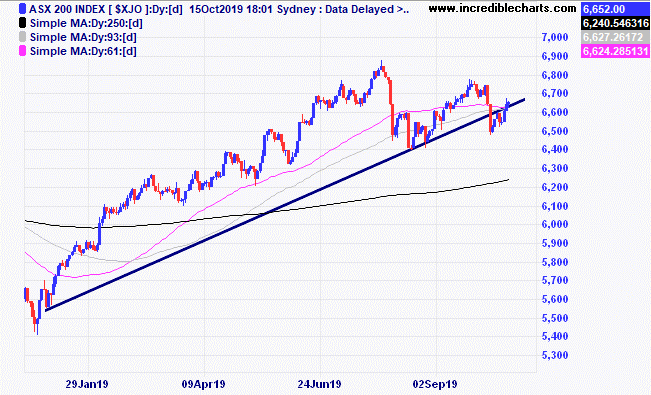

The local market is still trading in a mostly sideways range after putting in a higher low. A rising US stock market overnight has pushed the local index higher today despite a downbeat International Monetary Fund forecast for lower growth in the Australian economy. Profit warnings by media and furniture stocks yesterday tell some of the story.

Most world markets look to be stuck in large sideways patterns including the price of gold which has made a series of lower highs and one lower low.

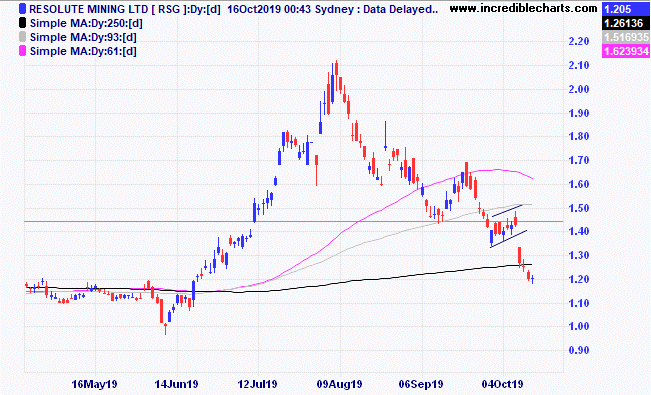

The price of Resolute Mining quickly moved below our tight stop loss point after we bought and we sold the next day as news surfaced of some production equipment problems sent the share price south.

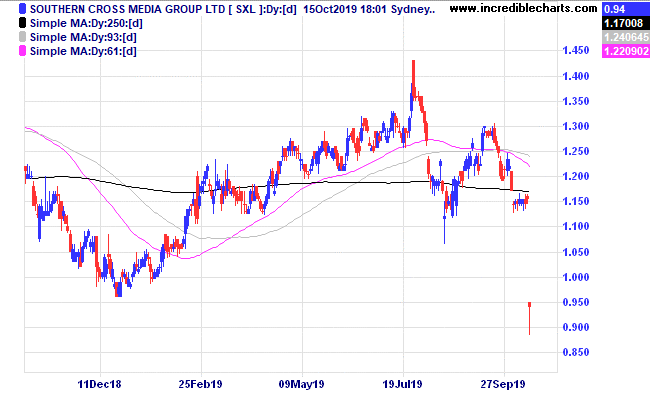

Southern Cross media shares fell after a fall in media revenue.

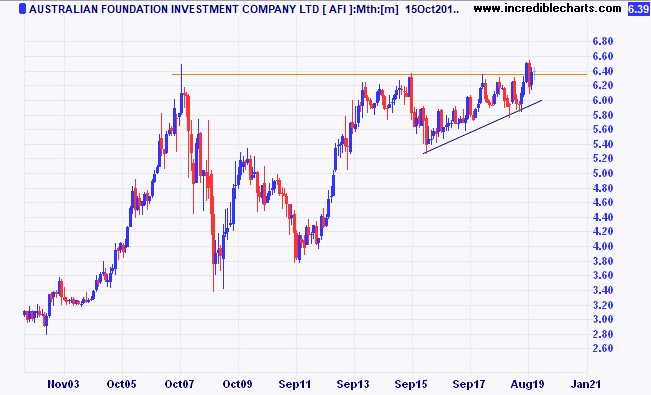

Australian Foundation Investment Company has pruned the number of stocks they hold and they still hold around 20 per cent of their massive portfolio in bank stocks despite the recent portfolio reshuffle.

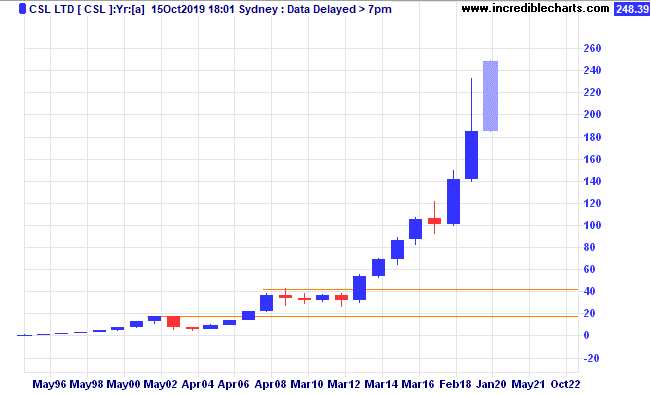

CSL was one stock accumulated in AFIC’s reshuffle. The yearly chart below shows the massive gains since the company listed 25 years ago.

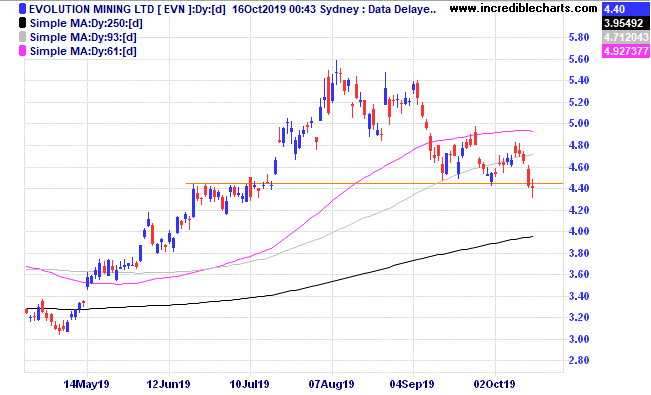

A few stocks in the educational portfolio are close to being stopped out including Evolution which we sold today after moving below the support line with chatter the continuing drought could impact production.

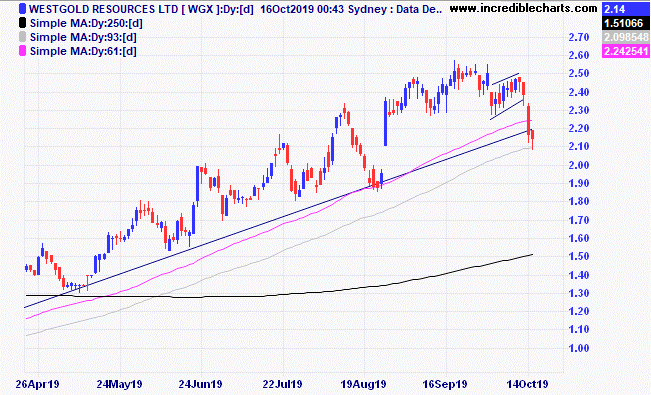

We sold one third of the Westgold stake as prices move below the uptrend line.

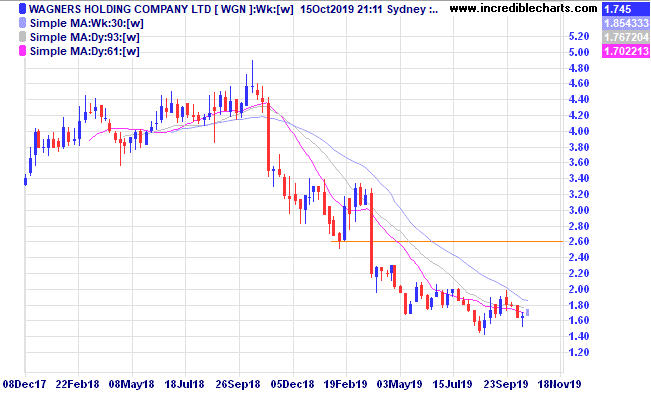

Wagners looks to have put in a higher low and we bought a parcel today.

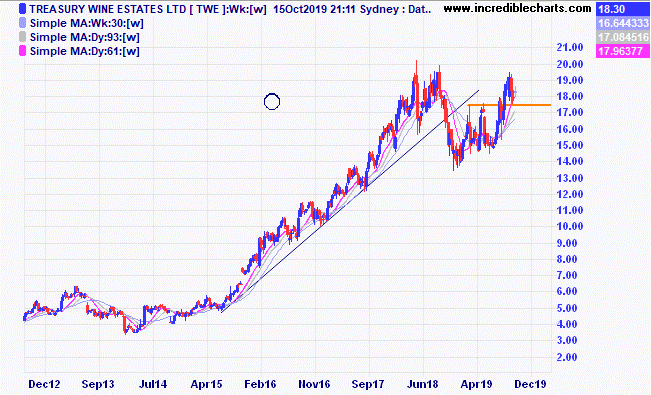

Treasury Wine Estates looks to be holding onto recent gains.

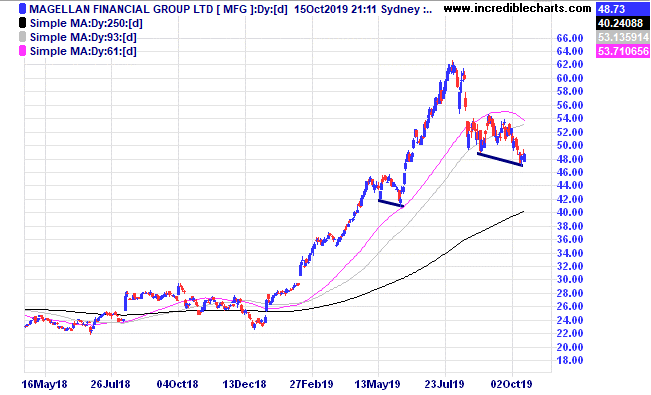

Magellan looks to be making a bottoming type pattern.

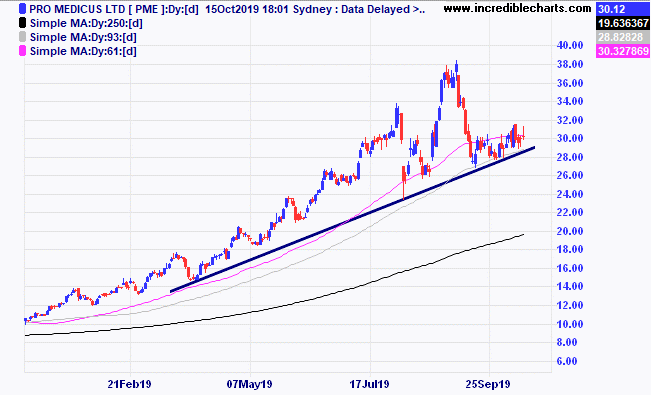

Pro Medicus is moving slowly along the trend line after falling rapidly from this year’s highs.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Bought CSL 3/12/18 $183 c/f 9/1 at $192.31 | Bought 15 at $192.31 | 9/1/2019 | $240.50 | $248.39 | +$118.35 |

Bought Westgold

| Bought 1,500 at $1.03 | 7/2/2019 | $2.40 | $2.14 | -$390.00 |

Bought Cooper Energy | Bought 5,000 at 53 | 18/4/2018 | 55.5c | 57.5c | +$100.00 |

Bought Evolution

| Bought 600 at $3.25 | 9/5/2019 | $4.66 | $4.40 | -$156.00

|

Bought Qube

| Bought 1,000 at $3.04 | 26/6/2019 | $3.26 | $3.35 | +$90.00 |

Bought Ecofibre

| Bought 1,000 at $2.80 | 18/7/2019 | $3.21 | $3.35 | +$140.00 |

Bought Western Areas | Bought 800 at $2.26 | 8/8/2019 | $3.11 | $3.07

| -$32.00 |

Bought IPH

| Bought 400 at $8.55 | 19/8/2019 | $8.36 | $8.17 | -$76.00 |

Bought Capitol Health | Bought 10,000 at 24c | 28/8/2019 | 23c | 23 c | Steady |

Bought NextDC

| Bought 400 at $6.55 | 28/8/2019 | $6.32 | $6.41 | +$36.00 |

Bought Reliance Worldwide | Bought 800 at $3.70 | 28/8/2019 | $3.92 | $4.09 | +$136.00 |

Bought Eclipse

| Bought 1,500 at $1.55 | 4/9/2019 | $1.67 | $1.55 | -$180.00 |

Bought Lifestyle Communities | Bought 300 at $7.20 | 4/9/2019 | $7.75 | $7.59 | +$27.00 |

Bought Whitehaven Coal | Bought 800 at $3.50 | 11/9/2019 | $3.18 | $3.18 | Steady |

Bought Santos

| Bought 350 at $7.80 | 16/9/2019 | $7.50 | $7.69 | +$66.50 |

Bought Kogan

| Bought 500 at $6.25 | 25/9/2019 | $6.68 | $6.04 | -$320.00 |

Bought Money3

| Bought 1,200 at $2.25 | 25/9/2019 | $2.25 | $2.18 | -$84.00 |

Bought Resolution | Bought 2,000 at $1.46 | 9/10/2019 | $1.46 | Stopped out 10/10 at $1.25 | -$450.00 |

|

|

|

|

|

|

|

| Start 7/1/19 $50,000.00 | Open balance $71,507.10 |

| $71,507.10 |

|

|

| Gains/losses week -$974.15 |

| -$974.15 |

|

|

| Current total $70,532.95 |

| $70,532.95 |

Brokerage at $30 per round turn added when sold. |

|

| Less purchase, close prices/FX/ Margins $49,275.85 |

| $49,275.85 |

Prices from Tuesday’s close or 6am for US |

|

| Cash available $21,257.10 |

| $21,257.10

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here