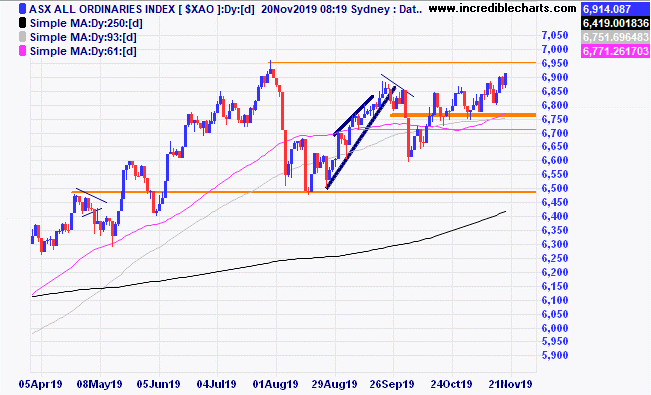

The local market continues to trade in the top half of the large sideways range that began in July and is down some 80 points at lunch today.

The Dow Jones Index in the US briefly spiked higher and then closed down forming an “outside” day last night. We sold our position earlier today at 27,861 points.

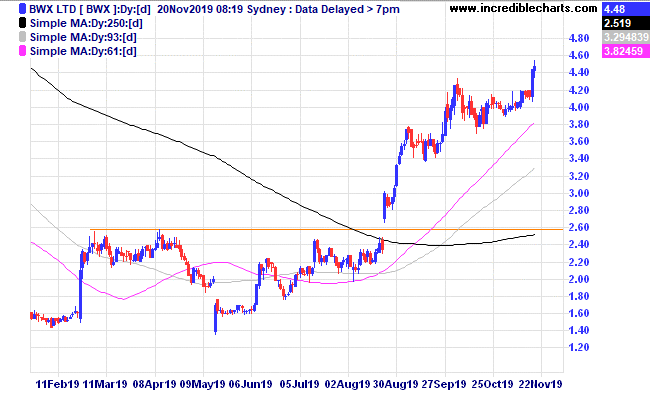

Not all stocks have been moving sideways and one of the top stocks over the past six months in the ASX 300 is BWX up 170 per cent. Interestingly 41 stocks are up 30 per cent or more in this index over that time.

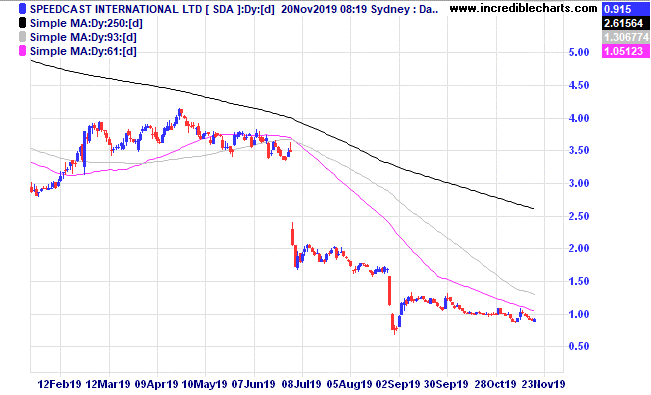

The weakest stock in the ASX 300 has been Speedcast International down 74 per cent. Fourteen stocks in this index have declined by more than 30 per cent over the past 6 months.

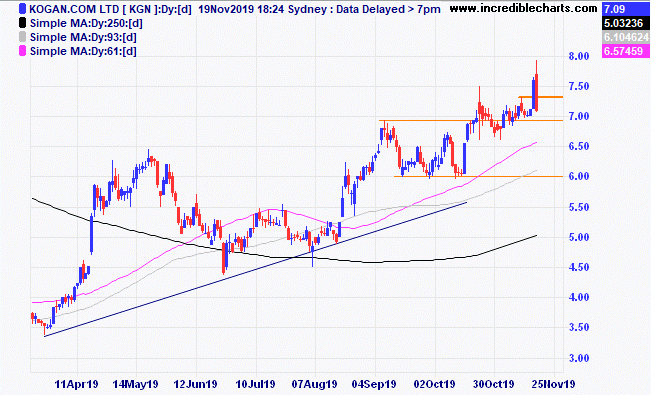

We topped up the Kogan holding after price moved higher out of the recent congestion. We have our stop in place should prices continue to fall after yesterday’s sell-off.

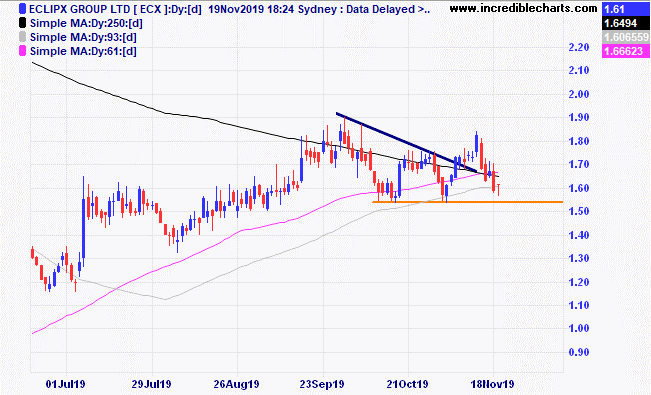

We sold out of Eclipse and Silverlake after some price weakness and a change in our outlook for holding the stocks. When in doubt get out is a market motto Charlie learned about in the early days. If you are not sure of the reasons you are holding a stock it can play on your mind. Best to get out and keep a clear head. There is always another opportunity just around the corner even if you miss out on this particular stock.

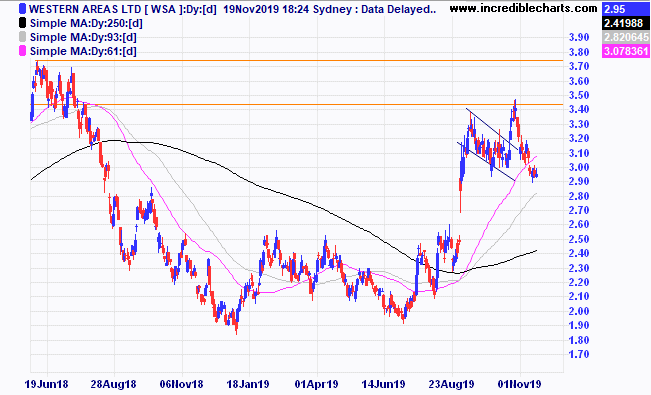

Western Areas is proving problematic after a great start when we took partial profits on the dramatic rise. It is getting very close to our stop level.

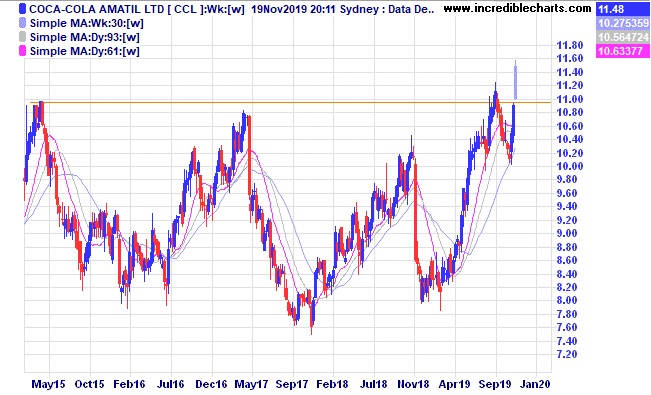

Coca-Cola Amatil looks to have busted out of a big range sideways move.

Audinate is again close to moving above resistance at around the $8 level. Will we see another strong run?

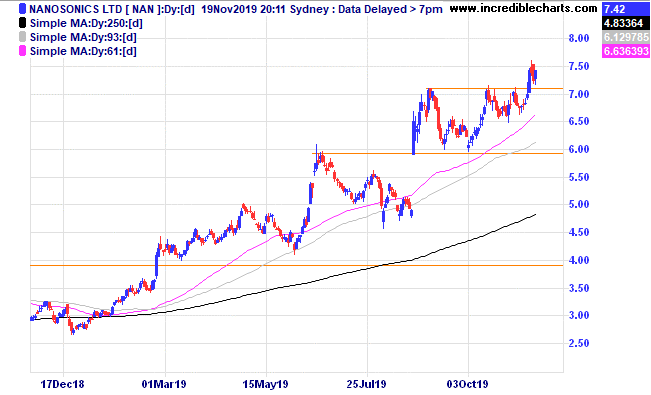

Nanosonics has made a fresh high recently.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 | Bought 15 at $192.31 | 9/1/2019 | $266.51 | $274.26 | +$116.25 |

Bought Westgold | Bought 1,000 at $1.03 | 7/2/2019 | $2.17 | $2.08 | -$90.00 |

Bought Cooper Energy | Bought 5,000 at 53 | 18/4/2018 | 58c | 55 | -$150.00 |

Bought Qube | Bought 1,000 at $3.04 | 26/6/2019 | $3.28 | $3.33 | +$50.00 |

Bought Ecofibre | Bought 1,000 at $2.80 | 18/7/2019 | $3.60 | $3.51 | -$90.00 |

Bought Western Areas | Bought 800 at $2.26 | 8/8/2019 | $2.97 | $2.95

| -$16.00 |

Bought IPH

| Bought 400 at $8.55 | 19/8/2019 | $8.05 | $8.23 | +$72.00 |

Bought Capitol Health | Bought 10,000 at 24c | 28/8/2019 | 25c | 24.5c | -$50.00 |

Bought NextDC | Bought 400 at $6.55 | 28/8/2019 | $6.59 | $6.80 | +$84.00 |

Buy Reliance Worldwide | Bought 800 at $3.70 | 28/8/2019 | $4.18 | $4.14 | -$32.00 |

Bought Eclipse | Bought 1,500 at $1.55 | 4/9/2019 | $1.82 | Sold 18/11 at $1.58 | -$390.00 |

Buy Lifestyle Communities | Bought 300 at $7.20 | 4/9/2019 | $8.13 | $8.35 | +$66.00 |

Whitehaven Coal | Bought 800 at $3.50 | 11/9/2019 | $3.20 | $3.11 | -$72.00 |

Bought Santos

| Bought 350 at $7.80 | 16/9/2019 | $8.15 | $8.14 | -$3.50 |

Bought Kogan | Bought 250 at $6.25 | 25/9/2019 | $7.08 | $7.09 | +$2.50 |

Buy Wagners | Bought 1,500 at $1.75 | 16/10/2019 | $1.89 | $1.97 | +$120.00 |

Buy Technology One | Bought 400 at $7.45 | 24/10/2019 | $8.04 | $7.85 | -$76.00 |

Bought Silverlake | Bought 2,500 at $1.10 | 30/10/2019 | $1.06 | Sold 18/11 at $1.04 | -$80.00 |

Bought Orocobre

| Bought 1,000 at $2.64 | 1/11/2019 | $2.75 | $2.68 | -$70.00 |

Bought e-mini Dow

| Bought 1 at 27,350 | 4/11/2019 | 27,682 | 27,903 | +$1,105.00 |

Bought Platinum Asset Management | Bought 700 at $4.40 | 6/11/2019 | $4.35 | $4.46 | +$77.00 |

Bought Kogan | Bought 250 at $7.35 | 18/11/2019 | $7.35 | $7.09 | -$65.00 |

|

|

|

|

|

|

Start 7/1/2019 $50,000.00 | Open balance $74,227.25 |

|

|

| $74,227.25 |

| Gains/losses week +$674.25 |

|

|

| +$674.25 |

| Current total $74,901.50 |

|

|

| $74,901.50 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $63,706.90 |

|

|

| $63,706.90 |

Prices from Tuesday’s close or 6am for US | Cash available $11,194.60 |

|

|

| $11,194.60

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie

To order photos from this page click here