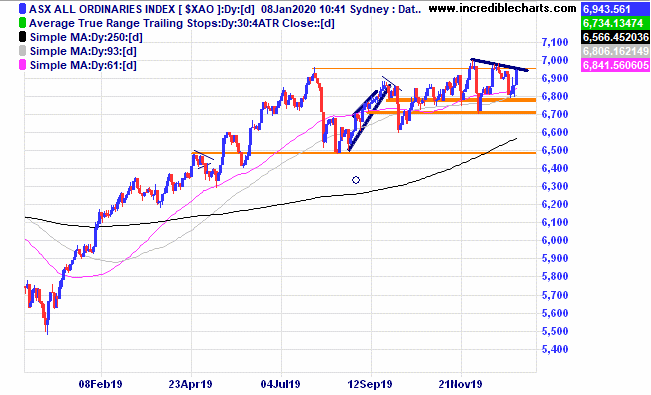

The local market again pushed higher and once again has met some resistance. It is the third slightly lower top in a row.

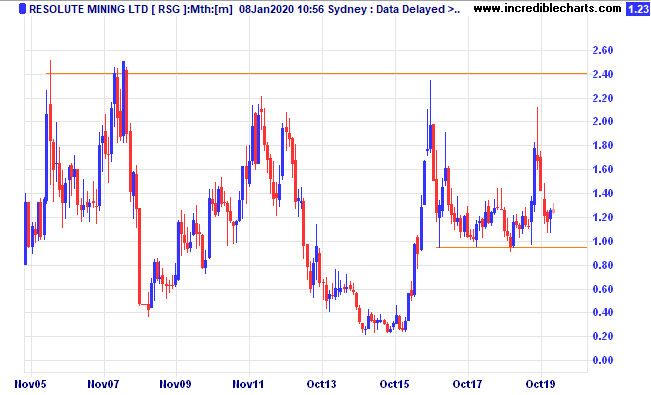

The gold price gyrations continue in the wake of the uncertainty of actions Iran may or may not continue to take. We were prepared to act last week and then lucky to be in and out of the market in one day before the weekend. We hold some gold stocks for the longer term.

Resolute Gold shows an interesting monthly chart and a reasonable and a potentially high risk-reward ratio on a trade. We added some to the educational portfolio earlier today.

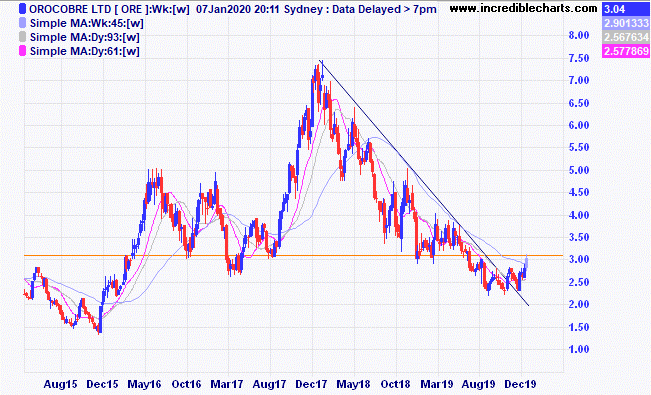

A few of the lithium miners have put in a few good days including Orocobre.

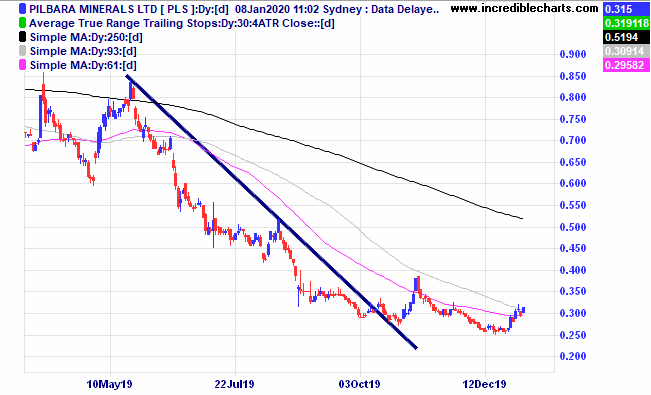

Pilbara and Galaxy both have a similar looking chart.

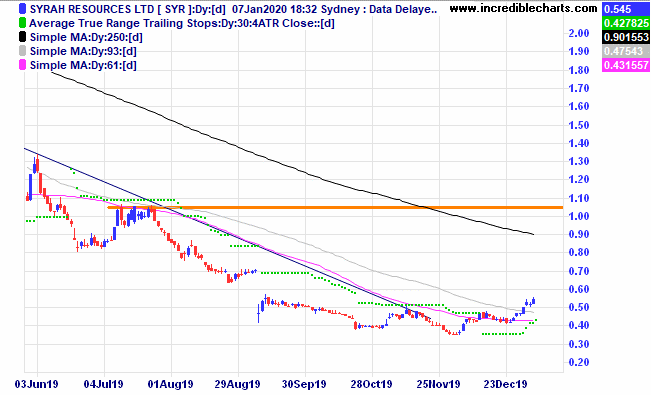

Syrah looks to be turning the corner and we will take a small position.

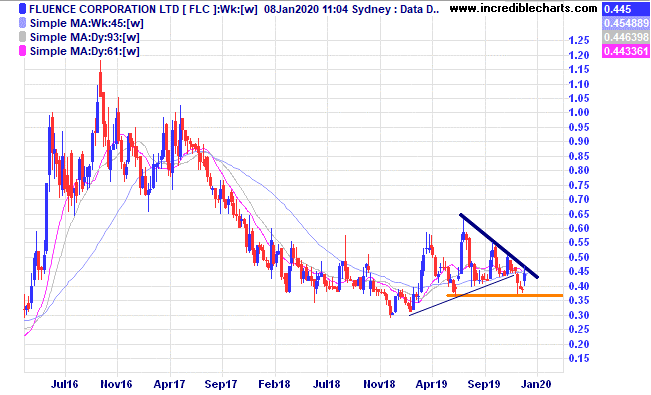

Fluence the water filtration mob looks to be setting up for a move higher, watching.

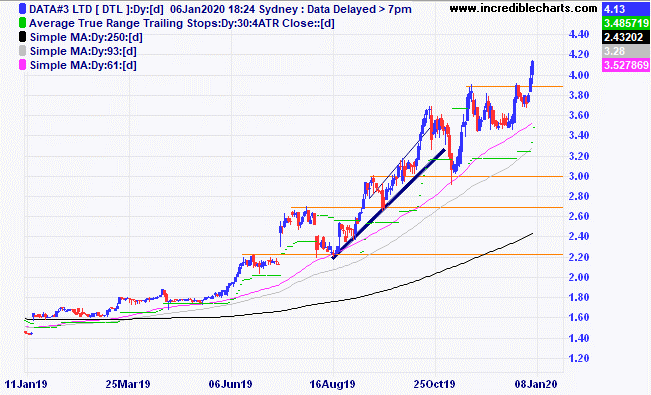

Data #3 has moved up to fresh highs and is having a great run.

The table has been reset for the start of the new year and the trade size of carryover stocks adjusted for the new portfolio size. We always include the initial date of purchase and the carryover price.

Last year we made a nice “educational” profit of over 40 per cent and a tad over half of all trades resulted in a profit. We generally like to keep losses small and we had 11 trades with losses less than 5 per cent and 3 trades with losses over 20 per cent. Sixteen profitable trades had a greater that 20 per cent profit with two generating more than 100 per cent profit. As always it is a mixed bag as you never know how any trade will turn out. Keeping losses small helps.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $280.00 | $283.42 | +$34.20 |

Bought Westgold c/fwd 3/1 at $2.33 | Bought 1,000 at $1.03 7/2/2019 | 7/2/2019 | $2.33 | $2.32 | -$10.00 |

Bought Santos c/fwd 3/1 at $8.29

| Bought 350 at $7.80 16/9/2019 | 16/9/2019 | $8.29 | $8.79 | +$175.00 |

Bought Kogan c/fwd 3/1 at $7.54 | Bought 300 at $6.25 25/9/2019 | 25/9/2019 | $7.54 | $7.78 | +$24.00 |

Buy Wagners c/fwd $2.73 | Bought 1,000 at $1.75 on 16/10/2019 | 16/10/2019 | $2.73 | $2.50 | -$230.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $59.00 | $59.70 | +$28.00 |

Bought Newcrest Mining c/fwd 3/1 at $30.44 | Bought 100 at $30.20 31/12/2019 | 31/12/2019 | $30.44 | $30.76 | +$32.00 |

Bought 1 e-mini gold

| Bought 1 at $1,531 | 3/1/2020 | $1,531 | Sold 3/1 at $1,552.00 | +$1,020.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $50,000 |

|

|

| $50,000.00 |

Stocks c/fwd $18,427.50 | Gains/losses week +$1,313.20 |

|

|

| +$1,313.20 |

| Current total $51,313.20 |

|

|

| $51,313.20 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $18,528.20 |

|

|

| $18,528.20 |

Prices from Tuesday’s close or 6am for US | Cash available $32,785.00 |

|

|

| $32,785.00

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise…

Cheers Charlie.

To order photos from this page click here