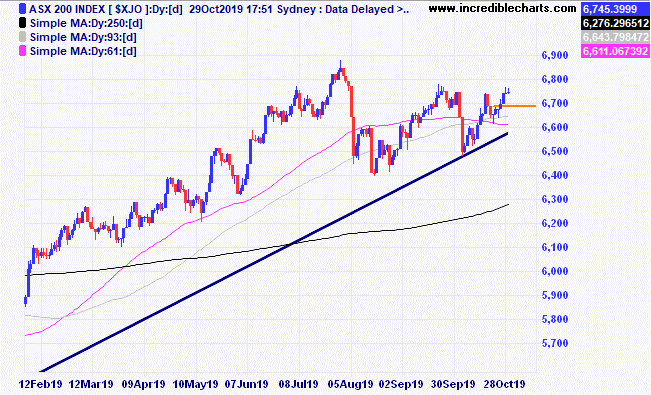

The local market has been steadily creeping up over the past week and is yet to break out of the larger 400 point sideways range. We bought 10 ASX200 cfd’s ahead of a potential breakout after a small ABC type pattern. The bigger range down today may form another higher low. Time will tell and we have our stops in place.

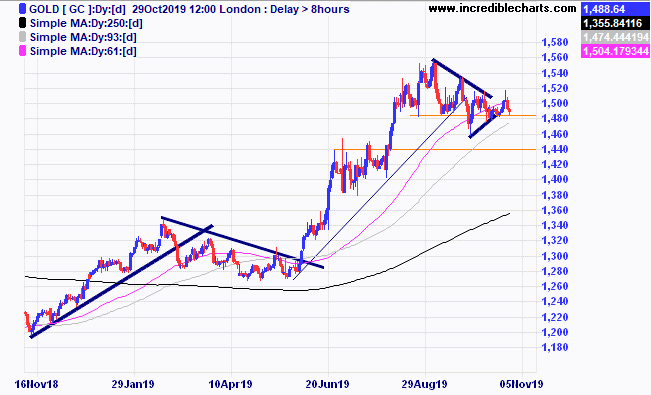

The price of gold has also been stuck in a sideways funk. The upcoming US Federal Reserve decision on interest rates could send markets in a more defined direction.

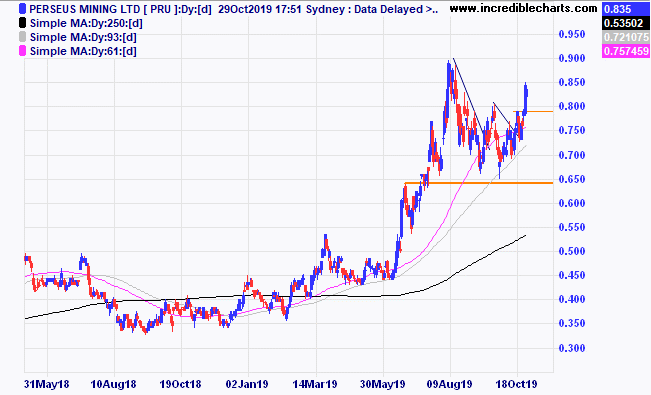

Gold miner Perseus looks to have moved out of the sideways funk for the moment, will it continue up?

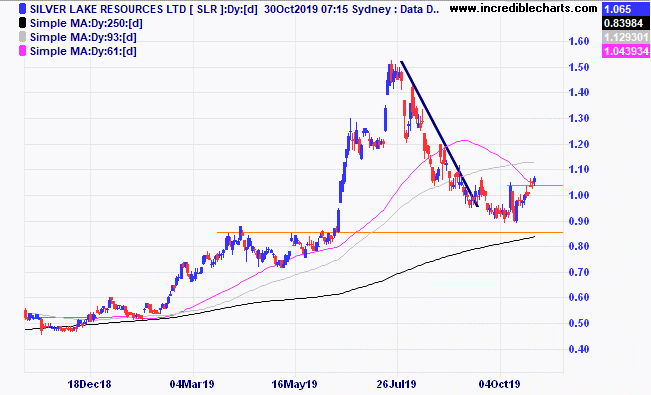

Silverlake has also just moved above some sideways action after a two month decline and we bought a small parcel today. Cimic which is in a totally different industry has a similar pattern and could also be setting up for a trade.

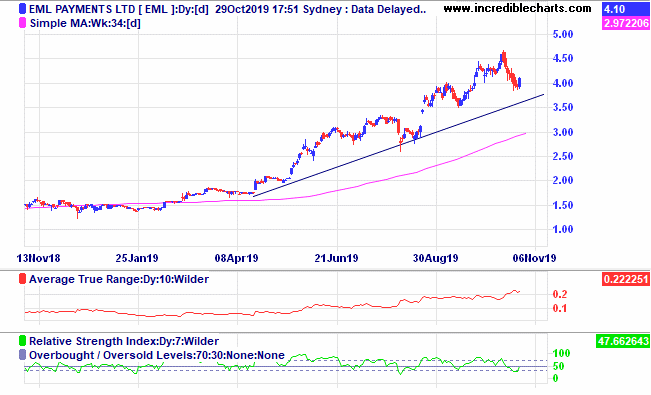

Well trending stock EML Payments has again retraced some of the recent gains in what appears to be a temporary dip. We will add some to the educational portfolio should price break yesterday’s high.

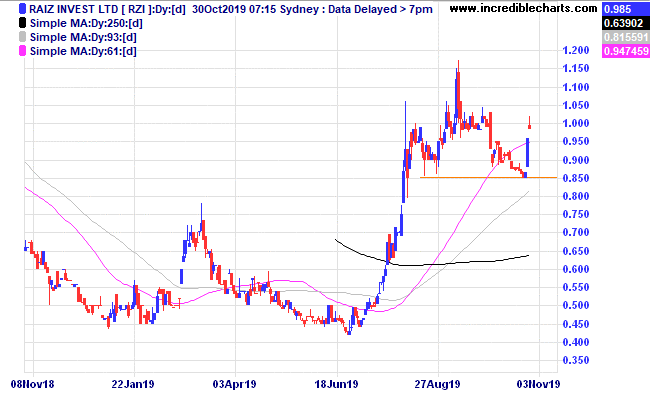

Raiz Invest looks to have found support and with the continuing business growth could well be one for a longer-term investment. We will be looking to add some to the educational portfolio.

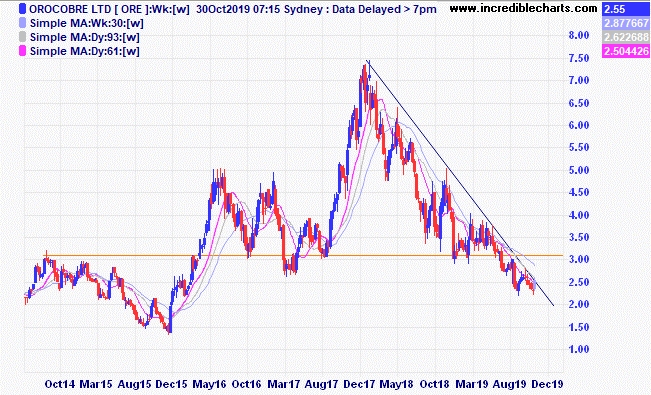

Lithium stocks have been on the nose for a while and Orocobre looks to be forming a “W” type bottom pattern and we will be keeping an eye on this over the next few days.

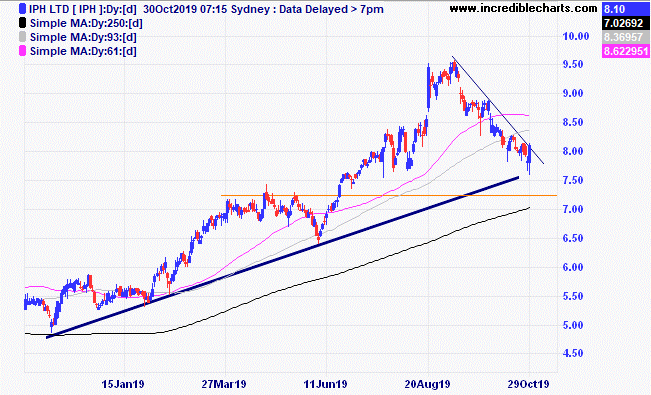

One of our current holdings IPH has fallen down close to a possible support zone.

Aristocrat Leisure also looks to have broken free of recent congestion with a target of around $36 should the move be of an equal range of the consolidation.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

buy CSL 3/12/18 $183 c/f 9/1 at $192.31 | Bought 15 at $192.31 | 9/1/2019 | $250.75 | $256.86 | +$91.65 |

Bought Westgold | Bought 1,000 at $1.03 | 7/2/2019 | $2.01 | $2.21 | +$200.00

|

Bought Cooper Energy | Bought 5,000 at 53 | 18/4/2018 | 56.5c | 57c | +$25.00 |

Bought Qube

| Bought 1,000 at $3.04 | 26/6/2019 | $3.25 | $3.30 | +$50.00 |

Bought Ecofibre | Bought 1,000 at $2.80 | 18/7/2019 | $3.29 | $3.16 | -$130.00 |

Bought Western Areas | Bought 800 at $2.26 | 8/8/2019 | $3.12 | $3.41

| +$232.00 |

Bought IPH

| Bought 400 at $8.55 | 19/8/2019 | $8.00 | $8.10 | +$40.00 |

Bought Capitol Health | Bought 10,000 at 24c | 28/8/2019 | 24.5c | 24 c | -$50.00 |

Bought NextDC

| Bought 400 at $6.55 | 28/8/2019 | $6.34 | $6.44 | +$40.00 |

Buy Reliance Worldwide | Bought 800 at $3.70 | 28/8/2019 | $4.25 | $4.17 | -$64.00 |

Bought Eclipse

| Bought 1,500 at $1.55 | 4/9/2019 | $1.67 | $1.66 | -$15.00 |

Buy Lifestyle Communities | Bought 300 at $7.20 | 4/9/2019 | $7.95 | $8.09 | +$42.00 |

Whitehaven Coal | Bought 800 at $3.50 | 11/9/2019 | $3.28 | $3.44 | +$128.00 |

Bought Santos

| Bought 350 at $7.80 | 16/9/2019 | $7.77 | $8.19 | +$147.00 |

Bought Kogan

| Bought 500 at $6.25 | 25/9/2019 | $6.97 | Sold 250 23/10 at $7.20/ 250 left at $6.82 | +$27.50 |

Bought Money3

| Bought 1,200 at $2.25 | 25/9/2019 | $2.22 | Sold 28/10 at $2.10 | -$174.00 |

Buy Wagners | Bought 1,500 at $1.75 | 16/10/2019 | $1.81 | $1.79 | -$30.00 |

Buy Australian Pharmaceutical | Bought 2,000 at $1.45 | 23/10/2019 | $1.45 | Sold 28/10 at $1.36 | -$210.00 |

Buy Technology One | Bought 400 at $7.45 | 24/10/2019 | $7.45 | $7.52 | +$28.00 |

Buy ASX 200 Cfd’s | Bought 10 at 6,700 | 24/10/2019 | 6,700 | 6,745 | +$450.00 |

|

| Start 7/1/19 $50,000.00 | Open balance $71,249.35 |

| $71,249.35 |

|

|

| Gains/losses week +$828.15 |

| +$828.15 |

|

|

| Current total $72,077.50 |

| $72,077.50 |

Brokerage at $30 per round turn added when sold. |

|

| Less buy/ close prices and Margin $52,858.40 |

| $52,858.40 |

Prices from Tuesday’s close or 6am for US |

|

| Cash available $19,219.10 |

| $19,219.10

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here