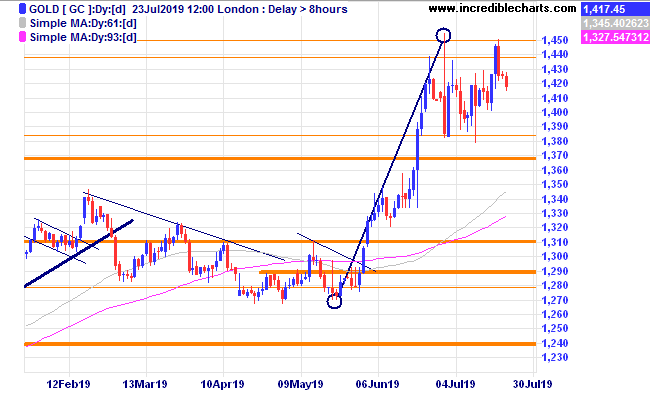

The price of gold spiked on a big range day on July 1st and has since been trading within that large range day. The price of gold has moved up 14 per cent in 28 days and a nice 25 per cent since the August 2018 lows and put a rocket under the local gold stocks.

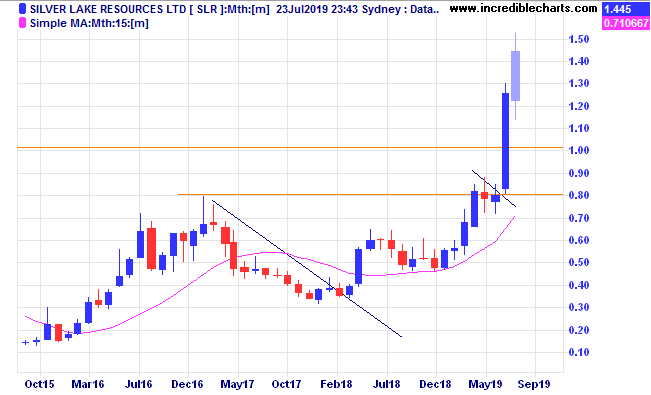

Silverlake is up 96 per cent in 2 months and could soon retrace some of those gains. We have already booked some early profits and will sell a few more shares today and look for a possible re-entry trade down the track. Charlie remains bullish on the gold price for now and with gold prices reactionary to global events will look to add further gold shares to the educational portfolio when conditions and viable trading plans permit.

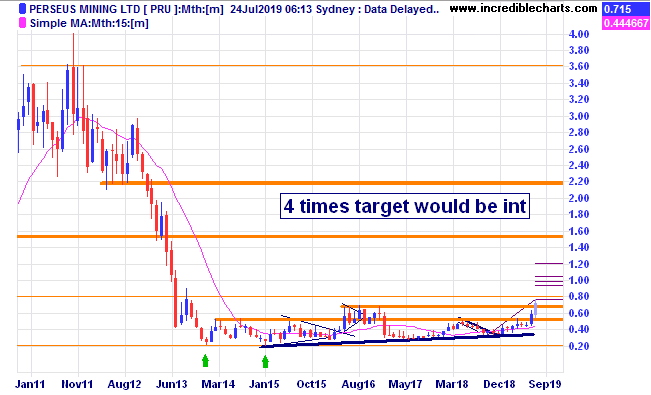

Perseus and Resolute have interesting production profiles and both could offer interesting trade possibilities in the near future. Perseus has been in a 5 year basing pattern only recently breaking upwards on the monthly chart.

The local market has been trading in a tight range inside the bar of the week ending July 5th and today broke through the top of that pattern giving some joy to bullish traders. We took a small Cfd trade and have our stop in place.

EML Payments has had a nice run up and looks to be forming a continuation type pattern and we bought a parcel when price bounced up from the old high which looks to be providing some support at these levels.

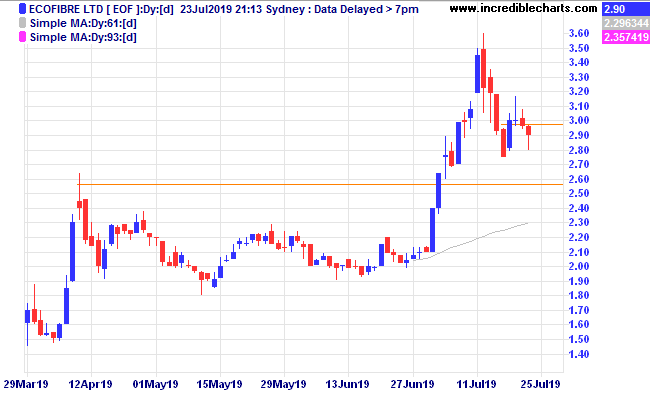

Ecofibre was also bought on an uptick in price.

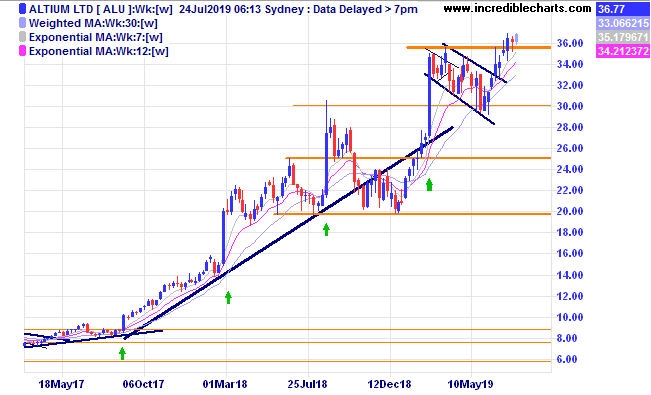

With the August reporting season just around the corner some traders punt on certain stocks to jump after the earnings announcement. Altium has a history of good gains after delivering good news and a small break to new highs is a bullish sign should prices continue to move up. We will take a speccy trade on this one today.

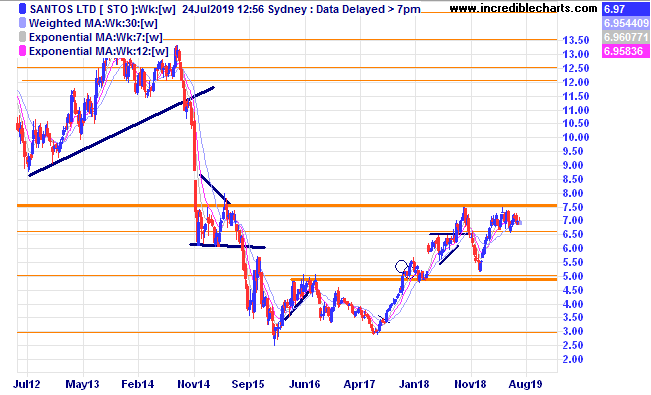

Santos is still trading in a small sideways range and when it breaks out could go for a decent run.

GUD looks to be forming a base type pattern after a decent downwards move and BWX has a similar pattern.

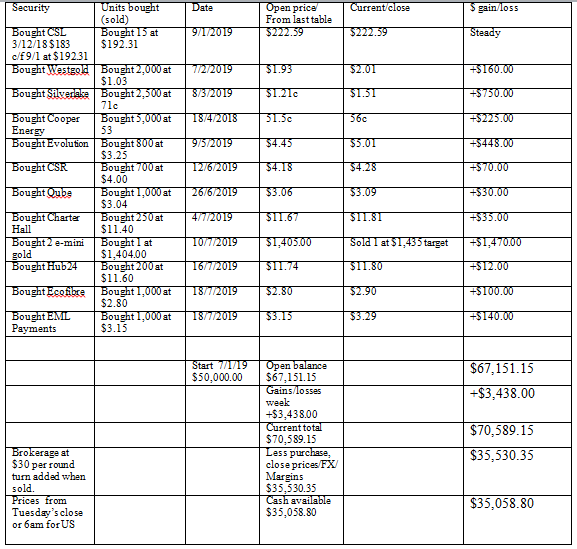

Table

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here