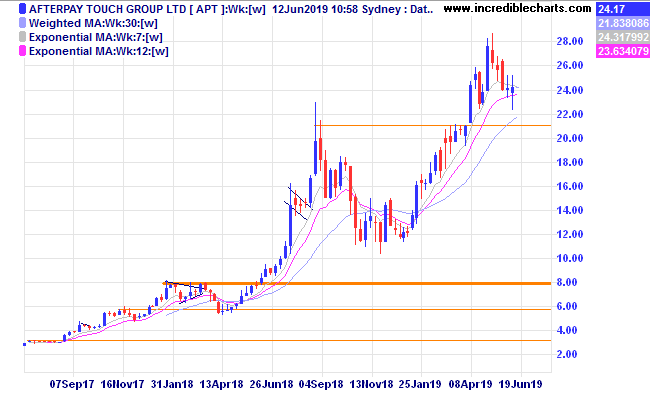

Afterpay looks to be consolidating the recent move up.

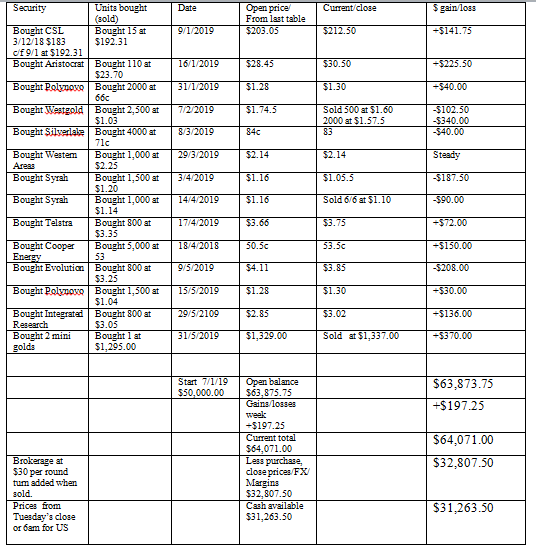

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here