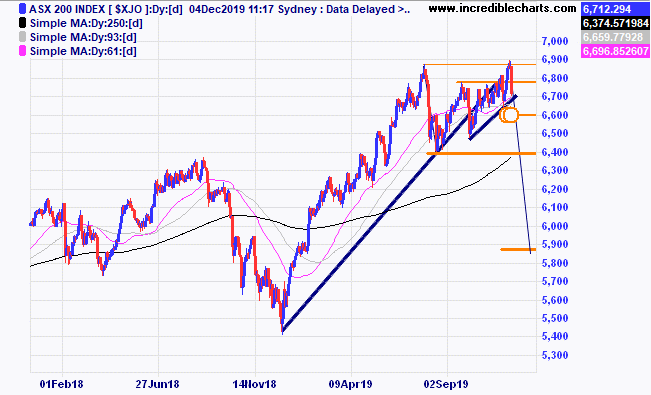

The local market is down a further 100 points at lunch today on the back of lower overseas markets and talk of more trade disruption. A double top type pattern followed by a similar 15 per cent correction to that from late last year would put the market at around 5,850 points.

The Dow Jones Index futures market fell heavily last night and bounced up from a possible support zone later in the session.

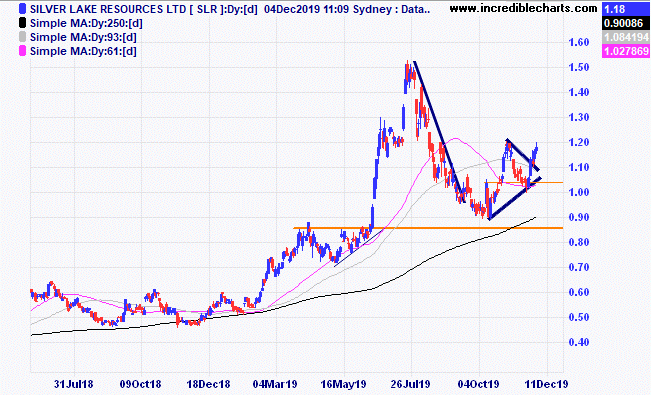

The gold price rose on strong volume and is yet to move above the current downtrend line after finding a base close to previous tops.

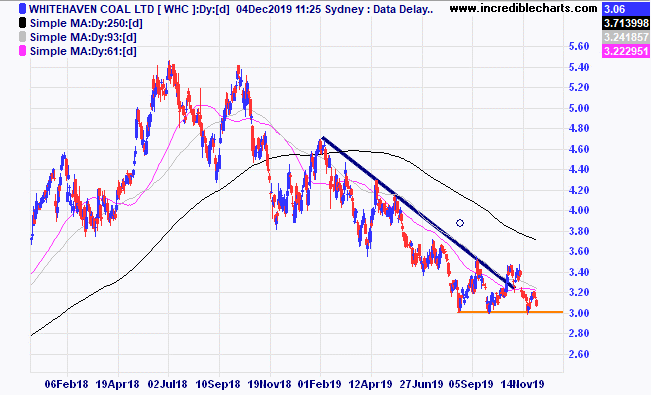

A few shares in the educational portfolio are close to or below the initial buy price like Whitehaven Coal and are close to being sold.

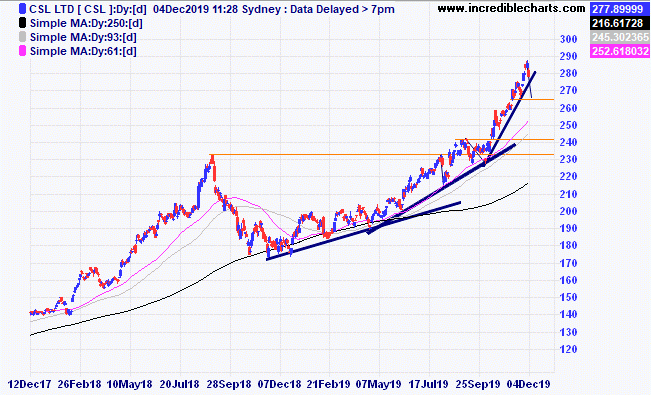

CSL has had an amazing run and is getting closer to moving below the recent uptrend line where some traders could consider selling. No trend lasts forever. The company lost 25 per cent late last year and rallied more than 55 per cent off the first higher low.

Silverlake has been one of the better performers over the past three days after bouncing up from a support zone.

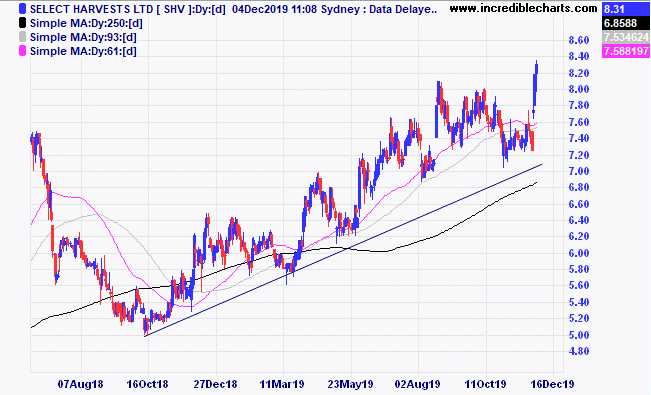

Select Harvests has also done well after posting record production numbers.

A small mistake in last week’s table has been rectified.

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 | Bought 15 at $192.31 | 9/1/2019 | $279.73 | $277.89 | -$27.60 |

Bought Westgold | Bought 1,000 at $1.03 | 7/2/2019 | $1.99 | $1.97 | -$20.00 |

Bought Cooper Energy | Bought 5,000 at 53 | 18/4/2018 | 54c | Sold 27/11 at 53c | -$80.00 |

Bought Qube | Bought 1,000 at $3.04 | 26/6/2019 | $3.29 | $3.25 | -$40.00 |

Bought Ecofibre | Bought 1,000 at $2.80 | 18/7/2019 | $3.60 | $3.28 | -$320.00 |

Bought IPH

| Bought 400 at $8.55 | 19/8/2019 | $8.76 | $8.37 | -$156.00 |

Bought Capitol Health | Bought 10,000 at 24c | 28/8/2019 | 23.5c | Sold 27/11 at 23c | -$80.00 |

Bought NextDC | Bought 400 at $6.55 | 28/8/2019 | $6.49 | $6.38 | -$44.00 |

Buy Reliance Worldwide | Bought 800 at $3.70 | 28/8/2019 | $4.02 | $4.11 | +$72.00 |

Buy Lifestyle Communities | Bought 300 at $7.20 | 4/9/2019 | $8.17 | $8.38 | +$63.00 |

Whitehaven Coal | Bought 800 at $3.50 | 11/9/2019 | $3.16 | $3.06 | -$80.00 |

Bought Santos

| Bought 350 at $7.80 | 16/9/2019 | $8.07 | $8.05 | -$7.00 |

Bought Kogan | Bought 250 at $6.25 | 25/9/2019 | $7.08 | $7.15 | +$17.50 |

Buy Wagners | Bought 1,500 at $1.75 | 16/10/2019 | $2.01 | $2.13 | +$180.00 |

Buy Technology One | Bought 400 at $7.45 | 24/10/2019 | $8.77 | $9.00 | +$92.00 |

Bought Orocobre

| Bought 1,000 at $2.64 | 1/11/2019 | $2.65 | $2.42 | -$230.00 |

Bought Platinum Asset Management | Bought 700 at $4.40 | 6/11/2019 | $4.24 | $4.25 | +$7.00 |

Bought Kogan | Bought 250 at $7.35 | 18/11/2019 | $7.08 | $7.15 | +$17.50 |

Bought Audinate | Bought 400 at $8.30

| 22/11/2019 | $8.50 | $8.97 | +$188.00 |

Bought Integrated Research | Bought 900 at $3.20 | 28/11/2019 | $3.20 | $3.26 | +$54.00 |

|

|

|

|

|

|

Start 7/1/2019 $50,000.00 | Open balance $74,756.05 |

|

|

| $74,756.05 |

| Gains/losses week -$393.60 |

|

|

| -$393.60 |

| Current total $74,362.45 |

|

|

| $74,362.45 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $52,677.35 |

|

|

| $52,677.35 |

Prices from Tuesday’s close or 6am for US | Cash available $21,685.10 |

|

|

| $21,685.10

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise… Cheers Charlie.

To order photos from this page click here