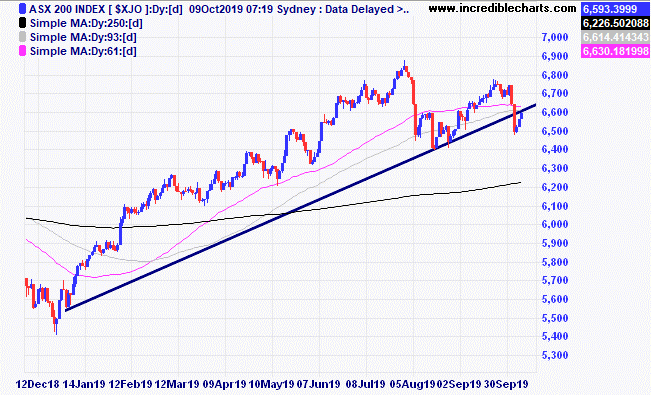

The local market has been grinding higher over the past three days and is yet to recover the ground lost last Thursday when it fell more than 2 per cent. A fall in overnight markets has continued to put the pressure on the developing downside move.

The S@P 500 index in the US is stuck in a volatile consolidation pattern as conflicting manufacturing and employment data takes a toll on analysts’ predictions.

Will the recent spike down in the gold price be the low for this correction?

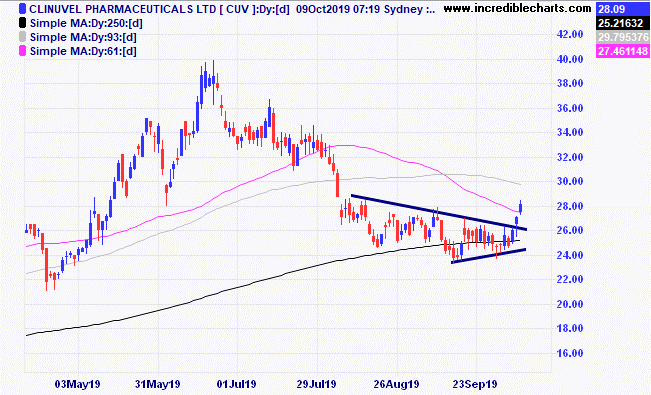

Clinuvel has moved up above the down trend line recently and those that bought in the last 2 days have done very well with an announcement today sending the stock 30 per cent higher in early trade.

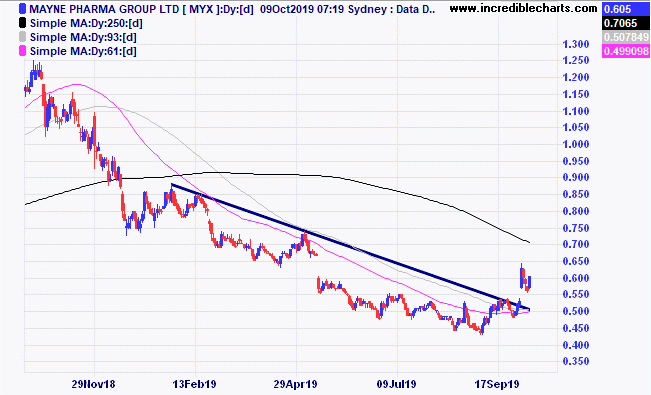

Mayne Pharma announced a new deal recently which has moved the share price higher and above the current down trend line.

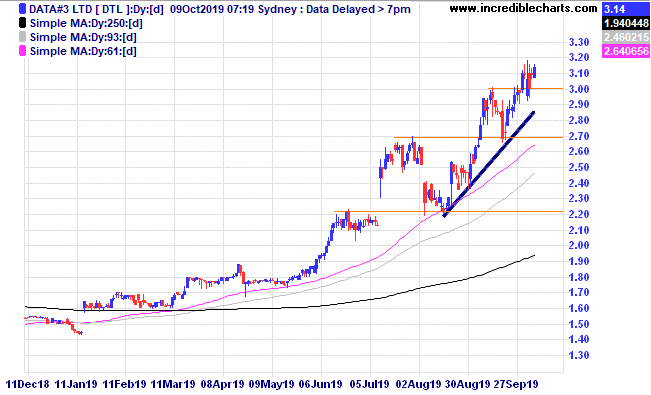

Data #3 is showing a nice trend up.

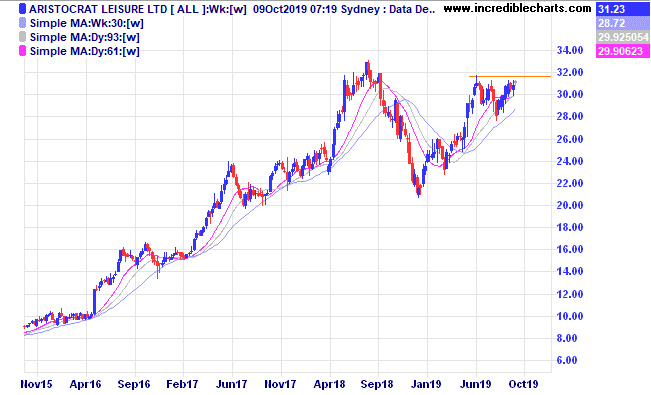

Aristocrat Leisure could be building up for another move higher if price can overcome stubborn resistance around this year’s high.

This is a graph of the dwindling margins of the major banks over the past 20 years showing the golden age of fat margins is over.

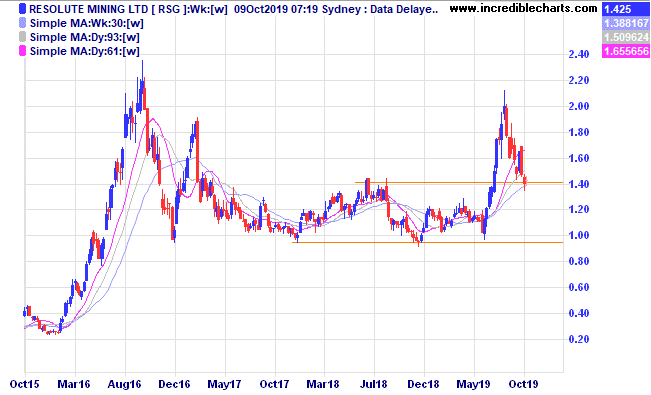

Some analysts continue to have a strong buy conviction for Resolute Gold. Could this be a spike down and the end of the current down trend? We bought a parcel for the educational portfolio at the open.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought CSL 3/12/18 $183 c/f 9/1 at $192.31 | Bought 15 at $192.31 | 9/1/2019 | $238.39 | $240.50 | +$31.80 |

Bought Westgold

| Bought 1,500 at $1.03 | 7/2/2019 | $2.32 | $2.40 | +$120.00 |

Bought Cooper Energy | Bought 5,000 at 53 | 18/4/2018 | 57.5c | 55.5c | -$100.00 |

Bought Evolution

| Bought 600 at $3.25 | 9/5/2019 | $4.54 | $4.66 | +$72.00

|

Bought Qube

| Bought 1,000 at $3.04 | 26/6/2019 | $3.24 | $3.26 | +$20.00 |

Bought Ecofibre

| Bought 1,000 at $2.80 | 18/7/2019 | $3.04 | $3.21 | +$170.00 |

Bought Western Areas | Bought 800 at $2.26 | 8/8/2019 | $3.17 | $3.11

| -$48.00 |

Bought IPH

| Bought 400 at $8.55 | 19/8/2019 | $8.86 | $8.36 | -$200.00 |

Bought Capitol Health | Bought 10,000 at 24c | 28/8/2019 | 23.5c | 23 c | -$50.00 |

Bought NextDC

| Bought 400 at $6.55 | 28/8/2019 | $6.28 | $6.32 | +$16.00 |

Bought Reliance Worldwide | Bought 800 at $3.70 | 28/8/2019 | $4.11 | $3.92 | -$153.00 |

Bought Eclipse

| Bought 1,500 at $1.55 | 4/9/2019 | $1.74 | $1.67 | -$105.00 |

Bought Lifestyle Communities | Bought 300 at $7.20 | 4/9/2019 | $7.66 | $7.75 | +$27.00 |

Bought Whitehaven Coal | Bought 800 at $3.50 | 11/9/2019 | $3.15 | $3.18 | +$24.00 |

Bought Santos

| Bought 350 at $7.80 | 16/9/2019 | $7.68 | $7.50 | -$63.00 |

Bought Kogan

| Bought 500 at $6.25 | 25/9/2019 | $6.27 | $6.68 | +$205.00 |

Bought Money3

| Bought 1,200 at $2.25 | 25/9/2019 | $2.27 | $2.25 | +$24.00 |

|

| Start 7/1/19 $50,000.00 | Open balance $71,516.30 |

| $71,516.30 |

|

|

| Gains/losses week -$9.20 |

| -$9.20 |

|

|

| Current total $71,507.10 |

| $71,507.10 |

Brokerage at $30 per round turn added when sold. |

|

| Less purchase, close prices/FX/ Margins $49,762.50 |

| $49,762.50 |

Prices from Tuesday’s close or 6amfor US |

|

| Cash available $21,744.60 |

| $21,744.60

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here