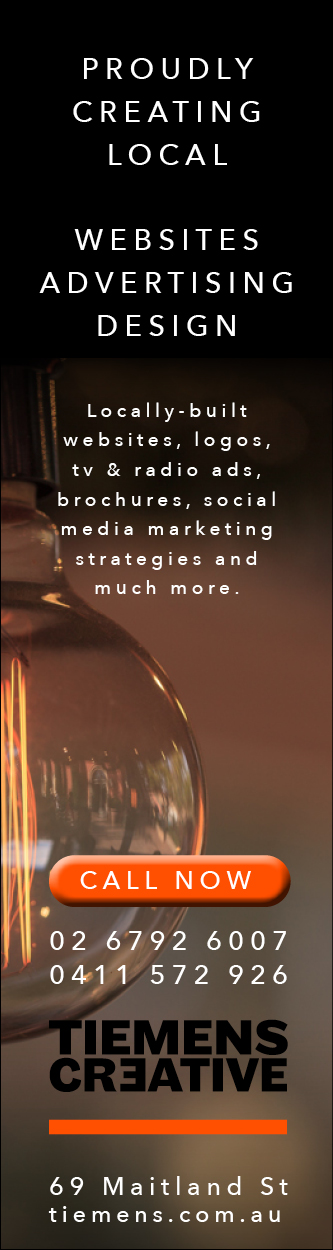

It looks like a case of break through or break down for the broad based S@P 500 Index along with a few individual stocks which are struggling to make decisive new highs. As traders take their positions it is important to follow your trading plan and to have the exit strategy planned ahead of time so there is no “heat of the moment” decisions to make.

The local index looks to be treading water and forming a small consolidation pattern at these levels as the world waits on any US, China trade deal or further ructions coming out of Iran.

Once the price of gold broke through the resistance zone it quickly moved a distance equal to the previous range up ($160) to hit the $1,440 level where for now price has moved down. How far down will this retracement go and will it provide another entry point are the questions on trader’s minds. A textbook reversal to somewhere close to the breakout level could offer some good entry points and is a very uncertain outcome at this point in time.

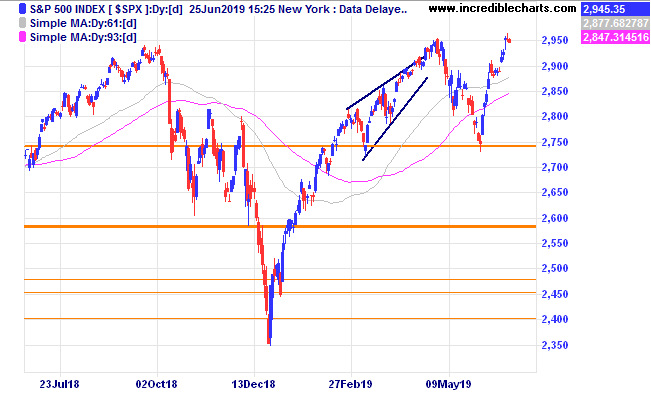

The gold stocks in the educational portfolio have done well and with Silverlake our largest holding we will sell 1,500 shares of our stake today and pocket some profits. Charlie’s guess is that the price of gold and gold stocks will retrace and hopefully provide another entry point. Time will tell.

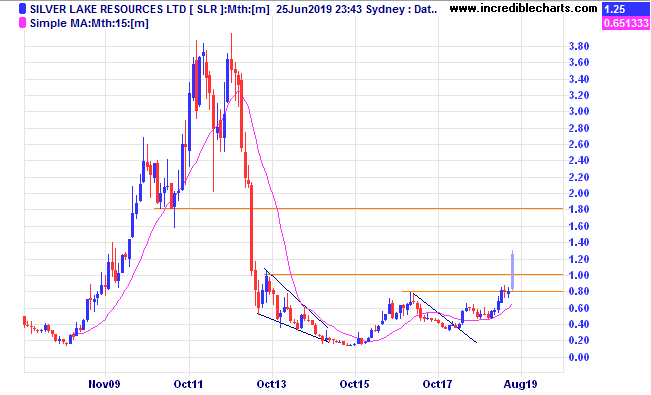

Aristocrat Leisure has been moving towards the previous high water mark and a small weekly reversal type candle last week shows this rally might be running out of steam.

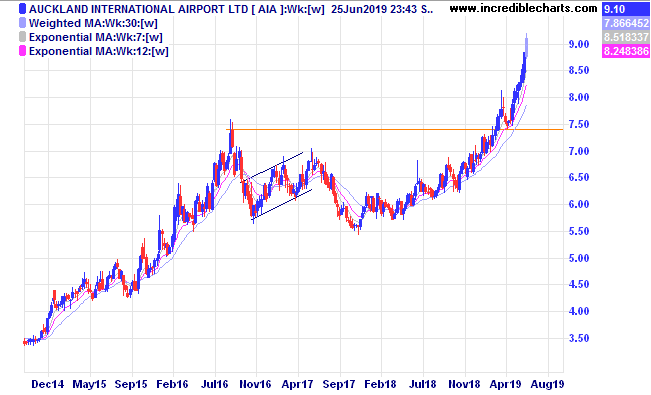

Auckland International Airport has moved up nicely after breaking resistance.

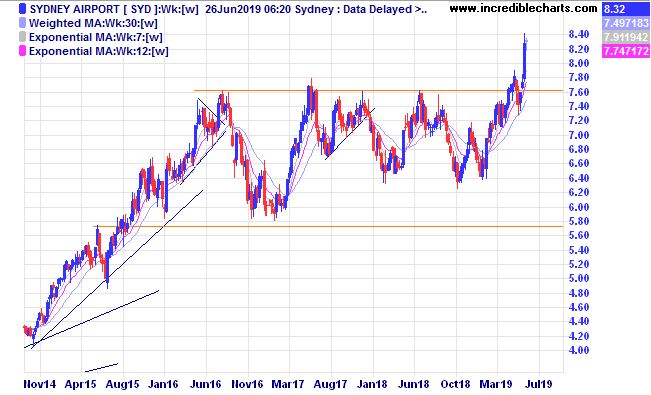

Sydney Airport has recently made a fresh high after trading sideways for some time.

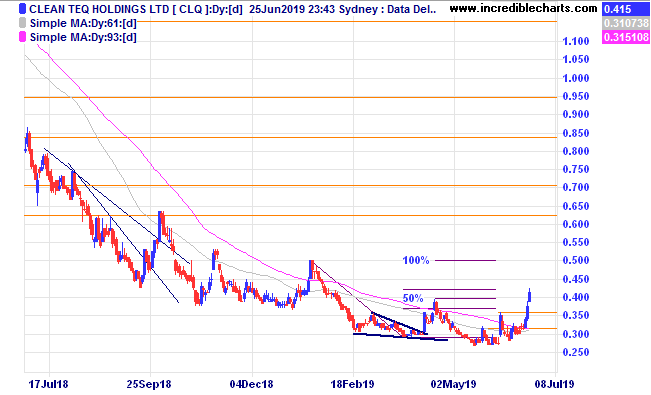

Clean Teq has found some strength over the past week.

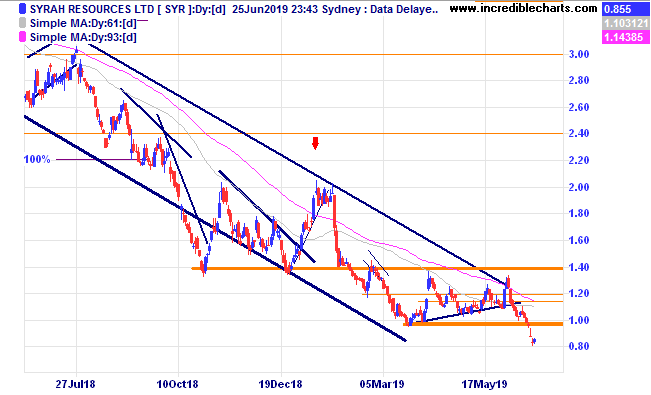

Syrah has fallen to new lows just as punters have discovered that Australian Super has taken up a large holding.

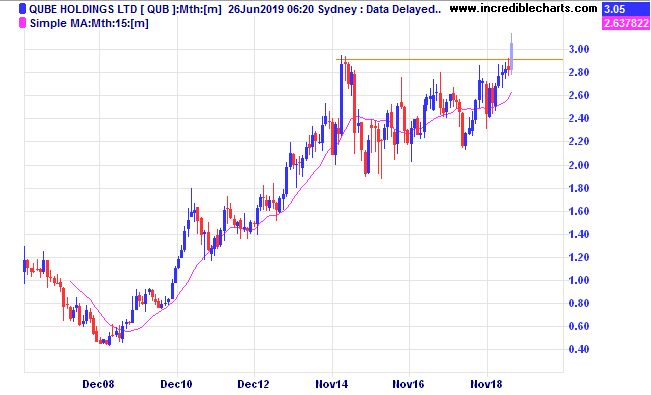

Qube Holdings looks to have moved up out of the recent sideways range and we will add some to the educational portfolio.

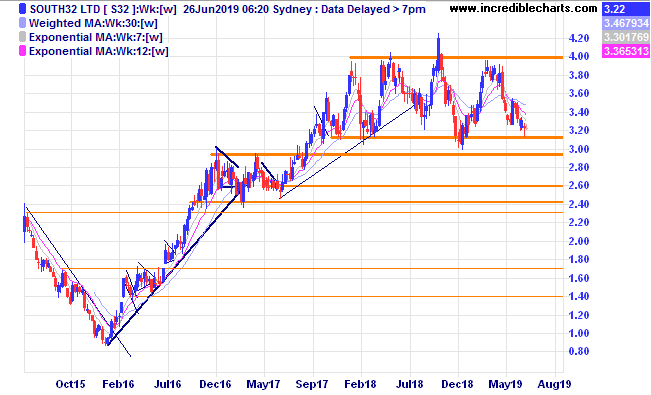

South32 is at the bottom end of the current trading range.

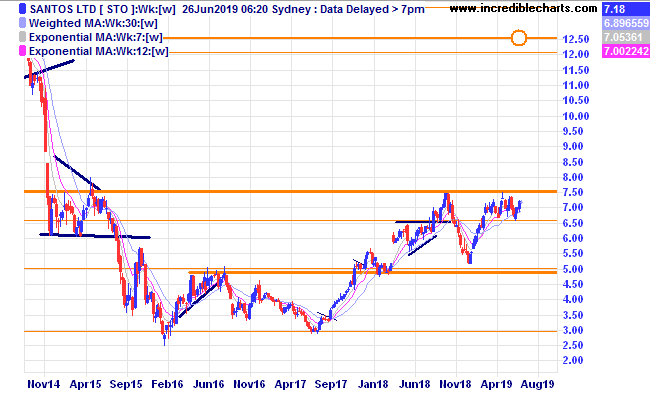

Santos has been range trading for some time.

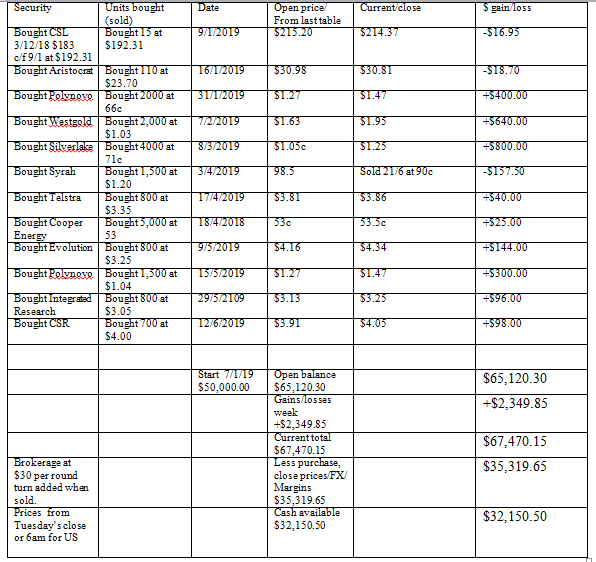

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here