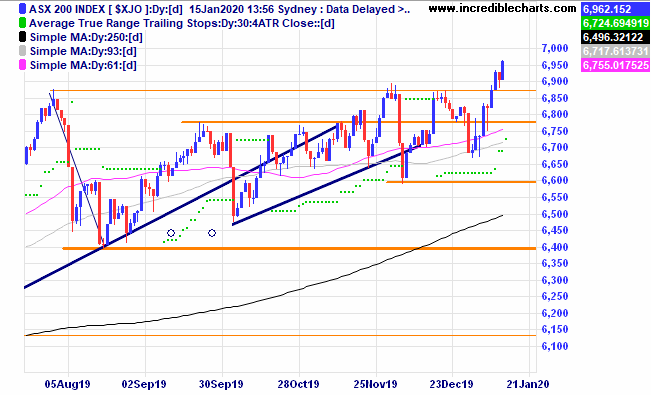

The local index moved through resistance at the 6,870 level and came back close to the breakout level in a classic ABC type move. While most of the headlines are about the devastating bushfires and the terrible losses the “market” looks to be climbing that wall of worry. After three months locked in a sideways move near to the old highs the probabilities suggest we are due for a bit of a run. Time will tell the story. A basic target could be to add the 250 point trading range to the 6870 breakout to make 7,180 as a likely target. We sold half our position today to lock in some profit and cover costs.

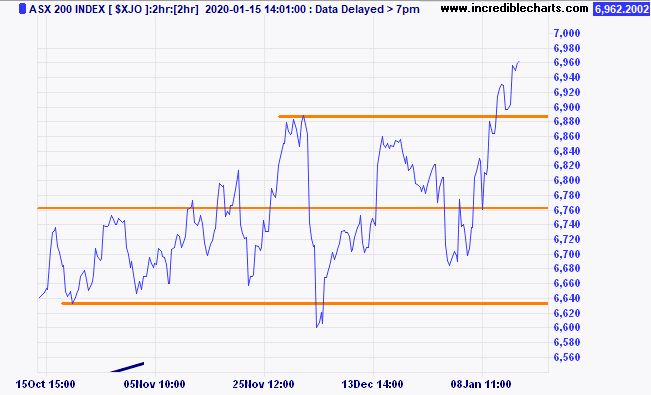

A two-hour line chart shows the breakout and retracement in a simple way. Charlie is an old-fashioned congestion and expansion trader. After periods of congestion markets tend to move a bit before the next congestion period. Some stocks tend to do this more than others. When looking at some charts all Charlie sees is a mess so we don’t look to trade what we don’t like.

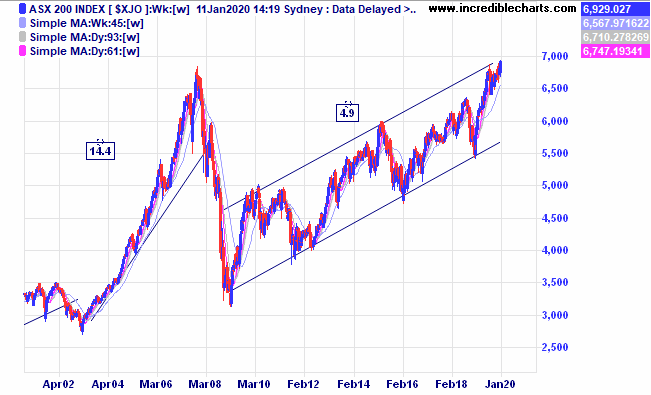

A view of the ASX 200 index on a weekly timescale showing it has reached the top of the current trend channel and could retrace some of the move up. A reason for some caution.

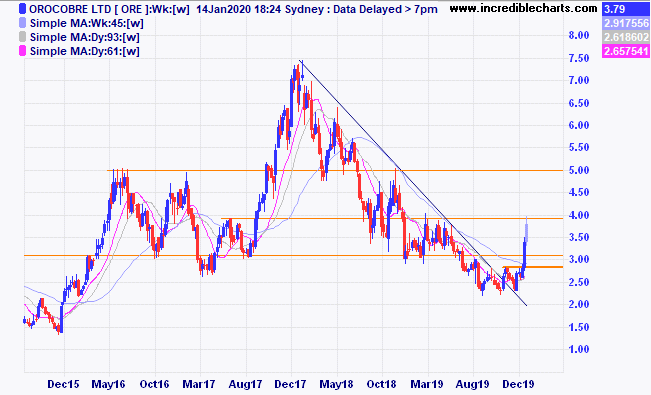

We bought Orocobre after price moved higher and it has reached the first resistance level. News out of China that it will continue to subsidise electric vehicles is seen as good news for some miners. Next possible target is $5 on the weekly chart. Watching carefully.

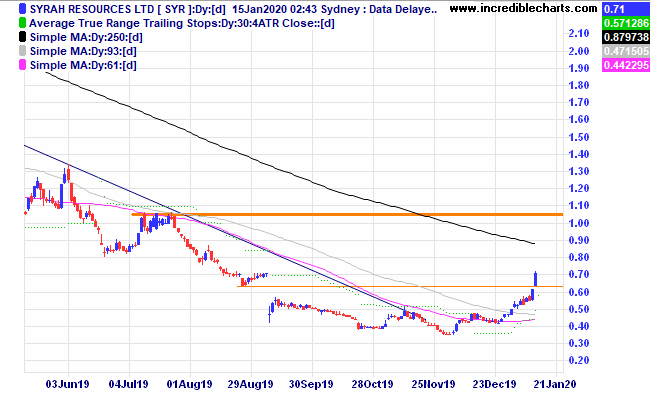

Syrah shows a similar move up and the next likely target, watching for a retracement.

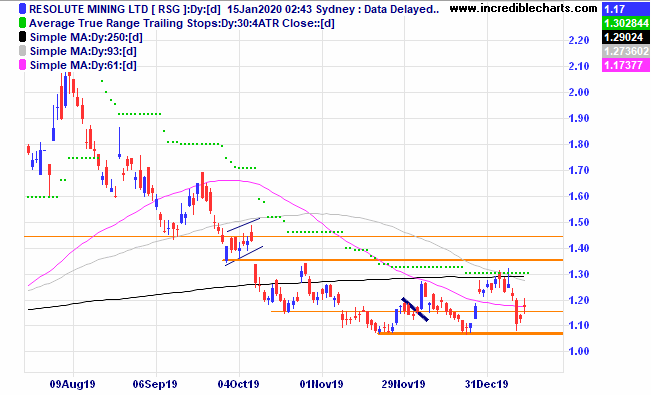

Resolute is still in a sideways range. The company has announced it has sold off the Ravenswood operation today. The company also recently updated production guidance.

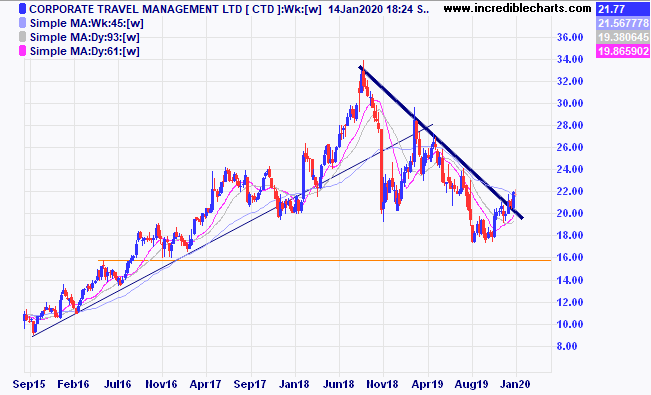

Corporate Travel looks to have broken the downtrend line and is making higher lows.

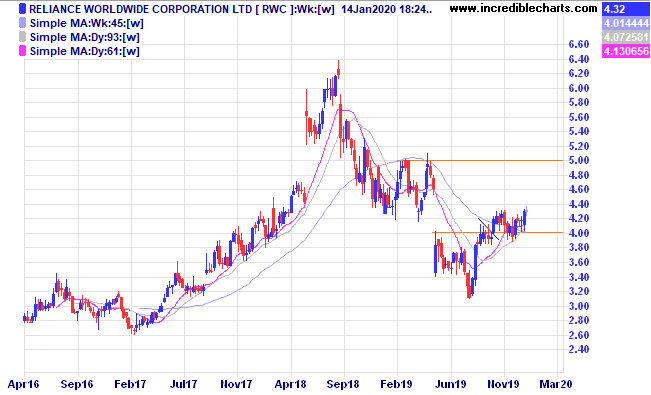

Plumbing outfit Reliance is in a congestion period for now.

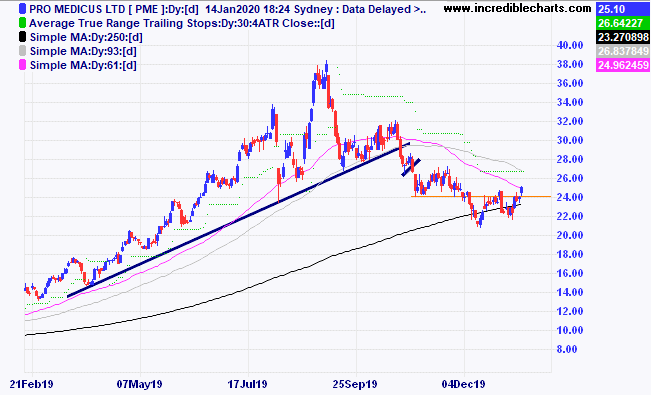

Pro Medicus has an interesting looking chart, perhaps preparing for another run up.

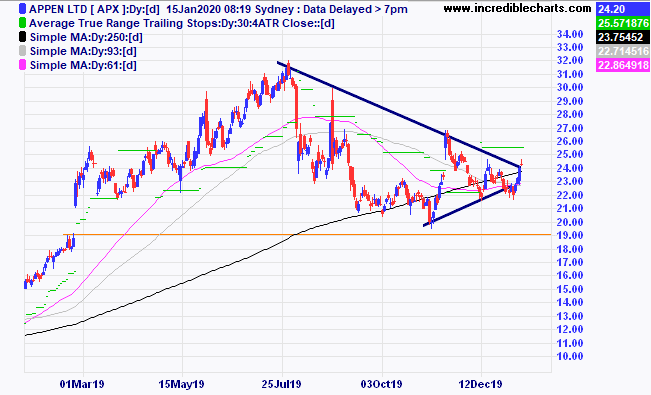

Appen looks to be on the cusp of a breakout either way, watching.

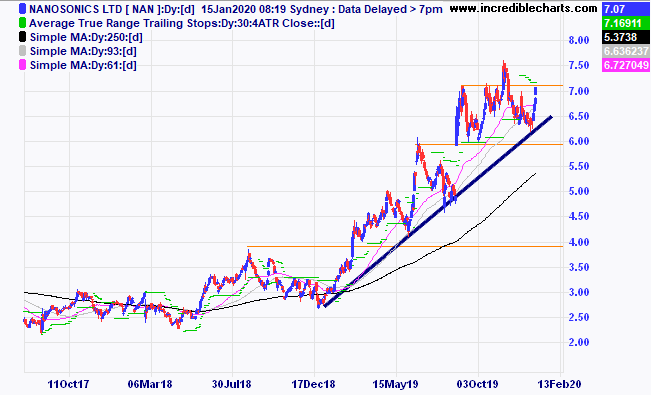

Nanosonics has again bounced up from the upwards trend line offering some interesting trade possibilities on any retracement pattern.

Table

Security | Units bought (sold) | Date | Open price/ From last table | Current/close | $ gain/loss |

Buy CSL 3/12/18 at $183 c/f 9/1 at $192.31 c/fwd 3/1 at $280 | Bought 10 at $192.31 9/1/2019 | 9/1/2019 | $283.42 | $296.50 | +$30.80 |

Bought Westgold c/fwd 3/1 at $2.33 | Bought 1,000 at $1.03 7/2/2019 | 7/2/2019 | $2.32 | $2.25 | -$70.00 |

Bought Santos c/fwd 3/1 at $8.29

| Bought 350 at $7.80 16/9/2019 | 16/9/2019 | $8.79 | $8.91 | +$42.00 |

Bought Kogan c/fwd 3/1 at $7.54 | Bought 300 at $6.25 25/9/2019 | 25/9/2019 | $7.78 | $7.79 | +$3.00 |

Buy Wagners c/fwd $2.73 | Bought 1,000 at $1.75 on 16/10/2019 | 16/10/2019 | $2.50 | $2.44

| -$60.00 |

Bought Magellan Financial Group c/fwd 3/1 at $59.00 | Bought 40 at $57.50 18/12/2019 | 18/12/2019 | $59.70 | $62.49 | +$111.60 |

Bought Newcrest Mining c/fwd 3/1 at $30.44 | Bought 100 at $30.20 31/12/2019 | 31/12/2019 | $30.76 | $30.39 | -$37.00 |

Bought Resolute Mining | Bought 2,000 at $1.25 | 8/1/2020 | $1.25 | $1.17 | -$160.00 |

Bought Syrah Resources | Bought 3,000 at 55c | 8/1/2020

| 55c | 71c | +$480.00 |

Bought Orocobre

| Bought 900 at $3.10 | 9/1/2020 | $3.10 | $3.79 | +$621.00 |

Bought 8 ASX 200 cfd’s | Bought 8 at 6934 | 14/1/2020 | 6934 | 6962 | +$224.00 |

|

|

|

|

|

|

Start 2/1/2020 $50,000.00 | Open balance $51,313.20 |

|

|

| $51,313.20 |

Stock c/fwd 3/1 $18,427.50 | Gains/losses week +$1,185.40 |

|

|

| +$1,185.40 |

| Current total $52,498.60 |

|

|

| $52,498.60 |

Brokerage at $30 per round turn added when sold. | Less buy/ close prices and Margin $31,364.60 |

|

|

| $31,364.60 |

Prices from Tuesday’s close or 6am for US | Cash available $21.134.00 |

|

|

| $21,134.00

|

Disclaimer: The commentary and trading positions taken are for educational purposes only and are not an invitation to trade. Trading is risky and individuals should seek Professional counsel before making any financial decisions. Many thanks to Incredible Charts.com software for most of the charts used in the column.

Monitor, measure, manage and maximise…

Cheers Charlie.

To order photos from this page click here