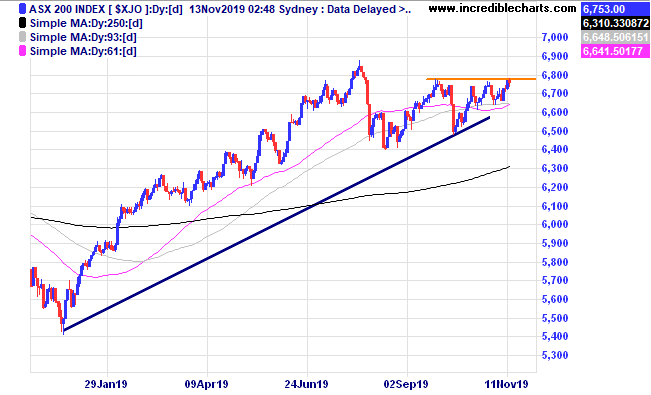

The local market continues the sideways consolidation.

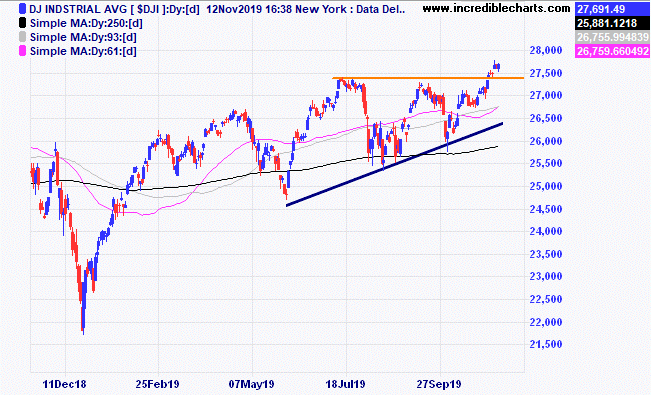

The US based Dow Jones Index tells a slightly different story with a recent fresh break to new highs at the start of a traditionally strong period for this market.

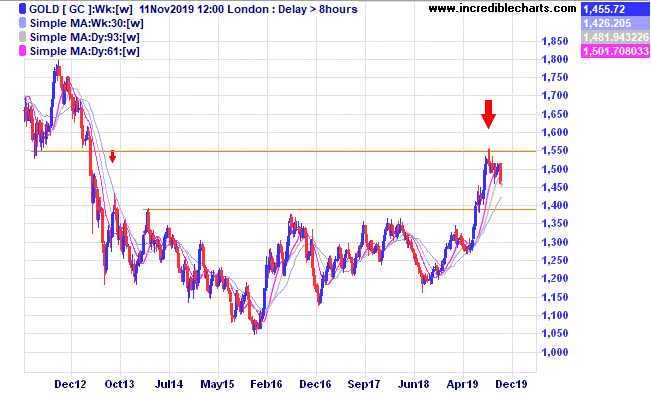

The price of gold took a 3 per cent tumble last week on relatively weaker weekly volume. Could we see a December low closer to the breakout?

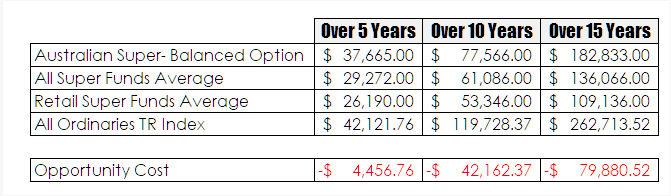

The table below was sent to Charlie and was taken from an online post showing the difference between superannuation funds and the All Ordinaries total return index and the “net” gains over these different timeframes. On quite a few superannuation comparison websites there is no option to compare a total return index or ETF. Hmmm wonder why?

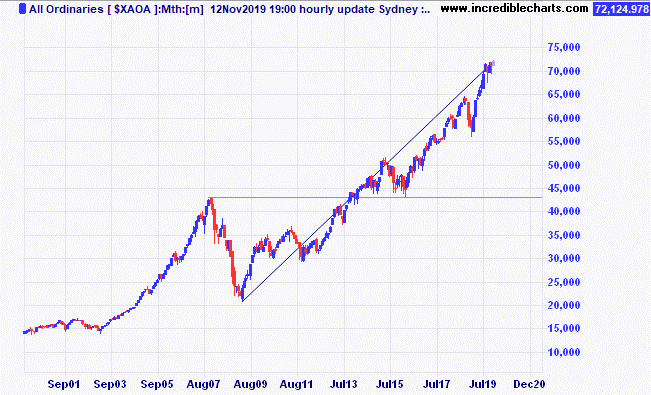

The chart below is that of the All Ordinaries accumulation index showing the power of compounding at work where new highs were reached in late 2013 after the depths of the GFC.

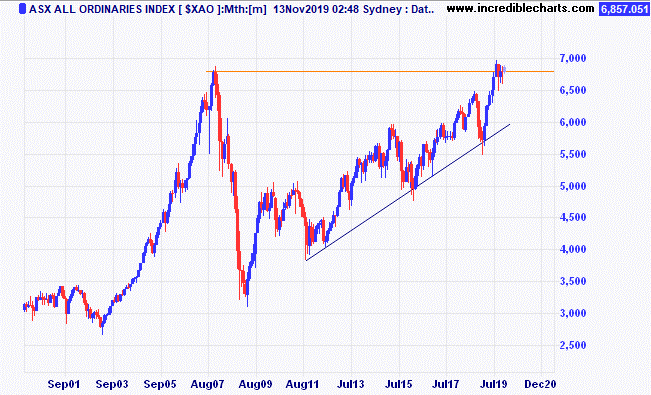

The All Ordinaries Index without the dividends took a lot longer to make a fresh high after the GFC.

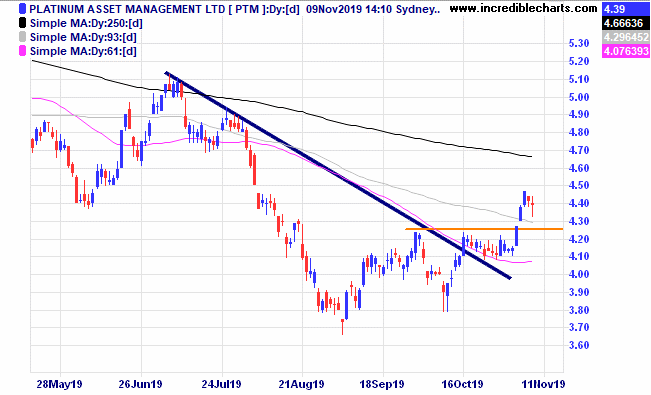

We bought Platinum Asset Management last week as it broke through a resistance level. Price has formed a small ABC pattern which could see higher prices coming. Time will tell.

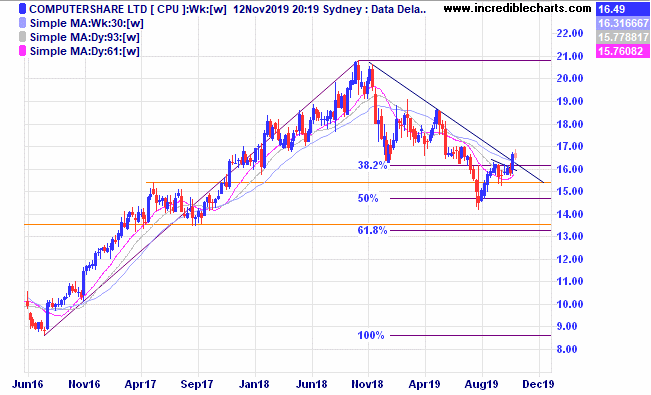

Computershare is also making a nice-looking pattern after breaking the downtrend line.

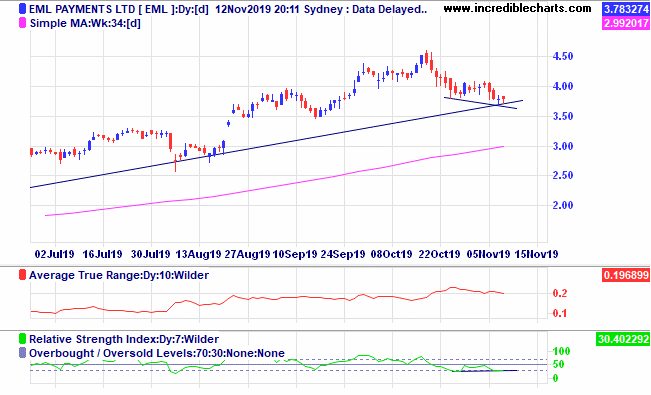

EML Payments recently bought Prepaid Financial Services which will expand their European footprint and announced a capital raising to help fund the purchase.

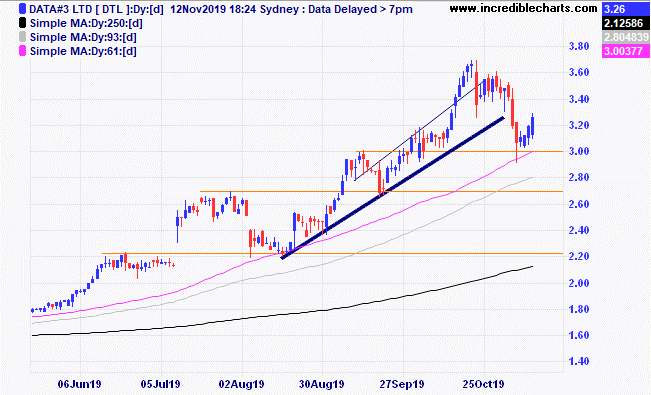

Data#3 looks to have found support and looks to be set for another move higher.

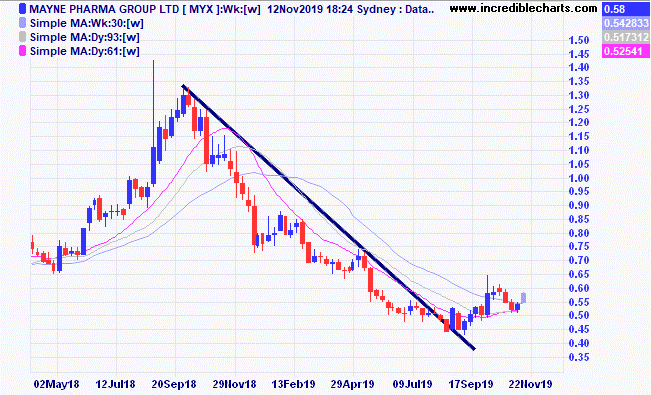

Mayne Pharma has made a nice ABC pattern on the weekly chart.

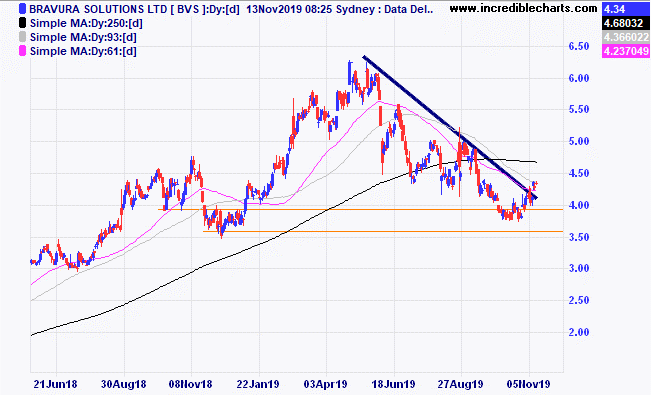

Bravura has just moved through the downtrend line after bouncing up from a potential support zone.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 | Bought 15 at $192.31 | 9/1/2019 | $260.75 | $266.51 | +$86.40 |

Bought Westgold | Bought 1,000 at $1.03 | 7/2/2019 | $2.46 | $2.17 | -$290.00 |

Bought Cooper Energy | Bought 5,000 at 53 | 18/4/2018 | 57.5c | 58 | +$25.00 |

Bought Qube | Bought 1,000 at $3.04 | 26/6/2019 | $3.30 | $3.28 | -$20.00 |

Bought Ecofibre | Bought 1,000 at $2.80 | 18/7/2019 | $3.48 | $3.60 | +$120.00 |

Bought Western Areas | Bought 800 at $2.26 | 8/8/2019 | $3.12 | $2.97

| -$120.00 |

Bought IPH

| Bought 400 at $8.55 | 19/8/2019 | $7.99 | $8.05 | +$24.00 |

Bought Capitol Health | Bought 10,000 at 24c | 28/8/2019 | 24.5c | 25c | +$50.00 |

Bought NextDC | Bought 400 at $6.55 | 28/8/2019 | $6.45 | $6.59 | +$56.00 |

Buy Reliance Worldwide | Bought 800 at $3.70 | 28/8/2019 | $4.20 | $4.18 | -$16.00 |

Bought Eclipse | Bought 1,500 at $1.55 | 4/9/2019 | $1.73 | $1.82 | +$135.00 |

Buy Lifestyle Communities | Bought 300 at $7.20 | 4/9/2019 | $8.40 | $8.13 | -$81.00 |

Whitehaven Coal | Bought 800 at $3.50 | 11/9/2019 | $3.40 | $3.20 | -$160.00 |

Bought Santos

| Bought 350 at $7.80 | 16/9/2019 | $8.15 | $8.15 | Steady |

Bought Kogan | Bought 250 at $6.25 | 25/9/2019 | $7.08 | $7.08 | Steady |

Buy Wagners | Bought 1,500 at $1.75 | 16/10/2019 | $1.86 | $1.89 | +$45.00 |

Buy Technology One | Bought 400 at $7.45 | 24/10/2019 | $7.42 | $8.04 | +$248.00 |

Bought Silverlake | Bought 2,500 at $1.10 | 30/10/2019 | $1.17 | $1.06 | -$275.00 |

Bought Orocobre

| Bought 1,000 at $2.64 | 1/11/2019 | $2.71 | $2.75 | +$70.00 |

Bought e-mini Dow

| Bought 1 at 27,350 | 4/11/2019 | 27,420 | 27,682 | +$1,310.00 |

Bought Platinum Asset Management | Bought 700 at $4.40 | 6/11/2019 | $4.40 | $4.35 | -$35.00 |

|

|

|

|

|

|

Start 7/1/2019 $50,000.00 | Open balance $73,054.85 |

|

|

| $73,054.85 |

| Gains/losses week +$1,172.40 |

|

|

| +$1,172.40 |

| Current total $74,227.25 |

|

|

| $74,227.25 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $67,446.15 |

|

|

| $67,446.15 |

Prices from Tuesday’s close or 6am for US | Cash available $6,781.10 |

|

|

| $6,781.10

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here