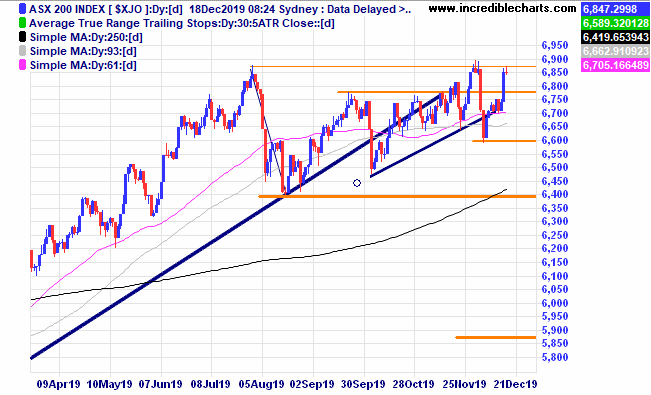

The local index has once again flirted with breaking out to all-time highs.

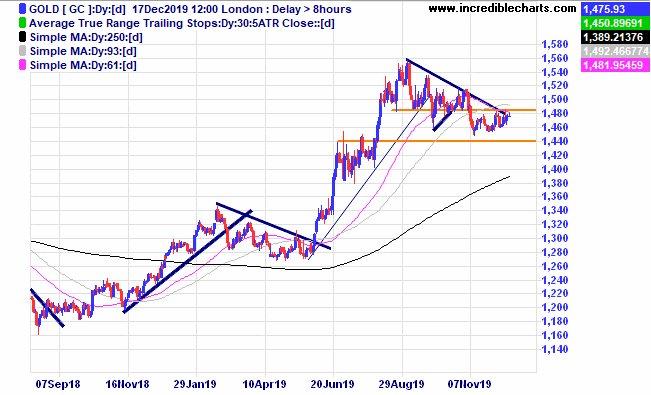

The price of gold is still in a sideways holding pattern and another failure at the resistance zone could see lower prices. Time will tell.

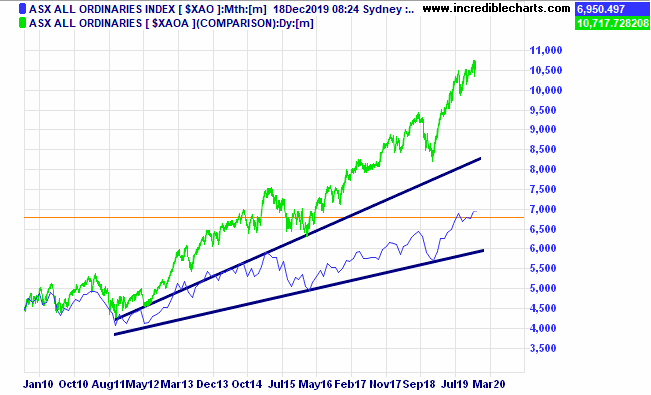

This is a chart comparing the All Ordinaries Index to the All Ordinaries Accumulation Index which includes dividends. All those little payouts reinvested makes a big difference over time.

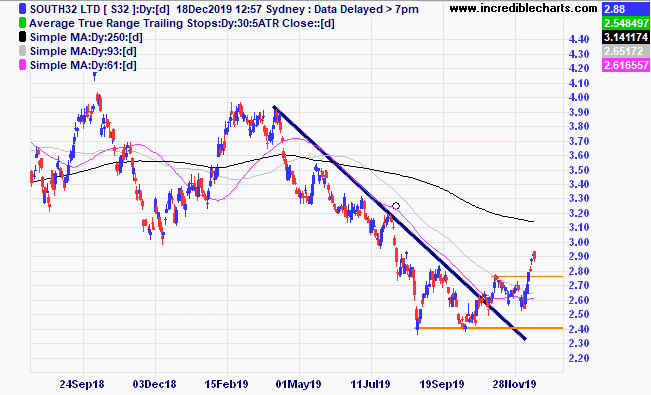

We bought some South32 after price moved higher on some good news on the impending trade deals.

Australian Ethical Investments has had a great run over the past few years and has more than doubled over the past year.

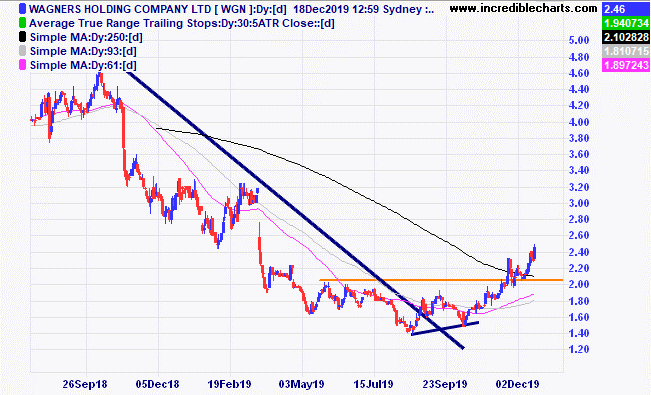

Wagners Holding Company looks like it could go for a decent run from here after bouncing off a possible support zone after forming a nice base pattern.

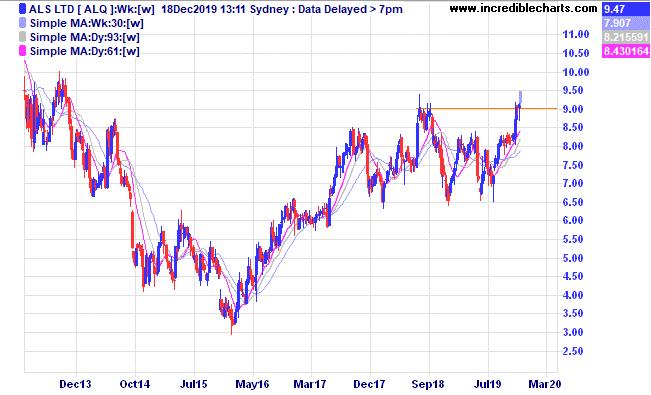

ALS looks poised to move higher.

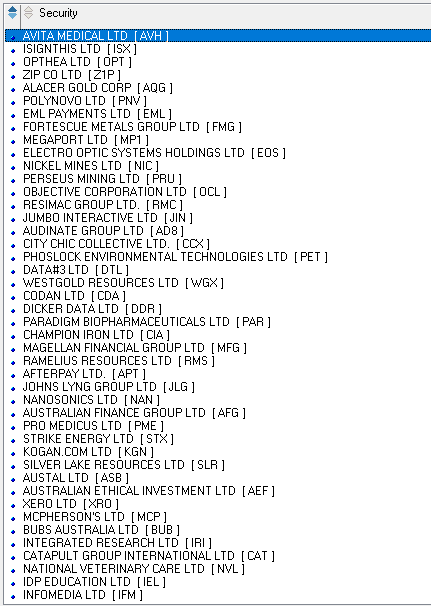

A list of the top performing stocks from the All Ordinaries Index over the past 12 months.

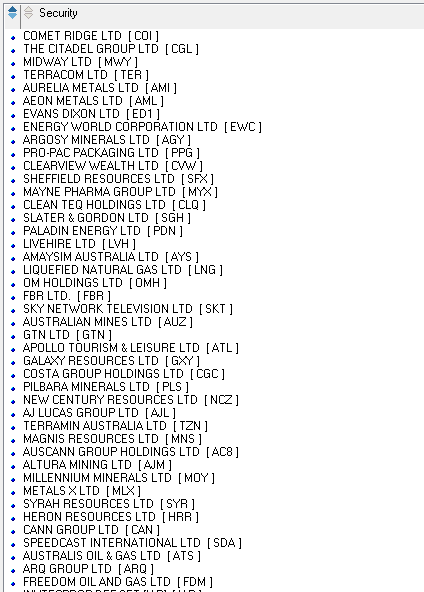

The worst performers in the All Ordinaries Index over the past 12 months.

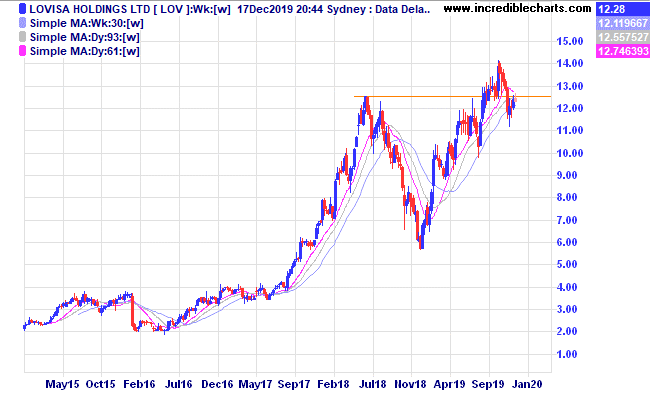

Lovisa Holdings had a record number of page views in the recent Black Friday sales.

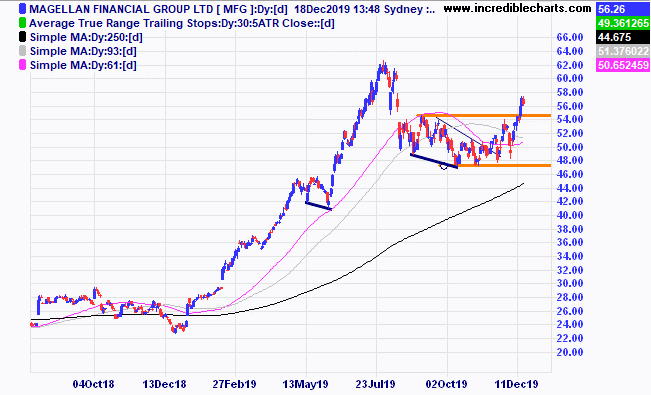

Magellan Financial Group has moved up out of a sideways consolidation and will be added to the educational portfolio in preparation for the year ahead.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 | Bought 15 at $192.31 | 9/1/2019 | $278.34 | $284.72 | +$95.70 |

Bought Westgold | Bought 1,000 at $1.03 | 7/2/2019 | $1.92 | $1.99 | +$70.00 |

Bought Qube | Bought 1,000 at $3.04 | 26/6/2019 | $3.20 | $3.33 | +$130.00 |

Bought IPH

| Bought 400 at $8.55 | 19/8/2019 | $8.15 | $8.59 | +$176.00 |

Bought NextDC | Bought 400 at $6.55 | 28/8/2019 | $6.67 | $6.87 | +$80.00 |

Buy Reliance Worldwide | Bought 800 at $3.70 | 28/8/2019 | $4.02 | $4.24 | +$176.00 |

Buy Lifestyle Communities | Bought 300 at $7.20 | 4/9/2019 | $8.40 | $8.45 | +$15.00 |

Bought Santos

| Bought 350 at $7.80 | 16/9/2019 | $8.12 | $8.40 | +$98.00 |

Bought Kogan | Bought 250 at $6.25 | 25/9/2019 | $7.10 | $7.21 | +$27.50 |

Buy Wagners | Bought 1,500 at $1.75 | 16/10/2019 | $2.19 | $2.46 | +$405.00 |

Buy Technology One | Bought 400 at $7.45 | 24/10/2019 | $8.85 | $8.96 | +$44.00 |

Bought Platinum Asset Management | Bought 700 at $4.40 | 6/11/2019 | $4.16 | $4.65 | +$343.00 |

Bought Kogan | Bought 250 at $7.35 | 18/11/2019 | $7.10 | $7.21 | +$27.50 |

Bought Audinate | Bought 400 at $8.30

| 22/11/2019 | $8.40 | $8.05 | -$140.00 |

Bought Integrated Research | Bought 900 at $3.20 | 28/11/2019 | $3.25 | $3.19 | -$54.00 |

Bought Beach Energy | Bought 1,000 at $2.55

| 9/12/2019 | $2.63 | $2.67 | +$40.00 |

Bought Select Harvests | Bought 300 at $8.54 | 11/12/2019 | $8.54 | $8.48 | -$18.00 |

Bought South32

| Bought 1,000 at $2.80 | 11/12/2109 | $2.80 | $2.88 | +$80.00 |

|

|

|

|

|

|

Start 7/1/2019 $50,000.00 | Open balance $73,279.20 |

|

|

| $73,279.20 |

| Gains/losses week -$1,595.70 |

|

|

| +$1,595.70 |

| Current total $74,874.90 |

|

|

| $74,874.90 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $51,647.80 |

|

|

| $51,647.80 |

Prices from Tuesday’s close or 6am for US | Cash available $23,227.10 |

|

|

| $23,227.10

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise…

All the best for the festive season. This is the last column for 2019, Cheers Charlie.

To order photos from this page click here