The US market finally moved above a stubborn resistance zone last night and could be headed for another leg higher. We bought a position in the S@P 500 e-mini contract and will include it in next week’s table. With luck the Australian dollar will remain at low levels and not move higher and impinge on any profits from the trade.

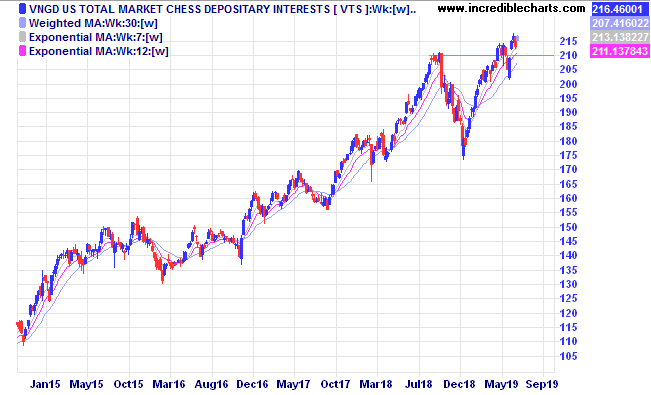

An easier and less volatile way to invest in the US market is through the locally listed Vanguard US Total Market ETF.

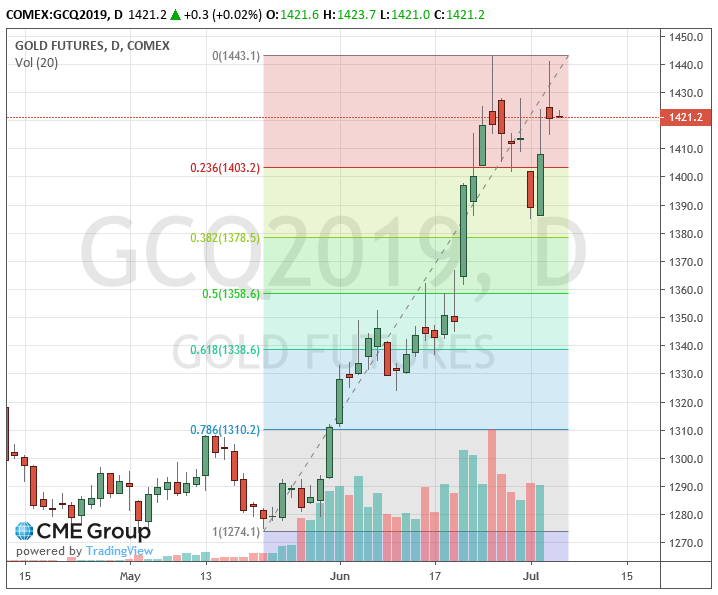

The gold futures price chart has two exhaustion type candles which could be a worrying sign that there will be more of a correction in price. Perhaps there will be a nice move down to the 50 per cent retracement level which could give some interesting trade possibilities.

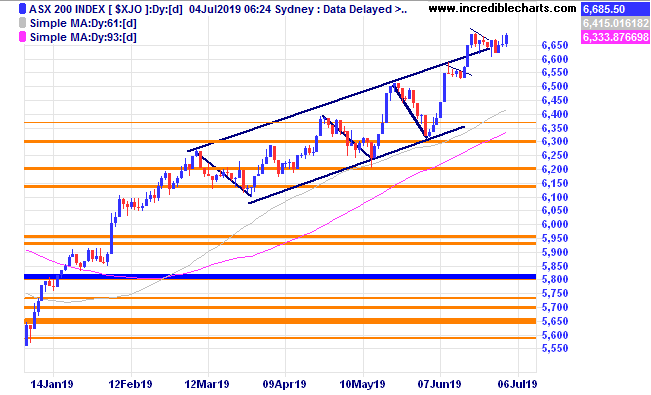

The local market has been creeping up.

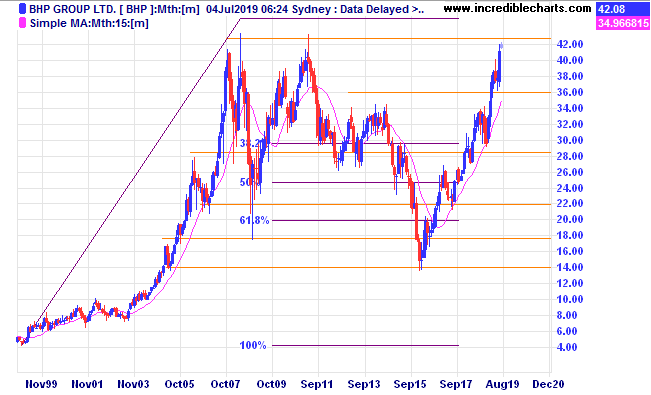

BHP is heading towards all-time highs on the back of a very strong iron ore price.

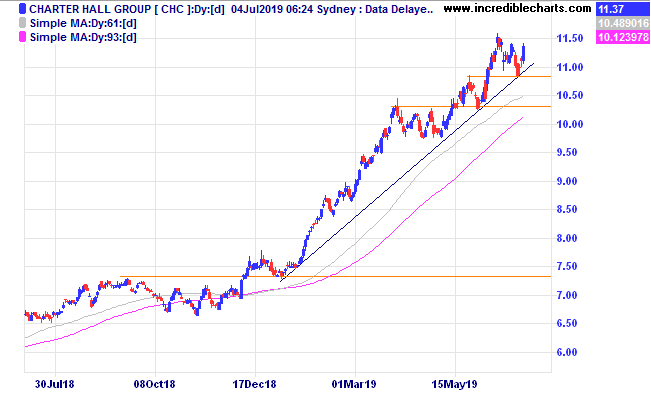

Charter Hall Group continues to trend nicely and we will add some to the educational portfolio.

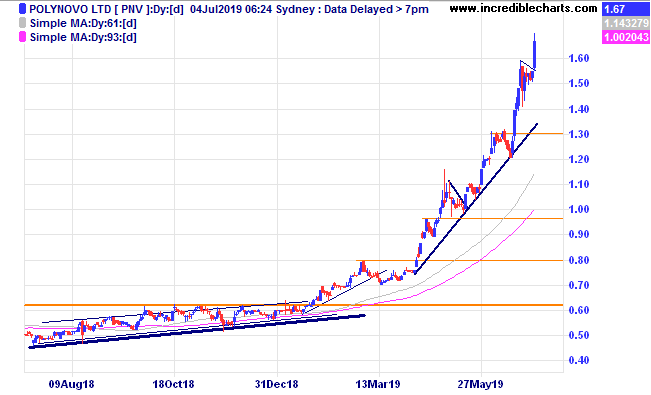

Polynovo continues to surprise to the upside.

Gold miner Perseus looks to have found some support at the recent breakout.

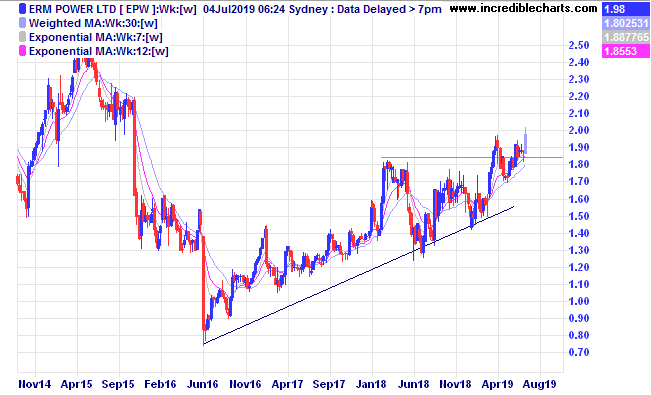

ERM is yet to move much above the recent breakout.

Speedcast fell heavily and shows that sudden adverse moves can happen. A diversified portfolio lessens the impact of any big fall in a single stock.

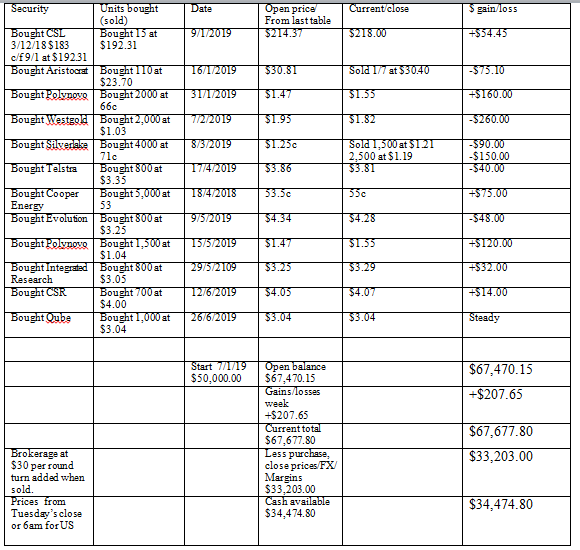

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here