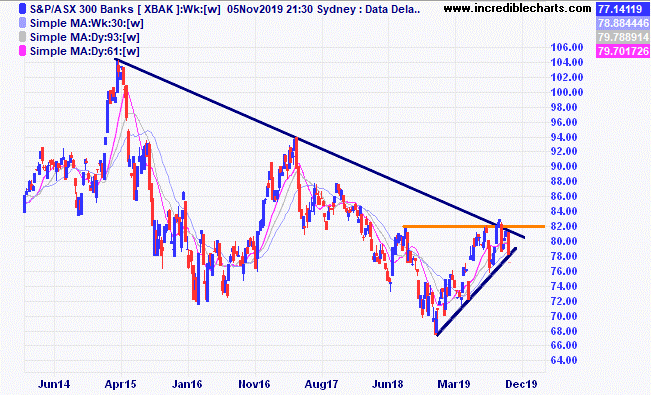

The local market continues the sideways congestion and we were stopped out of the ASX200 cfd position with a small loss. The banking sector looks to be putting a dampener on overall market gains.

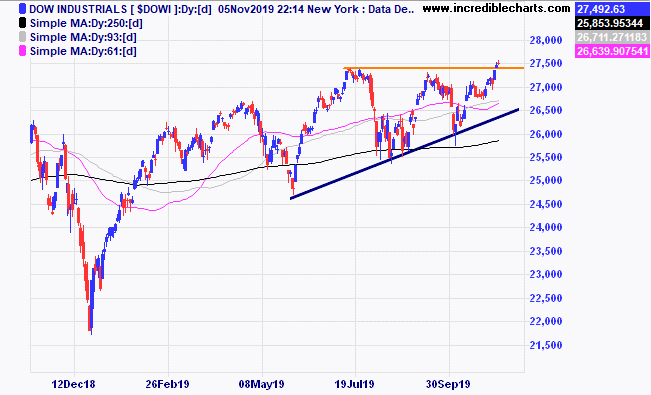

The Dow Jones Industrial Index has poked up to a new high and we bought a mini futures contract. This index looks stronger than the ASX 200 and has a strong seasonal trend for this time of year.

The price of gold has again had a down day where price has moved more than 1.5 per cent lower and is yet to puncture the spike low.

The banking index shows prices are up from the lows and have run into trend line resistance and looks to be making a triple top pattern. The current triangular congestion pattern spells danger and if prices break lower, we could see a decent fall.

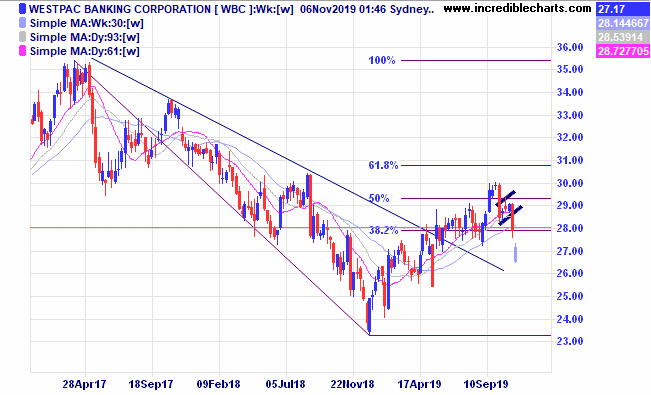

On the positive side Westpac closed near the top of yesterday’s range after announcing a $2.5 billion capital raising.

Macquarie Bank shows a much stronger trend than the big four.

A few fund managers look to be making a move higher including Pinnacle.

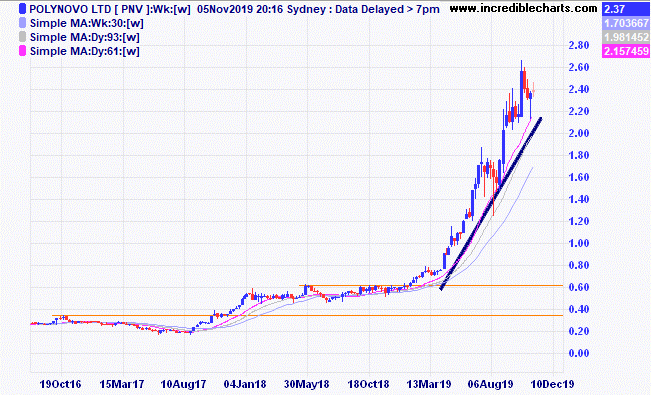

Polynovo has run well after a previous spike down. Will history repeat?

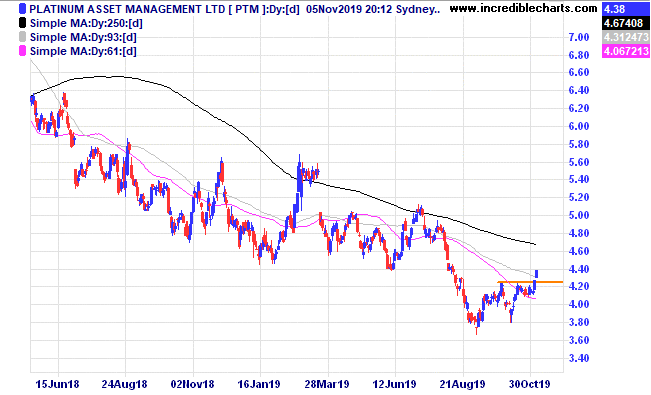

Platinum Asset Management had a nice move up out of congestion yesterday. Fellow fund manager Magellan is also forming an interesting pattern.

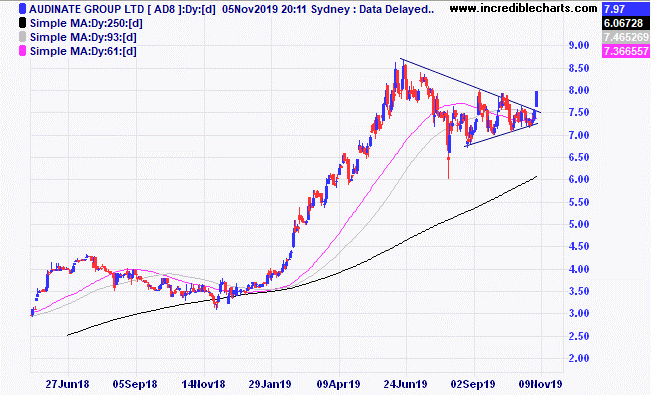

Audinate has moved up from the congestion and could run further and offers some nice trade possibilities.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

buy CSL 3/12/18 $183 c/f 9/1 at $192.31 | Bought 15 at $192.31 | 9/1/2019 | $256.86 | $260.75 | +$58.35 |

Bought Westgold | Bought 1,000 at $1.03 | 7/2/2019 | $2.21 | $2.46 | +$250.00 |

Bought Cooper Energy | Bought 5,000 at 53 | 18/4/2018 | 57c | 57.5c | +$25.00 |

Bought Qube | Bought 1,000 at $3.04 | 26/6/2019 | $3.30 | $3.30 | Steady |

Bought Ecofibre | Bought 1,000 at $2.80 | 18/7/2019 | $3.16 | $3.48 | +$320.00 |

Bought Western Areas | Bought 800 at $2.26 | 8/8/2019 | $3.41 | $3.12

| -$232.00 |

Bought IPH

| Bought 400 at $8.55 | 19/8/2019 | $8.10 | $7.99 | -$44.00 |

Bought Capitol Health | Bought 10,000 at 24c | 28/8/2019 | 24c | 24.5 c | +$50.00 |

Bought NextDC | Bought 400 at $6.55 | 28/8/2019 | $6.44 | $6.45 | +$4.00 |

Buy Reliance Worldwide | Bought 800 at $3.70 | 28/8/2019 | $4.17 | $4.20 | +$24.00 |

Bought Eclipse | Bought 1,500 at $1.55 | 4/9/2019 | $1.66 | $1.73 | +$105.00 |

Buy Lifestyle Communities | Bought 300 at $7.20 | 4/9/2019 | $8.09 | $8.40 | +$93.00 |

Whitehaven Coal | Bought 800 at $3.50 | 11/9/2019 | $3.44 | $3.40 | -$32.00 |

Bought Santos

| Bought 350 at $7.80 | 16/9/2019 | $8.19 | $8.15 | -$14.00 |

Bought Kogan | Bought 250 at $6.25 | 25/9/2019 | $6.82 | $7.08 | +$65.00 |

Buy Wagners | Bought 1,500 at $1.75 | 16/10/2019 | $1.79 | $1.86 | +$105.00 |

Buy Technology One | Bought 400 at $7.45 | 24/10/2019 | $7.52 | $7.42 | -$40.00 |

Buy ASX 200 Cfd’s | Bought 10 at 6,700 | 24/10/2019 | 6,745 | Stopped 31/10 At 6,690 | -$580.00 |

Bought Silverlake | Bought 2,500 at $1.10 | 30/10/2019 | $1.10 | $1.17 | +$400.00 |

Bought Orocobre

| Bought 1,000 at $2.64 | 1/11/2019 | $2.64 | $2.71 | +$70.00 |

Bought e-mini Dow

| Bought 1 at 27,350 | 4/11/2019 | 27,350 | 27,420 | +$350.00 |

Start 7/1/2019 $50,000.00 | Open balance $72,077.50 |

|

|

| $72,077.50 |

| Gains/losses week +$977.35 |

|

|

| +$977.35 |

| Current total $73,054.85 |

|

|

| $73,054.85 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $64,090.75 |

|

|

| $64,090.75 |

Prices from Tuesday’s close or 6am for US | Cash available $8,964.10 |

|

|

| $8,964.10

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here